Many consumers use starter credit cards to build their credit history without the upfront cost of a secured credit card. These cards provide you with a revolving line of credit without needing a refundable security deposit to activate your account.

And if you choose an established credit card issuer for your starter credit card, you may eventually qualify for a card upgrade as you progress in your credit-building journey.

The best part is that you can apply for any of these cards online and receive a credit decision within a matter of seconds. That means you can qualify for your starter credit card before you even get out of bed in the morning.

Best Overall | Unsecured Cards | Student Cards | FAQs

Best Overall Unsecured Card for No/Limited Credit

The Capital One Platinum Credit Card is the bank’s entry-level offering and is a great starter card for anyone who is serious about building credit. Not only does the card charge almost no fees and a competitive interest rate, but your responsible credit behavior may also help you qualify over time for one of Capital One’s many rewards credit cards.

- No annual or hidden fees. See if you're approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One's mobile app

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

Capital One will monitor your account every six months to see whether you qualify for a credit limit increase. If you qualify, the bank will automatically boost your spending limit without any additional fees or charges.

- Earn unlimited 1.5% cash back on every purchase, every day

- No rotating categories or limits to how much you can earn, and cash back doesn't expire for the life of the account. It's that simple

- Be automatically considered for a higher credit line in as little as 6 months

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Help strengthen your credit for the future with responsible card use

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$39

|

Average, Fair, Limited

|

The Capital One QuicksilverOne Cash Rewards Credit Card is the cash back sibling of the Platinum card listed above. This card lets you earn unlimited cash back on every qualifying purchase in exchange for a small annual fee.

But as long as you pay your balance in full each month to avoid interest charges, your rewards earnings will exceed the cost of the annual fee when you charge $217 each month to your card.

Best Student Cards for No/Limited Credit

The following cards are limited to student applicants who are just beginning their credit-building journey. These cards come with much of the same benefits found on cards for good credit, plus student-only perks like good grade rewards.

The Discover it® Student Cash Back offers generous cash back rewards in quarterly rotating categories that you must activate.

You’ll be charged a competitive APR on balances that aren’t paid off each billing cycle, and will never have to pay an annual fee.

- Earn unlimited 1.5% cash back on every purchase, every day

- Early Spend Bonus: Earn $50 when you spend $100 in the first three months

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Enjoy no annual fee, foreign transaction fees, or hidden fees

- Lock your card in the Capital One Mobile app if it's misplaced, lost or stolen

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

The Capital One Quicksilver Student Cash Rewards Credit Card offers an unsecured credit option for students with perks that fit students’ interests, spending, and lifestyle.

This includes cash back rewards, a competitive interest rate, no annual fee, and a signup bonus.

With the Capital One SavorOne Student Cash Rewards Credit Card, cardholders can earn elevated cash back rewards on dining, entertainment, streaming services, and at grocery stores. All of which are popular spending categories for young adults.

This card offers generous rewards for a student card, and these rewards can really add up fast. But be sure to pay your bill off each month so the interest charges don’t eat away at your earnings.

Lower-Rated Unsecured Starter Cards

The cards below are all for poor or no credit history. Although these cards are more affordable at first, they may provide you with a smaller credit line until you can prove you can responsibly manage credit.

Many also come with fee structures that may be undesirable if you are on a tight budget.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply!

- Monthly Credit Score – Sign up for electronic statements, and get your Vantage 3.0 Score Credit Score From Experian

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

- See if you’re Pre-Qualified without impacting your credit score

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

See website for Details

|

See website for Details

|

29.99% APR (Variable)

|

$75 - $125

|

See website for Details*

|

The Surge® Platinum Mastercard® is a decent starter credit card. But this card can also help rebuild your credit since this credit card company accepts applications from consumers who have bad credit.

Surge often provides larger initial credit limits to cardholders, but that doesn’t mean you should take advantage of the extra credit. Depending on your creditworthiness, you may only qualify for an interest rate that is higher than most credit card’s penalty APR.

The Destiny Mastercard® is an unsecured card with a pretty fair interest rate and annual fee compared to other cards for no or bad credit histories. But your initial credit limit will be low, and “set up and maintenance fees” will be deducted from your initial credit limit.

That said, it has a generous interest-free grace period and comparatively low regular APR, and can help you build credit over time with responsible use.

The Reflex® Platinum Mastercard® has an ongoing APR that matches the higher penalty APR of many cards — which can make this a very expensive option if you’re in the habit of carrying a balance from month to month.

