With the rise of digital technology, it seems as though everything has gotten faster and more immediate. Not only can you get movies and music instantly from anywhere, but you can have everything from food to household goods delivered in less than an hour in most cities.

Given that so much can be obtained so quickly, it’s natural to want the same results when you apply for a new credit card. At the very least, you’d expect same-day shipping, right?

But while you can often get same-day approval, only a handful of issuers offer same-day credit cards — with numbers — for instant use. You may need to settle for the next best thing and go for expedited shipping to get your hands on your card in a hurry. In the article below, we’ll dive into some of our experts’ picks for the best credit cards out there today with same day approval for a range of credit scores.

Approval | Card Numbers | Next Best Thing

You Can Typically Get Same-Day Approval

Online applications have transformed the credit card process, and most online applications can be completed and receive a decision in less than five minutes. In some cases, however, the online platform may not be able to make a decision, which can add days or weeks to your response time.

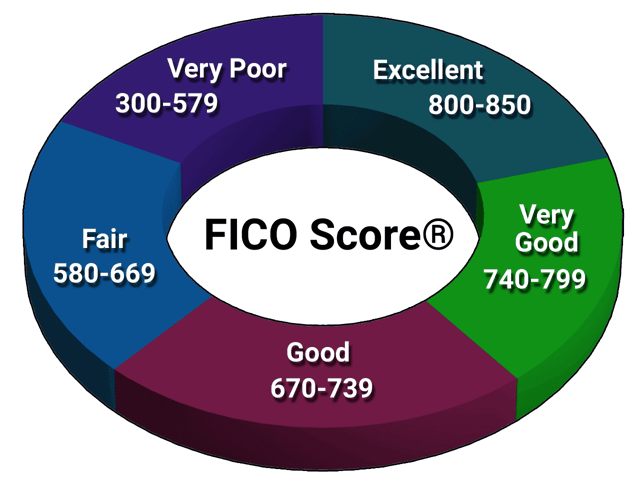

Where your credit falls in the credit score range can have a big impact on your ability to be approved for a card — and the speed with which your application gets a response. You can improve your chances of a quick credit card application approval by choosing cards that tend to approve applicants with credit profiles similar to your own.

Good Credit | Fair Credit | Bad Credit | No/Limited Credit

Best Cards for Good Credit (670+ FICO Score)

Applicants with good credit or better are often the most likely to receive a near-instant online decision in their favor. At the same time, be careful not to apply for cards that require excellent credit if your score is on the lower end of the “good” spectrum.

Our favorite cards for good credit include options for cash back and travel rewards, as well as a few good intro-APR offers. Plus, many will come without any costly annual fees.

+See More Cards for Good Credit

Best Cards for Fair Credit (580-669 FICO)

With fair credit, your ability to qualify for a credit card may depend more on the specifics of your credit profile, rather than simply your score itself.

Applying for cards that are marketed to those with fair credit can be the easiest way to avoid a nerve-racking “pending” notice when your application needs the human touch.

Our top cards for fair-credit applicants include a mix of entry-level prime cards as well as subprime card options.

+See More Cards for Fair Credit

Best Cards for Bad Credit (Below 580 FICO)

If your credit reports house the red flags of bad credit, you’ll still often get a quick response to your applications — it just may not be a good response.

Instead of wasting hard inquiries on cards you simply can’t qualify for, focus on cards designed for those with bad credit who need to rebuild. Our top-rated picks include both unsecured and secured options to help you get back on track.

+See More Cards for Bad Credit

Best Cards for No/Limited Credit

It takes at least six months of credit history for most credit scoring models to produce a credit score, which means potential issuers can’t judge your credit risk until you build up your credit profile.

For many, the best way to get around a limited credit history is to apply for entry-level cards with more flexible requirements. Many of our favorite options won’t even charge an annual fee.

+See More Cards for No/Limited Credit

Some Issuers Allow Same-Day Use

Provided you apply online, many credit card issuers can provide same-day approval, but only a handful of companies will give you the ability to use your card the same day you’re approved.

In general, you won’t be able to get your physical credit card the same day you’re approved. That said, some cards can be used same-day to make purchases, no physical card necessary.

Capital One | Chase | American Express | Stores

Best Capital One Cards

From start to finish, your online Capital One credit card application can be completed in only a few minutes, with responses often provided nearly right away.

If you’re approved for a Capital One card, you can typically gain access to your card’s information, including the card number and expiration date, immediately after setting up your online account.

You’ll need to download and log in to the Capital One mobile application to access the information for your new Capital One credit card.

