Debit cards are an essential part of modern-day banking and a convenient option to make purchases. Unfortunately, some banks and debit card issuers charge fees, including checking account monthly maintenance fees, ATM fees, and overdraft fees.

These costs can add up, but you can avoid them by considering a no-fee debit card. Here, we cover the best no-fee debit cards that you can get, even if you don’t have the best credit or would prefer a banking alternative.

Best Debit Cards With No Monthly or ATM Fees

The following debit cards don’t have any monthly or ATM fees, but it’s important to understand how each card works. Some cards have specific terms and requirements to waive fees, and these cards can help you avoid unnecessary charges and keep more of your hard-earned money.

- Cashback – Earn 1% cash back on up to $3,000 in debit card purchases each month

- No. Fees. Period. That means you won’t be charged an account fee on our Cashback Debit account.

- Early Pay – Get your paycheck up to two days early with no charge

- No Credit Impact – You can apply without affecting your credit score.

- Fraud Protection – You’re never responsible for unauthorized debit card purchases. If you suspect someone else has used your debit card without your permission, let us know.

- Member FDIC

- Fee-free overdraft protection

- No minimum opening deposit and no minimum balance

- Add cash into your account at Walmart stores nationwide

- Cash access at over 60,000 no-fee ATMs nationwide

- 100% US-based customer service available 24/7

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

$0

|

No Credit Needed

|

Discover® is a card issuer that’s well-known for its fee-free cash back credit cards, but Discover® also has a solid cash back debit card option. With the Discover® Cashback Debit, you earn cash back on debit card purchases up to $3,000 per month. This card has no monthly fee or ATM fee, and you can get paid up to two days early when you set up direct deposit.

The card also has no monthly maintenance or low balance fees, insufficient funds fees, or check reorder fees. Your bank account is FDIC-insured, and you can use your card wherever Discover® is accepted. The card includes fraud protection for your purchases, and you have access to more than 60,000 fee-free ATMs.

- Brink’s knows Security! 24/7 access to a suite of security benefits to help keep your account armored.

- Get access to over 100,000 Brink’s Money ATMs.

- Get paid faster than a paper check with direct deposit.

- Add funds to your Brink’s Armored Account and use Brinks Armored debit card anywhere Debit Mastercard is accepted.

- Account opening is subject to registration and ID verification. Terms & fees Apply. Deposit Account is established by Pathward®, N.A., Member FDIC.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Variable Monthly Fees

|

Not applicable

|

The Brink’s Armored™ Account is a debit card that offers fraud protection and robust security benefits to protect your money. You get one free ATM withdrawal per month at Brink’s Money network ATMs, and there’s no monthly fee when you deposit at least $500 in qualifying funds to your account every 35 days.

If you use ATMs often, you should probably choose another account where all in-network withdrawals are free, such as our #1 recommended card above. But if grabbing cash from an ATM isn’t a common occurrence, this card may fit your needs.

3. GO2bank

- Overdraft protection up to $200 with opt-in and eligible direct deposit*

- No monthly fees with eligible direct deposit, otherwise $5 per month

- Earn up to 7% cash back when you buy eGift Cards in the app

- Get your pay up to 2 days early – Get your government benefits up to 4 days early.*

- High-yield savings account, 4.50% APY paid quarterly on savings up to $5,000.*

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

All Credit Types Considered

|

If you’re looking for a debit card that’s also a bank account, consider Go2Bank. GO2bank has no overdraft fee and allows you to receive your paycheck up to two days early. The card also has fee-free withdrawals from in-network ATMs. It charges a small monthly fee but waives it if you set up direct deposit.

This card would be an ideal option as a bank account and a savings account, and you can easily set up direct deposit to avoid fees. Go2Bank offers a high-yield savings account that earns more than the national savings average. GO2bank does have some fees that are worth noting.

Those include an out-of-network ATM fee and a fee for depositing cash at a retail partner location. It also has a teller cash withdrawal charge, foreign transaction fee, and card replacement fee.

