If you’ve encountered offers for guaranteed approval credit cards with no deposit and thought it was hype, your instincts were right. No credit card guarantees all applicants will be approved. However, we’ve identified seven credit cards that have minimal requirements for approval.

Almost every credit card company can guarantee you an instant decision when you attempt to prequalify for one of its cards. But remember, prequalification does not guarantee final approval, although it certainly improves your chances.

If your credit score is below par, but you would like to own an unsecured credit card, read on to learn about some of your best options.

Unsecured Credit Cards For Bad Credit

These seven cards are all unsecured — they do not require a security deposit, even if your credit is bad. In fact, these cards are designed for consumers with poor credit. Before agreeing to accept an offer from one of these cards, be sure to understand the APRs and fees they charge, which are often substantial.

- Earn 3% Cash Back Rewards* on Gas, Groceries and Utility Bill Payments

- Earn 1% Cash Back Rewards* on all other eligible purchases

- Good anywhere Mastercard® is accepted

- $0 fraud liability**

- Free access to your VantageScore 4.0 credit score from TransUnion®†

*See Program Terms for important information about the cash back rewards program.

**Fraud liability subject to Mastercard® rules.

† Your credit score will be available in your online account starting 60 days after your account is opened. (Registration required.) The free VantageScore 4.0 credit score provided by TransUnion® is for educational purposes only. This score may not be used by The Bank of Missouri (the issuer of this card) or other creditors to make credit decisions.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% or 36% Fixed

|

As low as $85

|

Fair

|

The Fortiva® Mastercard® Credit Card is a cash back card that requires no deposit. It charges an annual fee plus a high APR. You can see whether you prequalify without hurting your credit score. Pay off your balance in full each month to enjoy rewards without interest fees.

- Greater access to credit than before – $700 credit limit

- Get a Mastercard accepted online, in store and in app

- Account history is reported to the three major credit bureaus in the U.S.

- $0 liability* for unauthorized use

- Access your account online or from your mobile device 24/7

- *Fraud protection provided by Mastercard Zero Liability Protection. If approved, you’ll receive the Mastercard Guide to Benefits that details the complete terms with your card.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

See terms

|

See terms

|

Fair/Good

|

The Milestone® Mastercard® is issued by the Bank of Missouri, which may recommend you for another issuer’s credit card if your application isn’t accepted. The card does not charge a monthly maintenance fee, but in addition to its annual fee, there are fees for cash advances (waived the first year), foreign transactions, over-limit transactions, and late or returned payments. You are limited to just one Milestone® Mastercard®.

3. Revvi Card

- Earn 1% cash back rewards^^ on payments made to your Revvi Credit Card

- Perfect credit not required

- $300 credit limit (subject to available credit)

- Checking account required

- Opportunity to request credit limit increase after twelve months, fee applies

- *See Rates, Fees, Costs & Limitations for complete offer details

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

See website for Details

|

N/A

|

35.99%

|

$75.00 1st year, $48.00 after

|

Fair

|

The Revvi Card is another cash back card that offers the same initial credit limit to all applicants. Because the limit is so low, the approval requirements are minimal. Your annual fee will be deducted from your initial limit, further reducing your available credit. But it can help you build credit with on-time payments, and you may eventually qualify for a higher credit limit with more spending power.

- $400 credit limit doubles to $800! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply

- Monthly reporting to the three major credit bureaus

- Initial Credit Limit of $400.00 (Subject to available credit)

- Fast and easy application process; results in seconds

- Use your card at locations everywhere Mastercard® is accepted

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99%

|

$99

|

Fair/Poor/Bad

|

Be prepared for an avalanche of fees when you apply for the FIT™ Platinum Mastercard® from Continental Finance. Besides the steep annual fee, there are fees for account setup, monthly maintenance (waived the first year), additional cards, cash advances, foreign transactions, and last/returned payments. The card’s standard APR is as high as the penalty APR charged by competing cards.

5. Mission Lane Visa® Credit Card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

The Mission Lane Visa® Credit Card lets you see whether you’re preapproved with no impact on your credit score. This card is tailored to applicants with subprime credit, claiming to have “helped millions of Americans access the credit they need.” Its APR is also lower than other cards for people with bad credit, and it doesn’t charge any monthly fees as some other subprime cards do.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply!

