Hotel accommodations are one of the biggest travel-related expenses. Whether you’re looking for a place to crash for a night or want a relaxing home-away-from-home where you can pamper yourself, you’re going to have to pay for a place to stay — unless you have one of our best credit cards for free hotel stays.

With the right credit card, you can earn free hotel stays and room upgrades by making regular purchases — which means you’ll have more money to spend on your adventures or souvenirs.

We’ve researched this expansive field and narrowed our top choices down by large issuing banks and hotels.

Best Overall

By Issuer: Amex | Bank of America | Capital One | Chase | Citi | Discover

By Hotel: Marriott | Hilton | IHG | Hyatt | Wyndham

Best Overall Cards For Free Hotel Stays

Even though you may spend months meticulously planning your vacation, you still need a little flexibility in your plans to account for the unexpected. And if you have to be flexible, shouldn’t your credit card act the same way?

Our best overall credit cards for free hotel stays, listed below, aren’t going to limit you as to where and when you travel and offer rich rewards with easy redemptions.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

The Capital One Venture Rewards Credit Card offers regular signup bonuses for new cardholders that provide bonus miles when you reach certain spending thresholds. You can turn those miles into reimbursements for airfare, hotels, and other travel-related expenses.

Chase Sapphire Reserve® cardholders receive an annual anniversary travel credit that reimburses travel expenses made on the card. You can use your earned points to purchase travel and other deals through the Chase platform or do a 1:1 transfer to participating airline and hotel loyalty programs.

The Capital One VentureOne Rewards Credit Card doesn’t charge an annual fee and offers a competitive interest rate to qualified applicants. Maybe the most attractive feature of this card is its 0% introductory period, which gives you time to pay off your trip expenses.

Best American Express Card For Free Hotel Stays

American Express was once the gold standard for vacationers with the company’s popular Travelers Cheques. That commitment to the traveler has continued over the years, and the credit card issuer still provides some of the best hotel perks on the market.

The Platinum Card® charges a hefty annual fee, but it doesn’t take much research to see how the fee can quickly pay for itself. The annual travel and shopping credits nearly cover the cost of the card.

You’ll also be reimbursed for Global Entry or TSA Pre✓® to get through airport security faster. Add all of that together and you have a do-it-all travel companion in your wallet.

Best Bank of America Card For Free Hotel Stays

Bank of America operates approximately 3,900 locations throughout the United States, its territories, and in 35 countries. With that kind of coverage, you’re likely to find a location wherever you travel. And with the card listed below, you can save more money in your Bank of America account when you take that trip.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Travel Rewards credit card pays points for every $1 spent using the card. You can earn bonus points using an introductory offer that kicks in after you reach certain spending thresholds.

Best Capital One Card For Free Hotel Stays

Capital One is one of the most popular credit card issuers in America because of its flexibility and ease of use. With the card below, you won’t have to worry about blackout dates, airline restrictions, or other limitations that can put a damper on your vacation.

With the Capital One Venture Rewards Credit Card, you can rack up miles quickly. If you’re like most people, and can’t stand waiting in long airport security lines, you can also receive up to a $100 credit for Global Entry or TSA PreCheck®.

Best Chase Card For Free Hotel Stays

Chase is already one of our go-to card issuers for travel rewards thanks to the bank’s robust Chase Ultimate Rewards platform. The platform allows you to transfer your accrued points to approved loyalty programs, so you can maximize the value of your rewards at your favorite hotel brand.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

Every year, Chase Sapphire Reserve® cardholders receive an annual travel credit that reimburses travel-related expenses charged to the card, including hotel reservations. You can use your points to book free or reduced-cost hotel stays through Chase or transfer the points to participating hotel loyalty programs.

Best Citi Card for Free Hotel Stays

Consumers already know Citi as a card issuer that places emphasis on savings. Citi cards are renowned for their long interest-free introductory periods and competitive terms. But what you may not know is that the bank also issues one of the best hotel cards on the market.

Additional Disclosure: Citi is a CardRates advertiser.

Plus, for a limited time, earn a total of 10 ThankYou® Points per $1 spent on hotel, car rentals, and attractions (excluding air travel) booked on the Citi Travel℠ portal through June 30, 2024.

The Citi Premier® Card offers points that can be redeemed for travel rewards, including hotel stays. You’ll also receive an annual hotel savings benefit through thankyou.com. Redeeming your points for travel ususally yields the most value, whereas cash back will yield you the least.

Best Discover Card for Free Hotel Stays

Cardholders of the popular Discover it® Miles card never have to worry about blackout dates or booking restrictions, making it a smart choice for consumers who want a simple way to earn miles.

