Whatever your credit profile, you should know the best credit cards by credit score so you can choose the card that’s currently right for you — or the one you can aspire to by improving your credit score.

The good news is that there’s a credit card available for any credit score — and our research indicates that these cards are the very best.

Excellent Credit (740+ FICO) | Good Credit (670 – 739) | Fair Credit (580 – 669) | Bad Credit ( | Limited/No Credit Score

Best Credit Cards for Excellent Credit Scores

You can earn an excellent credit score (740+) by staying disciplined and focused on your use of credit over several years. You must unfailingly pay your bills on time, keep your credit balances relatively low, and own accounts going back seven years or longer.

The following three cards recognize the work you’ve put in to achieve excellent credit by offering you top rewards and benefits. That means you will earn substantial cash back (sometimes double cash), prolific points, or massive miles on your purchases. The type of reward that works best for you depends on your lifestyle and needs.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

These cards compete against each other by offering benefits including signup bonuses, 0% introductory APRs on purchases and balance transfers, high reward rates on purchases, and various perks all aimed at making your life more comfortable.

While cash back is always in good taste, you may prefer points or miles cards if you like to travel, since they allow you to purchase flights at a discount (or get them for free). Excellent points/miles cards usually throw in other travel-related goodies, such as free hotel stays, travel and baggage insurance, free baggage check-in, travel credits, access to airport lounges, and much more.

You should expect a relatively generous credit limit when you have excellent credit. Your interest rate should be lower than average, and you may have fewer fees to negotiate.

While some of the best cards may charge a high annual fee in exchange for lofty rewards, plenty of cards in this category have a small or no annual fee without sacrificing too many perks.

Best Credit Cards for Good Credit Scores

While not quite up to the standards set by credit cards for excellent credit scores, the cards for good scores (670 – 739) have nothing to apologize for. Truth be told, you can get many cards from the excellent group even if your score is below excellent, although you may receive a slightly higher APR and/or smaller credit line. You still can choose from the full range of reward types and earn fairly generous benefits.

Some of the best credit cards for good credit scores may omit items like 0% intro APRs for balance transfers (and perhaps purchases). Once again, you will come across a range of annual fees.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

Cards for good (or excellent) credit offer rewards according to three schemes. The simplest one is a flat reward rate for all purchases. Typically, this rate is greater than 1X and is unlimited.

Tiered rewards are a little more complex, consisting of two or more rates based on merchant categories, such as grocery store purchases or gas station purchases. The higher rates may apply to a limited amount of spending on purchases, but all purchases qualify for at least 1X rewards.

The most complicated rewards scheme features high reward rates for quarterly rotating merchant categories. You must activate each quarterly category to receive the high rate, and purchase amounts at that rate may be capped. Typically, rewards remain active as long as your account remains open, but some travel cards may drop rewards after specified periods of inactivity.

Best Credit Cards for Fair Credit Scores

Fair credit scores are in the 580 to 669 credit score range, which is below the average score of 704. You may find yourself in this range if you’ve had some problems managing your credit, but it may also be due to having a relatively short credit history. The two most harmful items to your credit score are missed payments and high credit utilization.

Normally, only payments over 30 days late will appear on your credit report, but once there, they will remain for up to seven years. Your credit utilization ratio (CUR, equal to your credit card balances divided by your total available credit) can hurt your score if it is greater than 30%. Unlike missed payments, you can cure a high CUR as soon as you pay down your card balances.

- No annual or hidden fees. See if you're approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One's mobile app

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

- Earn unlimited 1.5% cash back on every purchase, every day

- No rotating categories or limits to how much you can earn, and cash back doesn't expire for the life of the account. It's that simple

- Be automatically considered for a higher credit line in as little as 6 months

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Help strengthen your credit for the future with responsible card use

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$39

|

Average, Fair, Limited

|

The cards in this score category are less likely to offer rewards, and the rewards they do offer typically take the form of flat cash back rates in the 1X to 1.5X range. Usually, their most significant benefit is $0 liability protection if your card is stolen or lost. In addition, many cards offer free credit score monitoring, although the score provided may be an alternative to the FICO standard.

Credit limits are fairly low in this category, but many cards promise to evaluate a limit increase if you pay your bills on time for a specified period, such as six months. Annual fees are typically in the $0 to $99 range, and it’s not unusual for a fixed or variable APR to exceed 20%.

