Everyone likes having options. That’s why hundreds of ice cream flavors exist and there’s always more than one movie playing in theaters. Life would be dull without choices.

And that goes for our financial lives, too. Credit card options for consumers with every credit score abound. Today, the diversity in rewards, fees, and other perks gives you more options than ever before, making shopping for a credit card much like shopping at the grocery store for your next ice cream fix. In this article, we’ll look at credit score ranges for credit card approval, from the lowest of the low scores to the perfect score of 850.

Check out the sections below to see the many card options available for your credit score.

Excellent Credit (740-850) | Good Credit (670-739) | Fair Credit (580-669)

Bad Credit (300-579) | No/Limited Credit (0 Score)

Credit Cards for Excellent Credit (740-850 Credit Score)

An excellent credit score provides a lot of benefits — including greater negotiating power and better car insurance and mortgage interest rates. But consumers with excellent credit also see the greatest perks when shopping for credit cards. This is where you can qualify for top-tier cards with the highest credit limits, greatest benefits, and richest rewards.

Just remember, though, that excellent credit doesn’t guarantee credit card approval. But you should have a better chance than most consumers when looking to acquire our top cards, which we’ve listed below.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

+ See More Cards for Excellent Credit

Credit Cards for Good Credit (670-739 Credit Score)

This range includes the average U.S. consumer credit score — 714 — but there’s nothing average about the benefits that can come from these credit card offerings. A good credit score helps lenders see you as an acceptable risk. This means that card issuers will open a wide array of offerings to you in hopes of earning your business.

And, whenever there are lots of options, there is competition. And you can use that fight for your attention to possibly secure some amazing rewards cards — like those listed below.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

+ See More Cards for Good Credit

Credit Cards for Fair Credit (580-669 Credit Score)

If your credit score falls in “fair” territory, you may find yourself not qualifying for upper-tier credit cards and loans. Your interest rate may be a little higher than the cards offered in the “Good” range and the rewards may not be quite as rich.

But, as mentioned above, recent competition in the credit card space has issuers upping their game — and their rewards — to earn your business. Cards designed for fair-credit consumers, like those below, have many of the same perks that, just a few years ago, were set aside for cardholders with good or better credit.

- No annual or hidden fees. See if you're approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One's mobile app

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

- Earn unlimited 1.5% cash back on every purchase, every day

- No rotating categories or limits to how much you can earn, and cash back doesn't expire for the life of the account. It's that simple

- Be automatically considered for a higher credit line in as little as 6 months

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Help strengthen your credit for the future with responsible card use

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$39

|

Average, Fair, Limited

|

+ See More Cards for Fair Credit

Credit Cards for Bad Credit (300-579 Credit Score)

Mistakes happen. Payments sometimes get missed or life’s circumstances may force you to default on a loan. You may currently find yourself in a space where you need to rebuild your credit but are struggling to find issuers who will take a chance on you.

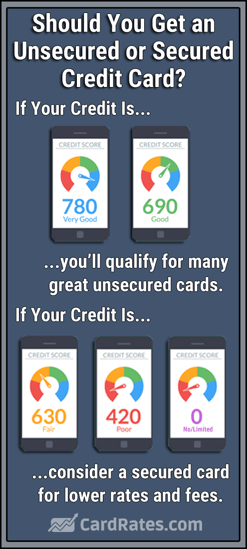

One of the easiest ways to rebuild credit is through a secured credit card that requires a refundable cash deposit that determines your credit limit. But, if a large deposit is out of the question, there are still a few credit card options available — just be ready to pay higher interest rates and annual fees.

- Greater access to credit than before - $700 credit limit

- Get a Mastercard accepted online, in store and in app

- Account history is reported to the three major credit bureaus in the U.S.

- $0 liability* for unauthorized use

- Access your account online or from your mobile device 24/7

- *Fraud protection provided by Mastercard Zero Liability Protection. If approved, you'll receive the Mastercard Guide to Benefits that details the complete terms with your card.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

See terms

|

See terms

|

Fair/Good

|

- PREMIER Bankcard credit cards are for building credit.

- Start building credit by keeping your balance low and paying all your bills on time each month.

- When you need assistance our award-winning US-based Customer Service agents are there to help.

- Credit Limit Increase Eligible after 12 months of consistent responsible account management.

- We report monthly to the Consumer Reporting Agencies to help you build your credit.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

See Provider Website

|

See Provider Website

|

Fair/Poor

|

- No credit check to apply

- Adjustable credit limit based on what you transfer from your Chime Checking account to the secured deposit account

- No interest* or annual fees

- Chime Checking Account and qualifying direct deposit of $200 or more required to apply. See official application, terms, and details link below.

- The secured Chime Credit Builder Visa® Card is issued by The Bankcorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted.

- *Out-of-network ATM withdrawal and OTC advance fees may apply. View The Bancorp agreement or Stride agreement for details; see back of card for issuer.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

$0

|

None

|

+ See More Cards for Bad Credit

Credit Cards for No/Limited Credit (0 Credit Score)

Everyone has to start somewhere, and, if you’re new to credit building, you’re likely standing on the ground floor and looking up at all of the offers you can’t yet qualify for.