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers - only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more.

- 0% intro APR for 15 months on purchases. Then 17.24% - 28.24% Standard Variable Purchase APR will apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Discover is accepted nationwide by 99% of the places that take credit cards.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

You can quickly rack up miles that help pay for your next trip with the Discover it® Miles card. You can redeem your miles as a statement credit to reimburse you for hotel, airfare, or other travel-related expenses.

Best Cards for Free Marriott Hotel Stays

Marriott is the largest hotel chain in the world, boasting 5,700 properties, 1.1 million rooms, and a portfolio of 30 brands. With so many thriving locations, you’ll certainly have no problem finding a Marriott-owned property at your favorite travel destination.

10. Marriott Bonvoy Boundless™ Credit Card

With the Marriott Bonvoy Boundless™ Credit Card from Chase, you can earn 6X points for every $1 spent at a Marriott Bonvoy hotel and 2X points on all other purchases. You’ll also earn one free night annually on your account anniversary, plus free premium internet access and Marriott Elite status as soon as you activate your card.

- 6X points for every $1 spent at Marriott Bonvoy hotels

- 2X points per $1 spent on all other purchases

- Free night award on your account anniversary every year

- $95 annual fee

Cardholders also receive lost luggage reimbursement, auto rental collision damage waiver, and trip delay reimbursement. The card does have a $95 annual fee, but the free night each year more than makes up for the charge.

(Non-Monetized. The information related to Marriott Bonvoy Boundless™ Credit Card was collected by CardRates.com and has not been reviewed or provided by the issuer of this product. Product details may vary. Please see issuer website for current information. Product details may vary. Please see issuer website for current information. CardRates.com does not receive commission for this product/card.)

Best Cards for Free Hilton Hotel Stays

More than 570 Hilton properties cover 78 countries on six continents. With our top-rated Hilton credit card below, you can work your way through the list while saving money and earning free stays and upgrades.

11. Hilton Honors American Express Aspire Card

Don’t let the Hilton Honors American Express Aspire Card’s $450 annual fee scare you. If you’re a regular traveler who loves the Hilton brand, this card can pay for itself very quickly. Not only will you earn a free weekend night every year, but you’ll also get a $250 Hilton Resort credit, $100 Hilton on-property credit, and a $250 airline fee credit annually. That covers the fee alone.

- Diamond Status with Hilton Honors

- Annual free weekend night reward, $250 Hilton Resort credit, $100 Hilton on-property credit & $250 airline fee credit

- Pay $450 annual fee

Cardholders also get an automatic boost to Diamond Elite status — the highest possible status in the Hilton rewards system. This unlocks free breakfast on most properties, regular upgrades, and many other perks for your stay.

Best Cards for Free IHG Hotel Stays

IHG’s property portfolio includes the popular InterContinental, Kimpton, Hotel Indigo, and Holiday Inn brands, among others. With such a diverse group of hotels and resorts, you’ll have no problem finding a property that allows you to maximize your rewards and get the most out of your trip.

12. IHG® Rewards Club Premier Credit Card

The IHG® Rewards Club Premier Credit Card helps you earn rewards for stays at any of the more than one-dozen brands in the IHG portfolio. You’ll earn bonus points for your stays and 2X points for every $1 spent at gas stations, grocery stores, and restaurants. All other purchases yield 1 point per $1 spent.

- Earn 10 points per $1 spent at 5,400+ hotels worldwide

- Earn 2 points per $1 spent at gas stations, grocery stores, restaurants

- Earn 1 point per $1 spent on all other purchases

- $89 annual fee

You’ll also earn a free night’s stay on every account anniversary, which more than makes up for the $89 annual fee. You’ll receive your fourth night free if you stay four or more consecutive nights at an IHG property and use your card to pay for the trip.

(Non-Monetized. The information related to IHG® Rewards Club Premier Credit Card was collected by CardRates.com and has not been reviewed or provided by the issuer of this product. Product details may vary. Please see issuer website for current information. Product details may vary. Please see issuer website for current information. CardRates.com does not receive commission for this product/card.)

Best Cards for Free Hyatt Hotel Stays

Hyatt runs 15 different hotel brands, from upscale to luxury, in almost every major travel destination around the world. With our top-rated credit card below, you can earn upgrades and free stays at any of its brands while saving money on your vacation.

13. World of Hyatt Credit Card

The World of Hyatt® Credit Card can help you earn free nights very quickly by awarding 9X points for bookings and purchases made at Hyatt hotels, restaurants, and spas. You can also get a point boost to 2X earnings on airfare, taxis, mass transit, tolls, ride-sharing, and other travel-related expenses.