You can build your credit using cards that report your monthly transactions to one or more of the major credit bureaus.

Best Credit Cards for Bad Credit Scores

If your FICO score is below 580, you are considered to have bad credit. However, a low score need not keep you from getting a credit card, although you shouldn’t expect the card to offer many benefits. In fact, it’s rare to find any unsecured cards in this range that provide rewards.

Unsecured cards for poor credit have a high variable APR and high fees. In fact, some are festooned with fees, like initial and monthly maintenance fees, that you won’t encounter in cards for higher credit scores. Credit limits will be minimal, often no more than $300, although you may be given a higher limit after paying your bill on time for a specified number of months.

- Greater access to credit than before - $700 credit limit

- Get a Mastercard accepted online, in store and in app

- Account history is reported to the three major credit bureaus in the U.S.

- $0 liability* for unauthorized use

- Access your account online or from your mobile device 24/7

- *Fraud protection provided by Mastercard Zero Liability Protection. If approved, you'll receive the Mastercard Guide to Benefits that details the complete terms with your card.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

See terms

|

See terms

|

Fair/Good

|

- PREMIER Bankcard credit cards are for building credit.

- Start building credit by keeping your balance low and paying all your bills on time each month.

- When you need assistance our award-winning US-based Customer Service agents are there to help.

- Credit Limit Increase Eligible after 12 months of consistent responsible account management.

- We report monthly to the Consumer Reporting Agencies to help you build your credit.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

See Provider Website

|

See Provider Website

|

Fair/Poor

|

- No credit check to apply

- Adjustable credit limit based on what you transfer from your Chime Checking account to the secured deposit account

- No interest* or annual fees

- Chime Checking Account and qualifying direct deposit of $200 or more required to apply. See official application, terms, and details link below.

- The secured Chime Credit Builder Visa® Card is issued by The Bankcorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted.

- *Out-of-network ATM withdrawal and OTC advance fees may apply. View The Bancorp agreement or Stride agreement for details; see back of card for issuer.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

$0

|

None

|

If you have bad credit, your best bet may be a secured credit card. You can also consider prepaid cards, which are similar to debit cards, but you deposit money into the card’s account instead of your bank account. You can only spend the amount you deposit, minus fees.

You get prepaid cards with the payment network (American Express, Visa, or Mastercard) logo, and they can be used wherever merchants accept debit cards from the payment network.

Because prepaid cards do not involve credit, they do not affect your credit score. Your usage of a payment card is not reported to any of the credit bureaus. This means you can get a prepaid card without reference to your credit score, no matter how bad it is.

Best Credit Cards for Limited/No Credit Score

Here’s a shocking statistic: 23% of millennials do not use credit cards and make up a large portion of consumers with limited credit and/or no credit score. That’s different from poor credit, but the credit cards in these two groups usually overlap and offer modest benefits.

By modest, we mean limited rewards, low credit limits, and high APRs and fees. On the plus side, these cards usually have $0 liability protection for fraudulent activity, offer the possibility of a higher credit limit over time, and report your payments each month to all three credit bureaus.

Cards for students are an important part of this group, as students often arrive at school without any credit history.

- No credit check to apply

- Adjustable credit limit based on what you transfer from your Chime Checking account to the secured deposit account

- No interest* or annual fees

- Chime Checking Account and qualifying direct deposit of $200 or more required to apply. See official application, terms, and details link below.

- The secured Chime Credit Builder Visa® Card is issued by The Bankcorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted.

- *Out-of-network ATM withdrawal and OTC advance fees may apply. View The Bancorp agreement or Stride agreement for details; see back of card for issuer.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

$0

|

None

|

- No annual or hidden fees. See if you're approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One's mobile app

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

- Earn unlimited 1.5% cash back on every purchase, every day

- Early Spend Bonus: Earn $50 when you spend $100 in the first three months

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Enjoy no annual fee, foreign transaction fees, or hidden fees

- Lock your card in the Capital One Mobile app if it's misplaced, lost or stolen

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

Some issuers in this category do not check credit scores when you apply for one of their cards. They may instead evaluate your application based on your job, income, housing expenses, and other criteria.