- With Direct Deposit, you can get paid faster than a paper check.

- No late fees or interest charges because this is not a credit card.

- Use the Netspend Mobile App to manage your Card Account on the go and enroll to get text messages or email alerts (Message & data rates may apply).

- Card use is subject to activation and ID verification. Terms and Costs apply.

- Card issued by Pathward N.A., Member FDIC. Card may be used everywhere Visa debit card is accepted.

- See additional NetSpend® Prepaid Visa® details.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Variable Monthly Fee

|

Not applicable

|

The NetSpend® Visa® Prepaid Card is easy to use and reload and requires no credit check, minimum balance, or activation fee. You also receive access to more than 130,000 cash reload locations, and you can earn cash back and personalized offers on certain purchases.

The card does have a few fees depending on your usage and situation. The Pay as You Go plan has no monthly fee, but does charge a per transaction fee, ATM fee, and cash reload fee. The Monthly Plan has a monthly fee, but no transaction fee. And you can reduce the monthly fee if you receive at least $500 by direct deposit each month.

This prepaid card has no overdraft fees but includes an inactivity fee if you don’t have any transactions for more than 90 days.

- Waive your monthly fee when you direct deposit $500+ in previous monthly period. Otherwise, $5.94 a month.*

- Earn 3% cash back at Walmart.com, 2% cash back at Walmart fuel stations, & 1% cash back at Walmart stores, up to $75 each year.*

- Earn 2% interest rate on up to $1,000 balance in your savings account. Plus, get chances to win cash prizes each month!*

- Get peace of mind with three coverage levels, up to $200, for purchase transactions with opt-in & eligible direct deposit.*

*Please see site for full terms and conditions.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: Walmart MoneyCard® is a debit card offer.

Walmart’s debit card is issued by Green Dot Bank, member FDIC. The Walmart MoneyCard® offers overdraft protection of up to $200 when you opt-in and set up direct deposit. It has no minimum account balance requirement or monthly fee if you receive direct deposits of at least $500 each month. And you can add cash to your card at any of the 90,000 network retail stores, including Walmart Money Centers.

Another card benefit is that you can earn cash back on purchases at Walmart.com, Walmart fuel stations, or in Walmart stores. This card is a great option for loyal Walmart shoppers as well as families because you can add up to four additional approved family members ages 13 and up. Family accounts have no additional fees.

- Earn points on swipes: Earn up to 7x the points on card swipes at over 14,000 participating merchants, then redeem them for cash back in your account.*

- Get paid up to 2 days faster with direct deposit*

- Qualifying direct deposits receive fee-free overdrafts*

- No minimum balance fees, no overdraft fees, no bank transfer fees

- Access to more than 40,000 fee-free ATMs*

- *View product disclosures here.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

The Current Account offers a convenient banking solution for those looking to avoid hidden fees. The account allows you to make free ATM withdrawals, earn cash back rewards for debit card purchases, and even overdraft with no fees or interest as long as you receive $500 in direct deposits per month.

The card has no minimum balance fees, bank transfer fees, or annual fees.

Current Visa Debit cardholders have access to fee-free Allpoint ATMs, and the account provides spending insights to help you budget and manage your money. Cardholders can also get paid up to two days early if they set up direct deposit. The card does charge an out-of-network ATM fee and foreign transaction fees.

- A reloadable prepaid debit account that can be used anywhere American Express® cards are accepted

- Get your paycheck up to 2 days faster with free direct deposit

- Shop with added confidence and Purchase Protection, which can help protect eligible purchases made with the card against accidental damage and theft for up to 120 days from the date of purchase

- Get free ATM access at over 38,000 MoneyPass® ATM locations. It’s free to add cash to your account at Family Dollar locations and free to transfer money to other Bluebird Accountholders.