- Monthly Credit Score – Sign up for electronic statements, and get your Vantage 3.0 Score Credit Score From Experian

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

- See if you’re Pre-Qualified without impacting your credit score

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

See website for Details

|

See website for Details

|

29.99% APR (Variable)

|

$75 – $125

|

See website for Details*

|

The Surge® Platinum Mastercard® from Continental Finance offers instant approval decisions and the possibility of a relatively high credit limit. Furthermore, it will evaluate you for a credit limit increase after six months of timely payments. In addition to the annual fee, check out the monthly maintenance fee (waived for the first year), foreign transaction fee, and fees for late/returned payments, additional cards, and cash advances.

- All the benefits of a Mastercard, without a security deposit

- 24/7 access to your account, even on mobile!

- Reports to all three major credit bureaus

- Less than perfect credit is okay, even with a prior bankruptcy!

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

See terms

|

See terms

|

Poor to Good

|

The Destiny Mastercard® is pretty expensive to own. It charges a high APR, an annual fee, and after the first year, a monthly fee. Alas, those qualities are what make this card easy to get approved for, and you can still rely on its small credit limit to make purchases when you need to.

What Is a Guaranteed Approval Credit Card With No Deposit?

“Guaranteed approval” is marketing jargon for cards with low credit score and income requirements. No card on this planet guarantees that your application will be approved. The best you can expect is to receive an instant decision when you apply or fill out a prequalification form.

As we often point out, prequalification is not the same as approval. It merely indicates that you satisfy the initial requirements for getting the card and in no way guarantees that the card issuer will ultimately grant you the card.

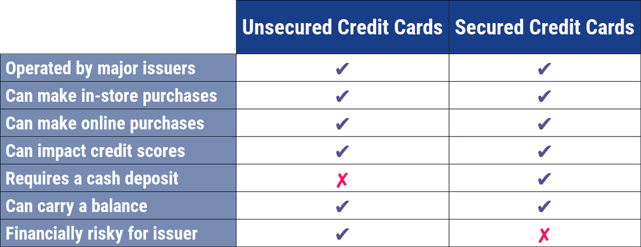

“No deposit” refers to the fact that these are unsecured credit cards. As such, you do not put down a security deposit to act as collateral for your credit limit.

If you have bad or fair credit, consider secured credit cards.

- Secured credit cards are easier to obtain. Just about anyone with a pulse and $200 can get a secured card, even with a limited credit history or bad credit score.

- Some secured cards pay cash back rewards.

- Secured cards have lower APRs than unsecured cards for bad credit.

- You may initially be able to get a higher credit line from a secured card (with a matching deposit).

As the following chart shows, in other respects, the two types of cards are quite similar:

One word of caution: We know of at least one secured credit card that does not provide a grace period on purchases. There is always an interval between the end of a billing cycle and the payment due date for that cycle, and virtually all credit cards do not charge interest on new purchases during this interval, which is why it’s called a “grace period.”

A card without a grace period charges interest starting from the day of purchase. If you don’t read the fine print before accepting this kind of card, you may be shocked when you receive your first billing statement. The only ways to avoid interest are to send in full payment on the same day as the purchase or to cut up the card and chuck it.

On a less egregious note, most secured credit cards do not pay you interest on your security deposit. Granted, the amount of interest may add up to a buck or less a year, but we think you should collect it as a matter of principle (no pun intended).

Finally, there is no guarantee that a secured card will be any cheaper to own than an unsecured card. We know of several secured cards that charge annual fees and high interest rates, so once again, it’s imperative you read the fine print before applying for any credit card.

If you are an undergraduate, you can get a student credit card even if you have limited or bad credit. A student credit card comes pretty close to offering guaranteed approval, but not every student will qualify.

What Credit Score Is Required For Approval?

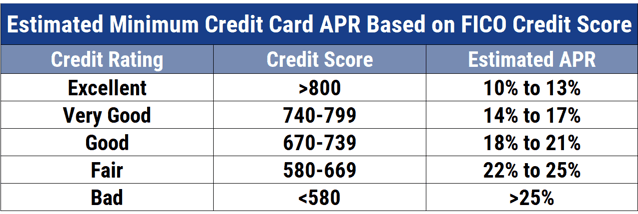

As mentioned, all the reviewed cards target consumers with fair credit to bad credit. On the FICO scoring scale, bad credit translates into scores lower than 580. We believe that some of the reviewed cards will accept scores as low as 500, but your chances of approval increase when your score is 600 or higher.

How can issuers offer unsecured cards to folks with poor credit? After all, consumers with low credit scores have probably had one or more serious credit problems, including delinquencies, defaults, collections, and bankruptcies. Issuers of cards designed for borrowers with less than good credit face the real risk that some customers won’t pay their bills.

