Some folks may not find a $2,000 credit limit all that impressive, given that the average new card credit line was $5,021 in the third quarter of 2022, according to TransUnion. But when you consider that 56% of Americans can’t cover a $1,000 emergency expense, $2,000 starts to look pretty good.

We’ve assembled a list of good-looking credit cards with $2,000+ limits, available to consumers with bad, fair, or good credit. A $2,000+ credit line can come in handy during an emergency. It also allows you to finance big-ticket purchases such as kitchen appliances, a large-screen TV, or a much-needed vacation.

-

Navigate This Article:

Cards For Bad Credit With $2,000+ Limits

Many cards for bad credit have limits in the $300 to $1,000 range. We review a pair of unsecured cards that may allow a limit of $2,000, after you demonstrate a history of on-time payments, and a few secured cards that allow you to deposit up to $2,500 for an equal-sized credit line.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply!

- Monthly Credit Score – Sign up for electronic statements, and get your Vantage 3.0 Score Credit Score From Experian

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

- See if you’re Pre-Qualified without impacting your credit score

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

See website for Details

|

See website for Details

|

29.99% APR (Variable)

|

$75 – $125

|

See website for Details*

|

You may be able to secure up to a $2,000 credit limit with the Surge® Platinum Mastercard® after you open an account and make a series of on-time payments. The annual fee cuts into your available limit, but the potentially high initial credit limit substantially exceeds the usual $300 credit limit for most subprime unsecured cards.

Of course, not all applicants are eligible for an initial $1,000 limit. Your credit limit depends on other factors, such as your income and recent payment history.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- See if you’re Pre-Qualified with no impact to your credit score

- All credit types welcome to apply

- Access to your Vantage 3.0 score from Experian (When you sign up for e-statements)

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% APR (Variable)

|

$75 – $125

|

Bad, Fair, or No Credit

|

The only difference between the Reflex® Platinum Mastercard® and the Surge® Platinum Mastercard® is the former welcomes consumers with no credit history. Otherwise, the cards are clones. Not surprisingly, the same sponsor and issuer offer both cards with the same stiff costs.

In its favor, the card waives the monthly maintenance fee in the first year. And you can avoid the high APR by paying your entire balance each month. Both cards prohibit cash advance transactions for 95 days after account opening.

- No annual or hidden fees, and you can earn unlimited 1.5% cash back on every purchase, every day. See if you’re approved in seconds

- Put down a refundable $200 security deposit to get a $200 initial credit line

- Building your credit? Using a card like this responsibly could help

- Enjoy peace of mind with $0 Fraud Liability so that you won’t be responsible for unauthorized charges

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Limited, Bad

|

As with almost all secured cards, the amount you deposit to the Capital One Quicksilver Secured Cash Rewards Credit Card equals the credit limit you’ll receive. In this case, the deposit can range from $200 to $2,500.

If you demonstrate creditworthy behavior, the issuer may raise your credit card limit without an additional deposit or even refund the deposit money entirely. It offers cash back rewards, including a special bonus rate when you book rental cars and hotels through Capital One Travel.

- New feature! Earn up to 10% cash back* on everyday purchases

- No credit check to apply. Zero credit risk to apply!

- Looking to build or rebuild your credit? 2 out of 3 OpenSky cardholders increase their credit score by an average of 41 points in just 3 months

- Get free monthly access to your FICO score in our mobile application

- Build your credit history across 3 major credit reporting agencies: Experian, Equifax, and TransUnion

- Add to your mobile wallet and make purchases using Apple Pay, Samsung Pay and Google Pay

- Fund your card with a low $200 refundable security deposit to get a $200 credit line

- Apply in less than 5 minutes with our mobile first application

- Choose the due date that fits your schedule with flexible payment dates

- Fund your security deposit over 60 days with the option to make partial payments

- Over 1.4 Million Cardholders Have Used OpenSky Secured Credit Card To Improve Their Credit

- *See Rewards Terms and Conditions for more information

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

25.64% (variable)

|

$35

|

Poor

|

The OpenSky® Secured Visa® Credit Card from Capital Bank lets you choose a credit limit of up to $3,000 based on your security deposit. Cardholders can request a credit limit increase at any time (additional deposit required).