- With Roadside Assistance, you can call us in case of emergency for coordination and assistance services to help you get on your way

- Pay no monthly fees or foreign transaction fees

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

Not applicable

|

Bluebird® American Express® Prepaid Debit Account is a prepaid debit card that has no monthly fees and free early direct deposit. You also have access to the Bluebird Mobile app to help keep track of your account activity. Members can customize mobile device notifications to show available balance and balance alerts.

An additional benefit to this card is the free customer access to MoneyPass ATMs. The card is available to most US residents who are at least 18 years old with some states requiring cardholders to be 19 years old. This prepaid card from American Express also allows you to load cash at any Family Dollar in the US. Just tell the cashier how much you would like to add, pay it, and it makes the funds available immediately.

How Do I Qualify For a Debit Card Without Fees?

Some banks look at your credit score, but other financial institutions, including those that offer prepaid cards or debit card banking solutions, perform full credit checks. In these cases, the focus is often on verifying your identity and ensuring that you meet residency requirements for opening a bank account.

To qualify for the best prepaid card with no fees, you’ll need to shop around and compare card offers. Some companies offer no-fee debit cards that require you to maintain a minimum balance or have a certain number of transactions. Other cards may have fees to load cash, replace your card, or foreign transaction fees.

It’s important to consider your unique financial situation and how you intend to use your debit card. For example, a foreign transaction fee may not affect you if you don’t plan to use your card when traveling abroad. Or if you primarily rely on direct deposits or mobile check deposits, you may not mind a rare cash reload fee.

Setting up direct deposit is the most common requirement for no monthly fees. Financial institutions may also accept direct deposits from government benefits and sources other than an employer’s paycheck.

Do All Debit Cards Have a Monthly Fee?

Not all debit cards have monthly fees. In fact, most banks offer fee-free debit cards to their customers. Some debit cards still charge foreign transaction fees or for ATM withdrawals outside of the bank’s network.

Other issuers may offer overdraft protection or out-of-network ATM fee reimbursement but come with monthly maintenance fees or cash reload fees. It’s best to read the fine print before signing up for a debit card to understand the fees. Two of the best no-fee debit cards are the Discover® Cashback Debit and the Current Visa Debit.

The Discover® Cashback Debit has no monthly maintenance fees and fee-free overdraft protection. This card also doesn’t charge any of the fees other banks tend to hide, including for check reorders or card replacement. Both accounts allow you to earn cash back and rewards on purchases and get paid earlier with direct deposit.

Is a Prepaid Card the Same as a Debit Card?

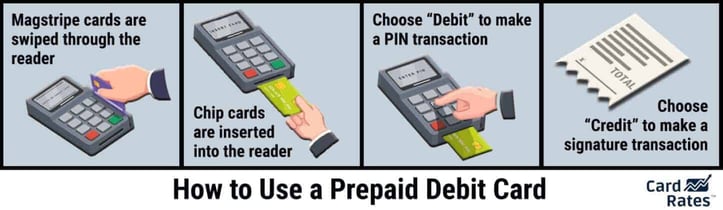

Prepaid cards and debit cards have many similarities, but they are not identical. A prepaid card is not linked to a bank account, while a debit card is tied to an account.

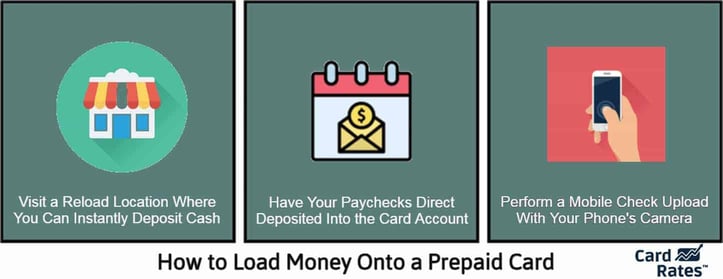

You can load money onto a prepaid card, and use it until the balance is depleted. A debit card, however, enables you to access funds directly from your bank account up to the total amount in your account.

