When you’re smart about the way you use credit cards, they come with fantastic benefits. When you’re not smart about the way you use credit cards, they can become problematic.

Responsible credit card usage will save you money, build your credit reports and scores, and even help you earn valuable rewards or cash back. Irresponsible usage of credit cards can lead to defaults, debt collector calls, and even bankruptcy.

Credit cards, along with student loans, have become the most demonized of all mainstream credit products. The interest rates on credit cards are higher than almost any other form of credit that isn’t a payday loan.

But unlike almost every other form of credit, the fees and interest associated with credit cards are optional — and entirely within your control.

Step #1: Make Every Payment on Time

When it comes to credit card management, it’s crucial to make your payments on time. Late payments can trigger late fees, interest rate increases, credit limit reductions, and even account closure.

Furthermore, if you fall behind by at least 30 days on your credit card payment, you may end up with a late payment on your credit reports. When a late payment notation appears on your credit reports, it indicates that you’re a riskier borrower.

Furthermore, if you fall behind by at least 30 days on your credit card payment, you may end up with a late payment on your credit reports. When a late payment notation appears on your credit reports, it indicates that you’re a riskier borrower.

This may lead to a credit score reduction of up to 110 points, in addition to the other punitive actions your card issuer can take against you.

Late payments and your payment history, in general, influence your credit scores in both FICO’s and VantageScore’s credit scoring models. In fact, the presence or lack of negative information is the most influential of all credit scoring metrics.

Roughly one-third of the points in your credit scores are determined by how well, or how poorly, you pay your credit obligations.

As such, on-time payments are essential to earning and maintaining good credit scores. It is the single most important step you can take when it comes to managing your credit card, and there should never be an exception to this rule.

Step #2: Watch Your Credit Utilization Ratio

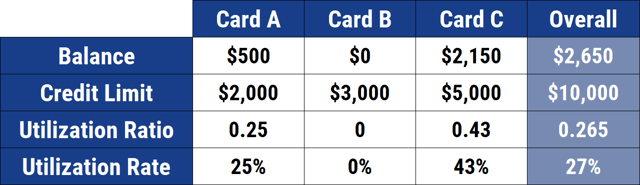

Credit utilization is the relationship between your credit card limits and the balances that are on your credit reports. This is also referred to as revolving utilization or the balance-to-limit ratio.

From a credit scoring perspective, a lower credit utilization ratio is better, meaning lower balances relative to your credit limits. You can calculate your utilization ratio by dividing the balances on all your revolving credit lines by the total credit limit you have available. Below is an example of utilization rates across three cards.

As with payment history, how you manage debt is also very influential to your credit scores. In both FICO’s and VantageScore’s credit scoring models, how well you manage debt is worth roughly another one-third of the points in your credit scores.

A similar issue that falls under the category of credit card utilization is whether you pay your balances in full each month, or if you carry some portion of your balance from one month to the next. Carrying or, more formally, “revolving” credit card debt from one month to the next can get expensive.

If you’re like many people, your credit cards have higher interest rates when compared with other types of credit. Yet thanks to the way credit card interest works, you can generally avoid paying interest fees altogether, as long as you pay your full statement balance every month.

Another perk to paying your full statement balance is that doing so may help keep your credit utilization low because of a sneaky, yet ethical, credit score hack. If you have the financial ability to pay your balance in full each month, then why not pay it off before your statement closing date?

Paying your balance before the statement closing date will result in a zero-dollar balance being reported to the credit bureaus. This should show a 0% utilization rate if your credit scores are calculated during the following month.

You get the benefit of using your credit card, the rewards points, and iron-clad fraud protections. You get all the great perks of using the card, with none of the credit score blowbacks.

Step #3: Review Your Statements & Leverage Technology

Part of using a credit card responsibly involves checking your statements for errors. Every month, you should go through your credit card statement, line by line, to make sure you recognize the charges on your account.

Credit cards come with considerable protections when it comes to billing errors and unauthorized charges. At the Federal level, the Fair Credit Billing Act , or “FCBA” protects you if any of the following occurs:

- Unauthorized charges appear on your credit card account

- Someone charges you for services or goods that you didn’t accept or weren’t delivered as agreed

- You discover mathematical errors on your credit card statement

- A charge posts to your account for the wrong amount

- Your payment isn’t posted to your account

As with most consumer protection laws, it’s up to you to sound the alarm if something goes wrong with your credit card account.

Per the FCBA, you must write a letter to your card issuer within 60 days from the date of your statement if you want to dispute a billing error on your account. The Federal Trade Commission offers a sample letter you can use to get the process started.

Another way to stay engaged with your credit card’s usage is to leverage the alert technology that comes with most major credit cards. Usage alerts, statement reminders, and due date reminders can all be sent via text message to your phone.

This way, you always know — in real time — how your account is being used, and by whom, if you have multiple users on the same account.

Step #4: Don’t Close Unused Accounts

You’ve probably read or heard that closing a credit card account can lower your credit score, and that’s true. You should typically leave your unused credit card accounts open.

You only want to think about closing a credit card if there’s a good reason, like if you’re going through a divorce and you don’t want an ex-spouse to have access to your account. When you close a credit card, it could potentially damage your credit scores in two ways:

- Closing a credit card may raise your total revolving utilization ratio. When you close a credit card account, you will lose the value of the unused credit limit in your credit scores. This could result in a spike in your credit utilization ratio and a lower score.

- Closing a credit card will eventually cause the account to be removed from your credit reports. When you close a credit card, you still get the value of the age of the card but only for as long as it remains on your credit reports. The credit bureaus will remove inactive accounts from your credit reports after 10 years. At that time, and not before, you’ll lose the value of the age of the card. This is only problematic if you close an account that is relatively old.

You should think hard before closing an unused account. You have no liability for fraudulent use. And, you can simply shred the card if you’re worried about someone stealing it.

If you want to use the account again someday, all you have to do is call your card issuer and ask them to send you a new card.

Responsible Credit Usage Can Make Your Life Easier

Not only is a credit card a convenient way to pay, but it also offers robust fraud protections and rewards, such as cash back or airline points. Best of all, credit cards can help you build better credit scores if you use them responsibly.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year]) 3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/05/atm-card-vs-debit-card-vs-credit-card--1.png?width=158&height=120&fit=crop)

![Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year]) Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/card-with-card-2.png?width=158&height=120&fit=crop)

![3 Ways Closing a Credit Card Can Hurt Credit ([updated_month_year]) 3 Ways Closing a Credit Card Can Hurt Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/closecard.png?width=158&height=120&fit=crop)

![Can I Use My Debit Card as a Credit Card? 3 Things to Know ([updated_month_year]) Can I Use My Debit Card as a Credit Card? 3 Things to Know ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/11/can-i-use-my-debit-card-as-a-credit-card--1.jpg?width=158&height=120&fit=crop)

![3 Key Differences: Charge Card vs. Credit Card ([updated_month_year]) 3 Key Differences: Charge Card vs. Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/03/charge-card-vs-credit-card.jpg?width=158&height=120&fit=crop)

![What Card is in the Jennifer Garner Credit Card Commercial? ([updated_month_year]) What Card is in the Jennifer Garner Credit Card Commercial? ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/jennifer-2.jpg?width=158&height=120&fit=crop)

![What is a Good Credit Card APR? 5 Best Low APR Cards ([updated_month_year]) What is a Good Credit Card APR? 5 Best Low APR Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/good-apr2.png?width=158&height=120&fit=crop)