Twenty-one months is a long time. That’s how long it takes an elephant to give birth. It’s also the longest period generally available for 0% APR balance transfers. No wonder they are so rare – the cards, not the pachyderms.

We review the few credit cards currently available with 21 interest-free billing cycles, along with several of the more common 18-month variety. These cards offer new cardmembers a thrifty way to consolidate their credit card debt. Although some are one-trick ponies, many of these cards are attractive for their additional benefits.

-

Navigate This Article:

Best 21-Month Balance Transfer Cards

These are the Methuselahs of balance transfer cards. New cardmembers enjoy almost two years of interest-free balance transfers, a great money-saving feature. But beware of much shorter deadlines for completing the transfers to participate in the interest holiday.

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 18.24% – 28.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is a balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater

- Get free access to your FICO® Score online.

- With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

- No Annual Fee – our low intro rates and all the benefits don’t come with a yearly charge.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 12 months on Purchases

|

0% 21 months on Balance Transfers

|

18.24% – 28.99% (Variable)

|

$0

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

Citi offers excellent balance-transfer credit cards, including the Citi® Diamond Preferred® Card. Only the balance transfers you complete in the first four months will get the 0% interest rate, after which the regular APR will kick in. Each balance transfer transaction has a fee of $5 or 5%, whichever is greater.

Apart from its balance transfer offer (and shorter 0% APR promotion for purchases), the card provides free FICO scores and special access to entertainment events. This card requires applicants to have good to excellent credit.

- No Late Fees, No Penalty Rate, and No Annual Fee… Ever

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 19.24% – 29.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is an introductory balance transfer fee of $5 or 3% of the amount of the transfer, whichever is greater for balances transfers completed within 4 months of account opening.

- Stay protected with Citi® Quick Lock

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR Period 12 months on Purchases

|

0% Intro APR Period 21 months on Balance Transfers

|

19.24% – 29.99% (Variable)

|

$0

|

Excellent, Good Credit

|

Additional Disclosure: Citi is a CardRates advertiser.

The Citi Simplicity® Card’s balance transfer promotion accompanies a 0% purchase APR. This card also targets applicants with good to excellent credit looking for a low-fee card.

As with similar Citi cards, this one limits the 0% APR to transfers you complete within the first four months. There is an introductory balance transfer transaction fee of $5 or 3%, whichever is greater, for each balance transfer you complete within four months of account opening. Balances will be subject to the regular APR after the promotional period expires.

BankAmericard® credit card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to BankAmericard® credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this card.

The BankAmericard® credit card charges no annual fee and accepts applicants with good to excellent credit. It offers a competitive interest rate and an initial average credit limit that can range from $1,000 and $10,000.

You don’t need a Bank of America account for card approval. Only the balance transfers you complete in the first 60 days qualify for the 0% APR. Each transfer incurs a transaction fee ($10 minimum). The regular APR will apply when the promotional period ends.

Best 18-Month 0% Balance Transfer Cards

Although less attractive than 21 months, 18 months of 0% interest on transferred balances is nothing to sneeze at. Citi is the leader in this area, but Chase, Discover, and U.S. Bank also offer compelling entrants.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% – 28.24% Variable APR

|

$0

|

Excellent/Good

|

The Discover it® Balance Transfer card treats new cardholders royally with introductory 0% APR promotions on balance transfers and purchases, as well as a Cashback Match on rewards that post within the first 12 months after account opening.

You must complete participating transfers by the deadline to qualify for the 0% rate. Qualified balance transfers charge a fee, so be sure to review the card’s terms first. This card offers online privacy protection, immediate account freezing and unfreezing, and a $0 annual fee.

Chase Slate Edge℠

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Chase Slate Edge℠ is an excellent everyday card offering an intro 0% APR on balance transfers and purchases. Your balance transfer amount cannot exceed your available credit or $15,000, whichever is lower.