But even if you pay your balance in full each month, you’ll still encounter some steep fees with this card. The first year’s annual fee alone is several times higher than the average fee in this category. But, starting in the second year, you’ll also have to pay a monthly maintenance fee depending on your credit limit that can raise the cost of this card to more than $200 per year.

The Milestone® Mastercard® offers an unsecured credit option for consumers who have a credit score of below 640. Be sure to read the terms and conditions so you know what your APR, annual fee, and other charges will be.

Milestone will report your payment and balance information to each major credit bureau every month. With responsible use, you can improve your credit score and eventually graduate to a better unsecured card with lower fees and rewards.

10. Total Visa® Card

You won’t have to pay a deposit to activate your Total Visa® Card, but you will be charged a hefty program fee when you apply. Then, when you activate your card, you’ll encounter your first year’s annual fee.

As if this weren’t expensive enough, the card also charges a monthly maintenance fee beginning in your second year with the card. This option is better left to those who need to rebuild damaged credit and have trouble being approved elsewhere.

As with other cards near the bottom of this list, the FIT™ Platinum Mastercard® heaps on the charges before you can even use your card. This includes a one-time program fee when you submit your application. Once you activate your new card, your first annual fee will automatically be deducted from your available credit balance.

On the other hand, this card offers a much higher potential starting credit limit for new cardholders. Just make sure to pay your balance in full each month to avoid any elevated interest charges.

What is a Starter Credit Card?

A starter credit card is a financial product designed to help first-time credit users establish a credit history. Consumers who do not have enough reliable and recent information on their credit report to generate a personal credit score are known as being credit invisible.

This is different from having bad credit, as someone with bad credit has a history of financial mistakes. Someone who has no credit simply does not have a reported borrowing history with the credit bureaus.

A starter credit card can be used to add to that history. These are typically no-frills cards that may not provide cash back or other rewards. They may also have a slightly higher interest rate or annual fee to offset the risks associated with lending to someone who has no traceable credit history.

But these cards help you out by reporting your payment and balance history every month to at least one major credit bureau — TransUnion, Equifax, and Experian.

Each major credit bureau collects this information and adds it to your credit file to help build your credit history. Then credit scoring systems such as FICO and VantageScore use this data to calculate your credit scores.

As you might expect, positive information — including on-time payments and a low balance — can help you build a good credit score. Negative information — including a high balance or late payments — will lower your credit score until the debt is paid down.

If you have no credit score at all, you may need up to six months of payments with your new card until you have enough payment history to generate a credit score. Your credit rating will continue to evolve based on your financial behaviors.

And, depending on which credit card company you choose to sign up with for your starter account, you may eventually qualify for a card upgrade.

Larger banks, including Capital One, offer massive portfolios of unsecured credit card options. As your credit score improves and you outgrow your current card, you may be able to move up to a new card with a better interest rate or richer rewards.

That’s something you can’t do with a bank that only issues starter credit cards or cards for bad credit, and is something you should consider when deciding which card you wish to apply for.

How Do I Apply For My First Credit Card?

Most credit card issuers allow you to complete an online credit card application that takes only a few minutes to submit and a matter of seconds to process.

These applications require basic identifying and financial information, including your name, address, phone number, email address, Social Security number, and income details. Some credit card issuers may even require you to link your bank account to their online system to verify your income.

If you apply for a student credit card, the bank may put your application on hold until you can prove that you’re actively enrolled in classes. The bank will typically ask for a recent class schedule, your final grades from the most recent semester, or a school transcript.

Once you submit your credit card application, you should receive a decision within a minute or less.

On some occasions, the bank may require more information from you before it can make a credit decision, or the bank may need to have a loan officer take a closer look at your application. Other times, you may need to link your bank account online to verify your mailing address or income information.

