Although the number of people with sub-500 FICO credit scores has dropped over the last decade, it’s still a fairly significant 4.7% of U.S. consumers as of the last update. In contrast, the national average FICO credit score is now 716, according to the credit scoring service.

And while having a credit score between 400 and 450 is above the lowest score you can have — FICO scores range from 300 to 850 — it’s still a very difficult situation to remedy.

That being said, it’s not impossible to find loans and credit cards for a 400 to 450 credit score, but you’ll need to accept that the rates and fees you’re offered will likely be quite high, the limits quite low, and the down payments practically mandatory.

Credit Cards | Personal Loans | Auto Loans | FAQs

Credit Cards: 400-450 Credit Score

Credit cards can be one of the easiest types of loans to obtain with a low credit score, mostly due to the fact that they often come with very small credit lines.

On the plus side, credit cards are what’s called revolving credit, which means you can reuse the credit line once you’ve repaid your balance (unlike a loan, which closes once it’s been repaid).

Secured credit cards — cards that require a refundable deposit — will be the easiest to obtain with poor credit, though closed-loop (only usable with one retailer) unsecured cards are available to a variety of credit scores.

- New feature! Earn up to 10% cash back* on everyday purchases

- No credit check to apply. Zero credit risk to apply!

- Looking to build or rebuild your credit? 2 out of 3 OpenSky cardholders increase their credit score by an average of 41 points in just 3 months

- Get free monthly access to your FICO score in our mobile application

- Build your credit history across 3 major credit reporting agencies: Experian, Equifax, and TransUnion

- Add to your mobile wallet and make purchases using Apple Pay, Samsung Pay and Google Pay

- Fund your card with a low $200 refundable security deposit to get a $200 credit line

- Apply in less than 5 minutes with our mobile first application

- Choose the due date that fits your schedule with flexible payment dates

- Fund your security deposit over 60 days with the option to make partial payments

- Over 1.4 Million Cardholders Have Used OpenSky Secured Credit Card To Improve Their Credit

- *See Rewards Terms and Conditions for more information

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

25.64% (variable)

|

$35

|

Poor

|

The OpenSky® Secured Visa® Credit Card is a great option for anyone who wants to open a credit card for the sake of building credit. It is a secured card that requires a refundable security deposit upon approval.

It is among the easiest credit cards to get because it doesn’t run a credit check for approval. And you can qualify to have your security deposit refunded when you manage the account responsibly, i.e., always paying your monthly bill on time.

The minimum deposit amount required to open an account is $200. It takes less than five minutes to apply, and all you’ll need is your SSN or ITIN number, address, a way to pay the deposit, and to be at least 18 years old.

The Capital One Platinum Secured Credit Card will require an initial deposit to open and maintain the account. On the plus side, your deposit is fully refundable (so long as you keep your account in good standing over a defined period).

Although the exact amount you will be required to deposit will depend on your credit profile, with a 400 to 450 score, you’ll likely be asked to make the maximum $200 down payment. You may receive a higher credit line after making a series of on-time payments.

Capital One will periodically check your credit profile and account activity to see if you qualify for an upgrade to an unsecured product. If so, you will be upgraded automatically and your deposit will be fully refunded.

The Surge Mastercard® will let you see whether you prequalify for the card before you officially apply. If you don’t qualify for the unsecured version of this card, it may instead recommend applying for the Surge Secured Mastercard®.

This card’s interest rate and fees are on the high side, but that’s to be expected from an unsecured card for bad credit.

This card doesn’t offer the bells and whistles of secured cards with lower rates and rewards, but it does offer credit reporting to each major credit bureau to help you build your credit history. Make your payments on time and avoid maintaining a high balance on the card, and your credit score will benefit over time.

The First Progress Platinum Prestige Mastercard® Secured Credit Card is another secured credit card that requires an initial deposit to open your account. As with other secured cards, your deposit is fully refundable so long as your account remains in good standing.

The size of your credit line is determined by the size of your deposit. The minimum deposit amount is $200, though qualifying applicants may be able to deposit up to $2,000 to secure a larger credit line.

The First Progress Platinum Prestige Mastercard® Secured Credit Card is fairly special in that it offers a particularly low APR for a card available to low credit scores, making it a better choice for cardholders who tend to carry a balance on a regular basis. It also charges no processing or application fees.

Personal Loans: 400-450 Credit Score

While some lenders will offer personal loans with collateral, most will stick to unsecured personal loans, which can be harder to get with a low credit score.