This credit card is one of the few available without a credit check. Whether you’re building or rebuilding credit, the OpenSky® Secured Visa® Credit Card is a good option that is regularly rated among the best secured credit card offers for bad credit.

Cards For Fair Credit With $2,000+ Limits

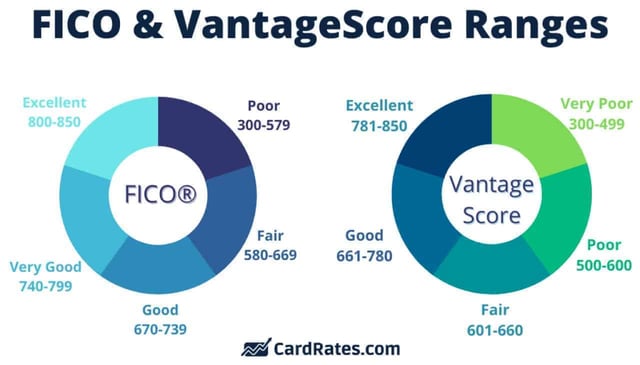

You have fair credit if your FICO score lies between 580 and 669. Consumers with fair credit qualify for a broader selection of credit cards, including the following four. All have reports of cardholders with a credit limit of $2,000 or more.

- No annual or hidden fees. See if you’re approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won’t be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It’s free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One’s mobile app

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

The Capital One Platinum Credit Card is excellent for building credit and is probably the best unsecured credit card for fair credit. The initial credit limit is relatively low, but cardholders report lines as high as $3,000.

This card also features a competitive interest rate, no penalty APR for late payments, fraud protection, and unlimited credit monitoring through Capital One CreditWise. The card helps you rebuild credit by reporting your payments to each major credit bureau.

- Earn unlimited 1.5% cash back on every purchase, every day

- No rotating categories or limits to how much you can earn, and cash back doesn’t expire for the life of the account. It’s that simple

- Be automatically considered for a higher credit line in as little as 6 months

- Enjoy peace of mind with $0 Fraud Liability so that you won’t be responsible for unauthorized charges

- Help strengthen your credit for the future with responsible card use

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$39

|

Average, Fair, Limited

|

If you have fair credit, the Capital One QuicksilverOne Cash Rewards Credit Card is also a good choice from this issuer. The starting credit limit may be as low as $300, but you should be able to increase that limit up to $2,000 or more over time through responsible use.

The card provides a competitive cash back rewards rate but carries a modest annual fee.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% – 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% – 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

The Discover it® Student Cash Back is available to students with no, limited, or fair credit. Your starting credit limit is based on your creditworthiness, but cardmembers report limits as high as $3,000.

The card has many of the same rewards and benefits as the non-student version, including the famous Discover Cashback Match that doubles the rewards earned during the first year after account opening.

- Earn unlimited 1.5% cash back on every purchase, every day

- Early Spend Bonus: Earn $50 when you spend $100 in the first three months

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Enjoy peace of mind with $0 Fraud Liability so that you won’t be responsible for unauthorized charges

- Enjoy no annual fee, foreign transaction fees, or hidden fees

- Lock your card in the Capital One Mobile app if it’s misplaced, lost or stolen

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% – 29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

While the Capital One Quicksilver Student Cash Rewards Credit Card card may not start you with an initial $2,000 credit limit, you may be able to earn a limit that high after becoming a cardholder and using the card responsibly, such as always paying your monthly bill on time. Reporting income increases to the bank will help your case, too.

This card features cash back rewards, no annual fee, and FICO credit score tracking, making it an excellent choice for any student who qualifies.

Cards For Good Credit With $2,000+ Limits

When you have good credit, you can have your choice of credit cards. The ones we’ve chosen for this list favor frugal consumers with FICO scores of 670 and higher.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% – 28.24% Variable APR

|

$0

|

Excellent/Good

|

We consider Discover it® Cash Back among the best credit cards for good credit. Reports indicate the minimum credit limit is at least $500, but some cardholders report limits as high as $20,000 or more over time.

This rewards card lets you earn bonus cash back, up to the quarterly maximum, when you activate quarterly rotating merchant categories. A 0% APR offer may apply to purchases and balance transfer transactions during the introductory period, after which the standard APR will apply.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) – worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% – 29.24%.