A hard pull, which requires your authorization, can hurt your credit score by five to 10 points for up to a year. Soft pulls don’t affect your credit score, so you have nothing to lose by applying. However, soft pulls don’t guarantee you will receive final approval.

What is the Best Credit Score for a Credit Card?

The top score in the FICO credit score system is 850. If that’s your score, you have almost unlimited access to any credit card on the market. Of course, you don’t need a perfect 850 score to get a credit card — a score of 740 or above will grant you access to the best cards on the market.

But even with an excellent credit score, there can be a couple of obstacles to approval. The first obstacle is that some credit cards are available by invitation only. This kind of card is aimed at free-spending millionaires who may or may not have an 850 score.

The second obstacle to approval is the issuer’s quota rules. For example, your 850 score won’t get you past Chase’s 5/24 rule, which limits you to five new credit accounts (from any creditors, not just Chase) in the past 24 months. Other issuers, including Citi, Bank of America, and Discover, have their own rules.

People with excellent credit have successfully managed several types of debt for no less than seven years, have a credit utilization of below 30%, and pay their bills on time each and every month.

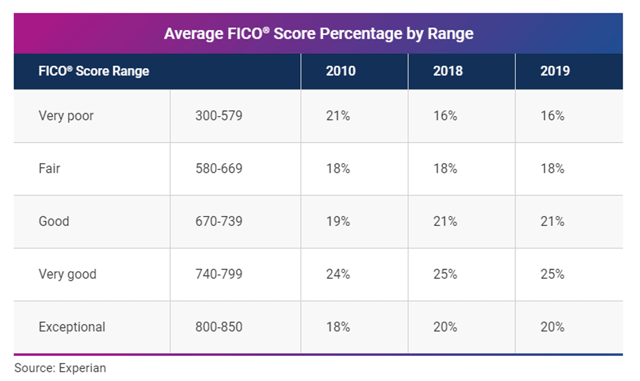

According to the good folks at Experian, little more than 1% of all FICO scores are 850. Folks with the perfect credit score have 6.4 credit cards, on average, almost twice the national average among all cardholders. The anointed ones also carry about half the credit card debt than the rest of us do.

Experian reports that 45% of consumers have a score of 740 or better.

Income is not one of the factors used to determine an 850 score or any other FICO credit score. A recent study from Experian showed that 38% of consumers with an 850 score have estimated annual incomes no greater than $75,000. A low credit utilization ratio is a key attribute among consumers with a perfect score.

In general, older consumers are more likely to have a long credit history, one of the requirements for an 850 score. However, millennials made up 4% of those with an 850 score, proving that age alone is not a primary requirement.

By the way, the largest concentration of perfect-score consumers lives in Hawaii, followed by Minnesota, Connecticut, Virginia, and Maryland.

What is the Best Credit Card Overall?

There are many cards out there, but only one can be the best overall. We here at CardRates.com bestow that title on the Chase Freedom Unlimited® card, with an overall score of 5 out of 5.

We like this card for many reasons, starting with the fact that it charges no annual fee.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

The card is aimed at consumers with good to excellent credit. It offers many of the bells and whistles you expect from a great card, including high, tiered cash back rewards, a signup bonus, and an introductory 0% APR on purchases. You’ll also receive $0 liability protection and a high cash back reward rate on travel purchased via the Chase Travel program.

Speaking of Chase Ultimate Rewards, here’s a little tip many folks may not know. If you also own a Chase points card, such as the Chase Sapphire Preferred® Card, you can swap your cash back from the Chase Freedom Unlimited® for Chase Ultimate Rewards points that are worth 25% more when redeemed for travel at the rewards site.

Our research indicates that you usually need a score of at least 680 to get the Chase Freedom Unlimited® card, but the lowest approved score appears to be 620. Credit Karma suggests that the card’s initial credit limit is about $3,000.

Now, the best overall credit card may not be the best card for you — that’s why we review so many cards. You may have certain preferences, such as the type of rewards or the favored merchant categories, that tilt you toward another card. You also need to evaluate the value you get versus the annual fee (if any), and whether you want a card optimized for travel.

What is the Minimum Credit Score for a Credit Card?