Both prepaid and debit cards won’t allow you to spend more money than you have. If you attempt to spend more than you have available, the transaction will be declined, or you could receive an overdraft fee. Some card issuers provide overdraft protection up to a certain amount.

Debit cards, however, provide more flexibility, and you may also receive free services at your bank, including check cashing.

You can use both prepaid cards and debit cards at your favorite stores or restaurants, as some popular card issuers include Visa® and Mastercard®. Both cards are effective alternatives to cash cash.

According to the FDIC, at least 5.9 million households in the US are unbanked. Prepaid debit cards are a popular option among those people since they allow you to load money and make card purchases without opening a bank account.

Prepaid cards are similar to debit cards because you can set up direct deposit and deposit checks at participating ATMs. You also don’t have to worry much about keeping your money secure, as prepaid debit cards offer federal fraud and liability protections.

While both cards may be used to make purchases, debit cards are typically better for long-term use, and prepaid cards are ideal for short-term budgeting.

Is it Better to Have a Credit Card or a Debit Card?

One option is not better than the other, and both can be helpful in different ways. Choosing a credit card or debit card is a personal financial preference.

A debit card links to your bank account, so you can only spend what you have. Using a debit card means you avoid debt and do not pay interest, but you may miss out on the benefits, such as cash back, points, or miles, that come with credit cards.

A credit card enables you to borrow money to make purchases. Many credit cards offer benefits and rewards, but can come with some downsides, including high interest rates, debt accumulation, and credit score damage.

With a credit card, you must manage your spending and avoid carrying a balance if you don’t want to be saddled with high interest fees. If you use more than 30% of your total credit limit, that can also cause your credit score to decrease.

Credit Score

Debit cards don’t require a high or average credit score, but credit cards depend heavily on your credit history. Check your credit report before applying for a credit card to see what you qualify for.

Safety and Rewards

Debit cards are safe to use, and some even offer rewards or cash back, including the Discover® Cashback Debit and NetSpend® Visa® Prepaid Card. Since debit cards pull funds directly from your bank account, you should closely monitor your account and actively manage your money.

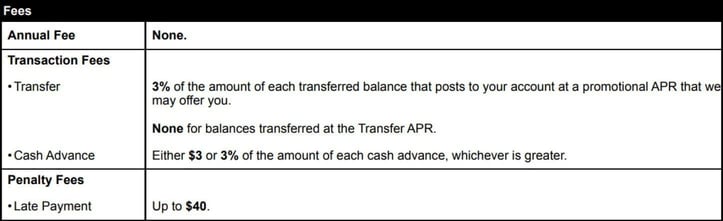

Fees

Credit cards give you more freedom, but overspending can put you in a bad financial situation if you aren’t careful. Even the best credit cards have fees; some even include an annual fee just for the privilege of having the card.

The best credit cards also require you to have good or excellent credit. Some ways to improve your credit over time include becoming an authorized user on someone else’s credit card, paying bills on time, paying off your other card balances, and aiming to keep your credit utilization ratio at less than 30%.

What Other Fees Might I Have to Pay?

Debit cards can come with several types of fees, but the good news is that it’s possible to avoid most (if not all) of them. Knowing the type of fees to look out for can help you make a better decision when choosing your next debit card.

Here is a summary of the types of debit card fees you may encounter, how much they cost on average, and how to avoid them.

- Monthly maintenance fee: Banks charge customers monthly fees to maintain an account with them. Most offer a few ways to avoid the fee, including setting up direct deposit or fulfilling the minimum balance requirement.

- Minimum balance requirement: Some requirements are as low as $100. You can typically avoid this fee if you link direct deposits to your checking account. However, some debit cards don’t have minimum balance requirements if you want to avoid this altogether.

- ATM fee: The safest way to avoid this is to only use in-network ATMs. Bank mobile apps can quickly identify those locations. If you need to use out-of-network ATMs, some banks offer a refund of up to a certain amount per billing cycle.