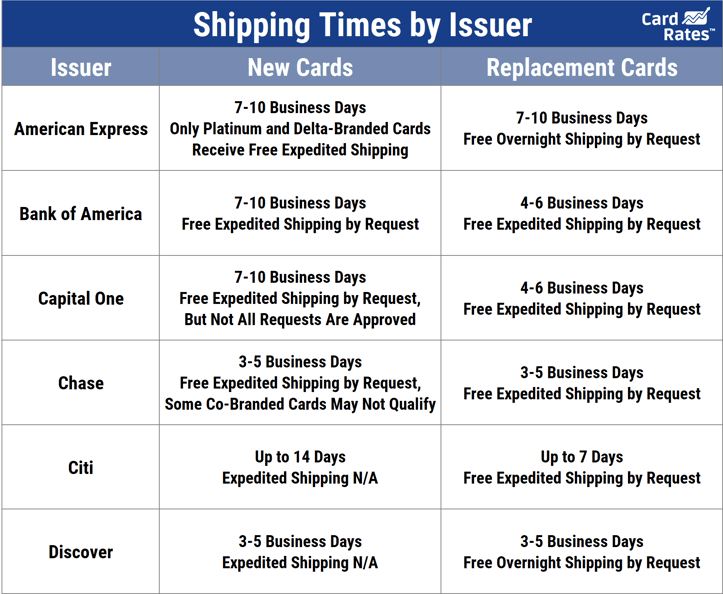

If you qualify, you will see an approval screen that shows your card’s spending limit and an invitation to sign up for an online account to manage your new card. The credit card issuer will then print your new card and you should have it in the mail within seven to 10 business days.

If you do not qualify for the card, the bank must send you an adverse action notice within seven to 10 business days that details why it did not accept your application. While this is disheartening, do not succumb to the temptation to apply for another credit card right away.

Every time you apply for a loan or credit, the lender places a hard inquiry on your credit report to access your credit history for a credit check. Each inquiry lives on your credit report for two years.

Lenders are typically fine with three or fewer inquiries on your report. But as you start to build up a large number of credit applications, you may see a slight drop in your credit score.

To avoid accruing too many inquiries, consider prequalifying for the credit cards you’re interested in. This is a shortened version of a credit application that will tell you whether you meet the bank’s initial requirements for approval.

When you submit a prequalifying form, you allow the credit card company to conduct a soft credit pull on your file. This gives the bank access to a modified version of your credit file and typically provides enough data for the bank to see whether you are likely to be approved for the credit card if you officially apply

You will not receive a hard inquiry on your credit report for a soft credit pull.

If you prequalify and decide to continue with the process, you can officially apply for the credit card in the manner outlined above. This will add a hard inquiry to your credit report — but that’s not bad if you are likely to qualify for the card.

Prequalifying does not guarantee you will receive the card if you apply. On rare occasions, the bank may see something on your full credit report after you apply that wasn’t listed on your modified report during prequalifying. This can cause the bank to rescind its prequalification offer.

In most cases, though, prequalification is a good indicator of success if you decide to formally apply.

Prequalifying can take less than five minutes to complete. The formal application will take a similar amount of time.

What is the Best Credit Card for New Users?

The best credit card for new users is one that allows you to eventually upgrade to a better card and continue your credit-building journey with better terms.

That may mean sticking to an established bank with a large portfolio of credit card offerings. Capital One and Discover all offer great starter credit cards as well as cards that provide rich rewards and fair interest rates.

We’ve rated the Capital One Platinum Credit Card as the best overall card for new credit users. This card will periodically review your account for credit limit increases and eventual upgrades.

- No annual or hidden fees. See if you're approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One's mobile app

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

As you prove your creditworthiness over time, most credit card issuers will increase your credit limit and give you access to greater spending power. If you remain a responsible borrower, the bank may decide to upgrade you to a better credit card. If this happens, you may receive a new card in the mail and any balance you have with your old account will carry over to your new card.

You can also contact your credit card issuer to see whether you qualify for a card upgrade. It usually takes six months to a year after opening your current card account to qualify, so consider the timing before calling customer service.

Building credit is a long journey taken in small steps. If you start off with a credit card issuer that does not have a large portfolio of cards, you may have to cancel your current card and apply for a new one when your credit score improves.

Take a long-view approach when deciding which starter credit card is best for you. Look at the bank’s portfolio of cards to see whether there’s a card you want to set a goal to qualify for.

If there is a card you’d like to qualify for in the future, you can build a long, successful relationship with that bank. If not, you may want to look for another option.

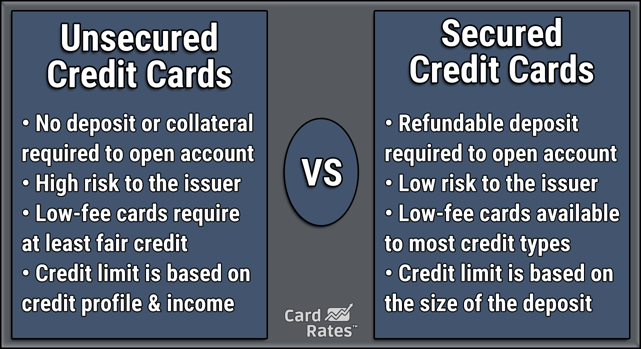

Do All Credit Cards Require a Deposit?