- 9X points at Hyatt hotels, resorts, restaurants, and spas

- 2X points on airfare, taxis, mass transit, tolls, ride-sharing, restaurants, and fitness and gym memberships

- 1X points on everything else

The card currently offers 50,000 bonus points when you reach certain spending thresholds within the first six months of card ownership — good for 10 free nights at a category 1 hotel. You’ll also receive one free night annually, which will cover the $95 annual fee.

(Non-Monetized. The information related to World of Hyatt® Credit Card was collected by CardRates.com and has not been reviewed or provided by the issuer of this product. Product details may vary. Please see issuer website for current information. Product details may vary. Please see issuer website for current information. CardRates.com does not receive commission for this product/card.)

Best Cards for Free Wyndham Hotel Stays

Travelers already associate Wyndham with luxury resorts and high-class accommodations. But this hotel giant offers more than meets the eye, running a portfolio of 19 brands that span every travel budget.

14. Wyndham Rewards® Visa® Card

The Wyndham Rewards® Visa® Card has one of the most affordable free night options on the market. Depending on which hotel you book with, you can earn free nights starting at 7,500 points (15,000 for premium properties). Cardholders earn 3X points per $1 spent on eligible Wyndham purchases, 2X points on eligible gas, utility, and grocery store purchases, and 1 point per $1 on every other purchase.

- Free nights start at 7,500 points

- 15,000 bonus points after your first purchase or balance transfer

- Automatic Wyndham Rewards Gold Membership

- No annual fee

This card offers regular introductory offers for new cardholders that can earn you instant free nights after reaching certain spending thresholds. Do some research before applying to make sure you’re getting the best offer possible.

How Do Hotel Credit Cards Work?

Several types of hotel credit cards exist, and each has a unique way of paying out rewards.

Some all-purpose travel credit cards, like the popular Discover it® Miles card, allow you to earn miles on every purchase you make using the card. Those miles equate to cash earnings you can redeem as a statement credit to reimburse you for any travel-related expense — not just hotel stays.

You can use your earned miles to pay for flights, hotel bookings, car rentals, ride-sharing fees or any other approved travel charge. You can let the miles build up over time and redeem them whenever you choose.

Other cards, like those under the Chase umbrella, use platforms such as the Chase Ultimate Rewards portal that let you apply your accrued points (which you earn on every purchase) toward several travel categories, including hotels.

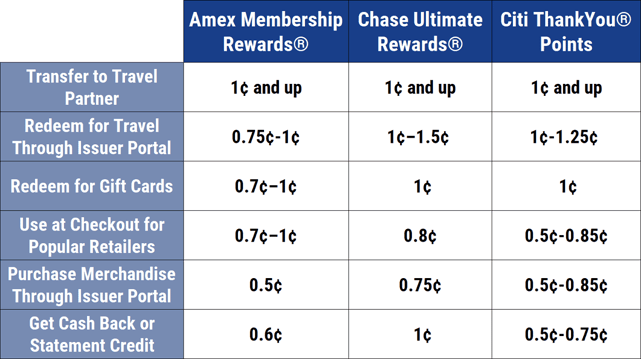

The value of your points will depend on the category you choose to redeem them in. And travel rewards are among the most lucrative rewards in the program.

With hotels specifically, you can stay for free if you have enough points or use your points to lessen the cost of the reservation.

Rewards points carry different values depending on what you redeem them for.

Hotel-branded credit cards work entirely differently. Specific hotel chains issue these cards, which means you can only redeem your rewards at a property owned and operated by that brand.

While that may sound limiting, there are several perks to these types of cards. Since they’re meant to build loyalty to a specific hotel chain, they often include added perks when you stay at one of the brand’s properties.

These can include room upgrades, free meals, free WiFi, spa treatments, or other accommodations other travelers have to pay for.

Plus, these cards often allow you to earn free nights faster — and some offer signup bonuses that can earn you free nights after you meet certain spending requirements.

Finding the card that works best for you will require examining your travel preferences and how much flexibility you need in a travel credit card. If you’re not overly loyal to a specific brand, you may find an all-purpose travel credit card is better suited for you.

How Can I Get Free Hotel Stays?

Many hotel loyalty programs offer free nights when you stay at one of the chain’s hotels for a certain number of nights. But that’s not the only way to earn free stays.

With a good hotel or travel credit card, you can earn miles or points for every purchase you make. You can then turn those points into free hotel stays.

