With roots in the Wild West and the earliest days of US banking, Wells Fargo has a history that goes back centuries. But, a long pedigree doesn’t make the bank any less relevant to the financial industry today. In fact, Wells Fargo is the fourth-largest bank in the US, with over $200 billion in market capitalization.

Given its ubiquity, it’s little surprise that millions of Americans have — or want to have — a Wells Fargo credit card. And, while the bank has been known to be stingy when you don’t have a previous banking relationship, it isn’t known for requiring excellent credit of all of its cardholders.

Indeed, browsing through the reviews and cardholder posts, it seems that, while most of Wells Fargo’s prime credit cards are marketed toward consumers with good to excellent credit, even a modest score in the upper-600 range can get you in the door. And, for consumers with lower scores, Wells Fargo offers both a student credit card and a secured card.

Cash Wise | Propel | Platinum | Rewards® | Student | Secured | FAQs

Wells Fargo Cash Wise Visa® Card: 650+ FICO

The Wells Fargo Cash Wise Visa® Card is a popular choice for consumers who want simple rewards that don’t require much hassle. It offers an unlimited 1.5% cash back on every purchase, without categories to activate or track, and it never charges an annual fee.

- Receive 0% APR on new purchases and balance transfers for 12 months

- Receive up to $600 in cellphone protection

- Pay $0 annual fee

The card may also draw in applicants with its new cardholders offers, including a competitive cash back signup bonus and extra cash back — for a total of 1.8% — on eligible mobile wallet purchases for the first year. New cardholders can also enjoy an introductory APR deal for 0% APR on new purchases and balance transfers.

According to reviews, this card should be fairly easy to qualify for if you have a credit score of 700 or higher, though a number of reports of approvals can be found online for reviewers with credit scores in the 600 to 700 range. Your chances of being approved with a score below 600 are likely slim to none.

Your credit score will impact more than just your approval chances, however. Cardholders with the best credit scores are typically offered the best credit limits, and starting limits of $15,000 to $25,000 can be obtained with the right qualifications. The minimum starting limit, according to the terms and conditions for the card, will be $1,000.

(The information related to Wells Fargo Cash Wise Visa® Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.)

Wells Fargo Propel American Express® Card: 650+ FICO

Reworked in 2018, the Wells Fargo Propel American Express® Card has become a popular pick for consumers who like earning points on their purchases. Users can earn 3X points per dollar on their travel purchases — including gas — as well as on dining purchases. Plus, get the same 3X points on select streaming services.

New cardholders can also get a slew of additional perks, including a solid signup bonus and an introductory APR offer. All cardholders can benefit from paying their cellphone bill with their card, as this can unlock up to $600 in cellphone protection.

- Receive 0% APR on new purchases and balance transfers for 12 months

- Earn 3x points on eating out and ordering in, gas, and travel

- Pay $0 annual fee

Looking through the online reviews for this card, it seems that most users who were instantly approved had credit scores of 700 or higher, though some reviews can be found reporting approval with credit scores in the mid-600s. One reviewer even reports being approved despite a four-year-old bankruptcy.

Of course, a higher credit score will mean a better credit limit, as evidenced by one reviewer with a 790 score who received a $22,500 credit limit. The card’s terms and conditions state that the minimum limit you will receive if you’re approved is $1,500.

(The information related to Wells Fargo Propel American Express® Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service. The Wells Fargo Propel American Express® Card is no longer accepting new applicants.)

Wells Fargo Platinum card: 640+ FICO

The Wells Fargo Platinum card is a popular card for its long introductory APR deal for new cardholders. It applies to both new purchases and balance transfers, the latter making it appealing to consumers looking to consolidate debt.

Cardholders will need to pay a balance transfer fee for all transfers, but the card charges no annual fee. It also offers the same cellphone protection as other Wells Fargo cards provided you pay your cellphone bill with your card.

Wells Fargo Platinum card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Although this card is marketed for the same good to excellent credit range as the previous cards, it seems to have slightly more flexible approval requirements, as many reviewers report being approved with credit scores in the low- to mid-600 range. As with most cards, a higher credit score will likely increase your chances of being approved.