The answer can be found in one word — fees. While all credit cards charge fees, several in this group have tacked on extra fees you would never see in better credit cards. These include:

- Signup fees: Also called processing fees, these are a one-time charge levied when you first get your card. We’ve seen signup fees as high as $99, almost half of the minimum credit line! Signup fees almost always are deducted from your initial credit limit. Your limit is restored to its full amount after you pay the fee.

- Maintenance fees: These are monthly fees that supposedly help defray the cost of running a credit card operation. Typically, maintenance fees are waived for the first year, which creates a strong incentive for cardholders to find a better card before the first year is up.

- Credit limit increase fees: You may be able to get a higher credit limit after a period of on-time payments. But some cards may charge you a fee for the privilege.

- Extra card fees: Many cards in this group charge you a fee when you order an extra card, say, for your spouse or for an authorized user. Cards for borrowers with higher credit scores usually send these out for free.

Cards for bad credit almost always charge the more conventional fees as well, starting with annual fees and then adding foreign transaction, cash advance, late or returned payment, and over-limit fees. In addition, expect high regular and penalty APRs from these cards (one card’s regular APR exceeds 33%), coupled with low initial credit limits (i.e., as low as $200).

The effect of all these assaults on your wallet is that it’s hard for these issuers to lose money, even if the card owner doesn’t pay their bill. The name of the game is to collect high fees and interest early on, keep credit limits tight, and offer almost no perks or rewards.

These measures may seem harsh, but they give many people, especially folks who cannot afford to put down the deposit for a secured card, their only access to credit cards.

In addition, one of the few perks provided by the reviewed cards is that they report your payments to every major credit bureau, giving you the opportunity to build credit, a topic we discuss below. If you pay your bills on time for six to 12 months, you have an excellent shot at boosting your credit score and qualifying for better credit cards.

What Credit Limit and Interest Rate Can I Expect?

The initial credit limits offered by the reviewed cards here range from $200 to $1,000. Some cards subtract your annual and/or setup fee from your initial limit. You must repay the fees to restore your full limit.

APRs for these cards usually start at 24.99%, which is well above the national average. Cash advance APRs are usually several percentage points higher and, of course, accrue interest starting on the day of the advance.

The following chart shows the APRs to expect based on your credit score:

Most of the reviewed cards charge a penalty APR of 29.99%. You will receive this APR if you miss a payment date, and it will linger for an indeterminate length of time.

You may, over time, be able to increase your initial credit limit on most of these cards. However, it might make more sense to get a better card as soon as you can, one that charges less and offers more benefits. As mentioned earlier, some cards may charge you a fee for raising your credit limit, so caveat emptor.

Can I Get a Business Card With Bad Credit?

A handful of credit cards are available to business owners lacking good credit, although you may never have heard of them.

Here are two subprime card candidates that business owners may want to consider. You’ll note that one of them is secured, which means it requires a deposit:

- OpenSky® Secured Visa® Credit Card: This is not a business credit card per se, but it does seem to readily approve business owners. The credit limit ($200 to $3,000) is secured by your deposit, and you can get the card without submitting to a hard credit check.

- Credit One Bank® Platinum Visa® for Rebuilding Credit: This is an unsecured credit card that offers business-friendly cash back rewards on WiFi, mobile phone, cable, and satellite TV services, and gasoline purchases. Credit limits range from $300 to $3,000.

Almost all business credit cards require a personal guarantee from business owners. This means the cardholder is personally responsible for any unpaid balance on the business credit card, and card issuers tap the owners’ personal assets in court for failure to pay.

This is something to keep in mind if you have a bad credit score and are already struggling to meet your minimum payments. You want to ensure you can afford your potential business credit card payments because if anything goes wrong, it could take years for your finances to recover.

How Do I Use My Card to Rebuild Credit?

Bad credit isn’t a permanent stain, and it may not take long to get on the path to making significant improvements. When the goal is building credit, you can use your credit cards responsibly by doing the following:

Make Payments On Time

Late payments are credit score killers. You can help your score by always paying your bills on time and in amounts greater than the minimum due. The due date for payments is listed on your credit card statement and is usually 21 to 25 days after the close of the billing cycle — an interest-free interval known as the grace period.

If you miss the due date, the card company will hit you with a late fee and possibly assign you a penalty APR (typically several percentage points higher than your regular APR for purchases). After 30 days, the issuer will report your delinquency to a major credit bureau and send your credit score tumbling.