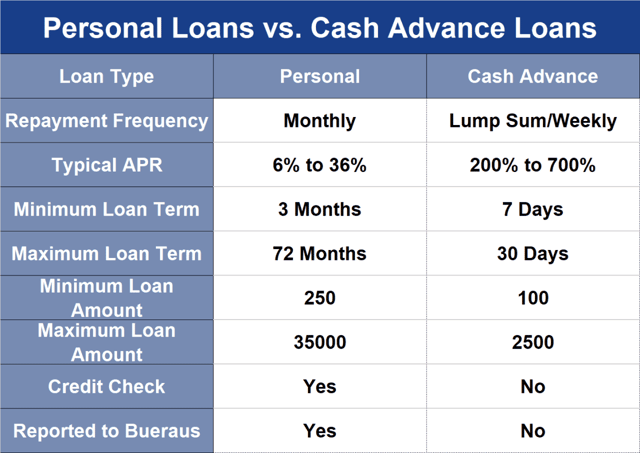

In general, personal loans will either be long-term installment loans, which can be repaid via regular payments over months or years, and short-term cash advance loans, which are repaid in a lump sum after a period of weeks.

While short-term loans will likely be easier to qualify for with a 400 to 450 credit score, they tend to be significantly more expensive — i.e., they have much higher rates and fees — than installment loans.

5. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- Not available in NY or CT

MoneyMutual.com is an online lending network that specializes in lenders who offer short-term loans, which are usually small loans with repayment terms shorter than six months.

These loans are typically repaid at the end of the loan term in a single lump sum that includes both the principal amount and all applicable fees. Most short-term loans charge finance fees, rather than typical interest rates, which are set amounts based on the size of your loan and the amount of time you need to repay it.

As a result, it can be difficult to compare the real cost of a short-term cash advance loan with other types of credit products that use APRs (annual interest rates) instead.

For example, a typical short-term loan may charge a $20 fee for every $100 borrowed. If you borrowed $500 at that rate for one month, you’re essentially being charged an APR of 243%. Compare this to the worst credit card you can find, and you’ll still be paying over 200% more for your loan.

6. CashUSA.com

- Loans from $500 to $10,000

- All credit types accepted

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

CashUSA.com is another personal loan network that can connect you with a bad credit loan, even with a 400 credit score. You won’t qualify for the largest loan amount with a poor credit score, but you may be offered one of several payday loans available on the site.

A payday loan is considered an emergency loan and should be used with caution. The high interest rates and fees can really add up if you fail to pay the loan back on time and lead to a debt spiral that’s difficult to recover from.

That said, if you’re confident you can repay the loan on time, need cash ASAP, and can’t get a loan elsewhere, a payday loan may be the best personal loan option you have.

- Loan amounts range from $500 to $10,000

- Compare quotes from a network of lenders

- Flexible credit requirements

- Easy online application & 5-minute approval

- Funding in as few as 24 hours

BadCreditLoans.com is an online lending network that connects borrowers with lenders that offer personal installment loans to a range of credit scores. While the site’s partners can provide loans of up to $10,000, those with particularly low credit scores are unlikely to qualify for large loan amounts.

The maximum APR charged for a loan through BadCreditLoans.com is 35.99%, which can mean significant interest rate costs, though even a high-interest installment loan will typically be more cost-effective than a short-term cash advance or payday loan.

Always compare offers to ensure you choose the right lender for you. This means looking at all of the loan’s terms — not just the monthly payment. The APR, time you’ll take to repay the loan, and size of the loan itself will all contribute to the total cost of your loan.

Auto Loans: 400-450 Credit Score

Most automobile loans are secured loans, meaning the vehicle itself acts as collateral for the loan. In other words, if you default on the loan (stop making payments), the lender can — and will — seize the vehicle and sell it to recover its losses.

The extra security provided by the collateral means you may successfully obtain an auto loan with a 400 to 450 credit score, but you’ll likely be required to make a sizable down payment.

- Dealer partner network has closed over $1 billion in auto loans

- Can help those with bad credit, no credit, bankruptcy, and repossession

- Established in 1999

- Easy, 30-second pre-qualification form

- Bad-credit applicants must have $1500/month income to qualify

Because the average bank will turn down a credit score below 600, many people turn to dealers to finance car purchases when they have low scores. Auto Credit Express is an online dealer network that helps people with poor or limited credit connect with dealers for financing.

Auto Credit Express can help a wide range of credit types, though you’ll need to meet the minimum income requirement of $1,500 a month. There’s no fee for using Auto Credit Express to connect with a dealer.

While Auto Credit Express can connect you with dealers and show you pre-approval offers, the network itself doesn’t have anything to do with your car loan. Once you select a dealer partner, you’ll be invited to meet with a dealer representative to select a vehicle and complete the process.

And, after you obtain your vehicle and financing, you’ll make your payments to the dealer (or the third-party bank, depending on the nature of your financing), not Auto Credit Express.

9. Car.Loan.com

- Free, no-obligation application

- Specializes in auto loans for bankruptcy, bad credit, first-time buyer, and subprime applicants

- Affordable payments and no application fees

- Same-day approval available

- Connects thousands of car buyers with auto financing a day

Car.Loan.Com is another auto loan network that can match you with a local dealer or direct lender willing to finance your next vehicle purchase. Bad credit need not stop you from submitting a prequalifying application.