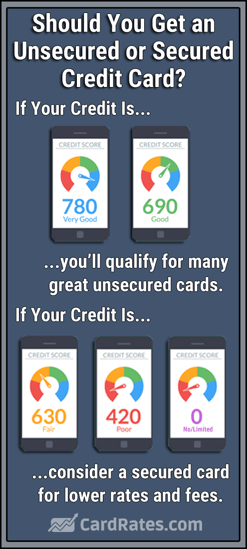

You may be amazed to learn that you can get a credit card with any credit score, even the minimum score of 300. That’s because some secured credit cards do not look at credit scores when approving your application. These secured cards require no credit check for approval.

To qualify, you simply have to deposit cash into a special account maintained by the credit card company. The deposit serves as collateral to secure the card’s credit limit. That’s why secured cards don’t require a good (or any) credit score.

Furthermore, because your credit is secured, you can expect relatively low APRs and fees. While some cards limit your initial credit limit to $300, others allow higher credit lines with deposits of up to $5,000.

Secured cards have the same appearance as unsecured ones, so there is no embarrassment in using one. But you have options even if you would prefer an unsecured credit card:

- Use a cosigner: Several issuers allow a cosigner to be the joint owner of your credit card account. The cosigner is responsible for making payments if you fail to do so. A credit card company understands that you are using a cosigner because you have bad credit, which means the cosigner may be the first to be alerted when a payment is late.

- Become an authorized user: A cardholder can authorize you to use the holder’s card as a secondary account holder. This gives you the opportunity to build your credit over time. You are not obligated to make payments on the card, though failing to pay for your own purchases may destroy your relationship with the primary cardholder.

- Use a prepaid card: As described above, a prepaid card is a debit card that uses a special account to which you deposit cash. It’s not a credit card, so anyone can get one no matter their credit score.

If you don’t like any of these options, you may consider opening a credit-builder account at your local credit union or at Self Financial. You can open this kind of account even if your credit score is 300. It works like this:

- You sign up for an installment loan from the lending institution. A typical loan amount is $1,500.

- The loan proceeds are deposited into a special savings account — you do not have access to this money.

- Every month, you make a payment on the loan until you pay it off.

- The money in the savings account is returned to you at the end of the loan term.

The point of this exercise is that your repayments are reported to the three credit bureaus (Experian, TransUnion, and Equifax). By repaying your loan on time each month, you build your credit score and put yourself in an excellent position to get an unsecured credit card after paying off the loan. Not to mention you’ll have saved up some money to jump-start an emergency savings fund or to pay down debt.

What Types of Credit Cards are Available?

There are many ways to categorize credit cards. In this review, we sort them by credit score. Earlier, we categorized credit cards by the way they figure rewards using a flat, tiered, or quarterly rotating scheme. We also mentioned the forms that rewards take — rewards points, cash back, or miles.

But the most fundamental way to characterize cards is by the type of user:

- Unsecured cards: These are used by the vast majority of consumers with credit cards. Typically, you need a credit score of at least 550.

- Secured cards: These cards are collateralized by your cash deposit, so they are theoretically available to consumers with any (or no) credit score. Some secured cards may set a minimum required score in the 500 to 550 range.

- Travel cards: These are credit cards that offer rewards in points or miles that can be used to pay for travel. Normally, you must have an excellent or good credit score to qualify for a travel card.

- Student cards: If you are an eligible student, you can get a student credit card independent of your credit history (or lack thereof). These cards are available to students who meet the attendance requirements set forth by the card issuer. Typically, these are a consumer’s first credit card, and brand loyalty is part of the reason why they are available to students even when they have no credit score.

- Business cards: These credit cards are designed for business owners or corporations that want to earn high rewards for their business purchases. They focus their rewards on the expenses companies typically encounter, including office supplies, internet/cable/phone services, gas station purchases, and dining. Business cards frequently have generous signup bonuses.

- Store cards: These cards are co-branded to a particular merchant and are usually not for general use, but exceptions exist. For example, the Amazon Store Card can only be used to make purchases on Amazon.com, whereas the Amazon Prime Rewards Visa Signature Card can be used everywhere Visa is accepted. Store cards are available for brick-and-mortar stores, online stores, and brands that are a combination of both.

Given the various types available to you, it seems that any consumer age 18 or older can get a credit card. Our general advice is to choose a card that gives you the best benefits for the smallest fees.