In addition to making approval easier, a higher credit score may be best if you intend to take advantage of the card’s introductory APR deals, as well. That’s because your credit limit will be strongly influenced by your creditworthiness — more so, perhaps, than even your income. Please see terms for additional details.

(The information related to Wells Fargo Platinum card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.)

Wells Fargo Rewards® Card: 630+ FICO

The Wells Fargo Rewards® Card is a popular card pick for users who want to take advantage of an introductory 0% APR offer while still earning purchase rewards. The new cardholder offer provides 15 months worth of 0% APR on new purchases and balance transfers (though a balance transfer fee also applies).

So far as rewards go, cardholders earn an unlimited 1X point per dollar on every purchase. New cardholders can also earn 5X points per dollar on up to $12,500 worth of gas station, grocery store, and drugstore purchases during the first six months.

- Earn 5X points per $1 on gas, grocery purchases, & drugstores for first 6 months

- Earn 1X point per dollar on everything else

- Pay $0 annual fee

This card appears to have similar approval requirements as the other prime Wells Fargo cards, offering the easiest approval to consumers with scores over 700. But, as seems to be the case with many Wells Fargo cards, this option has multiple reviews reporting being approved with credit scores between 600 and 700.A low(ish) credit score may not even be a hurdle for a five-figure credit limit, as evidenced by this reviewer’s report of getting a $15,000 credit limit with mid-600 scores. According to the card’s terms and conditions, the lowest credit limit you will receive is $1,000, but it’s hard to tell what the typical starting credit limit is as data for this card is limited.

(The information related to the Wells Fargo Rewards® Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.)

Wells Fargo Cash Back College℠ Card: No Score Needed

The Wells Fargo Cash Back College℠ Card is the bank’s only student card, but it packs some decent perks without charging an annual fee. Cardholders can earn an unlimited 1% cash back on every purchase, as well as earning 3% cash back on up to $2,500 in gas station, grocery store, and drugstore purchases during the first six months.

The card also offers an introductory 0% APR offer that’s good on both new purchases and balance transfers, a relative rarity in the student credit card market. Just watch out for the balance transfer fee.

- Earn 3% cash back on gas, grocery, and drugstore purchases for the first 6 months

- Earn unlimited 1% cash back on other purchases

- Pay $0 annual fee

This card is specifically designed for students, which means it won’t have minimum credit score requirements, as college students are not expected to have much credit history, if any at all. This means you can be approved even without any previous credit experience. At the same time, if you already have poor credit due to missed payments or other negatives, you may have trouble qualifying.

Approved applicants will receive a credit limit of at least $500, according to the card’s terms and conditions, and the maximum limit for the card is likely relatively low due to its nature. A limit between $500 and $2,000 seems to be average.

(The information related to the Wells Fargo Cash Back College℠ Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.)

Wells Fargo Secured Credit Card: No Score Needed

The Wells Fargo Secured Credit Card is a fairly typical secured card, requiring a cash deposit to open and maintain the account. The credit limit will be determined based on the deposit you make, at a 1:1 ratio, with a minimum deposit requirement of $300.

Qualified applicants may put down more for a larger credit line, and the maximum deposit reportedly gets as high as $10,000 for a credit limit of the same size. The card comes with an annual fee of $25, but cardholders will get the standard set of Wells Fargo cardholder benefits, including the bank’s popular cellphone protection.

- Card can be used anywhere Visa credit cards are accepted — not a debit or prepaid card

- Make a minimum $300 deposit

- Pay a $25 annual fee

Despite being a secured credit card, the reviews are mixed as to what score ranges will be approved. Technically, it advertises itself as a card for both building and rebuilding credit, so even consumers with bad credit should have a decent chance of approval. But, while there are some reports of approval with scores in the 400s, other reviewers report being denied with similar scores.

As with many big-bank secured cards, this one has the potential to upgrade to an unsecured account, but, as with approval, reviews on upgrades are mixed. Some users report quick upgrades, while others can go years without being upgraded.

(The information related to the Wells Fargo Secured Credit Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.)

What’s the Best Wells Fargo Credit Card?

Trying to pick the best credit card is similar to picking the best cooking pan or fishing lure — the right tool will depend entirely on the job at hand. In the case of Wells Fargo credit cards, the best card option will depend on your credit profile, your spending habits, and your goals.