Auto loans can usually be obtained the same day you apply, and you can drive your new car home today if you find a car you like. APRs range from 0% to 25%, depending on your location, vehicle type, and credit history.

There is no obligation to accept a loan offer. But you should read the terms and conditions of any loan offers you do receive so you can carefully compare their costs and choose the best one.

Is It Possible to Get a Loan With a 450 Credit Score?

As this article shows, it is indeed possible to get a loan with a 450 credit score. But the loan amount you qualify for will likely be small, and you may have to repay it as soon as you receive your next paycheck.

The loan I’m talking about is a payday loan, which you can apply for online through any of the loan networks mentioned above.

You may also qualify to get a cash advance through a free app, such as Dave, Earnin, or Brigit. These apps charge no to low fees and will advance you a small portion of your next paycheck. You must be employed and have a bank account to use these apps, but there’s no credit check required, making them a great option for a quick cash loan.

There’s also something called a Payday Alternative Loan (PAL) from a credit union, which you may qualify for if you’re a member of a credit union that offers these loans. Otherwise, you will have to apply to become a member and wait up to one month before you qualify, depending on the type of PAL it offers.

You may even qualify for a home equity loan, regardless of a bad credit score. These loans are usually for larger amounts, but you must be a homeowner with enough equity in your home to borrow against. These loans also take up to 30 days to close, just like a traditional home loan, and may come with hefty closing costs.

Lastly, there’s something called a credit builder loan that’s easy to get with bad credit, but this isn’t an actual loan you can use to pay for something. A credit builder loan helps you build credit history and savings by letting your make payments that are then put into an account.

The financial institution that offers this loan then reports your payments to the credit bureaus to help you build credit. At the end of your loan term, usually 12 to 24 months, the funds are returned to you.

Can I Get a Credit Card With a 400 Credit Score?

Yes, but it may be a secured credit card that requires a cash deposit for collateral. This is a secured loan until your deposit is refunded and you’re upgraded to an unsecured account.

The biggest benefits of secured cards are that they help add positive data to your credit report when you make your payments on time and keep your credit utilization ratio below 30% of your available credit limit. Payment history is the most important thing when it comes to your credit score, and having a lengthy on-time payment record is necessary for achieving a good credit score.

Secured cards also give you a means to make payments with a credit card, which is necessary for most online transactions.

Even With Poor Credit, You Still Have Options

Unless you have the income to simply pay cash for everything, having a low credit score can make your entire financial life a struggle. But it’s not impossible to find credit or a loan with a 400 to 450 credit score.

And, what’s more, while a 400 to 450 credit score may take time to improve, it can be improved. Creating a sustainable budget so you can pay down debt and build a positive payment history can go a long way toward improving your credit score over time. Researching the factors that go into your credit score can help you build a plan of action for rebuilding credit.

Range of credit scores covered in this article: 400, 401, 402, 403,404, 405, 406, 407, 408, 409, 410, 411, 412, 413, 414, 415, 416, 417, 418, 419, 420, 421, 422, 423, 424, 425, 426, 427, 428, 429, 430, 431, 432, 433, 434, 435, 436, 437, 438, 439, 440, 441, 442, 443, 444, 445, 446, 447, 448, 449, 450

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![9 Loans & Credit Cards: 450 to 500 Credit Score ([updated_month_year]) 9 Loans & Credit Cards: 450 to 500 Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/450500.png?width=158&height=120&fit=crop)

![9 Loans & Credit Cards: 550 to 600 Credit Score ([updated_month_year]) 9 Loans & Credit Cards: 550 to 600 Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/550-to-600-Credit-Scores.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards & Loans: 800-850 Credit Score ([updated_month_year]) 7 Best Credit Cards & Loans: 800-850 Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/11/850.png?width=158&height=120&fit=crop)

![9 Best Loans & Credit Cards: 500-550 Score ([updated_month_year]) 9 Best Loans & Credit Cards: 500-550 Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/loans-and-credit-cards-for-500-to-550-credit-scores.jpg?width=158&height=120&fit=crop)

![7 Best Loans & Credit Cards: 600-650 Score ([updated_month_year]) 7 Best Loans & Credit Cards: 600-650 Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/650.png?width=158&height=120&fit=crop)

![8 Best Loans & Credit Cards: 650-700 Score ([updated_month_year]) 8 Best Loans & Credit Cards: 650-700 Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/08/700.png?width=158&height=120&fit=crop)

![8 Best Loans & Credit Cards: 700-750 Score ([updated_month_year]) 8 Best Loans & Credit Cards: 700-750 Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/09/7501.jpg?width=158&height=120&fit=crop)

![7 Best Loans & Credit Cards: 750-800 Score ([updated_month_year]) 7 Best Loans & Credit Cards: 750-800 Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/10/800-plum.png?width=158&height=120&fit=crop)