But having no or limited credit doesn’t mean you can’t get a credit card. There’s a whole sector of the credit industry designed for consumers who want to establish a credit history. With responsible card usage, such as a strong payment history, you could be climbing those stairs and reaching for top-tier cards faster than you think.

- No annual or hidden fees. See if you're approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One's mobile app

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

- No credit check to apply

- Adjustable credit limit based on what you transfer from your Chime Checking account to the secured deposit account

- No interest* or annual fees

- Chime Checking Account and qualifying direct deposit of $200 or more required to apply. See official application, terms, and details link below.

- The secured Chime Credit Builder Visa® Card is issued by The Bankcorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted.

- *Out-of-network ATM withdrawal and OTC advance fees may apply. View The Bancorp agreement or Stride agreement for details; see back of card for issuer.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

$0

|

None

|

- Earn unlimited 1.5% cash back on every purchase, every day

- Early Spend Bonus: Earn $50 when you spend $100 in the first three months

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Enjoy no annual fee, foreign transaction fees, or hidden fees

- Lock your card in the Capital One Mobile app if it's misplaced, lost or stolen

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

+ See More Cards for No/Limited Credit

What Credit Score Do I Need to Be Approved for Credit?

While there’s no general minimum score needed to obtain a credit card, each card has its minimum acceptance requirements. Those requirements can sometimes be vague, though, and meeting those standards doesn’t guarantee acceptance. That’s because your credit score is just one factor used to determine your eligibility for a credit card.

Don’t know your score? Here are a few free ways to find it. FICO and VantageScore are the two most common credit scoring models used, so make sure it’s one of those scores you’re receiving.

A top-shelf card with the richest rewards and greatest benefits will require not only excellent credit (a credit score above 740) but also a solid proof of income and a low debt-to-income ratio.

On the other hand, some secured credit cards — offerings that require a refundable cash deposit that equals your credit limit — don’t require credit checks for acceptance. But keep in mind that some of these cards will reject you if you have a pending bankruptcy the court hasn’t yet discharged.

But if your needs are simple and you aren’t as concerned with all the bells and whistles — or you don’t want to fuss with the annual fee that often comes with many popular rewards cards — you have options with almost any credit score.

Just remember that, as with most things in life, the higher your standing — in this case, your credit score — the better the offers you’ll receive. If you’re in the lower credit score tiers, you’re likely to encounter more annual fees, lower credit limits, fewer rewards, and higher APRs.

The key to finding your next credit card isn’t to only look for the best card you may qualify for, but rather the card that best suits your needs and current economic situation. That may mean a lower credit limit to avoid an annual fee or opting for fewer rewards so you can obtain a better interest rate.

What is the Easiest Credit Card to be Approved For?

If you’re looking for easy approval, nothing beats a secured credit card. Many of these cards skip the credit check altogether as long as you can provide a refundable cash deposit to fund your credit limit.

These cards are traditionally designed for consumers who are building or rebuilding their credit profiles. If you have an established credit history, there are literally hundreds of better options you may qualify for.

And, thanks to modern technology, almost all of them are easy to apply for. Most credit cards now feature online application processes that take less than five minutes to complete and can provide most credit decisions within minutes.

It’s important to shop for cards that accept applicants within your credit score range. Don’t get too enticed by premium cards that are out of your reach. By choosing a practical card that you qualify for, you’ll find easier acceptance and can begin clearing your financial path toward a premium credit card offer.

Just remember that each time you apply for a credit card or loan, the financial institution issuing the loan or credit card makes a hard inquiry on your credit report. Credit reporting bureaus typically allow for three or fewer inquiries on your credit report over a two-year period. After that, each inquiry may slightly lower your credit score and can make it harder to gain approval for some credit cards.

That’s why you should limit your credit card applications to one every six months. This keeps you from bogging down your credit report with inquiries and lessens the impact of previous inquiries since their effect on your overall credit score lessens over time.

How Many Americans Have a Credit Score Above 800?

According to an April 2018 FICO report, 21.8% of U.S. consumers have a FICO score between 800 and 850. The number of Americans with excellent credit continues to rise, as only 16.2% of consumers fell in that sterling score range in April 2005.

Depending on where your credit score currently stands, you may need years to get to the 800 level. Consumers who fall in this range have no negatives on their payment history, as well as a diverse mix of credit accounts that show a positive history of managing different types of credit and loans. These can include but aren’t limited to credit cards, personal loans, student loans, auto loans, and mortgages.

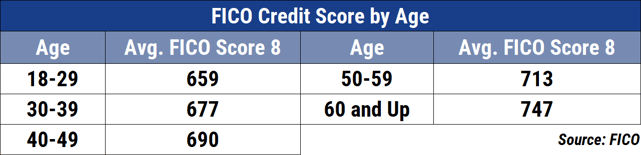

As depicted in this graph, it takes time to build excellent credit.