Best Chase Cards

Chase introduced its Spend Instantly feature that allows cardholders to begin using their card the day they’re approved.

All you have to do is add your new card to a digital wallet using the Chase Mobile app. Compatible wallets include Apple Pay, Google Pay, and Samsung Pay.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

Best American Express Cards

When you apply for an American Express credit card online, you’ll generally get a response in just a few minutes. If approved, you may be given the option to access your credit card information to make purchases with your new account.

Keep in mind that not every American Express card will offer the option for same-day use. Once approved, you can add your actual card number to your digital wallet on your mobile device and begin shopping online or anywhere digital wallets are accepted.

- Earn 150,000 Membership Rewards® points after you use your new card to make $8,000 in purchases in your first 6 months of Card Membership

- Earn 5X Membership Rewards® points for flights booked directly through airlines or American Express Travel, on up to $500,000 on these purchases per calendar year. Also earn 5X Membership Rewards® points on prepaid hotels on AmexTravel.com. Earn 1X points on all other purchases.

- $200 annual hotel credit, $200 annual airline fee credit, $25 monthly Equinox credit, $15 monthly Uber cash credit, $50 bi-annual Saks Fifth Avenue credit, and more.

- Platinum Card Members have unlimited complimentary access to all locations of The Global Lounge Collection, including 1,400 airport lounges across 140 countries.

- Automatic Marriott Bonvoy Gold Elite Status and Hilton Honors Gold Status. Enrollment required.

- Choose among three card designs

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% - 29.24% Pay Over Time

|

$695

|

Excellent

|

- Earn 90,000 Membership Rewards® points after you spend $6,000 on purchases on your new card in your first 6 months of card membership

- Earn 4X Points at U.S. supermarkets on up to $25,000 per calendar year in purchases. Also earn 4X Points at restaurants, including takeout and delivery, and 3X points on flights when booked directly with airlines or on amextravel.com. All other eligible purchases earn 1X point.

- No foreign transaction fees

- Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. Enrollment required.

- Delight your senses when you book The Hotel Collection with American Express Travel. Get a $100 experience credit to use during your stay. Minimum 2-night stay is required.

- $250 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% - 29.24% Pay Over Time

|

$250

|

Excellent

|

- Earn 120,000 Membership Rewards® points after you spend $15,000 on eligible purchases with your Card within the first 3 months of card membership

- Earn 5X Membership Rewards® points on flights and prepaid hotels on amextravel.com, 1.5X points on business categories and purchases of $5,000 or more on up to $2 million per calendar year, and 1X point for each dollar you spend on other purchases.

- Get up to $400 back per year toward U.S. purchases with Dell Technologies, up to $360 back per year for purchases with Indeed, and $120 back per year for wireless telephone service purchases on the Business Platinum Card, plus additional credits. Enrollment is required for all.

- Access to more than 1,400 lounges across 140 countries and counting with the American Express Global Lounge Collection®

- Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees, such as checked bags and in-flight refreshments, are charged by the airline to your Business Platinum Card® Account.

- $695 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.49% - 28.49% Pay Over Time

|

$695

|

Excellent

|

Best Store Cards

Store credit cards are some of the easiest same-day cards to use. Store cards are often offered during the checkout process, either by a helpful internet pop-up or as part of a well-rehearsed speech from your cashier.

In most cases, you can apply on the spot and receive an almost-immediate response. If you’re approved, you’ll typically be given the option to place your current purchase on the card right away.

Additionally, many stores can look up your credit card information through your account and charge items without needing the physical card present. This can allow you to use the card account repeatedly before your physical card ever shows up. Just be careful not to go overboard; you may not be able to actually pay your need store card off until it arrives in the mail.

- Earn 5% cash back at Aamzon.com and Whole Foods market

- Earn 2% cash back at restaurants, gas stations, and drugstores, 1% back on all other purchases

- Exclusively for customers with an eligible Prime membership

- Get a $100 Amazon Gift Card instantly upon credit card approval

- See your rewards balance during checkout at Amazon.com and easily use rewards to pay for all or part of your purchase — no minimum rewards balance to redeem rewards

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

14.24% - 22.24%

|

$0 (Prime Membership Required)

|

Good/Excellent

|

23. Home Depot Consumer Credit Card

With the Home Depot Consumer Credit Card, you can not only finance that important home improvement purchase right away, but if your purchase is $299 or more, you can also take advantage of special financing.

- Receive special financing on Home Depot purchases of $299 or more made with your card

- Get exclusive product-specific and seasonal offers

- Pay no annual fee

As with many special financing deals, the Home Depot Consumer Credit Card charges deferred interest. This means you’ll be charged interest on your entire purchase amount if you don’t pay your full balance before the end of your financing period.