There are two main types of credit cards — secured and unsecured — but only secured credit cards require a deposit. A secured credit card is a financial product designed to help consumers build or rebuild their credit score.

The refundable security deposit typically matches the card’s credit limit. For example, a $500 deposit will net you a $500 spending limit.

Most secured cards have a minimum deposit requirement of between $200 and $300. You may also find secured cards with a maximum deposit limit of as high as $5,000.

Your deposit serves as security should you default on your account and does not cover your monthly payments. If you place a $2,000 deposit to open your account and immediately charge $2,000 on the new card, you will need to pay at least the minimum amount due each month, which will include interest charges, to keep your account active.

When you close your secured card account, the bank will refund your security deposit, unless you have outstanding debts on your card. If that is the case, the bank will subtract that balance from the deposit and refund the remaining amount.

An unsecured credit card is a traditional credit card product that doesn’t require a deposit for approval. Your new card may charge an annual fee when you activate it, but that does not qualify as a deposit.

Since these cards have no security backing, a bank may reserve them for consumers who have good credit. If a bank offers unsecured credit to applicants who have bad credit or no credit, the card may come with a higher interest rate or fee structure to offset the bank’s risk.

What Fees Do Starter Credit Cards Have?

Banks can charge any fees they want to — as long as the fee is legal. As a result, you may find different fee types across the various credit cards available.

An example of some of the types of fees you may find on your starter credit card include:

- Annual Fee: This is a somewhat common fee some credit cards charge to your credit account every year on your account anniversary. The fee can vary from as little as $30 to hundreds of dollars each year for more exclusive rewards credit cards. Some cards charge no annual fee at all.

- Interest Rate Fee: Banks make money with credit cards by charging interest on all of the money they lend out. Interest is calculated as a daily percentage of your card’s balance that is not paid within the card’s purchase grace period.

- Late Fee: Most cards charge a late fee if you submit a payment after the due date. The fee amount will vary by the card you choose. Some banks may also initiate a penalty APR that increases your interest rate after you make a late payment.

- Balance Transfer Fee: Some cards charge a balance transfer fee when you transfer an existing balance from one card to another. A balance transfer may make sense if your new card has a lower interest rate than your old card. This fee is usually 3% to 5% of the amount of debt you transfer.

- Over-Limit Fee: Some banks will simply decline any transaction that attempts to charge more money than your available credit limit. Other cards provide a purchase cushion that lets you exceed your spending limit by a set amount. If you do this, though, you can expect to be charged a fee.

- Cash Advance Fee: Credit cards are great for making purchases online or in-store, but you can also withdraw money from your credit card at an ATM or a bank teller window, known as a cash advance. Most cash advance fees are around 3% of the amount withdrawn from your credit line. You will also have no grace period for this type of transaction and will start immediately accruing interest charges on the amount you withdraw. Most credit cards also charge a higher interest rate for cash advances than they do purchases.

- Foreign Transaction Fee: If you make a purchase in a foreign country — or one that requires payment in a currency other than your native currency — your issuing bank may charge a foreign transaction fee to convert the amount spent. This is usually a small percentage of the total transaction.

- Returned Payment Fee: You will likely encounter a returned payment fee of $25 or more if your check or online bank transfer for a payment bounces due to insufficient funds.

- Card Replacement Fee: If you lose your credit card, the bank will need to freeze your account and print and send you a new card. You may be charged a fee that varies based on the card issuer, but most banks replace cards for free.

Some credit cards offer new cardholders promotional deals that waive certain fees. For example, a card may offer a 0% intro APR for new applicants for a period of between six and 18 months.

Some banks may also offer a balance transfer offer that waives interest charges or balance transfer fees on debt you move from an existing card to your new card. This can be a great way to eliminate debt without incurring heavy finance charges along the way.

For the most part, standard fees — such as a late payment, returned payment, over limit, or card replacement fee — are not covered under promotions and will charge to your account when they apply.

Is an Annual Fee the Same as a Deposit?

An annual fee is different from a security deposit in several ways. The key difference is that you can receive a refund of your deposit with a secured credit card. An annual fee is simply a charge you cannot recoup after you pay it.

