Opinions expressed here are ours alone, and are not provided, endorsed, or approved by any issuer. Our articles follow strict editorial guidelines and are updated regularly.

Dramatic price hikes across consumer goods and services since inflation began surging in mid-2021 have prompted people to take on record credit card debt — surpassing $1 trillion at the end of 2023, as the Federal Reserve Bank of New York reported.

While skyrocketing food, energy, and housing costs are much to blame for consumer debt, we can’t ignore poor credit card spending habits.

Taking control of how you use your credit card is the first step in getting out of debt. Here’s a look at 11 credit card habits you need to break immediately to start taking control of your finances.

1. Carrying a Revolving Balance

Carrying a revolving balance on your credit card makes each purchase you make more expensive thanks to interest fees. As your balance grows, interest charges accumulate, taking a big bite out of each payment you make to your account. Paying any amount of interest on your credit card account also voids any rewards you earn since the interest rate is calculated at a much higher rate than the rate at which you may earn cash back, points, or miles for your purchases.

Break this habit by treating your credit card like a debit card and only charging what you can afford to pay off in full at the time you charge it. It’s also a good idea to check in on balances once a month so you know when it’s time to scale back on spending.

2. Relying on Credit to Make Ends Meet

A recent LendingTree survey found that 64% of Americans are living paycheck-to-paycheck and many of them are relying on credit cards to make ends meet. While using credit cards to pay bills and afford other monthly expenses may seem like your only option when there’s no money left in the bank, setting up a budget can help get your finances back on track.

Begin by creating a detailed spending plan that accounts for saving and paying down debt. Scrutinize bills for potential savings, start meal planning to reduce grocery spending, and track each purchase to ensure your dollars are going exactly where they need to so you can stay on budget. Tap into budgeting apps like YNAB or PocketGuard for help organizing your expenses and use services like Trim to identify and cancel unused services.

3. Keeping High Balances

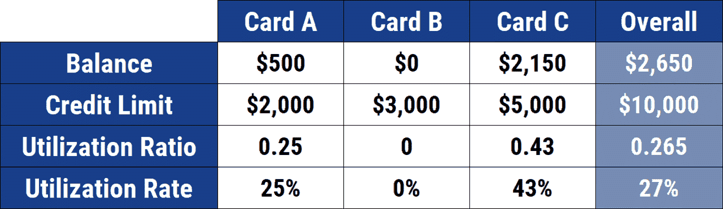

Pushing your credit limits can cost you in the form of a poor credit score. Although the 2009 Card Act prevents credit card issuers from allowing accounts to go over their set limit so you don’t get charged an over-the-limit fee, there are other negative consequences that come with carrying a high balance such as dinging your credit score.

In fact, credit utilization rate refers to how much available credit you have versus how much debt you owe. Your total indebtedness accounts for 30% of your credit score points.

In general, it’s advised that you use no more than 30% of your available credit to maintain a good credit rating. Using any more than that will impact your score for the worse and make it harder to secure a loan to buy a house or car.

4. Paying Just the Minimum Payment

Paying just the minimum due each month will trap you into a revolving cycle of debt that becomes increasingly difficult to pay off. As your balance grows and interest fees rise, you end up shelling out an incredible amount of money to pay down your original charges.

Say you’re carrying a credit card balance of $5,000 at the average interest rate of 20.74% and are only able to make a payment of $100 per month, it is estimated that it will take you 117 months (that’s almost 10 years!) to pay off the entire balance. That will cost you $6,650 in interest on top of your original purchase charges. That means you will have spent a total of $11,650 during this time.

Use a credit card payoff calculator to get a better understanding of where you stand and take steps to pay down your balance faster, paying at least double to triple the minimum due each month. Better yet, use a balance transfer card to alleviate the mounting pressure of those fees each month.

5. Missing Payments

Pay close attention to when statement charges are due to avoid late payment fees and other potential penalties. Those who miss their payment due date will get slapped with a late payment fee of up to $41, and they will begin accruing interest on purchases charged during that billing cycle. Missing payments for 60 days or more will result in a penalty rate increase which will make your balances more difficult to pay off, leading to a vicious debt cycle.

If you’re struggling to pay your credit card bill, don’t ignore it. Call your credit card issuer to set up a payment plan to avoid fees and penalties. Otherwise, setting up bill reminders and auto pay are easy ways to avoid these potential fees.