The longer you keep your credit lines open and in good standing, the better they look to lenders. That’s because a long history of on-time payments and responsible usage makes you a better credit risk than someone who has only a brief track record of success.

But while you may set a goal to become a member of the 800+ club — which is a great goal to have — remember that most credit issuers place the cutoff for “excellent” credit around the 740 mark. That means you can get a lot of the same offers with a credit score above 740 that you’d get with a score above 800. That doesn’t mean that those extra points won’t make your application a tad more attractive to banks and lenders.

Getting to the 800 mark takes patience, practice, and financial know-how. You don’t need a six-figure income to get there, though. And like every good recipe, the ingredients you add to your credit report will determine the quality of your outcome.

How Can I Quickly Raise My Credit Score?

Your credit score doesn’t just work to help you get better credit card offers. Your overall rating also impacts your access to loans, better interest rates for car insurance, and even job opportunities.

That’s why it’s important to keep your score as high as possible. And there are several ways to give yourself a boost before applying for a credit card, loan, or job.

Your first step should be to obtain a free annual credit report from each of the three major credit reporting bureaus. While these reports won’t show your actual credit score (there are many free sources for obtaining that information), they will show any items that may be weighing your score down.

Once you better understand the negative information on your reports, you can take the necessary actions to improve your credit.

While you’re working to improve your score, it’s vital that you pay every bill on time. Even one 30-day late payment can knock between 90 and 110 points off your credit score. You also want to refrain from closing credit card accounts (unless it has an annual fee you want to stop paying).

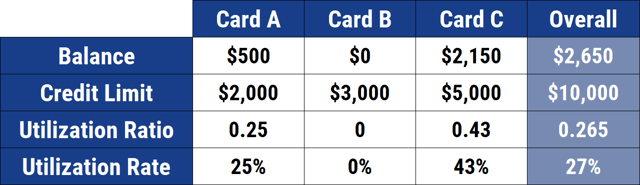

That’s because your credit utilization ratio accounts for 30% of your FICO credit score calculation. You can determine your credit utilization ratio by dividing the amount of credit you’re currently using by the total amount of credit you have available. For example, if you have a card with a $2,000 credit limit and you carry a $500 balance, you have a 25% utilization.

Credit utilization accounts for 30% of your FICO credit score calculation. Keep your balances low to quickly improve and maintain a good credit score.

Your credit score will increase when your utilization ratio decreases. But when you cancel a credit card, the amount of credit available to you also drops — which can drastically raise your utilization ratio and create a sudden spike in your credit score.

Even if you don’t plan to use your credit card, it’s better to lock it away somewhere safe than to cancel it with the issuer.

Another way to improve your utilization ratio is to request a credit limit increase on your existing credit cards. If you have a good payment history and don’t carry a high balance, your card issuer may consider you for a credit increase.

You can ask for an increase by calling your card issuer’s customer service number. Some issuers also provide a credit limit increase request form online that provides an instant decision.

By increasing your current credit limits, you immediately lower your utilization ratio, which can improve your credit score.

There’s a Card for Every Score

Just as your local ice cream parlor offers 31 flavors for customers with differing palates, credit card companies often curate several different card options for consumers with varying credit scores. These cards have a wide array of APRs, rewards, and fees, but all can give your wallet an instant boost in spending power.

Before you apply for a card, you should first determine which cards fall within your current credit score range, as we’ve detailed above. When you apply for a card you likely won’t qualify for, you add a potentially harmful hard inquiry to your credit report, which can make it more difficult to be approved for another card down the road.

But, if you apply for a card within your credit score range and work to improve your score — you could find yourself in the 800+ club much faster than you expect — unless you’re already in the coveted “excellent” range.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![Capital One Platinum Card: Credit Score Needed for Approval ([updated_month_year]) Capital One Platinum Card: Credit Score Needed for Approval ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/01/Capital-One-Platinum-Credit-Score-Needed.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='29774' field_choice='title']: Credit Score Needed for Approval ([updated_month_year]) [card_field card_choice='29774' field_choice='title']: Credit Score Needed for Approval ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/02/reserve--1.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='5909' field_choice='title']: Credit Score Needed + 3 Approval Factors ([updated_month_year]) [card_field card_choice='5909' field_choice='title']: Credit Score Needed + 3 Approval Factors ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/06/average-credit-score-2.png?width=158&height=120&fit=crop)

![Discover Card: Credit Score Needed & 5 Best Cards ([updated_month_year]) Discover Card: Credit Score Needed & 5 Best Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/11/discovercard2.png?width=158&height=120&fit=crop)

![Capital One Credit Score Requirements By Card ([updated_month_year]) Capital One Credit Score Requirements By Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/caponecredit.png?width=158&height=120&fit=crop)

![9 Best Loans & Credit Cards: 400-450 Credit Score ([updated_month_year]) 9 Best Loans & Credit Cards: 400-450 Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/bestloans.png?width=158&height=120&fit=crop)

![9 Best Credit Cards by Credit Score ([updated_month_year]) 9 Best Credit Cards by Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/11/shutterstock_402532915.jpg?width=158&height=120&fit=crop)