Unlike other cards, this one does not impose a short deadline for participating transfers. But the balance transfer transaction fee of $5 or 3% rises to $5 or 5% after 60 days. This no-annual-fee card offers APR reductions each year for using your card and paying on time.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% – 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% – 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

The Citi Double Cash® Card is an excellent tool for consolidating debt thanks to its 0% APR on balance transfers and potentially high credit limit. Only the balance transfers you complete within four months of account opening will receive the 0% APR and the 3% fee on each transaction. After that, the standard transfer APR applies, and the transfer fee rises to 5%.

This rewards card lets you redeem your cash back as a statement credit, mailed check, direct deposit into a bank account, or as points to use for travel and other purchases.

New cardmembers earn a signup bonus by spending a set amount on purchases during the first three months after account opening. Bank of America designed this no-annual-fee card for students with good to excellent credit.

- For a limited time, get a special 0% introductory APR on purchases and balance transfers for 18 billing cycles. After that, the APR is variable.

- Enjoy Cellphone Protection Coverage of up to $600 annually when you pay your monthly cellphone bill with your card

- View your credit score anytime, anywhere in the mobile app or online banking. It’s easy to enroll, easy to use, and free to U.S. Bank customers.

- Fraud Protection detects and notifies you of any unusual card activity to help prevent fraud

- Choose your payment due date

- $0 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 18 billing cycles

|

0% for 18 billing cycles

|

19.24% – 29.24% (Variable)

|

$0

|

Excellent Credit

|

The U.S. Bank Visa® Platinum Card offers an introductory 0% APR on balance transfers and purchases. The deadline for participating balance transfers is 60 days following account opening.

The card’s balance transfer fee is 3% of each transfer amount with a $5 minimum. This card doesn’t offer rewards, but you do get cellphone insurance, ID theft protection, and free credit scores. You must have good to excellent credit to get this no-annual-fee card.

What Are 0% Balance Transfer Credit Cards?

A 0% balance transfer credit card offers new customers interest-free financing on balance transfers for six to 21 months or longer. You can transfer existing credit card balances — up to the new card’s limit — and repay the balance interest-free during the promotional period.

These offers vary among card issuers. The cards can save significant interest charges if you have outstanding balances on one or more credit cards. With a 0% balance transfer credit card, your payments pay down your transferred balances without the drag of interest costs.

How Do I Get a Balance Transfer Credit Card?

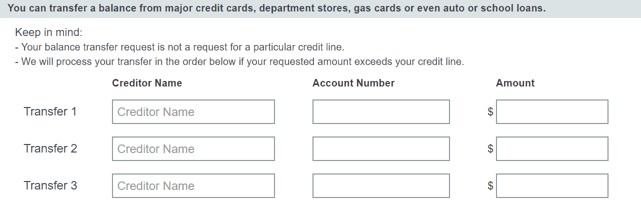

You can apply online for a balance transfer card by providing information about yourself and your finances.

The issuer will reveal the card’s APRs and credit limit upon approval. You can e-sign the credit card agreement and receive your new card in three to 10 business days.

Do Balance Transfers Hurt Credit Scores?

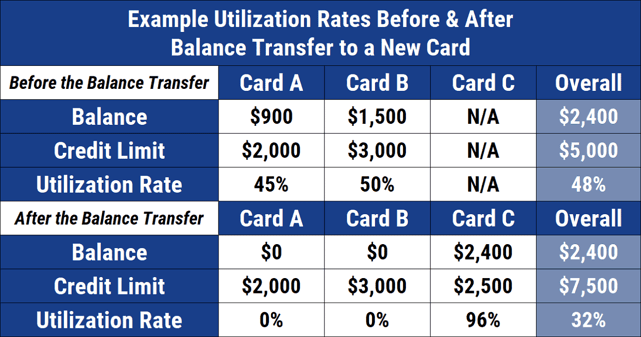

Balance transfers can help your credit score if you use them to consolidate debt and reduce your overall credit utilization ratio (CUR). But they may damage your score if you go on a shopping spree using your older cards that now have $0 balances.

You can calculate your CUR by dividing your current credit card balances by your available card credit limits. FICO and VantageScore evaluate your CUR in their credit scoring algorithms. FICO sets the optimal CUR at 1%, whereas VantageScore allows for values up to 30% without harming your score.

