Driving is America’s great pastime. Of course, driving requires regular stops at a gas station to fill up the old chariot for its next foray. Since you have to pay for gas, you may as well reap some rewards in the process by paying with one of the best credit cards to use at gas stations.

And, if you need to pick up a container of antifreeze, a six-pack of synthetic oil, or for that matter, a six-pack of gum, even more rewards may accrue to your benefit, depending on the card you use.

Here is our list of the best credit cards to use at gas stations. One or more is sure to be a perfect match for your needs.

Best Overall

Signup Bonus | Flat-Rate | Rotating Rewards | Points |

Business | Students | Bad Credit | Credit Union | Station-Branded

Best “Overall” Card to Use at Gas Stations

The Discover it® Cash Back card includes gas stations as one of its quarterly reward categories that — when activated — earns bonus cash back, up to the quarterly limit.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

This card, like some others from Discover, features an impressive cash back rewards system with rotating bonus rewards categories each quarter. Because one of the common categories is gas stations, you could elect to earn the most bang for your buck back in cash rewards. You’ll also enjoy Discover’s unmatched year-end bonus rewards if you’re a new cardholder.

You can receive your cash back at any time, with no minimum redemption amount. If you prefer, you can redeem your rewards as gift cards, Amazon.com payments, or charitable donations.

Best “Signup Bonus” Card to Use at Gas Stations

Signup bonuses are a great incentive for obtaining a new credit card. We think the Chase Freedom Unlimited® offers the best signup bonus in the gas-station card category.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

The Chase Freedom Unlimited® is a no-annual-fee card that offers a modest signup bonus when you spend enough on purchases during the first few months. But this card is no one-trick pony. You also receive introductory 0% APR offers for a limited time. Keep in mind the variable APR will kick in once the promotional period ends.

In addition, you earn cash back on every purchase, with some purchases earning even more depending on the spending category. Cash back rewards don’t expire as long as the account remains open, and there’s no minimum redemption amount.

Best “Flat-Rate Cash Back” Card to Use at Gas Stations

If you feel like you need a math degree to figure out your credit card’s cash back rewards, consider a flat-rate cash back card that offers one simple rate on all purchases. It’s easy-peasy, and the Capital One Quicksilver Cash Rewards Credit Card is our top pick.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One Quicksilver Cash Rewards Credit Card card provides 1.5% cash back on all purchases every day. There are no quarterly categories to activate or complicated sliding scales depending on the type of merchant.

The cash back rewards don’t expire while the account is open, and you can redeem any amount at any time. The card charges no annual fee and offers several customer protection features.

Best “Rotating Cash Back” Card to Use at Gas Stations

Rotating cash back rewards offer enhanced rewards on purchases at specific merchant types, one quarter at a time. Our pick, the Discover it® Cash Back card, offers top rewards at gas stations during at least one quarter of the year.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

You can redeem your cash back at any time, in any amount, and the cash back never expires while the account remains open. You can also redeem your rewards in the form of Amazon.com payments, gift cards, or charitable donations.

Best “Points” Card to Use at Gas Stations

Points are flexible because you can use them in many ways, including making purchases, redeeming for cash, or transferring to a frequent traveler program. Our top choice in this category is the Wells Fargo Propel American Express® Card.

5. Wells Fargo Propel American Express® Card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

The card offers a broad range of benefits, including a signup bonus opportunity and a 0% APR on purchases and balance transfers for the first 12 months. There’s no limit to the points you can earn, and you can even change your points category monthly to match your spending and maximize your return.

Best “Business” Card to Use at Gas Stations

Gas station rewards are a great fit for business credit cards, especially when employees drive for business reasons. We recommend the American Express® Business Gold Card.

- Earn 70,000 Membership Rewards® points after you spend $10,000 on eligible purchases with the Business Gold Card within the first 3 months of card membership

- Earn 4X Membership Rewards® points on the 2 categories where your business spends the most each billing cycle, including U.S. purchases for advertising in select media (online, TV, radio), U.S. purchases made directly from select technology providers of computer hardware, software, and cloud solutions, and U.S. purchases at gas stations, restaurants, or for shipping. Applies to the first $150,000 in combined purchases from these 2 categories each calendar year.

- Earn 3X Membership Rewards® points on flights and prepaid hotels and prepaid flight + hotel packages booked on AmexTravel.com using your Business Gold Card.

- Earn 1X Membership Rewards® points on other purchases

- $375 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.49% - 28.49% Pay Over Time

|

$375

|

Excellent

|

This is a premier business card offer (with an annual fee to match) that earns an industry-leading rate on gas purchases. There’s also a signup bonus opportunity and several included business perks.