24. Target RedCard

Whether you apply in-store or online, the Target RedCard can typically be used as soon as you’re approved to make those necessary Target purchases.

- Get 5% off your total purchase at checkout for eligible in-store or online Target purchases

- Receive exclusive deals & discounts

- Pay no annual fee

Perhaps the best part of the Target RedCard’s 5% discount is that you can stack it with both manufacturer coupons and Target coupons and promo codes to really save big.

Overnighting Your Card May Be the Next Best Thing

The typical turnaround from approval to receipt of your new card is between seven and 10 days, which not only covers the time to ship your card, as you might expect, but also includes the time it takes to make your card. This process includes the actual fabrication of the card itself — which can be even more complex for the newer metal credit cards — as well programming and attaching the EMV chip with your account information.

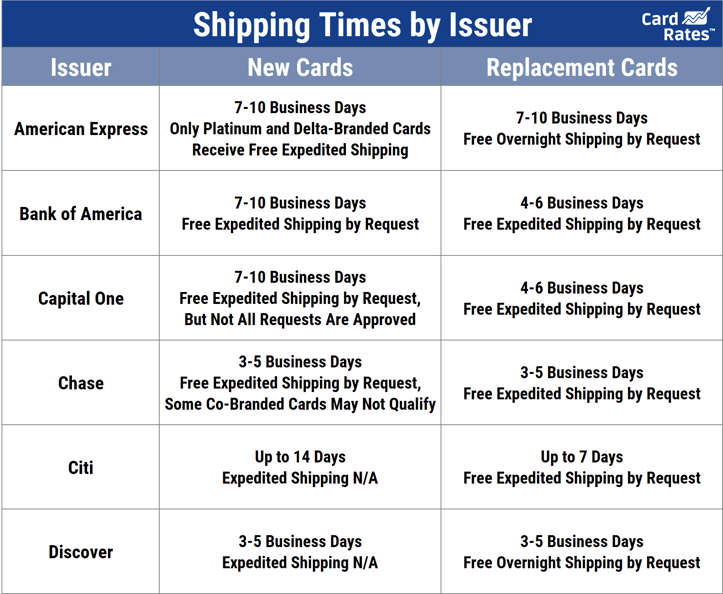

Outside of those cards you can use same-day sans-card, the next best thing for those who need quick use of their cards is likely having your physical card sent via expedited shipping. With expedited shipping, your new card could be physically in your hands within a few days.

Overall, many issuers don’t offer expedited shipping for new cards, and those that do often charge a fee for the service. The following chart shows which issuers may expedite your shipping upon request:

Your best options for getting your card overnighted are American Express, Bank of America, Capital One, and Chase.

Start Shopping Right Away with a Same-Day Card

Whether you want gourmet chocolates, a five-piece patio set, or a new pet fish, you can get almost anything delivered to your doorstep in the practical blink of an eye — including your credit card, if you choose the right one.

However, don’t be too quick to load up your new card if it hasn’t even hit your mailbox yet. Until you have your card in hand and your online account established, it may be difficult to make a payment, which may mean trouble if something happens to your card in transit to your mailbox.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![9 Best Credit Cards For Rebuilding Credit ([updated_month_year]) 9 Best Credit Cards For Rebuilding Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/07/rebuildcredit.png?width=158&height=120&fit=crop)

![9 Credit Cards that Use Equifax Credit Reports ([updated_month_year]) 9 Credit Cards that Use Equifax Credit Reports ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/equifax2.png?width=158&height=120&fit=crop)

![9 Best Credit Cards for No Credit ([updated_month_year]) 9 Best Credit Cards for No Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/10/nocredit.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards for 600 to 650 Credit Scores ([updated_month_year]) 8 Best Credit Cards for 600 to 650 Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-600-to-650-Credit-Scores-Feat.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards for New Credit Users ([updated_month_year]) 5 Best Credit Cards for New Credit Users ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-New-Credit-Users-Feat.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards for High Credit Scores ([updated_month_year]) 9 Best Credit Cards for High Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Best-Credit-Cards-for-High-Credit-Scores-Feat.jpg?width=158&height=120&fit=crop)

![7 Same-Day Credit Cards for Poor Credit ([updated_month_year]) 7 Same-Day Credit Cards for Poor Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Same-Day-Credit-Cards-for-Poor-Credit.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards by Credit Score ([updated_month_year]) 9 Best Credit Cards by Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/11/shutterstock_402532915.jpg?width=158&height=120&fit=crop)