What Credit Score is Needed for Store Credit Cards?

Experts agree that store credit cards are among the easiest unsecured cards to obtain. Among store cards, we perennially recognize the Fingerhut Credit Account among the easiest to get. You can qualify for the account with just about any credit score, but you can also get the card if you have no credit history (hence, no score) at all.

If Fingerhut decides it can’t offer you the credit account, it will automatically consider you for a Fingerhut® Fresh Start Installment Loan. With this loan, you make a $30 deposit before your first purchase of $50 or more, up to your assigned spending limit. You then pay off the loan in fixed installments for six to eight months.

When you repay the loan satisfactorily, you’ll likely be given a Fingerhut® Advantage Credit Account. The account, which has no annual fee, can only be used for online purchases at Fingerhut and its partners. Late and returned payment fees apply, and the account does not provide for a cash advance or balance transfer.

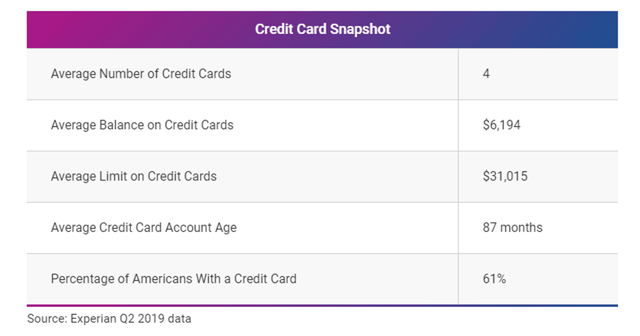

Among cardholders in America, the average Joe or Jane owns four credit cards and has an average balance of just under $6,200. The combined average credit limit for those four cards hovers around $31,000.

Experian found that Americans have an average of four credit cards with a combined average balance of $6,194, according to Q2 2019 data.

If statistics are your jam, here are some more: The average credit card account age is about 87 months. About 34% of Americans carry three or more credit cards, while 14% have at least 10 cards. The upshot from all these numbers is that the majority of Americans like credit cards and keep their accounts open for many years.

None of this suggests how many credit cards you should own. The answer isn’t obvious and is complicated by the fact that experts advise you to never close a credit card account, as doing so can hurt your credit score. This implies that you may have many credit cards lying fallow in your junk drawer while only the favored few reside in your wallet.

Let’s start with the case of owning a single credit card. That one card is enough to establish your credit history, initiate a credit report, and give you a credit score. A credit report is very handy when you need a loan or more credit, apply for a job or a rental home, set up utility and cellphone accounts, and undergo background checks.

All of that can be yours just by owing a single credit card. If you choose one with no annual fee and you pay your balance in full each month, the card will cost you nothing to own and use. In fact, by getting a rewards card, the issuer pays you to use the card through cash back, points, or miles.

It’s easy to make the case that you should own at least two credit cards, in case one is lost, stolen, or above its credit limit. The reward structures of different cards may motivate you to own more than two.

For instance, you may want to own a cash back card, a travel card, and a business card, plus individual miles or points cards for half a dozen airlines, several hotel cards, and so forth.

Moreover, if you live to shop, you may have dozens of store cards that you’ll proudly display to another shopaholic with minimal prompting. In fact, you may require a custom wallet (one with anti-gravs would be nice) in which to carry all your credit and charge cards. Perhaps the right question to ask is how many cards you need to maintain a good credit profile.

Another reason to get yet another credit card is to consolidate multiple card balances onto a new card featuring a 0% introductory APR for balance transfers. Some cards offer introductory periods as long as 18 months.

Transferring and paying down balances can help boost your credit score under certain conditions having to do with the amount of credit you use. Your credit score can suffer when your credit utilization ratio (i.e., used credit divided by available credit) rises above 30%. Coincidently, 30% of your credit score is determined by the amount you owe.

Consolidating your credit balances onto a new card can help increase your score if:

- Your current CUR is above 30%.

- You have trouble paying the minimum amounts due each month, either because you can’t afford it, or you have trouble keeping track of when payments are due.

- Your new 0% introductory APR credit card has a credit limit sufficient for you to transfer most or all of your current balances. Be aware of the card’s balance transfer fee.

- The minimum payment after the transfers is less than the sum of your minimum payments beforehand, thereby allowing you to pay down some of your balance each month.