When you apply for a secured credit card, the issuing bank will require you to place a refundable security deposit to activate your account. The amount of your deposit will typically match the spending limit associated with the card.

When you submit your deposit, the bank will hold the funds in a savings account over the life of your card account. This ensures the bank will get paid if you default on your credit card debt. If you close your secured credit card account with no outstanding balance, the card issuer will refund your entire security deposit.

An annual fee can apply to either a secured or unsecured credit card. This is a fee that banks charge to pay for the costs associated with maintaining your account, including rewards and other valuable perks like travel insurance.

Not every credit card charges an annual fee. This fee can vary widely based on the type of credit card you add to your wallet. Some cards charge an annual fee of $30 to $95. A few ultra-exclusive credit cards with superior rewards and perks may charge as much as $5,000 each year for membership.

Since you agreed to the annual fee when signing up for the card, you will not receive a refund for the expense. Under some rare circumstances, however, you may be able to negotiate a reduction or elimination of an annual fee.

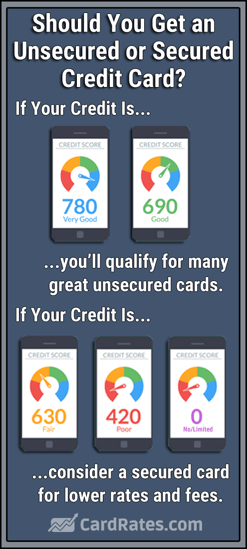

What Credit Card Can I Get With No Deposit?

An unsecured card does not require a deposit for activation and will not require upfront money for approval.

To determine the card that best suits your needs, consider your current credit score and financial situation. After all, someone who has good credit shouldn’t spend time considering credit cards designed for applicants who have bad credit.

Your FICO credit score can range between 300 and 850. A bad credit score is any number below 580. A score of between 580 and 669 is considered fair credit or limited credit. You have good credit if you fall between 670 and 739. You have very good credit if you’re between 740 and 799. Any score at or above 800 is excellent credit.

Cards for bad credit will charge a higher interest rate, and will likely have annual fees and other charges that make them more expensive for consumers. Depending on how bad your credit is, you may have to settle for a secured credit card that requires a refundable security deposit for approval.

Cards for fair credit will have slightly better terms than cards for bad credit, including lower interest rates. Some of these cards will also offer cash back and other rewards.

You’ll have a much more robust selection of cards if you have good credit. These cards generally offer low interest rates, solid rewards, lower overall fees, and a higher credit line.

If you have very good or excellent credit, you should have little trouble qualifying for any credit card you want. You can usually find a good rewards card with travel points or cash back and other valuable perks, including a much higher credit line.

And since your credit score ranks among the top compared with those of most consumers, you can leverage your spending power to potentially negotiate fees or improve your rewards structure on new and existing cards.

What is the Difference Between a Secured and Unsecured Credit Card?

While both cards perform the same purpose at the register, a secured credit card requires a refundable security deposit for approval. An unsecured credit card requires no deposit at all.

Secured credit cards are designed to help people build, or rebuild, their credit. They’re a credit card option for consumers who may not qualify for a traditional unsecured credit card.

But since these consumers may have a history of late payments or defaults, a secured credit card has a mandatory deposit requirement that serves as security for the bank in case the debt goes unpaid.

Unsecured credit cards do not require a deposit for approval. Banks determine an unsecured card’s credit line by evaluating the applicant’s credit history, current debts, and income. A solid credit history and a low debt-to-income ratio will net you a high spending limit.

Most secured credit cards give you the ability to determine your own credit limit based on the amount of your security deposit. For example, placing a $600 deposit will give you a $600 spending limit. Some secured credit cards start all new cardholders at the same spending limit and allow them to earn credit limit increases over time and with responsible use.

Since unsecured cards provide no safety net for banks in the case of late payments or default, these cards are typically harder to qualify for if you have very bad credit. But, if you’re a newcomer to credit and have no credit at all, it is generally easier to qualify for an entry-level unsecured credit card that doesn’t require a deposit.

Whichever type of card you choose — secured or unsecured — the bank that issues your card will report your payment and balance history to at least one major credit bureau. This is how you build a credit history and eventually develop a credit score.

If you have financial mistakes in your past, this new information can help push your previous mishaps further down your credit file and give you a fresh start on your financial journey.

Although many consumers think that secured credit cards are not as helpful as their unsecured counterparts, they are indeed a good way to stick to a budget while growing your credit history.