- No annual fee – You won’t have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% – 29.24% Variable

|

$0

|

Good/Excellent

|

The Chase Freedom Unlimited® offers an extended range of credit limits, from $500 to $20,000 or more. It offers tiered cash back rewards with no earnings caps.

This card has been ranked our top cash back card for a while, and new cardholders will especially appreciate the intro offer.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won’t expire for the life of the account and there’s no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% – 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One VentureOne Rewards Credit Card offers annual-fee-free No Hassle Rewards® and a reported maximum credit limit of at least $20,000. The card doesn’t charge an annual or foreign transaction fee, which means your rewards go further.

The card offers many benefits, including travel accident insurance, auto rental collision damage waiver, and extended warranty protection. You can redeem your miles in several ways or transfer them to partner loyalty programs.

How Do Credit Card Limits Work?

Most credit cards limit how much you can charge for purchases and cash advances. American Express also offers charge cards that do not have a preset spending limit and require you to pay the monthly balance in full.

Your credit card adjusts your credit limit to your credit score or security deposit. The credit card company will deny transactions that may cause you to exceed your credit limit, although some cards may give you extra wiggle room if the overage is relatively small. Some cards charge a fee if you attempt a transaction that would put you over your limit.

A card’s available credit line applies to the sum of purchase, cash advance, and balance transfer transactions. Almost all issuers limit cash advances to a portion of your credit line.

Secured Cards

In almost all cases, a secured card’s credit limit equals the security deposit. The exception is the Capital One Platinum Secured Credit Card, which allows you to establish a $200 credit line with a fixed deposit as small as $49.

The credit limits on secured cards vary. The minimum amount is usually $200, and some cards set their maximum limit at $5,000 or more. Secured cards may set low initial limits but allow you to increase your deposit later.

Many secured cards will increase your limit without additional funds or even refund your entire deposit if you consistently pay your bills on time for a set period. It also helps to keep your credit utilization ratio (i.e., used credit / available credit) low — the lower, the better.

Unsecured Cards

Unsecured cards do not require deposits. They set their credit limits based on your credit score and other factors. Some premium cards offer six-figure limits, but most cards operate in the range of $200 to $50,000.

Occasionally, you may receive a credit limit increase, either at the issuer’s instigation or your request.

How Do I Get a Credit Card With a $2,000 Limit?

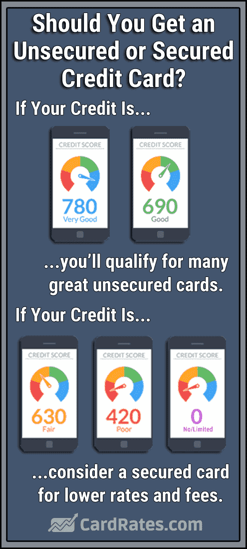

If you have bad credit, you’ll probably need to rely on a secured credit card to get a $2,000 limit by depositing an equal amount. If your credit is fair or better, the odds of getting an unsecured card with a $2,000 limit improve.

You can apply for a credit card online by providing information about yourself and your residence, income, and expenses. Many cards let you first prequalify without impacting your credit score. But prequalification does not guarantee final approval.

Most cards perform a hard credit check when you apply, which may affect your score. But the impact will be small and could be reversed by positive factors if you receive approval.

You must cough up any security deposit or signup fee before the credit card company sends you a card, but you won’t have to pay the annual fee, if any, ahead of time. The card should arrive within seven to 10 days, although some issuers (such as Discover) can expedite the shipping. You must notify the issuer that you’ve received the card before using it.

What Credit Score Do I Need to Get a Card With a $2,000 Limit?

Many secured cards have relatively low or no credit score requirements (a FICO score of 500 or less). But you may need a FICO score of 580 or higher to get a $2,000 limit on an unsecured card.

Your credit score is irrelevant for cards that do not perform credit checks, which is the case for a few of the cards in this review.

You can achieve a higher score by paying your bills on time and keeping your credit utilization ratio low but not quite at zero. Some revolving card debt is better than none when it comes to credit scores.

Sometimes, cards break their own rules by rejecting applicants with acceptable scores or approving those with low scores. This indicates that issuers use more than a credit score to decide who they will approve.