- You resolve not to use any more credit until you pay down your consolidated balance.

If you follow this disciplined approach, you’ll see your CUR drop each month. You should slowly see your credit score increase as your CUR falls below 30% on its way (ideally) to 10% – 20%. That’s a happy outcome, and although you will now have one more credit card than you did before beginning the program, your credit score will benefit.

Besides the recuperative powers of lowering your CUR, balance transfers (despite the balance transfer fee) can be even more helpful if you just can’t remember to pay all your monthly card payments on time. Your credit history accounts for 35% of your total score and missed payments can wreak havoc on your credit profile.

To the extent that balance consolidation improves your ability to make timely payments, getting a new card to perform a balance transfer can prevent further damage to your score.

Those 0% introductory APRs can be very alluring when they apply to purchases and are accompanied by a signup bonus. That’s why some folks like to get a new card when their latest introductory period expires. Before you know it, you have a pile of old credit cards you seldom use, as well as a home full of purchases you financed at no interest.

In the final analysis, there isn’t a one-size-fits-all answer to how many cards you should own. The best approach to take is to understand how to navigate FICO’s rules for calculating credit scores. If you do that, you can own two or 200 cards without hurting your credit score.

Can I Get an Unsecured Credit Card with Bad Credit?

If your FICO score is below 580, you have bad credit. While it’s much easier to get a secured card when your credit is forlorn, you may, in fact, be able to acquire several unsecured credit cards for low credit scores. The online forums are full of stories of folks who were able to get an unsecured card with a score as low as 500, or even lower.

Naturally, these cards are nothing to write home about. Typically, they have high APRs, high fees, and tiny credit limits ($200 is a popular initial credit line). They don’t offer rewards, and their benefits are paper-thin.

Naturally, these cards are nothing to write home about. Typically, they have high APRs, high fees, and tiny credit limits ($200 is a popular initial credit line). They don’t offer rewards, and their benefits are paper-thin.

Nonetheless, they are credit cards, and if you use them responsibly, you should be able to rebuild your credit because they usually report your payments to the three credit bureaus.

To get the most credit improvement from a card in this category, you should always, without fail, pay your monthly bill on time. You should also endeavor to pay the full amount each month so you are not carrying a balance. Many of these cards will review your behavior after six months and reward you with a higher credit limit.

You should apply for a better card once you raise your score into the fair credit score range (580 – 669 on the FICO scale).

Cards for consumers with fair credit are much better because they charge fewer fees, permit higher credit limits, and may offer you rewards and benefits. You will want to graduate to a fair credit card within a year because many of the unsecured cards for bad credit impose a monthly maintenance fee after the first year — we hate that fee and so should you.

As discussed earlier, you may be able to snag a good credit card despite having lousy credit if you can recruit a cosigner or someone who will make you an authorized user. Students have it made because they can get a student credit card without reference to their credit score.

What are the Best Credit Cards to Rebuild Your Credit?

Rebuilding your credit requires effort and discipline. The amount of care you put into the project will determine how quickly your credit score will recover. Credit cards are excellent tools to help reestablish a good credit score and some cards fit the task better than others.

What are the characteristics of credit cards that will help you build credit? It’s a short list:

- Easy to obtain: If your credit needs rebuilding, it means that you’ve faced financial challenges in the past and the challenges won. Your resulting low score makes it hard to qualify for a credit card, and the cards for folks with bad credit often have drawbacks like high costs and low credit limits. A good card for rebuilding your credit would be easy to get and rewarding to use.

- Reports your activity: You want to use the credit card in a responsible manner, and you want everyone to know it. In practical terms, that means the card should report your payments to all three credit bureaus. Many cards report only to one bureau, so make sure your new card communicates with all of them.

- Is relatively low cost: You want your money to go to paying for your purchases rather than paying the high APRs and fees associated with unsecured cards for consumers with bad credit.

Secured credit cards are the best solution. They are very easy to obtain, they report your activity to all the credit bureaus, and they sport a low interest rate and fees. The only downside is the money you must deposit with the card issuer to collateralize the card.

Many secured cards have starting credit limits of $200 to $300. In most cases, that means you must deposit an amount equal to your credit line into a locked bank account provided by the issuer. The deposited money will be used if you miss a payment or exceed the credit limit.