And since many large banks offer both secured and unsecured credit cards, you can potentially work your way up to an unsecured offering as you improve your credit.

What is the Easiest Credit Card to Get Approved For?

Secured credit cards are the easiest credit cards to get approval for because your refundable security deposit makes up for your poor credit history. In fact, many secured credit cards don’t even require a credit check for approval.

But as with most things in the financial world, the easiest does not always equate to the best.

If a bank makes a product — such as a credit card — easy to get, extra fees and charges are often tacked on to make up for that convenience. In the case of a secured credit card, that isn’t just the upfront security deposit.

Even after you put down several hundred — or even thousands — of dollars for your deposit, your new secured card may also charge an annual fee, an account setup fee, or another charge you have to pay before you can use your card.

These fees come directly out of your available balance. Let’s say you open a secured card account with a $400 deposit. This gets you a $400 spending limit.

If your card has a $75 annual fee that you pay upon activation, your available credit will drop to $325 until you pay that fee.

You may also find that a secured credit card has a higher interest rate, late payment penalty, or other fees that can make your credit builder account even more expensive.

With an unsecured credit card, you may still have an annual fee and higher-than-average interest rate, but the lack of up-front costs make them affordable options for establishing your credit.

Keep in mind that someone who has no credit — or limited credit — will not qualify for a high-end unsecured credit card with all the bells and whistles. You may have to start with an entry-level card that doesn’t provide cash back or other rewards.

But as you build your credit history and prove your responsibility, you can work your way up to a top-shelf credit card that is worthy of your hard work and determination.

How Can I Get a Credit Card With No Credit History?

Banks understand that you have to start somewhere. That’s why most create entry-level credit cards for consumers who have no or limited credit history. These cards may not have a lot of bells and whistles, but they’re a great way to build a credit history and work your way up to more lucrative rewards credit cards.

In many cases, you can check to see whether you’ll qualify for a credit card before you officially apply.

Capital One, for instance, provides a prequalifying tool that takes less than five minutes to complete. You’ll submit basic information, including your name, address, phone number, email address, Social Security number, and income information. The bank will then process that data and conduct a soft credit pull that will not affect your credit score.

And, within seconds, you can find out whether you prequalify for a specific credit card. If you qualify, you can officially apply for the credit card. This will require you to submit a formal application and agree to a full credit check.

The entire process typically takes less than 10 minutes and can return an instant credit decision. Prequalifying for a credit card does not guarantee that you will get the card when you apply, but it is typically a strong indicator of success.

During the prequalifying process, the bank conducts a soft credit pull that gives it access to a modified version of your credit history. The official application will give the bank access to your entire credit report.

On rare occasions, something may appear on your full credit report that wasn’t on the modified version. If that happens, the bank can rescind your prequalifying status.

If you qualify for a credit card, the bank will show you an approval screen with your new card’s credit limit. The bank will then print and send your new card in the mail. It should arrive within seven to 10 business days.

Once you receive the card, you can activate it over the phone or online. Your card is then ready to use.

If the bank rejects your application, you will receive an adverse action notice in the mail within seven to 10 business days. This letter will outline the reasons why the bank did not accept your application and may give you some tips on what you can work on to improve your chances of approval when you apply later.

How Can I Build Credit If I Can’t Get Approved For Anything?

If you’re having trouble finding approval with a credit card company or lender, you may want to retrace your steps to see where the issue stems from. A lender may reject your application for several reasons, but that doesn’t mean you don’t have a way to build credit.

- You may be setting your sights too high: All credit cards aren’t created equal. Some cards are designed for people who have a good credit score. Others are credit rebuilders for people who have bad credit. If you apply for a card that is a tier or two above your current credit status, you will almost always be rejected. Instead, focus on your current credit level. While these cards may not be the most appealing, they’re the stepping stone you need to move up to a bigger and better card.

- Start with a secured card: A secured credit card will require a refundable security deposit that typically matches your credit limit. These cards will report your payment and balance history to each major credit bureau, which helps you build credit. And some of these cards don’t even require a credit check for approval.

- Diversify your options: If you’re having trouble qualifying for a credit card, consider a small personal loan. While this won’t provide a revolving line of credit like a credit card, it can give you a quick infusion of cash and allow you to show a pattern of on-time payments that credit card issuers will like. And many online lenders specialize in extending small loans to consumers who have bad credit. And with online lending networks, you can complete the loan process in a couple of hours and have your money by the next day.