For example, if your credit history is limited and your goal is building credit, then the Wells Fargo Secured Card is likely your best option — unless you’re a student, then you may be better off with the Wells Fargo Cash Back College℠ Card. However, if you are looking to consolidate your debt, the Wells Fargo Platinum card may be your best bet.

Consumers with good to excellent credit will probably want to base their Wells Fargo credit card choice on the type of rewards they’re most likely to earn and use. The Wells Fargo Cash Wise Visa® Card is best for cardholders who want rewards that are easy to use, as it offers cash back rewards that can be simply redeemed for statement credit.

Depending on your spending habits, you may even consider pairing the two rewards cards to cover both bonus and non-category purchases.

(The information related to Wells Fargo Secured Card, Wells Fargo Propel American Express® Card, Wells Fargo Cash Back College℠ Card, Wells Fargo Cash Wise Visa® Card, and Wells Fargo Platinum card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service. The Wells Fargo Propel American Express® Card is no longer accepting new applicants.)

What Other Factors Can Influence Your Approval?

A lot of people tend to focus on credit scores because they’re relatively easy to use; from grade school up, we’re taught to assign numerical scores and grades to things (and people) and to judge them accordingly.

But, while credit scores can be good tools for estimating your approval chances for a given credit product, your score doesn’t tell the whole story. Any lender with whom you apply for credit will pull at least one of your credit reports, and while this may include a FICO or VantageScore credit score, it’s very rare that your score is the only part of the data that’s used.

Instead, lenders will typically analyze your entire credit report when evaluating your credit application. Many lenders will also use additional data that is collected from the application itself — such as your income — as well as data from their own internal records, like your history with the bank.

- Your credit history: Before offering you credit, Wells Fargo — and any other lender — will want to know how you’ll handle that credit. To find out, the bank will look at your entire credit history, including your payment history, how much you currently owe, and how many hard credit inquiries you’ve had in the last two years. Wells Fargo is said to be particularly wary of charged off accounts.

- Your debt-to-income ratio: Although your income isn’t a part of your credit reports, Wells Fargo will ask for you to provide your annual income amount on your credit card application. The bank will use this data to determine your debt-to-income (DTI) ratio, which Wells Fargo will use to decide whether it thinks you can afford a new credit line. If you’re approved for a card, Wells Fargo will use your DTI to set your credit limit.

- Your history (or lack thereof) with Wells Fargo: Most banks will give current customers a little edge when it comes to applying for a credit card, but Wells Fargo reportedly has a particular focus on your history with its branches. Some cards require you to have a current Wells Fargo bank account to apply online, and a number of reviewers have reported being turned down for a Wells Fargo credit card because of an insufficient history with the bank. And a poor history with the bank can also get your application rejected. Moreover, while your credit reports will shed most negative items — like delinquent payments or discharged accounts — within seven years (bankruptcies can take 10), banks can have much longer memories, meaning even an ancient issue with Wells Fargo can be used against you now.

As you can see, even a perfect credit score may not always be enough to net you a Wells Fargo credit card. Of course, that’s not to say that your excellent credit can’t overcome a shortcoming like a lack of history with Wells Fargo — just that there are no guarantees.

And, unfortunately, Wells Fargo doesn’t offer an online pre-qualification process to check for pre-approved offers, so you can’t use that route to estimate your chances. The only ways to get pre-approved for a Wells Fargo credit card are to check with a representative in a branch, or to receive a pre-qualification offer in the mail.

Which Credit Bureau Does Wells Fargo Check?

Although most consumers have three credit reports — one each with Experian, Equifax, and TransUnion — most credit card issuers only pull your credit report from one bureau when evaluating your card application. The challenge is that issuers aren’t prone to disclosing exactly which credit bureau they query.

This means we need to rely on reports from cardholders and applicants to get an idea of which bureau will be queried. According to the data points, Wells Fargo seems to have a preference for using Experian and TransUnion credit reports, though reported Equifax inquiries make up a not insignificant portion of pulls.

As is the case with many card issuers, the bureau Wells Fargo queries seems to vary based mostly on location, with state of residence the most common variable on which bureau is referenced. Applicants in California and Florida, for instance, report mostly Experian pulls, while Ohio and Virginia residents are more likely to have their TransUnion report pulled.

