Turning 18 can be an exciting time, full of new adventures. Many will leave home for the first time, vote for the first time, and buy their first Powerball ticket in the fruitless hope of becoming a millionaire.

At one time, another rite of passage for newly-minted 18-year-olds was to signup for their first credit card, choosing from among the bounty of applications inevitably hitting their mailbox — until the CARD Act of 2009.

These days, the CARD Act (Credit Card Accountability, Responsibility And Disclosure Act) requires consumers under the age of 21 to have a cosigner or a steady income to obtain a credit card. In one fell swoop, the CARD Act limited the options for 18-year-olds to obtain credit from the entire consumer marketplace down to a handful of issuers and cards.

Though somewhat limited, the best credit cards for 18 year olds are still out there to help you start building credit.

Students | No/Limited Credit | Prepaid | Secured Cards

Those under the age of 21 who wish to obtain a credit card under their own name will need to have a regular income substantial enough to repay any credit card debt. At the same time, that income doesn’t necessarily need to be from a job, which can open up some doors — particularly for students.

Why? Because you can typically report extra money from scholarships, grants, and fellowships as income on a credit card application. What’s more, you can also find a range of credit cards designed specifically for students, with flexible credit requirements and room for those who have yet to start establishing a credit history.

You can start exploring some of the best student credit card options available below:

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

|

|

|

|

|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

- Earn unlimited 1.5% cash back on every purchase, every day

- Early Spend Bonus: Earn $50 when you spend $100 in the first three months

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Enjoy no annual fee, foreign transaction fees, or hidden fees

- Lock your card in the Capital One Mobile app if it's misplaced, lost or stolen

|

|

|

|

|

|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

|

|

|

|

|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), with 1% on all other purchases

- Early Spend Bonus: Earn $50 when you spend $100 in the first three months

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Enjoy no annual fee, foreign transaction fees, or hidden fees

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

|

|

|

|

|

|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- When handled responsibly, a credit card can help you build your credit history, which could be helpful when looking for an apartment, a car loan, and even a job. Access your FICO® Score for free within Online Banking or your Mobile Banking app.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

|

|

|

|

|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

+See More Student Credit Cards

One important thing of which you should be aware of is that certain types of school-related monies should not be reported as income on a credit card application, the most prominent of which is student loan funds.

Basically, since your student loan is really a type of debt rather than actual income, it’s a bad idea to claim it as such. In other words, you’ll need to pay back your loans, meaning they’re not a very reliable option for repaying other types of debt.

Moreover, if you need to falsely report student loan funds as income to qualify for a student card, you probably don’t need to take on any other potential sources of debt in the first place — particularly not ones with the high interest rates that come with revolving credit lines.

The main issue with not having an established credit history is that issuers can’t get an idea of how much financial risk you present. Think of it like this: if you were to lend someone money, wouldn’t you want to know they can — and, more importantly, will — pay you back? That’s where your credit history comes into play. Enter: the starter credit card.

Offered by many major issuers (and not-so-major ones, too), starter cards are like the base model subcompact car of bank credit card products. In other words, they’ll get you where you need to be, but they’re not likely to have a lot of creature comforts, like purchase rewards on eligible purchases or lucrative signup bonuses. Our favorite cards for those with no/limited credit include a number of annual-fee-free options.

NO/LIMITED CREDIT RATING

★★★★★

4.7

- No credit check to apply

- Adjustable credit limit based on what you transfer from your Chime Checking account to the secured deposit account

- No interest* or annual fees

- Chime Checking Account and qualifying direct deposit of $200 or more required to apply. See official application, terms, and details link below.

- The secured Chime Credit Builder Visa® Card is issued by The Bankcorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted.

- *Out-of-network ATM withdrawal and OTC advance fees may apply. View The Bancorp agreement or Stride agreement for details; see back of card for issuer.

NO/LIMITED CREDIT RATING

★★★★★

4.7

- No annual or hidden fees. See if you're approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One's mobile app

|

|

|

|

|

|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

NO/LIMITED CREDIT RATING

★★★★★

4.7

- Earn unlimited 1.5% cash back on every purchase, every day

- Early Spend Bonus: Earn $50 when you spend $100 in the first three months

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Enjoy no annual fee, foreign transaction fees, or hidden fees

- Lock your card in the Capital One Mobile app if it's misplaced, lost or stolen

|

|

|

|

|

|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

+See More Cards for No/Limited Credit

After you open your first credit account, your creditor — the credit card issuer, in this case — will start reporting your payment behavior to the three major credit bureaus (Equifax, Experian, and TransUnion). This will establish your consumer credit profile, which credit scoring agencies will use to calculate your credit scores.

FICO is the most commonly used credit scoring agency, and the FICO Score 8 the most frequently used credit scoring model. VantageScore 3.0 comes in a close second.

Since most major credit card issuers now offer free FICO tracking as a benefit to cardholders, you can likely keep track of your changing credit score through your online banking/bill paying portal. Don’t be alarmed or dismayed if it takes some time for you to get a credit score, however, as it takes up to six months of credit history for FICO to have the means to calculate your credit score.