6. Using Multiple Credit Cards

The more credit cards you have, the easier it is to lose track of your total spending and rack up balances across multiple accounts, leading to devastating debt. It’s better to stick with one credit card so you can keep a watchful eye on spending to ensure you aren’t going over budget. This also allows you to maximize rewards to earn a greater amount of cash back, miles, or points on those daily purchases and monthly expenses.

To figure out which type of rewards credit card will work best for you, tap into services like Gigapoints, a credit card matching tool that analyzes your every purchase and selects the card that will yield the most rewards on everything you buy.

Otherwise, review your year-end bank and credit card statements from 2023 to see where you spend the most money, and look for a credit card that offers bonus rewards for those categories.

7. Chasing Rewards

Spending more to earn rewards will cost you more in the long run compared to what you get back from the card issuer. Only use your credit card for purchases you carefully planned and use other tools to increase cash back or other reward earnings.

In fact, there are a variety of cash back tools that you can use with your credit card to supercharge rewards. For example, download the Fetch app to earn cash back on groceries, gas, and other purchases by simply uploading pictures of your receipts to your account. You’ll earn points toward free gift cards to a variety of stores like Amazon, Target, and Walmart. Check their special offers section to see which stores and brands will get you more points to rack up rewards faster.

8. Ignoring Bonus Reward Offers

Many reward credit cards offer bonus-earning potential each month for select retailers and businesses. These promotional offers allow you to rack up more cash back, miles, or points when making purchases with these companies, but you don’t automatically qualify for the extra perks.

Such offers are usually emailed to you from your credit card company and require you to log into your account and opt-in to qualify for the extra rewards. Overlooking these promotional offers could mean you miss out on extra rewards to put toward a purchase or travel booking.

9. Swiping on Impulse

According to the Impulse Spending Report from Slickdeals, the average consumer spends just over $150 on impulse purchases each month. While $5 here and $10 there seems harmless, these small purchases quickly snowball and can cause you to take on a balance you cannot pay off by the due date. Tracking each purchase and following a carefully crafted budget is key to avoiding debt.

It’s also a good idea to think about what triggers those impulse purchases. If you can’t resist a sale, delete shopping apps on your phone and unsubscribe from store newsletters using Unroll.me.

10. Opening Store Cards to Score a Discount

Retailers entice shoppers to open store credit cards by offering an immediate discount of 10 to 20% off their purchase if approved for an account. While the additional savings is tempting, opening a new credit card for a discount is ill-advised for a few reasons.

First, your credit score may get dinged each time you request a new line of credit which will put a current loan request in jeopardy. Second, most store cards have low credit limits, high interest fees, and limited reward earning and redemption options, making them a poor choice for most shoppers.

You’re ultimately better off paying with a general-use cash back credit card that offers more flexible redemption. This doesn’t mean you have to forgo savings. Instead, look for coupons online or via a mobile coupon app like Coupon Cabin to get in-store deals right to your phone that you scan at checkout for immediate savings.

11. Ignoring Savings When Paying Down Debt

A common mistake people make when trying to get out of debt is to use all their available funds to pay down balances. However, ignoring the need to save at the same time can backfire and cause you to take on more debt down the road. While it’s important to work toward paying down high-interest debt, it’s even more important to build up savings in case of emergencies.

An emergency fund protects your financial health by giving you a cash cushion that you can lean on during a tough financial time or when an unexpected bill pops up. Having access to liquid cash ensures you can pay bills rather than rely on a high-interest credit card and dig yourself back into a deeper debt hole. Aim to save up to three months of these living expenses in a separate account so it’s out of sight and out of mind.

Where you put your savings matters too, and you can earn over 5% interest through a high-yield online savings account (HYSA). For example, Bread Savings currently offers a competitive rate of 5.15% annual percentage yield (APY) and only requires a minimum of $100 to open an account.

Interest is compounded daily and deposited into your account by the end of the month so your money earns more for you. By comparison, traditional brick-and-mortar banks pay an average of 0.46% APY.

![7 Credit Card Habits to Stay Out of Debt ([updated_month_year]) 7 Credit Card Habits to Stay Out of Debt ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/cover-3.jpg?width=158&height=120&fit=crop)

![3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year]) 3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/05/atm-card-vs-debit-card-vs-credit-card--1.png?width=158&height=120&fit=crop)

![3 Ways Closing a Credit Card Can Hurt Credit ([updated_month_year]) 3 Ways Closing a Credit Card Can Hurt Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/closecard.png?width=158&height=120&fit=crop)

![Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year]) Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/card-with-card-2.png?width=158&height=120&fit=crop)