- Start small: If you have very bad credit and can’t qualify for any of the card options above, consider a credit builder loan from an online financial institution or a local bank or credit union. These loans allow you to essentially lend money to yourself. Your loan will require monthly payments that the bank will report to the credit bureaus to help you improve your credit score. All of your payments will be deposited into a savings account. Once you make your final payment, the bank will report the loan as paid off and remove its fees from the money you’ve paid. The rest of the funds are returned to you. This is a great way to build your credit score and create a small savings cushion at the same time.

- Limit your applications: It’s easy to succumb to temptation and apply for another credit card as soon as you receive a rejection from another. But doing that can hurt your credit score even more. Every time you apply for a loan or credit, the lender will run a credit check that places a hard inquiry on your credit profile. Each inquiry will live on your credit file for two years. A few inquiries are fine, but several can cause a slight decrease in your credit score.

Rejection isn’t easy. And when you’re constantly told “no,” it can sometimes seem like you’ll never be able to build credit.

But the best path to success sometimes is the least attractive. You may have to start small and set your sights a little lower. By doing this, though, you’ll set yourself up for a much more comfortable financial future.

What is the Fastest Way to Build Credit?

It’s easy to be impatient when you have big plans and goals for your future. Those goals may require a credit score that’s better than what you currently have. And while you may want to get there fast, banks want to see that you are a responsible borrower over a long period.

You’ll build credit fast by adding positive information to your credit history. That means maintaining on-time payments and low balances.

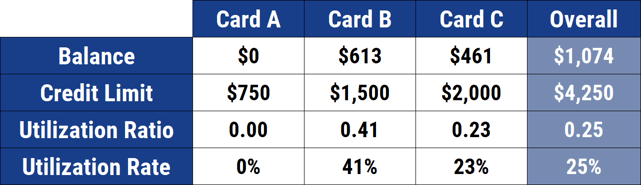

Many people think good credit means you make all of your payments on time, and while that’s part of the equation, keeping a low balance can be just as beneficial. Approximately 30% of your credit score is based on how much debt you have. Banks look at your credit utilization ratio to determine your debt.

You can calculate your credit utilization ratio by dividing the sum of your debts by the total amount of credit available to you. For example, a credit card with a $1,000 credit limit and a $500 balance has a credit utilization ratio of 50% — in other words, you’re utilizing 50% of your available credit.

Banks like to see a credit utilization ratio of below 30%. If you’re above that number, you may see a significant drop in your credit score.

While the amount you owe accounts for 30% of your credit score, you can still build credit fast by focusing on the other 70%.

- Payment history (35%): It doesn’t matter how large your payment is, only that it was made on time. Consistent on-time payments are the fastest way to build a positive credit history.

- Length of credit history (15%): There’s no way to speed this one up. Banks like to see that you have long and successful relationships with lenders. A general rule of thumb is that seven years is a good length of credit history.

- New credit (10%): Banks get scared if they see an applicant who has submitted several credit applications in a short period. Keep the number of inquiries you make low.

- Credit Mix (10%): Banks like to see a consumer who can juggle multiple types of debt. Beyond credit cards, consider adding a car loan, home loan, student loan, or personal loan to increase your mix of credit. While you may think you can supercharge your credit-building journey if you add to your credit mix, adding new credit also increases your debt-to-income ratio.

Don’t take on new debt in the name of increasing your credit score. That rarely works. Instead, take the long-view approach and live within your means. Doing so will get you meaningful credit score gains that stick with you forever.

Plus, this builds good financial habits.

Is Having No Credit Considered Bad Credit?

There is a pretty big difference between having no credit and having bad credit. Unfortunately, many lenders and banks still clump these two types of consumers together.

If you have a bad credit score, chances are you either have very high balances on your current debt or you have other financial mistakes in your past — including defaults, charge-offs, or late payments.

If you have no credit score, it means you’re essentially credit invisible. This means you do not have enough information on your credit history to generate a reliable credit score. You may have no financial mistakes in your past, but your lack of credit history can not prove that.

As a result, a bank may see you as a similar risk as someone who has bad credit. That’s because lenders often fear the unknown as much as the known. This means that both types of consumers are often relegated to loan and credit card products that feature high finance charges and fees to offset the lender’s risk.