Best “Student” Card to Use at Gas Stations

Many students live on a tight budget, so rewards for an expense like gas are especially welcome. We name the Discover it® Student Chrome as the best-educated choice.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

The Discover it® Student Chrome provides elevated cash back rewards on purchases made at gas stations and restaurants up to a quarterly limit of combined purchases each quarter. If you misplace the card, you can freeze the card in seconds via the mobile app or website.

Students can earn a statement credit if a friend they refer is approved for their own card. Your cash back rewards don’t expire while the account remains open, and you can redeem your rewards at any time, in any amount.

Best “Bad Credit” Card to Use at Gas Stations

It can be hard for a consumer with bad credit to get a credit card. A secured card, like the Bank of America® Customized Cash Rewards Secured Credit Card, is much easier to obtain.

This card actually pays out cash back rewards for gas station purchases, something rather unheard of from a secured credit card.

8. Bank of America® Customized Cash Rewards Secured Credit Card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Bank of America® Customized Cash Rewards Secured Credit Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.

To obtain this card, you make a refundable deposit up to the approved credit line. The card reports your payments to the three credit bureaus, which can help you build your credit.

Best “Credit Union” Card to Use at Gas Stations

Credit unions are like banks, but they are not-for-profit, and their customers are the owners. The PenFed Platinum Rewards Visa Signature® Card is our favorite for use at gas stations.

9. PenFed Platinum Rewards Visa Signature® Card

The PenFed Platinum Rewards Visa Signature® Card offers unlimited 5X points for gas purchases at the pump, 3X on groceries, and 1X on all other purchases, including fuel purchases for boats and airplanes. Note that the top reward rate applies only to gas purchases and excludes other gas station purchases.

- 5X points on fuel purchases

- $100 statement credit when you spend $1,500 in the first 90 days

- Must be a member of PenFed Credit Union to apply

- No annual fee

The minimum redemption is 1,000 points, which you can use for merchandise, gift cards, and travel. Unredeemed points expire in five years or sooner if you close your account. The PenFed Platinum Rewards Visa Signature® Card charges no annual or foreign transaction fees and offers a 0% APR on balance transfers for the first 12 months (fees apply).

Best “Station-Branded” Card to use at Gas Stations

Station-branded cards offer discounts on gas purchases at the issuer’s gas stations. The Shell Fuel Rewards® Mastercard® offers one of the better discount programs among station-branded cards.

10. Shell | Fuel Rewards® Mastercard®

The Shell Fuel Rewards Mastercard provides a 10-cents-per-gallon discount on all fuel purchases at participating Shell locations. Where available, the discount immediately posts at the pump when you insert the card. You’ll also receive 10% off your first $1,200 spent annually on non-fuel purchases at Shell locations, which is applied as a statement credit.

- 10 cents off every gallon, up to 20 gallons

- 2% rebate applied to dining and grocery purchases, 1% rebate on everything else

- No annual fee

For accounts opened during specified periods, the card may offer an additional discount for an initial period after opening the account. For example, new cardholders currently receive 30 cents off every gallon (up to 20 gallons) for the first five fill-ups using the card. Your account must be open and in good standing to receive discounts.

(The information related to Shell Fuel Rewards® Mastercard® has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.)

Is It Worth It to Get a Gas Credit Card?

According to the U.S. Energy Information Administration, Americans consumed almost 392 million gallons of gas per day in 2018. That’s a lot of gas, meaning gas rewards cards can provide plenty of value.

Drivers spend thousands of dollars each year on gas, so for them, a gas credit card can be well worth it. Most of the cards reviewed here are co-branded with Visa, Mastercard, American Express or Discover, which means you can use them everywhere that accepts these payment networks.

The distinguishing feature of the reviewed cards is that they offer rewards on purchases of gas and, in most cases, other items at gas stations.

You can use the co-branded cards to get rewards on all types of purchases, including the purchase of any brand of fuel. If gasoline is a significant expense in your monthly budget, a gas credit card will reward you well for your fuel purchases.

The considerations are different for station-branded gas cards issued by oil companies. These may not be co-branded, making them useful only at participating gas stations.

For example, the Shell Fuel Rewards® Mastercard® offers discounts on fuel purchased only at participating Shell locations. You may find this card worthwhile if you want to pay less at the pump without dealing with cash back or points.

Also, the card makes sense if you want to limit your use of credit to specific types of purchases. These cards usually have no annual fees, so owning one won’t necessarily cost you any money.

However, the non-co-branded, oil-company gas cards present certain problems. They are useful only at one brand of gas station, so you may need to own multiple cards. You may not be able to use them for general purchases, and they may charge relatively high APRs on unpaid balances.