So, why concern yourself with which credit report is pulled? For one thing, the single-bureau credit pulls associated with most credit cards mean it’s easily possible to have more hard credit inquiries on one credit report than on your other credit reports. Too many hard inquiries can be a red flag for many credit card issuers.

Furthermore, credit bureaus don’t actively gather credit report data; it’s up to the creditors to report your payment and account information to the credit bureaus. This means the information on your three reports can vary in many ways depending on which bureaus receive a creditor’s reports.

How Can You Get Your Credit Score for Free?

As one of the largest banks in the country, Wells Fargo serves millions of Americans, but its share of the credit card market is limited compared to some of the more prominent names like Chase and American Express. But that isn’t necessarily from lack of trying; Wells Fargo’s stable of credit cards — most with no annual fee — are still competitive offerings in the space.

Part of what helps Wells Fargo is that it seems to have flexible credit requirements, offering credit to a wide range of credit scores. But, that flexibility isn’t limitless. And, since Wells Fargo doesn’t offer online pre-qualification, you’ll probably want to know your credit scores before you choose a Wells Fargo credit card for which to apply.

Luckily, getting your credit scores is easier than ever — and, often, completely free. To start, the majority of major credit card issuers now offer you monthly credit score updates for being a cardholder. These scores can typically be accessed through your online banking portal or mobile app.

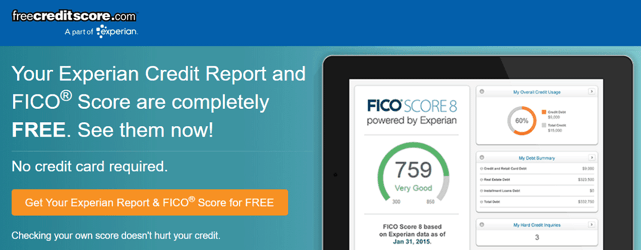

You can get a free credit score from a number of sources, including through the Experian credit bureau.

If you don’t have a credit card that offers credit tracking, you can get a free FICO credit score from Experian that is updated every 30 days. Both Discover and Capital One offer free credit scores, and you don’t need to have an account to access the free score feature.

Additionally, many third-party companies have joined the credit score market, offering free credit scores and credit tracking.

One thing to keep in mind is that your credit scores may vary based on any number of factors, from the credit bureau that furnished the data to the scoring model that was used to calculate the score. Scores can also vary from day to day, depending on when creditors submit updates to the reporting agencies.

There are dozens of possible scoring models that a lender may use to get your credit scores, though the FICO® Bankcard Scores 2, 4, 5, and 8 are the most common scoring models used by credit card issuers. You’ll likely need to purchase scores directly from FICO to get these industry-specific scores, however, as most free scores will be calculated using the FICO Score 8, FICO Score 9, or VantageScore 3.0 models.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![6 Best Wells Fargo Credit Cards ([updated_month_year]) 6 Best Wells Fargo Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/wellsfargo.png?width=158&height=120&fit=crop)

![12 Best Credit Cards By Credit Score Needed ([updated_month_year]) 12 Best Credit Cards By Credit Score Needed ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/02/Best-Credit-Cards-By-Credit-Score-Needed.jpg?width=158&height=120&fit=crop)

![Discover Card: Credit Score Needed & 5 Best Cards ([updated_month_year]) Discover Card: Credit Score Needed & 5 Best Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/11/discovercard2.png?width=158&height=120&fit=crop)

![7 Bank of America Cards By Credit Score Needed ([updated_month_year]) 7 Bank of America Cards By Credit Score Needed ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/Bank-of-America-Cards-By-Credit-Needed.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='5859' field_choice='title']: Review & Credit Score Needed ([updated_month_year]) [card_field card_choice='5859' field_choice='title']: Review & Credit Score Needed ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/01/shutterstock_1023516253-1.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='29774' field_choice='title']: Credit Score Needed for Approval ([updated_month_year]) [card_field card_choice='29774' field_choice='title']: Credit Score Needed for Approval ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/02/reserve--1.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='11298' field_choice='title']: Review & Credit Score Needed([updated_month_year]) [card_field card_choice='11298' field_choice='title']: Review & Credit Score Needed([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/unlimited-cover.jpg?width=158&height=120&fit=crop)