The world of credit is filled with countless terms and acronyms that you probably will not hear in normal conversation. One such term you’re likely to come across when reading about credit scores is “credit card utilization rate” or, more formally, “revolving utilization ratio.” For the purposes of this article, let’s agree to refer to it as your utilization ratio.

Although utilization ratio may sound confusing on the surface, it’s actually not at all difficult to understand and even calculate. And you do really need to understand how utilization works. It is the most important of all the debt-related measurements in your FICO and VantageScore credit scores.

Credit Card Utilization Ratio Defined

Your credit card utilization ratio represents the relationship between your credit card balances and your credit card’s credit limits as they appear on your credit reports. Another way to describe credit card utilization is the percentage of your credit card limits that are in use in the form of a balance.

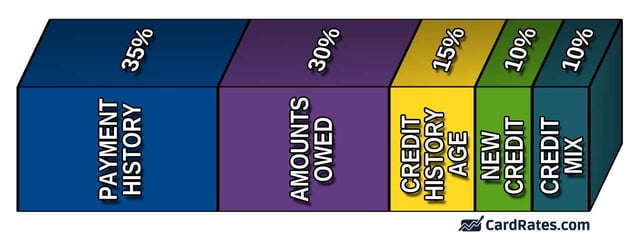

Utilization is a big deal when it comes to your credit scores. Utilization is the cornerstone metric from the debt category, also referred to as amounts owed, and is worth 30% of the points in your FICO credit scores. The same metric is extremely influential to your VantageScore credit score.

Regardless of the terms used to describe the metric, they all are used to describe the same thing — the important relationship between credit card limits and credit card balances. One rule applies universally to all credit scores, which is that the higher your utilization ratio, the fewer points you’re going to earn and the lower your credit scores are going to be. So, lower is always going to be better.

The Difference Between Individual and Aggregate Utilization

The basic formula used to calculate credit card utilization is credit card balance divided by credit card limit (balance ÷ limit). Because you’re dealing with percentages, you’ll also need to multiply the quotient (the number you arrive at in this calculation) by 100 (balance ÷ limit x 100 = utilization ratio).

Here’s an example of how it works. If your credit card balance is $250 and your account limit is $1,000, your credit card utilization rate is 25%. In other words, you’re using 25% of the maximum credit limit on your account.

$250 (Balance) ÷ $1,000 (Limit) = 0.25 x 100 = 25% (Utilization Ratio)

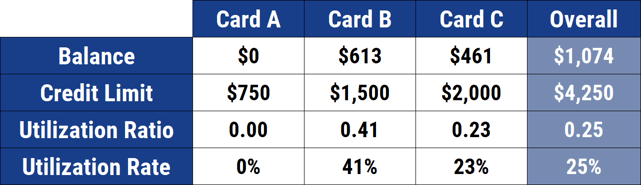

The example above shows you how to figure the utilization ratio on an individual credit card account. However, scoring models are designed to look at your individual credit card utilization rate as well as your aggregate utilization rate.

Aggregate utilization is a measurement of your total credit card balances relative to your total credit card limits and is calculated the exact same way as individual credit card utilization. The only difference is that you’ll need to add all your credit card balances and all your credit card limits before you follow the formula.

Here’s an example:

If you have four credit cards, each with a $1,000 balance, then your aggregate balance is $4,000. Combine the total credit limits for all of your credit cards to get your aggregate credit limit amount.

For example, if all of your credit cards have an aggregate credit limit amount of $25,000, you would divide $4,000 (your combined balance) by $25,000 (your combined credit limit) to get an aggregate credit card utilization ratio of 16%.

The lower that percentage, the better for your credit scores. You can calculate this ratio yourself by simply pulling your credit reports and doing the math based on the information contained in them.

Common Myths Associated with Utilization Ratios

Almost every article written about utilization ratios includes common misconceptions, but we’re not going to make the same mistakes here.

One such myth is that all revolving lines of credit are considered in the FICO and VantageScore revolving utilization ratios. This is untrue. The revolving utilization metric is designed to consider credit cards and credit cards only.

Home equity lines of credit or “HELOCs” are revolving lines just like credit cards are revolving lines. But, HELOCs are not counted in the calculation of your revolving utilization ratios because they are entirely different from credit cards and aren’t equally predictive of credit risk.

HELOCs are secured by the value of your home. Credit cards are not. If you default on a HELOC, the lender can take ownership of your house. If you default on a credit card, the lender cannot take anything back. Interest paid on HELOCs is tax deductible. Interest paid on credit card accounts is not. The underwriting process of a HELOC is very different than the underwriting process of a credit card. Point being, the two really don’t have much in common.

Another such myth is that just because you pay your credit cards in full each month you have a zero-utilization ratio, which is also untrue. What matters are the balances that appear on your credit reports, not the fact that you pay them in full each month.

VantageScore suggests keeping your utilization ratio at or below 30%.

Your credit card activity isn’t reported to the credit bureaus in real time. Instead, your account information, like your balance and payment status, is only updated on your credit report once a month by your creditors. That means if you get a credit card statement with a balance, that balance will be what’s reported to the credit bureaus and used to calculate your utilization ratios.

If you want to keep a zero-utilization ratio on your credit report, you’ll need to pay off your full credit card balance before your statement is generated. That means paying off the balance before the statement closing date, which is generally at least 21 days before your due date.

And finally, what is the target utilization ratio you should shoot for to max out your credit scores? FICO performed a study some years ago that quantified the average credit card utilization ratio for the highest scoring consumers, those with scores of 750 or higher.

The average credit card utilization for this group was 7%. VantageScore suggests keeping your ratio at or below 30%.

Because both FICO and VantageScore credit scores are commonly used by lenders in the U.S., it makes sense to err on the safe side and go as low as possible. For example, if your utilization ratio is 5%, you’re going to do very well across both credit scoring platforms. If, however, your utilization ratio is 27%, you may do very well on the VantageScore platform, but you’re definitely going to forgo some points on the FICO platform.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![How to Calculate Credit Card Interest: 3 Steps to Find Your Rate ([updated_month_year]) How to Calculate Credit Card Interest: 3 Steps to Find Your Rate ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/how-to-calculate-credit-card-interest.jpg?width=158&height=120&fit=crop)

![APR vs. Interest Rate: Is There a Difference? ([updated_month_year]) APR vs. Interest Rate: Is There a Difference? ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/APR-vs-Interest-Rate-Feat.jpg?width=158&height=120&fit=crop)

![3 Ways: Get a Lower Interest Rate on Credit Cards ([updated_month_year]) 3 Ways: Get a Lower Interest Rate on Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/09/lowerinterest.png?width=158&height=120&fit=crop)

![9 Best Flat Rate Cash Back Credit Cards ([updated_month_year]) 9 Best Flat Rate Cash Back Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/03/Best-Flat-Rate-Cash-Back-Credit-Cards.jpg?width=158&height=120&fit=crop)

![3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year]) 3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/05/atm-card-vs-debit-card-vs-credit-card--1.png?width=158&height=120&fit=crop)

![3 Key Differences: Charge Card vs. Credit Card ([updated_month_year]) 3 Key Differences: Charge Card vs. Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/03/charge-card-vs-credit-card.jpg?width=158&height=120&fit=crop)