It goes without saying (or writing) that your credit scores are a big deal. They are especially so when you want to apply for a new loan, credit card, or some other service that uses credit scores as part of its underwriting process. And while there are two primarily utilized scoring platforms, FICO and VantageScore, FICO is still the most commonly used credit score by most lenders.

What you may not understand is exactly how FICO and other scoring models get to that three-digit number, and what you can do to improve it. Certainly one of the most influential actions you can take with respect to your credit scores is to use credit card accounts. They are very influential to your credit scores.

Credit Cards Can Influence All 5 FICO® Score Factors

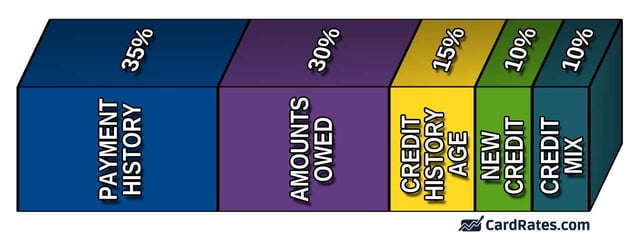

Although FICO doesn’t reveal the exact formula it uses to calculate credit scores, the company does give some clues regarding what influences their models. Your credit scores are based on the information found in your credit reports, broken down into five different categories.

Each factor above accounts for the associated percentage of the points in your FICO credit scores. And, credit cards are so influential because they can touch each aforementioned category.

Rather than just taking a generic look at how a FICO Score is calculated, let’s dig deep into how a credit card account can play a role in determining your FICO Scores.

Payment History – 35%

Payment history matters most when your credit scores are calculated – whether those scores are created by FICO or VantageScore. In fact, payment history is so important that it makes up roughly one-third of your FICO Score points.

The most important responsibility you have when you open a credit card account is to make your monthly payments on time, always. Fail to pay by your due date and your card issuer may add expensive late fees to your account, or worse.

If you’re a full 30 days or more behind on your bill, your card issuer will probably report you as being late to the credit bureaus. Late payments aren’t a good look for your credit scores, if you were wondering.

On the other hand, if you consistently make timely payments on your credit card accounts, your scores could increase over time. If you’re worried about forgetting a credit card due date, automatic payment drafts from your checking account will help.

Amounts Owed – 30%

The second category on the list is also very influential. You may be surprised to know that how much you owe and how much of your available credit card credit limits you’ve used is almost as important as whether you’re paying your bills on time.

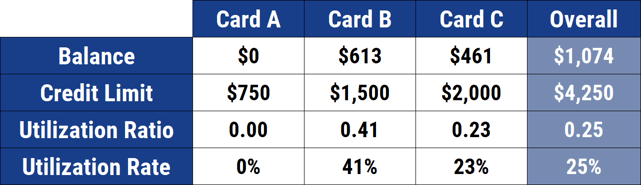

How you manage your credit card debt could help or hurt your scores. If your balance-to-limit ratio — also known as your utilization ratio — is low, you will earn more points. That means higher credit scores.

Credit scoring models look at utilization for each of your credit cards individually and your overall utilization.

To determine your utilization rate for a particular card, simply divide your card balance by your total credit limit for that card. For example, if a credit card has a credit limit of $1,500 and a balance of $613, then the utilization rate is: $613 / $1,500 = 0.41 = 41%.

If your reports show that your credit cards are being heavily utilized, meaning your balances are too close to your credit limits, you may be awarded fewer points in this category. The result would be lower credit scores.

Thankfully, if a high usage ratio is holding your FICO scores back, it’s a problem that can be easily fixed. Once you decrease your usage ratio — i.e., pay down your balances — your credit scores will start to improve as soon as your next billing cycle as this is when your card issuer sends a new account update to the credit reporting agencies.

Length of Credit History – 15%

The third category on the list is the length of your credit history. Factors that influence your FICO Score in this category include:

- Average Age of Your Accounts

- Age of Your Oldest Account

- Age of Your Newest Account

- How Long Specific Accounts Have Been Open

- Length of Time Since You Used an Account

From a scoring perspective, the longer your accounts have been open, the better.

Opening a new credit card could hurt this category because new cards mean lower average age of account measurement results. However, keep in mind that length of credit history is only worth 15% of your score points.

If a new credit card helps you earn more points in other, more important, scoring categories, any negative score impact here may be offset. As your credit cards age, they can help you earn extra points within this credit score category as well.

Mix of Credit – 10%

This category is sometimes called “types of credit used.” FICO scoring models evaluate the mixture of accounts on your reports; the more diverse, the better.

It may benefit your FICO credit scores to have a variety of different account types present on your reports, such as:

- Credit Cards (Revolving Accounts)

- Auto Loans and Personal Loans (Installment Loans)

- Mortgages

Of course, you don’t need to rush out and buy a home or car just to improve your scores. Credit scoring is more complicated than that anyway and your strategy may backfire. However, if you don’t have a credit card on your reports, adding one to the mix may be a good idea.

FICO also points out that credit mix isn’t typically a key factor in determining FICO Scores. Yet it could matter more if you have a thin credit file (aka not many accounts on your credit report).

New Credit – 10%

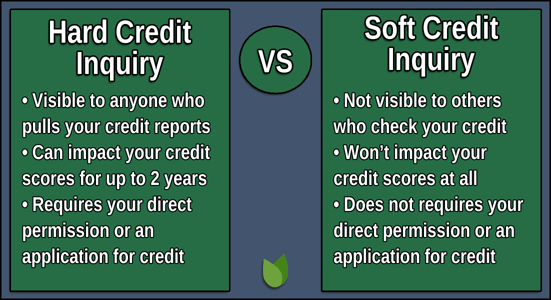

The last factor looks at the new credit for which you’ve recently applied. You may have heard that allowing lenders to pull your credit reports could hurt your credit scores. And while it’s true that too many hard credit inquiries can hurt your FICO score, it may not be as big of a problem as you fear.

When you apply for a new credit card, a lender will pull your credit report from one of the three credit bureaus – Equifax, TransUnion, or Experian – to evaluate your credit risk. A record of that credit access, known as an inquiry, will be added to your credit report.

You shouldn’t apply for credit too frequently, but a new credit card application isn’t going to trash your credit scores either. Remember, inquiries are only worth 10% of your FICO Score. Not every inquiry will lower your credit score either. (That’s a myth.)

Finally, inquiries only remain on your credit reports for 24 months and FICO only considers inquiries for 12 months. After that, they’re ignored and have zero impact on your score.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Best Credit Cards By FICO Score ([updated_month_year]) 7 Best Credit Cards By FICO Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/02/fico.png?width=158&height=120&fit=crop)

![9 Balance Transfer Cards For 600-700+ FICO Score ([updated_month_year]) 9 Balance Transfer Cards For 600-700+ FICO Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/Balance-Transfer-Cards-For-600-700-FICO-Score.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards for Low Credit Scores ([updated_month_year]) 5 Best Credit Cards for Low Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/credit-cards-for-low-credit-scores-feat.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards for 600 to 650 Credit Scores ([updated_month_year]) 8 Best Credit Cards for 600 to 650 Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-600-to-650-Credit-Scores-Feat.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards for High Credit Scores ([updated_month_year]) 9 Best Credit Cards for High Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Best-Credit-Cards-for-High-Credit-Scores-Feat.jpg?width=158&height=120&fit=crop)