Moreover, by using these cards, you are sacrificing rewards (sometimes, more generous rewards) from your other credit cards. It’s up to you to decide whether you prefer fuel discounts to general rewards for the money you spend on gas.

Do Gas Cards Build Credit?

The general-purpose credit cards reviewed here report your card payments to one or more of the three credit bureaus (Experian, TransUnion, and Equifax). This allows you to build your credit by paying your credit card bills on time, especially if you pay more than the minimum amount. On the other hand, if you miss payments, your credit score will suffer.

The story is different for non-co-branded oil company gas cards. Some don’t report your payments to the credit bureaus, and those can’t help you improve your credit. However, these cards could hurt your credit if you are delinquent on your payments and the card issuer turns your account over to a collection agency.

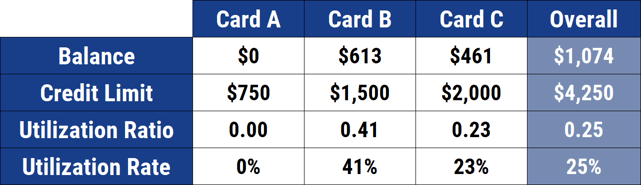

However, in some situations, you could use an oil company card as part of an overall strategy to improve your credit. One metric that affects your credit score is your credit utilization rate, which is the amount of credit you use divided by the amount of credit available to you.

You can picture a scenario where you have a high credit utilization rate and choose to reduce your credit balances. Accordingly, you use cash for most of your new purchases so your credit card balances shrink over time.

If you use gas station credit cards that don’t send reports to the credit bureaus, you can take advantage of gas discounts without increasing your reported credit utilization rate. In this way, your oil-company gas card can help you in your efforts to reduce your credit utilization ratio and boost your credit score.

Who Has the Best Fuel Rewards Program?

Our top overall choice for the best fuel rewards program is the Discover it® Cash Back. It offers bonus cash back rewards for purchases in different categories each quarter when activated, one of which is gas stations.

Other quarterly categories include restaurants, groceries, and selected merchants. All other purchases earn cash back at a reduced standard rate. You must activate the new category each quarter to receive the bonus cash back rate.

We love the card’s first-year bonus offer for new cardmembers, and that is what effectively makes it our top-rated card. In addition, the card ranked as our top “rotating cash back” card, and Discover is ranked very highly in customer service.

Our top choice among station-branded credit cards is the Shell Fuel Rewards® Mastercard®. The card provides a 10-cent-per-gallon discount on fuel purchases (up to 20 gallons) at participating Shell locations. This discount appears automatically at the pump when available. Rebates on other purchases appear as statement credits.

If you are a fan of a Discover’s first-year bonus for new cardholders, check out these cards: Discover it® Cash Back, Discover it® Student Cash Back, and Discover it® Secured Credit Card. All three provide new cardmembers with Discover’s unique year-end bonus. Also, all three offer enhanced rewards for purchases at gas stations.

Pump Up the Rewards with a Good Gas Card

All the cards in this review provide enhanced rewards for gas purchases. With them, drivers can reap rewards every time they fill up.

The cards are especially valuable to drivers who log many miles every year. Whether your credit is good, bad, or non-existent, there is a gas card that will fit your needs well.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![8 Best Credit Cards for Gas Stations ([updated_month_year]) 8 Best Credit Cards for Gas Stations ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/08/gascards.jpg?width=158&height=120&fit=crop)

![8 Best Gas Credit Cards For Fair Credit ([updated_month_year]) 8 Best Gas Credit Cards For Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/09/Best-Gas-Credit-Cards-For-Fair-Credit.jpg?width=158&height=120&fit=crop)

![17 Best Gas Credit Cards ([updated_month_year]) 17 Best Gas Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/gascard.png?width=158&height=120&fit=crop)

![7+ Gas Cards for Bad Credit ([updated_month_year]) 7+ Gas Cards for Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/02/gascards--1.png?width=158&height=120&fit=crop)

![11 Best Credit Cards For Gas & Groceries ([updated_month_year]) 11 Best Credit Cards For Gas & Groceries ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/02/Best-Credit-Cards-For-Gas-and-Groceries-3.jpg?width=158&height=120&fit=crop)

![12 Easy-Approval Gas Credit Cards ([updated_month_year]) 12 Easy-Approval Gas Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/12/Gas-Credit-Card-Feature.jpg?width=158&height=120&fit=crop)

![5 Best Gas Cards For Students ([updated_month_year]) 5 Best Gas Cards For Students ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Best-Gas-Cards-For-Students.jpg?width=158&height=120&fit=crop)

![5 Best Prepaid Gas Cards ([updated_month_year]) 5 Best Prepaid Gas Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/Prepaid-Gas-Cards.jpg?width=158&height=120&fit=crop)