While the CARD Act seeks to protect young people from taking on credit card debt they cannot repay, it can be an inconvenience for those who are unable to obtain a credit card as a result, particularly in the modern world of digital payments. If you are between the ages of 18 and 20 and cannot meet the requirements to obtain a credit card under the CARD Act, your best solution may be to get a prepaid credit card.

When adorned with a credit card network logo — e.g., Visa, Mastercard, Discover, or Amex — prepaid cards can be used just like credit cards to conveniently make purchases anywhere the network is accepted. The main difference is that prepaid cards need to be loaded with funds to be used, sort of like a gift card or debit card.

Unlike gift cards, prepaid cards, including our expert-rated options below, can receive direct deposits.

EXPERT'S RATING

★★★★★

4.9

- Cashback – Earn 1% cash back on up to $3,000 in debit card purchases

each month

- No. Fees. Period. That means you won’t be charged an account fee on our

Cashback Debit account.

- Early Pay – Get your paycheck up to two days early with no charge

- No Credit Impact - You can apply without affecting your credit score.

- Fraud Protection - You’re never responsible for unauthorized debit card

purchases. If you suspect someone else has used your debit card without

your permission, let us know.

- Member FDIC

- Fee-free overdraft protection

- No minimum opening deposit and no minimum balance

- Add cash into your account at Walmart stores nationwide

- Cash access at over 60,000 no-fee ATMs nationwide

- 100% US-based customer service available 24/7

|

|

|

|

|

|

N/A

|

N/A

|

N/A

|

$0

|

No Credit Needed

|

EXPERT'S RATING

★★★★★

4.9

- Your Chime Checking Account comes with a Chime Visa® debit card, no monthly fees or maintenance fees.

- Avoid out-of-network ATM fees and access to 60,000+ fee-free ATMs¹ — more than the top 3 national banks combined!

- Direct deposits arrive up to 2 days early.²

- Disclosures: Chime is a financial technology company, not a bank. Banking services and debit card provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC.

- ¹Out-of-network ATM withdrawal fees may apply except at MoneyPass ATMs in a 7-Eleven, or any Allpoint or Visa Plus Alliance ATM.

- ²Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.

|

|

|

|

|

|

N/A

|

N/A

|

N/A

|

$0

|

Not applicable

|

EXPERT'S RATING

★★★★★

4.8

- Brink’s knows Security! 24/7 access to a suite of security benefits to help keep your account armored.

- Get access to over 100,000 Brink’s Money ATMs.

- Get paid faster than a paper check with direct deposit.

- Add funds to your Brink’s Armored Account and use Brinks Armored debit card anywhere Debit Mastercard is accepted.

- Account opening is subject to registration and ID verification. Terms & fees Apply. Deposit Account is established by Pathward®, N.A., Member FDIC.

|

|

|

|

|

|

N/A

|

N/A

|

N/A

|

Variable Monthly Fees

|

Not applicable

|

+See More Prepaid Cards

Although prepaid cards can be used the same way as credit cards for purchases, prepaid cards have one key difference: They cannot help you build credit like a credit card can.

Credit card purchases borrow money from the issuing bank to pay for purchases, then you pay off that debt when the issuer bills you. In contrast, prepaid cards use the money you load onto the card to pay for purchases directly and must be reloaded once that money is spent.

And because prepaid cards are not technically credit cards, they are exempt from the CARD Act and do not require a credit check to obtain. Prepaid cards are not tied to your credit in any way and they won’t report your payment behavior to the credit bureaus, meaning you can’t use prepaid cards to establish or build credit.

Far and away the easiest credit card to obtain — and, arguably, one of the safest — is a secured credit card. Made for credit builders (or rebuilders for those with bad credit scores), secured credit cards require an initial deposit to open the account. That deposit acts as security for the account, and the size of your deposit will determine the size of your credit line.

Since a secured card is less risky for the issuer, they tend to have lower interest rates and fees than unsecured cards for building credit. Plus, your secured card deposit is fully refundable when you close your account in good standing — those pesky unsecured card fees are gone for good.

Many of our top-rated secured cards have no annual fee at all:

- No credit check to apply

- Adjustable credit limit based on what you transfer from your Chime Checking account to the secured deposit account

- No interest* or annual fees

- Chime Checking Account and qualifying direct deposit of $200 or more required to apply. See official application, terms, and details link below.

- The secured Chime Credit Builder Visa® Card is issued by The Bankcorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted.

- *Out-of-network ATM withdrawal and OTC advance fees may apply. View The Bancorp agreement or Stride agreement for details; see back of card for issuer.

- New feature! Earn up to 10% cash back* on everyday purchases

- No credit check to apply. Zero credit risk to apply!