Fortunately, someone who has no credit can build a positive credit score faster than someone who has bad credit. While you may have to settle for a below-average credit card to start, you can start to build a credit history in as little as six months and begin the process of upgrading to a card that better suits your financial abilities.

Just make certain that you only make on-time payments and maintain a low balance with your new credit account. One slip-up can quickly put you in bad credit territory and increase the time it will take to move into a better credit card.

How Long Does it Take To Build Credit From Nothing?

If you have no credit score, it can take as long as six months with a starter credit card to generate your first FICO credit score, which is used by more than 90% of lenders to make credit decisions.

The process takes this long because each credit bureau wants to see that you have a consistent pattern of on-time payments. After all, one or two on-time payments can be an anomaly. But stringing together six months of positive payment history shows that you’re responsible and serious about handling and building credit.

It takes about six months to generate a credit score.

Just remember that you can also build a negative credit history within those six months. Even after five months of on-time payments, a late payment during your sixth month can tank your credit score.

Lenders report payment and balance data to each credit bureau once a month. Your late payment will not show up on your credit history — or affect your credit score — until it is at least 30 days past due.

Late payments can be reflected on your credit file as 30-days late, 60-days late, or 90-or-more-days late. The longer you go without making a payment, the more it hurts your credit score. But a 30-day late payment can shave as many as 100 points off your current credit score.

When you generate your first credit score after approximately six months, your new score will likely change each month as you continue to add information to your credit file. Positive items will raise your credit score and negative items will lower your score.

What Credit Score Do You Start Off With?

Many people believe you start out with a credit score of zero and have to work your way up to the desired 800 range. This isn’t true. In fact, it’s impossible to have a credit score of zero.

Your FICO credit score will range between 300 and 850. But, even then, you will not start out with a score of 300. Credit newcomers start out with no score at all because they do not have enough reliable information on their credit file to generate a credit score.

Your first credit score comes after you’ve established a pattern of financial behaviors. This typically takes around four to six months after you get your starter credit card.

If you make on-time payments, you will start off with a credit score in fair credit territory (typically in the low 600s). If you have late payments during your first months with your new credit card, you will likely start with bad credit (below 580).

Although credit scores and reports may seem confusing, the power is in your hands to determine your score. If you make on-time payments and keep your card balances low, your score will continue to grow, and you will have access to more lucrative and more affordable credit products in the future.

Research Starter Credit Cards With No Deposit Online

Building credit is a marathon, not a sprint. And when you’re on starting blocks, the finish line may look very far away.

But that just means you have time to build your credit history the right way. That means finding the right starter credit cards with no deposit, keeping your balances low, and making all of your payments on time.

If you do that, you’ll run the best race of your life — and, eventually, reach the finish line with a lot to be proud of.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Best Starter Credit Cards ([updated_month_year]) 7 Best Starter Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/01/startercard.png?width=158&height=120&fit=crop)

![7 Best Starter Credit Cards to Build Credit ([updated_month_year]) 7 Best Starter Credit Cards to Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Best-Starter-Credit-Cards-to-Build-Credit.jpg?width=158&height=120&fit=crop)

![5 Best Starter Credit Cards by Experts ([updated_month_year]) 5 Best Starter Credit Cards by Experts ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/10/What-Is-the-Best-Starter-Credit-Card.jpg?width=158&height=120&fit=crop)

![7 Cards For Bad Credit With No Deposit ([updated_month_year]) 7 Cards For Bad Credit With No Deposit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/01/Cards-For-Bad-Credit-With-No-Deposit.jpg?width=158&height=120&fit=crop)

![7 Guaranteed-Approval Credit Cards With No Deposit ([updated_month_year]) 7 Guaranteed-Approval Credit Cards With No Deposit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/Guaranteed-Approval-Credit-Cards-With-No-Deposit.jpg?width=158&height=120&fit=crop)

![7 Easy Approval Credit Cards with No Deposit ([updated_month_year]) 7 Easy Approval Credit Cards with No Deposit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Easy-Credit-Cards-To-Get-Approved-For-With-No-Deposit.jpg?width=158&height=120&fit=crop)

![$50 Deposit Secured Credit Cards ([updated_month_year]) $50 Deposit Secured Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/50-Dollar-Deposit-Secured-Credit-Card.jpg?width=158&height=120&fit=crop)

![8 Credit Cards With No Security Deposit ([updated_month_year]) 8 Credit Cards With No Security Deposit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/10/Credit-Cards-With-No-Security-Deposit-Required.jpg?width=158&height=120&fit=crop)