For example, Chase’s 5/24 Rule prohibits getting a new Chase card if you’ve opened five or more credit card accounts (from any issuers) in the past 24 months. Sometimes, a credit card issuer will deny your application if it previously had a negative interaction with you. But generally, your odds of a $2,000+ credit limit improve as your FICO score increases.

How Do I Get a Credit Limit Increase?

There are four ways to get a credit limit increase:

- For secured cards, you can increase your limit by adding money to your security deposit, assuming the credit card issuer allows it.

- You can ask for a higher credit limit on your unsecured card. The issuer may ask you for supporting financial information to prove you can afford to repay a higher credit line. A few cards set hard ceilings on the credit lines they will approve. In that case, you may need to apply for additional credit cards.

- Be patient. Many card issuers routinely review payment performance and reward responsible cardowners with a higher credit limit.

- If you own multiple cards from the same issuer, you may be able to shift some of your credit line from one card to another.

What Is the Average Credit Limit?

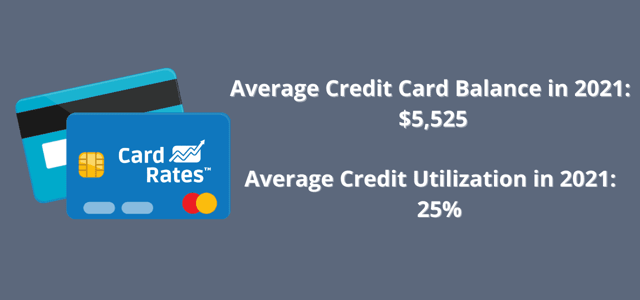

Experian reports that the average American has access to just over $30,000 in credit, but the average credit card balance is almost $5,600. The $30,000 figure includes the credit limits on all owned cards.

Individual cards, as described earlier, set their credit limits according to credit scores or security deposits. Bankrate reports that the credit limit on your first credit card will usually be $500 to $1,000.

A $2,000 Credit Limit Is Within Reach

You may be able to obtain credit cards with $2,000 limits, even with bad or limited credit. Getting a secured credit card is pretty easy, and some cards skip the credit check entirely. If your credit is fair or better, you will have more luck getting an unsecured card with a $2,000 credit line.

Among the many reasons to improve your credit score is the increased access to better quality credit cards with higher limits, lower costs, and more generous perks. In any case, it’s an excellent move to scale your credit limit to your budget lest you find yourself with an uncomfortable amount of debt.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![9 Unsecured Credit Cards With $1,000 Limits ([updated_month_year]) 9 Unsecured Credit Cards With $1,000 Limits ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/09/Unsecured-Credit-Cards-With-1000-Limits.jpg?width=158&height=120&fit=crop)

![11 Credit Cards with $10,000+ Limits ([updated_month_year]) 11 Credit Cards with $10,000+ Limits ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/08/10000limit.jpg?width=158&height=120&fit=crop)

![19 Highest Credit Card Limits by Category ([updated_month_year]) 19 Highest Credit Card Limits by Category ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/11/shutterstock_370788551.jpg?width=158&height=120&fit=crop)

![11 Highest Capital One Credit Limits ([updated_month_year]) 11 Highest Capital One Credit Limits ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/06/Highest-Capital-One-Credit-Limits.jpg?width=158&height=120&fit=crop)

![3 Highest Discover Card Credit Limits ([updated_month_year]) 3 Highest Discover Card Credit Limits ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/03/Highest-Discover-Card-Credit-Limits.jpg?width=158&height=120&fit=crop)

![12 Bank of America Credit Card Limits ([updated_month_year]) 12 Bank of America Credit Card Limits ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/04/Bank-of-America-Credit-Card-Limits.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards for Employee Spending Limits ([updated_month_year]) 9 Best Credit Cards for Employee Spending Limits ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/06/Best-Credit-Cards-With-Employee-Spending-Limits-2.jpg?width=158&height=120&fit=crop)

![7 Balance Transfer Cards With High Limits ([updated_month_year]) 7 Balance Transfer Cards With High Limits ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/06/Balance-Transfer-Cards-With-High-Limits.jpg?width=158&height=120&fit=crop)