If you’re already a frequent traveler, you can essentially double your perks if you choose a good hotel-branded credit card. These offer special cardholder benefits and upgrades during your stay and free nights when you accumulate a certain number of paid nights.

If you’d rather have the freedom to pick your hotel without worrying about sell-outs our blackout dates, an all-purpose travel credit card — such as the Capital One Venture Rewards Credit Card — will allow you to redeem your earned miles or points as statement credits that reimburse you for travel expenses, such as flights, car rentals, and hotel stays.

Still, not every card that rewards you with points or miles will pigeonhole you into using your earnings on travel expenses. The Chase Ultimate Rewards program, which most Chase-branded credit cards use, lets you choose how you use your rewards — including options to earn cash back, merchandise, gift cards, or travel rewards.

Keep in mind that your rewards will hold varying values depending on how you choose to redeem them. For example, using your rewards for cash back will yield a smaller return than cashing them in for free hotel stays.

Which Hotel Rewards Program is Best?

Every hotel loyalty program is different, but they all have the same goal — making you loyal to their brand. And many hotels and resorts go out of their way to earn that loyalty.

Wyndham Rewards, for example, makes it easy to earn free nights that start at just 7,500 points and max out at 15,000 — meaning you can earn a free stay at the most economical Days Inn or the fanciest Wyndham Resort for 15,000 points. And, those points rack up quickly with the Wyndham Rewards® Visa® Card, which offers as much as 3X points per $1 spent.

The World of Hyatt loyalty program focuses on maximizing a member’s in-stay experience. The program’s elite Globalist members receive free lounge access and breakfast, room upgrades, and guaranteed late checkout at 4 p.m. — perfect for when you want to extend your trip just a little bit longer.

You’ll also earn a whopping 9X points on purchases made with your World of Hyatt® Credit Card during your stay.

World of Hyatt® cardholders earn 9X points on purchases made at Hyatt properties.

If free nights and room upgrades aren’t enough, the Hilton Honors loyalty program aims to make your upscale stay as affordable as possible. Every member gets a guaranteed discount on each stay, with each tier of the program receiving deeper discounts.

Every member also receives free in-room WiFi as well as point pooling, which lets family members combine their points into one pool for maximum value.

And, if you carry the Hilton Honors American Express Aspire Card, you’ll receive an automatic upgrade to Diamond status — the program’s top tier. As a Diamond Member, you’ll get automatic space-available room upgrades, up to one-bedroom suites.

Diamond members also get guaranteed late-reservation rooms as long as they book at least 48 hours in advance, and every fifth night is free when staying five or more nights.

Minimize Lodging Costs with a Hotel Rewards Card

Traveling is a fun and rewarding experience. But if you don’t plan your trips properly, you can easily find yourself paying off those adventures for a long time after you return home.

With one of our best credit cards for free hotel stays, you can earn rewards every day and save them for the trip of a lifetime or a weekend getaway. No matter how you choose to redeem your rewards, you’re certain to find more value with a good travel credit card than if you rely solely on your vacation savings fund.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Best Hotel Rewards Credit Cards ([updated_month_year]) 7 Best Hotel Rewards Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/01/hotels.png?width=158&height=120&fit=crop)

![9 Best Credit Cards for Free Flights ([updated_month_year]) 9 Best Credit Cards for Free Flights ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Best-Credit-Cards-for-Free-Flights.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards For Free Car Rentals ([updated_month_year]) 8 Best Credit Cards For Free Car Rentals ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Best-Credit-Cards-For-Free-Car-Rentals--1.jpg?width=158&height=120&fit=crop)

![How to Get Free Flights With Credit Cards ([updated_month_year]) How to Get Free Flights With Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/03/How-to-Get-Free-Flights-With-Credit-Cards.jpg?width=158&height=120&fit=crop)

![7 Credit Cards With Free Credit Monitoring ([updated_month_year]) 7 Credit Cards With Free Credit Monitoring ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Credit-Cards-With-Free-Credit-Monitoring.jpg?width=158&height=120&fit=crop)

![12 Credit Cards that Offer Free Checked Bags ([updated_month_year]) 12 Credit Cards that Offer Free Checked Bags ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/02/Credit-Cards-that-Offer-Free-Checked-Bags.jpg?width=158&height=120&fit=crop)

![8 Free Prepaid Credit Cards ([updated_month_year]) 8 Free Prepaid Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/03/Free-Prepaid-Credit-Cards.jpg?width=158&height=120&fit=crop)

![12 Free Prepaid Debit Cards ([updated_month_year]) 12 Free Prepaid Debit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/09/Free-Prepaid-Debit-Cards.jpg?width=158&height=120&fit=crop)