The optimal way to boost your credit through balance transfers is to avoid accumulating new credit card debt as you repay the entire transferred balance.

How Much Can I Save With a 21-Month Balance Transfer?

The savings from a 21-month balance transfer depends on the amounts transferred and the interest rates they were subject to before the transfer. The savings could be in the hundreds or thousands even after accounting for the 3% to 5% fee charged for each balance transfer.

For example, suppose Card A has an average balance of $1,000 per month and an APR of 20%. The annual interest cost would be approximately $200 (i.e., 0.20 x $1,000) and $350 for 21 months (i.e., $200 x 21/12).

You would save $350 minus the $30 transfer fee, or $320, by transferring to Card B with its 0% APR promotion.

The following table shows estimated savings for various transferred amounts:

| Potential Savings For a 0% Intro-APR Offer vs. a 20% APR Credit Card | ||

| Amount Transferred to the New Card | Cost of 3% Balance Transfer Fee | Estimated Savings Over 21 Months |

| $1,000 | $30 | $320 |

| $2,500 | $75 | $800 |

| $5,000 | $150 | $1,600 |

| $7,500 | $225 | $2,400 |

| $10,000 | $300 | $3,200 |

The higher your balance, the more you can save.

What If I Don’t Repay the Entire Transferred Balance Within the 0% Intro APR Period?

Any unpaid transferred balances will incur the card’s standard APR once the introductory period expires. You should repay the entire transferred amount before the end of the promotion if you want to avoid extra charges.

Many balance transfer promotions extend 0% interest to transfers occurring only within the first four months from account opening. Any balance transfers you perform after the deadline will incur the card’s regular APR.

Most credit cards have the same standard APRs for purchases and balance transfers, but you can only be sure by checking the card’s fee schedule.

Remember that the issuer will likely terminate any 0% APR promotions if you miss a payment. That’s an important reason to ensure you make timely payments, especially during promotional periods.

Are 0% Balance Transfers a Good Idea?

The pros of balance transfers include saving interest costs, reducing your number of monthly payments, boosting your credit score, and avoiding multiple minimum payments. The cons include balance transfer fees, reversion to a regular APR, and the temptation to build new balances on the cards you just drained.

Pros

The advantages of balance transfers include the following:

- Saving interest costs: You may save hundreds or thousands of dollars by avoiding the typical APRs on outstanding credit card balances. These interest rates may reach as high as 36%.

- Reducing the number of monthly payments: You must remember to pay monthly on each credit card with an outstanding balance. Not only is that extra work, but it creates the possibility of forgetting to make a payment and triggering late fees. Consolidating your credit card debt resolves this problem.

- Boosting your credit score: Getting a new balance transfer card improves your credit utilization ratio by increasing your available credit. You further decrease your CUR by consolidating your balances on one card, mothballing your other cards, and paying down your single outstanding balance. Your credit score may improve as you reduce your CUR.

- Avoiding multiple minimum payments: You must pay at least the minimum amount on each card with an outstanding balance. Minimum payments mainly cover interest charges, meaning you make almost no progress repaying your balances. Consolidating your card balances in one place means a larger percentage of your monthly payment goes toward paying off your principal.

The ideal scenario is to consolidate and repay all your credit card debt during the 0% APR promotion period and then pay all your new monthly balances in full. This strategy will minimize your CUR and help raise your credit score.

Cons

Balance transfers have a few disadvantages:

- Reversion to regular APR: You must pay the card’s regular variable APR on any transferred balances you fail to repay by the end of the promotional period. If the card has a high regular APR, you may spend more than if you had not transferred the balance.

- Temptation: You may experience the temptation to go shopping with a credit card after you transfer its balance elsewhere. This may lead to overspending, increasing your overall debt, and possibly hurting your credit. A good rule of thumb is only to charge what you can afford to repay monthly.