One interesting exception is the Capital One Platinum Secured Credit Card, in which you may be able to deposit as little as $49 to secure a $200 credit line, depending upon your credit history.

Like most secured cards, this one may grant you a higher credit line if you pay your bills on time for six months or so. The card has no minimum credit score nor required credit history.

Some secured cards explicitly declare that they don’t do credit checks, and these are the easiest to obtain. Our top pick among these is the OpenSky® Secured Visa® Credit Card. The card is a good choice if you have no credit score record, as virtually all such cardholders will receive a score in as little as six months.

If you own a small business but have bad credit, consider a secured business credit card. A secured credit line can range from $500 to $50,000, and the annual fee is typically low or $0. In addition, secured business credit cards may offer purchase rewards.

Eventually, you will want to trade in your secured credit card for an unsecured one so you can recoup your security deposit. Some cards may offer you this opportunity, but often you have to ask for it. It’s best to wait six months to a year before asking for the upgrade and only do so if you have a perfect record of timely payments.

Another class of credit cards that are easy to obtain are unsecured cards that allow cosigners. By enlisting a cosigner with good credit, you gain access to higher-quality credit cards that offer rewards and benefits. Within this group, we like the unsecured cards issued by Bank of America and U.S. Bank.

Our top pick among cards that allow cosigners is the Bank of America® Customized Cash Rewards credit card. The card boasts a high, tiered cash back rate on the merchant category of your choice, plus a signup bonus and a 0% introductory APR on purchases and balance transfers. Your cosigner for this no-annual-fee card should have a good or excellent credit score.

If you do your banking at U.S. Bank, you will prefer the U.S. Bank Altitude® Reserve Visa Infinite® Card. This card gives you all the advantages of the Visa Infinite program along with high point rewards on eligible purchases, annual travel reimbursements, and a dozen complimentary WiFi passes. You will find this card useful when traveling because of its many travel-related perks.

If you are a student, your task isn’t to rebuild your credit but rather to establish it. The nice thing about student credit cards is that you needn’t pass a credit check to get one — you just have to meet the card’s school attendance requirements.

Our favorite, easy-to-obtain student credit card is the Journey Student Rewards from Capital One. It has no annual or foreign transaction fee, pays you cash back on all purchases (as cash or statement credit), and boosts your cash back rewards when you pay on time. It also has some nice perks, including a rebate on selected streaming subscriptions, automatic consideration for a higher credit limit after six months, and your choice of the monthly due date. (Information for this card not reviewed by or provided by Capital One.)

We also like the Bank of America® Customized Cash Rewards credit card for Students. If offers cash back rewards (or statement credit), a signup bonus, and a 0% introductory APR on new purchases and balance transfers (fees apply). The card charges no annual fee and offers optional overdraft protection if you have an eligible Bank of America checking account.

What Other Factors Determine Credit Card Approval?

While your credit score is the most important factor determining whether your card application will be approved, it is by no means the only one. Some factors are easily determined, others require more interpretation.

Here’s a rundown of some other factors:

- Age: You must be 18 or older to own a credit card. Some states may require a different age.

- Other cards: Several issuers limit the number of cards they will issue you based on how many credit accounts you already have. The Chase 5/24 rule is an example, where you are barred from additional Chase cards if you’ve opened any five or more credit accounts in the past 24 months.

- Credit utilization ratio: In cases where your credit score is on the border of acceptability, your CUR may tip the decision one way or another. You can increase your odds by getting your CUR down below 20% or even 10%. If it’s above 30%, you may have a problem.

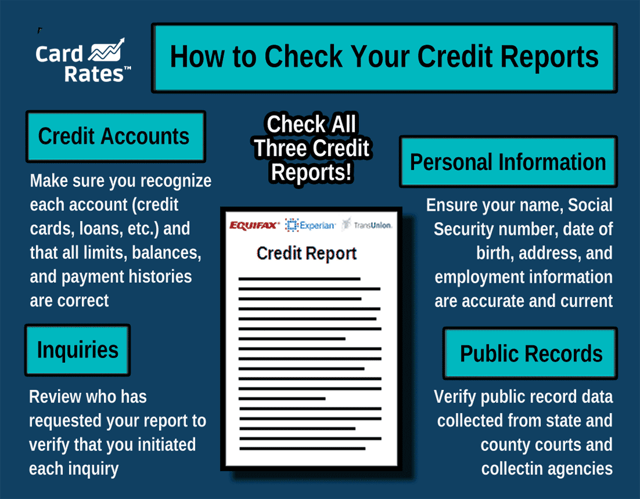

- Derogatory entries on your credit report: Some issuers may balk if your credit history includes account write-offs, collections, bankruptcies, foreclosures, and other unfortunate events. To be sure that your credit report is free from erroneous data, you should clean up your reports either by yourself or with the help of a credit repair company.