- Looking to build or rebuild your credit? 2 out of 3 OpenSky cardholders increase their credit score by an average of 41 points in just 3 months

- Get free monthly access to your FICO score in our mobile application

- Build your credit history across 3 major credit reporting agencies: Experian, Equifax, and TransUnion

- Add to your mobile wallet and make purchases using Apple Pay, Samsung Pay and Google Pay

- Fund your card with a low $200 refundable security deposit to get a $200 credit line

- Apply in less than 5 minutes with our mobile first application

- Choose the due date that fits your schedule with flexible payment dates

- Fund your security deposit over 60 days with the option to make partial payments

- Over 1.4 Million Cardholders Have Used OpenSky Secured Credit Card To Improve Their Credit

- *See Rewards Terms and Conditions for more information

|

|

|

|

|

|

N/A

|

N/A

|

25.64% (variable)

|

$35

|

Poor

|

- No credit score required to apply.

- No Annual Fee, earn cash back, and build your credit history.

- Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount, starting at $200. Bank information must be provided when submitting your deposit.

- Automatic reviews starting at 7 months to see if we can transition you to an unsecured line of credit and return your deposit.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get an alert if we find your Social Security number on any of thousands of Dark Web sites. Activate for free.

- Terms and conditions apply.

|

|

|

|

|

|

N/A

|

10.99% Intro APR for 6 months

|

28.24% Variable APR

|

$0

|

New/Rebuilding

|

+See More Secured Credit Cards

Another reason to go with a low- or no-fee secured credit card over a pricey unsecured credit card is that some secured cards can be upgraded down the line. For example, if you have a Discover it® Secured Credit Card, Discover will periodically check up on your credit progress to see if you can qualify for an unsecured card.

If your credit report passes muster, you’ll be automatically upgraded to an unsecured card, and your deposit will be refunded in full. As an added bonus, the switch is often seen as an upgrade, not a new credit product, which means you’ll hang onto the account history you’ve built with your secured card. (Your average account age is factored into your credit score, so maintaining old accounts can be important.)

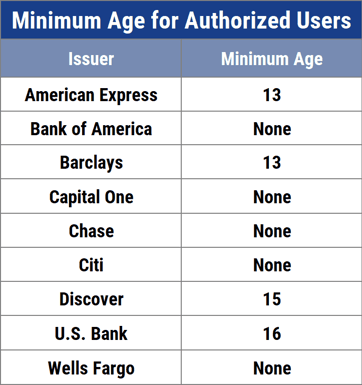

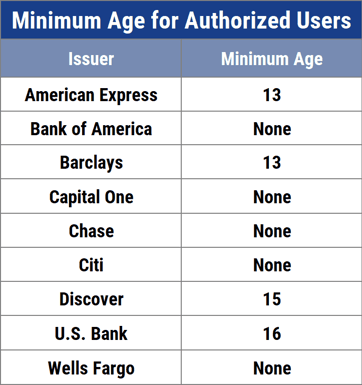

If you can’t qualify for your own credit card but you want to begin building credit, one way to do that is to become an authorized user on someone else’s account. You’ll receive your own card with your name on it, but you won’t be the primary borrower. That means you aren’t legally responsible for repaying the debt.

Becoming an authorized user means the account will be reported to each major credit bureau for inclusion on your credit reports. This will only help, though, if the account is in good standing and managed responsibly.

Ideally, the account will have been opened for a few years, has a spotless record of on-time payments, and has a balance below 30% of its available credit limit.

You should see the account appear on your credit reports after it is reported to the bureaus, which will generate a credit score.

As the young cub in the den, it can be challenging to measure your progress against that of the more experienced people around you. But the thing to realize here is that you have time working on your side, and, when used wisely, time can be a powerful weapon.

To make the most of that time — and your finances — you should start planning for the future as early as you can. This not only means starting to build your retirement savings with your first paycheck, but also responsibly establishing your consumer credit profile as soon as (reasonably) possible.

Ideally, having a parent or other responsible cardholder add you to their accounts as an authorized user can jumpstart your credit journey. Even without this boost, however, you can reasonably build credit in a few short months.

So, once you’ve opened your first credit account, you should focus on building a positive credit history. The most important thing to do is to be sure to pay your bills on time and as agreed each month. Late payments can have a devastating effect on your credit, particularly newly established credit.

You should also be careful to build credit slowly; opening four credit cards all at once won’t build your credit faster, and it could have the opposite effect if you can’t stay on top of the payments. Plus, every credit card application will result in a hard credit inquiry, and excessive inquiries can do some serious damage to a fledgling credit profile (and not a little damage to an established one, for that matter).

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![8 Best Credit Cards for 20- to 30-Year-Olds ([updated_month_year]) 8 Best Credit Cards for 20- to 30-Year-Olds ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-20-to-30-Year-Olds-Feat.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards For 16- & 17-Year-Olds ([updated_month_year]) 9 Best Credit Cards For 16- & 17-Year-Olds ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/03/Best-Credit-Cards-For-16-17-Year-Olds.jpg?width=158&height=120&fit=crop)

![12 Best Credit Cards For Young Adults ([updated_month_year]) 12 Best Credit Cards For Young Adults ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Best-Credit-Cards-For-Young-Adults.jpg?width=158&height=120&fit=crop)

![12 Best Credit Cards for Teens ([updated_month_year]) 12 Best Credit Cards for Teens ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/teens.png?width=158&height=120&fit=crop)