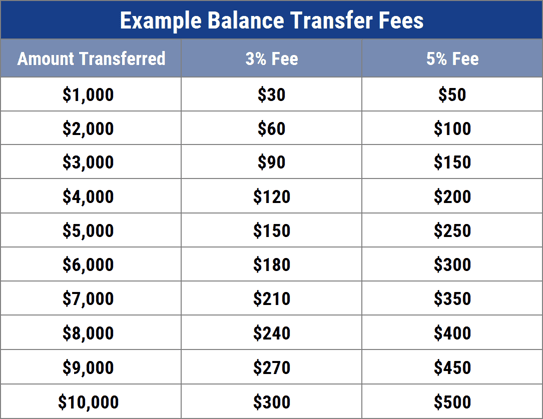

- Fees: Typically, you must pay 3% to 5% of each transferred amount, reducing your net savings by a small amount.

You can do nothing about the balance transfer fees, but the other negative factors are within your control. Practicing discipline now can avoid punishing debts down the road.

Do Credit Cards Ever Waive the Balance Transfer Fee?

Waived balance transfer fees used to be a thing. They aren’t generally available anymore, except perhaps for a few credit union credit cards. Typically, balance transfer fees range from 3% to 5% of the transferred amount.

Many cards offer a 3% fee during the transfer promotion period (or by a deadline within the period) and 5% otherwise. The minimum fee is usually $5 or $10.

Can I Serially Transfer Balances to One Card After Another?

Theoretically, it’s possible to shuffle your outstanding balance to a new 0% APR balance transfer credit card from your current one after its promotional period ends. But first, you must qualify for a new card with a suitable promotion and avoid the restrictions some issuers place on transfers between their cards.

It may make sense to transfer your credit card’s outstanding balance to another card offering a good 0% APR promotion and a high credit limit once your current promotion ends. You will have to apply for a new card, which may impact your credit score.

Also, some issuers, such as Capital One, prohibit balance transfers among their credit cards.

In sum, serial transfers are OK if you are confident about obtaining new balance transfer credit cards when necessary.

Enjoy Interest-Free Debt For 21 Months With a Balance Transfer Card

If, after reading this review, you feel 0% balance transfer for 21 months credit cards are the best things since sliced bread, you have a few good choices. If you can settle for an 18-month promotional period, many more options are available. In any case, be sure to pay off the transferred amount before the promotion expires, lest you suddenly expose yourself to the card’s variable APR.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![0% For 24 Months Balance Transfer Cards ([updated_month_year]) 0% For 24 Months Balance Transfer Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/0-Percent-For-24-Months-Balance-Transfer-Cards.jpg?width=158&height=120&fit=crop)

![0% For 12+ Months: Balance Transfer Cards ([updated_month_year]) 0% For 12+ Months: Balance Transfer Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/0-percent-for-12-months-balance-transfer-cards.jpg?width=158&height=120&fit=crop)

![5 Best 0% Balance Transfers For 18+ Months ([updated_month_year]) 5 Best 0% Balance Transfers For 18+ Months ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/05/Best-0-Balance-Transfers-For-18-Months.jpg?width=158&height=120&fit=crop)

![9 Best Balance Transfer & Rewards Credit Cards ([updated_month_year]) 9 Best Balance Transfer & Rewards Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/09/btandrewards.png?width=158&height=120&fit=crop)

![3 Balance Transfer Credit Cards for Fair Credit ([updated_month_year]) 3 Balance Transfer Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/Balance-Transfer-Credit-Cards-For-Fair-Credit.jpg?width=158&height=120&fit=crop)

![9 Best 0% Balance Transfer Credit Cards ([updated_month_year]) 9 Best 0% Balance Transfer Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/11/shutterstock_1495481012.jpg?width=158&height=120&fit=crop)

![7 Balance Transfer Cards With High Limits ([updated_month_year]) 7 Balance Transfer Cards With High Limits ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/06/Balance-Transfer-Cards-With-High-Limits.jpg?width=158&height=120&fit=crop)

![Are Balance Transfer Cards a Good Idea? ([updated_month_year]) Are Balance Transfer Cards a Good Idea? ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/06/Are-Balance-Transfer-Cards-a-Good-Idea.jpg?width=158&height=120&fit=crop)