The last item is very important — you must ensure your credit report is free from errors that hurt your credit score. You can streamline the correction process by finding out which credit bureau your intended card uses in your state. For example, Discover tends to use Equifax, so if you want to apply for a Discover credit card, you would fix your Equifax report first.

If you are the DIY type, you can fix your credit reports on your own. The first step is to order free copies of your three credit reports from AnnualCreditReport.com, the only federally authorized free credit report source.

Comb through each report, looking for accounts or activity you don’t recognize, and then go online to the credit bureau to dispute the questionable items.

One of the most frequent sources of errors involves hard inquiries, i.e. when you authorize a creditor or lender to look at your report in response to your application for a credit card or loan. You should dispute hard inquiries you didn’t authorize because each hard inquiry can lower your credit score by five to 10 points.

Other items to dispute are accounts you didn’t open and negative items (like late payments or collections) that didn’t occur.

The credit bureau will investigate each disputed item and render a decision within 30 days. If it agrees with you, it will remove the item and you should see your credit score rise soon thereafter. If it disagrees with the dispute, you can appeal the decision by sending in additional evidence.

Even if your dispute is ultimately rejected, you can append a short note to the item in your credit report explaining your side of the story. This won’t help your score but may give better context to decision-makers when you next apply for credit.

If you’d rather have a professional fix your credit reports for you, you can hire a credit repair service. These are companies that are experts at finding and fixing erroneous or incomplete information on your credit reports. Typically, you subscribe for about six months in return for a specified number of monthly challenges they will lodge on your behalf.

Research the Best Credit Cards by Credit Score

This review of the best credit cards by credit score proves that anyone can get a credit card, no matter how bad the score. We’ve shown you the best credit cards in each score category so you don’t have to waste time on inferior choices.

Even if you’re not happy with your current score, it’s never too late to begin repairing your credit. Fix your credit reports, pay your bills on time, reduce your debt, and, over time, you should start to see higher scores — your portal to a better lifestyle.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![9 Best Loans & Credit Cards: 400-450 Credit Score ([updated_month_year]) 9 Best Loans & Credit Cards: 400-450 Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/bestloans.png?width=158&height=120&fit=crop)

![12 Best Credit Cards By Credit Score Needed ([updated_month_year]) 12 Best Credit Cards By Credit Score Needed ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/02/Best-Credit-Cards-By-Credit-Score-Needed.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards For a 700 Credit Score ([updated_month_year]) 5 Best Credit Cards For a 700 Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/12/Credit-Cards-For-700-Credit-Score.jpg?width=158&height=120&fit=crop)

![Discover Card: Credit Score Needed & 5 Best Cards ([updated_month_year]) Discover Card: Credit Score Needed & 5 Best Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/11/discovercard2.png?width=158&height=120&fit=crop)

![7 Best Credit Cards By FICO Score ([updated_month_year]) 7 Best Credit Cards By FICO Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/02/fico.png?width=158&height=120&fit=crop)

![6 Top Cards: Credit Score Needed for Wells Fargo ([updated_month_year]) 6 Top Cards: Credit Score Needed for Wells Fargo ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/cover-2.jpg?width=158&height=120&fit=crop)

![7 Bank of America Cards By Credit Score Needed ([updated_month_year]) 7 Bank of America Cards By Credit Score Needed ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/Bank-of-America-Cards-By-Credit-Needed.jpg?width=158&height=120&fit=crop)

![5 Credit Score Ranges for Credit Card Approval ([updated_month_year]) 5 Credit Score Ranges for Credit Card Approval ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/06/Credit-Score-Ranges-for-Credit-Card-Approval-Feat.jpg?width=158&height=120&fit=crop)