There’s no question that your credit card accounts influence your credit score, so closing a credit card may be a risky move. If you open a credit card account when you have little to no established credit history, the new account can help you build a better credit score.

If you over-utilize your credit cards, they can negatively impact your credit score. And yes, if you close a credit card account, you may damage your credit score. We’ll explore why in the article below, including taking a closer look at exactly how credit utilization works.

Of course, sometimes you may want to close a credit card account for completely valid reasons. If you’re going through a divorce, for example, closing a joint credit card may be a necessity.

If your card issuer increases your annual fee, you may wish to close your account as well. The good news is that closing a credit card won’t automatically lower your credit score, but it can happen because it could impact one of the most important metrics of credit scoring models.

Closing a Credit Card Can Impact Your Revolving Utilization

Closing a credit card account may be a risky move for your credit score, but there are some myths surrounding why that occurs. The truth is closing a credit card account often hurts credit scores because it can impact your revolving utilization ratio.

Revolving utilization is a term used in the credit scoring world to describe the relationship between your cards’ credit limits and the associated account balances as they appear on your credit reports. It’s essentially a ratio that represents how much or what percentage of your available credit you are currently using in the form of a balance.

Credit scoring models focus on your revolving utilization ratio for one important reason — it is highly predictive of credit risk. As a result, revolving utilization can have a considerable impact on your credit score. Generally speaking, the closer your balances get to your credit limits, the lower your credit score will be.

Revolving utilization is so important, it is considered by credit scoring models in two different ways. First, a scoring model will calculate the revolving utilization on each of your individual credit card accounts. Second, a scoring model will calculate your aggregate utilization, which considers your total balances relative to your combined credit limits.

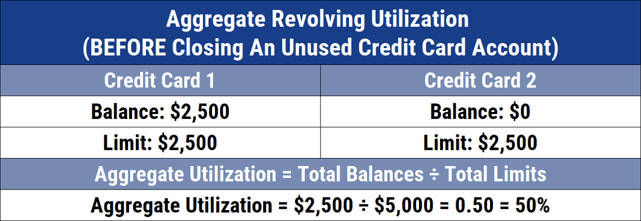

The aggregate utilization metric is where closing a credit card account could come back to bite you. When you close an unused, zero balance credit card account, the limit on the account will no longer be factored into your aggregate utilization ratio. This can cause your aggregate utilization ratio to increase, even if your actual credit card balances themselves remain the same.

Here’s how it works…

In the example above, the aggregate utilization is 50% because across the two credit cards the balance relative to the limits was half. That’s not a great utilization ratio from a credit scoring standpoint, but it could be worse.

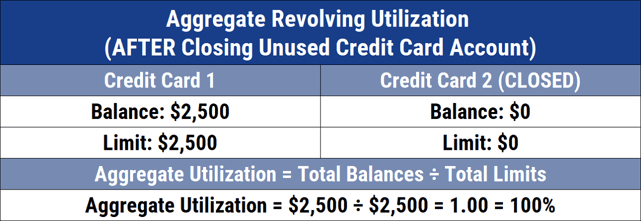

Now look at what happens to the aggregate utilization ratio if you were to close the unused credit card with a $0 balance and a $2,500 limit.

The original aggregate utilization of 50% in the first example already wasn’t good as far as credit scoring is concerned but an aggregate utilization of 100% is horrible.

Simply by closing a credit card account, you would have doubled your aggregate utilization ratio in the example above. If you made this mistake in real life, your credit score would be virtually guaranteed to go down.

On the other hand, if your balances were $0 on both cards above, your aggregate utilization would be 0%. Closing one card or the other would have no impact on your revolving utilization ratio if both accounts had already been paid to zero.

If you want to avoid having an account closure raise your utilization ratio, simply make sure all your credit card accounts reflect a $0 balance on your credit reports. This is a smart credit card management strategy anyway — both from a credit scoring and financial perspective — and another alternative to choosing to not close the card in the first place.

Don’t Close a Credit Card Prior to a Loan Application

One of the more stubborn credit myths which simply refuses to die is that closing a credit card account will have a negative impact on the average age of accounts on your credit reports. That’s why you’ll often see articles or blogs that advise you to not close your older credit card accounts.

The premise behind the myth is that closing a credit card causes you to lose the value of the age of the credit card account and, thus, lowers the average age of your accounts. This is incorrect.

As long as an account, any account, appears on your credit reports, both FICO and VantageScore’s credit scoring systems will consider the account in their age-related metrics. In fact, closed accounts continue to age even after they’ve been closed. So, if you closed a 10-year old credit card account today, in 12 months it would be considered an 11-year-old credit card account by scoring systems.

If you’ve resolved to close one or more of your credit card accounts, that’s fine. But, you should at least be cognizant that by doing so, you may end up with a lower credit score. I would strongly suggest that you not close credit card accounts just before you apply for some form of credit because the lower score could result in less attractive terms. Wait until you close on the loan before you close the credit card.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![Game Over: Here’s Why the Best Credit Card Rewards May End Soon ([updated_month_year]) Game Over: Here’s Why the Best Credit Card Rewards May End Soon ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/01/game-over-credit-card-rewards.jpg?width=158&height=120&fit=crop)

![3 Ways Closing a Credit Card Can Hurt Credit ([updated_month_year]) 3 Ways Closing a Credit Card Can Hurt Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/closecard.png?width=158&height=120&fit=crop)

![Can I Use Credit Cards Before Closing on a Home? ([updated_month_year]) Can I Use Credit Cards Before Closing on a Home? ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/06/Can-I-Use-My-Credit-Card-Before-Closing-on-a-Home.jpg?width=158&height=120&fit=crop)