- Overdraft fee: Overdraft fees vary by bank, but can cost as much as $35 per transaction. You can add overdraft protection to most checking accounts. So when you have a situation where your account is at risk of overdraft, your linked secondary account or line of credit can cover the transaction and spare you a fee.

- Nonsufficient funds fee: If you don’t have overdraft protection on your account and the funds aren’t available, the transaction will be declined, but you still may pay a fee for the failed attempt. Avoid this by activating balance notifications on your account or using a card with optional overdraft protection. Most banks offer text, email, or mobile app notifications when your balance is low.

- Inactivity fee: Some prepaid card issuers charge this fee if you don’t use your card in a certain number of days or weeks. With Netspend, you should use your card (make at least one transaction) every 90 days to avoid an inactivity fee. Also, consider setting up automatic bill pay on your card for a small expense, such as Netflix, or using your card for fuel fill-ups each month. Even if the payment is small, it will help you avoid the inactivity fee.

- Stop payment fee: In some cases, you can cancel a payment online or by calling the merchant. If it’s too late and the payment is already pending on your account, you can still stop it — for an additional cost. This is another fee that some banks refund as a courtesy.

- Check fee: Banks may offer free checks when you open an account. Some will even offer free checks for certain accounts or if you set up direct deposit.

- Card replacement fee: Replacing your debit card can be a hassle, especially when you have to pay another fee. To avoid this, ask the card issuer to waive the cost or choose a debit card that doesn’t charge the fee.

Understanding all of the fees a particular debit card charges is a significant part of the research process. This will help you decide if the card is a good fit for your situation or if you may need to use another financial product first.

You can find a detailed list of these fees in the card’s terms and conditions before you activate it. And be sure to weigh any costs or fees against the overall perks (or rewards) the card offers. With so many competing issuers and financial institutions, you should find a debit card that has the right balance for your needs.

Avoid Unnecessary Debit Card Fees

A debit card is a convenient, secure, and practical financial tool that you can use to help manage your budget and avoid debt. Consider choosing one of the best no-fee debit cards by comparing options from different banks and financial institutions. You can avoid most fees if you set up direct deposit and consider the card options on this list.

With prepaid cards, read the fine print and ensure no hidden fees accumulate later on. Earning rewards with a debit card is always a nice bonus, but avoiding paying fees for monthly maintenance, ATM withdrawals, and overdrafts is essential.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![14 Best No-Fee Credit Cards ([updated_month_year]) 14 Best No-Fee Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/09/CR-no-fees.png?width=158&height=120&fit=crop)

![8 Best No Annual Fee Credit Cards ([updated_month_year]) 8 Best No Annual Fee Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/05/annualfee.png?width=158&height=120&fit=crop)

![7 Travel Cards with No Foreign Transaction Fee ([updated_month_year]) 7 Travel Cards with No Foreign Transaction Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/06/foreign.png?width=158&height=120&fit=crop)

![13 Best No-Annual-Fee Credit Cards ([updated_month_year]) 13 Best No-Annual-Fee Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/03/best-no-annual-fee-credit-cards.jpg?width=158&height=120&fit=crop)

![7 Credit Cards for Fair Credit: No Annual Fee ([updated_month_year]) 7 Credit Cards for Fair Credit: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/credit-cards-for-fair-credit-with-no-annual-fee-feat.jpg?width=158&height=120&fit=crop)

![7 Best Student Credit Cards With No Annual Fee ([updated_month_year]) 7 Best Student Credit Cards With No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Best-Student-Credit-Cards-With-No-Annual-Fee.jpg?width=158&height=120&fit=crop)

![5 Best Air Miles Credit Cards: No Annual Fee ([updated_month_year]) 5 Best Air Miles Credit Cards: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/09/Best-Air-Miles-Credit-Cards-With-No-Annual-Fee.jpg?width=158&height=120&fit=crop)

![13 Prepaid Cards With No Activation Fee ([updated_month_year]) 13 Prepaid Cards With No Activation Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Prepaid-Cards-With-No-Activation-Fee.jpg?width=158&height=120&fit=crop)