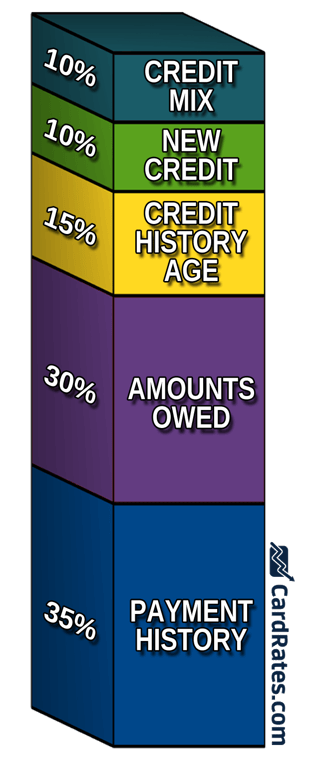

According to the FICO system, your payment history accounts for 35% of your total score. You can expect your score to drop by dozens of points if the card issuer reports you for delinquency.

All too often, missed payments are but a prelude to more serious problems that result in collections, write-offs, repossessions, foreclosures, and bankruptcy. These kinds of events will haunt your credit reports for seven to 10 years, seriously limiting your access to credit and inflating the interest rates you’ll be charged on loans and credit cards.

On the other hand, timely payments may eventually get you a higher credit score, a fatter credit limit, and even an invitation to a better card.

If your card is secured, the issuer may return the money in your refundable security deposit after six months of on-time payments.

Maintain Low Balances

Another 30% of your FICO score stems from your credit card balances as measured by your credit utilization ratio (CUR, defined as total credit used divided by total credit available).

A CUR below 30% can help your credit score, but higher values will cause you to lose points. The lower your CUR, the better your credit score.

The reasoning behind this metric is that a high CUR may indicate financial distress. While this may seem speculative, it’s undoubtedly true that perpetually high CURs will saddle you with sizable interest charges that displace other uses of your money.

FICO assesses your CUR in the aggregate and for each credit card. You, therefore, will want to keep each card’s CUR below 30%. One way to achieve this is to consolidate your credit card balances onto a card that offers a 0% introductory APR balance transfer promotion. A balance transfer promotion typically runs for six to 18 months with fees of 3% to 5% per transfer.

Another way to consolidate credit card debt is through a personal loan in which you use the proceeds to pay off your credit card debt.

You can then repay the loan through monthly installments, usually at an interest rate below that of what credit cards charge. Loan terms of up to 72 months can help make repayment more affordable.

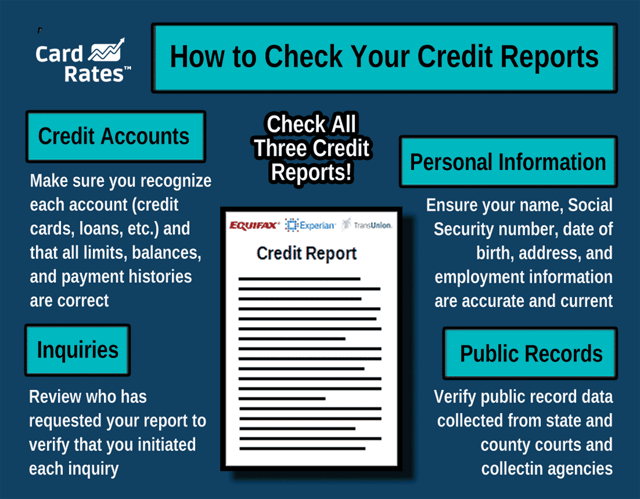

Remove Unauthorized Hard Pulls

The big three credit bureaus (i.e., Experian, Equifax, and TransUnion) record hard credit inquiries (or “hard pulls”) made by creditors when you apply for a new loan or credit card. You must authorize hard pulls of your credit report, each of which may reduce your credit score by five to 10 points.

You can avoid this type of damage to your credit history by not applying for new credit. But, sometimes, unauthorized hard inquiries appear on your credit reports, and it’s up to you to have them removed.

If you’d like to fix your credit reports, you can order your three free credit reports from AnnualCreditReport.com, the only source authorized by federal law.

If you find unauthorized or unverifiable hard inquiries, you can dispute them with the credit bureau, which has 30 days to resolve the problem.

If your dispute is successful, the bureau will expunge the information from your payment history, and you should see your score rebound within a month or two. Alternatively, you can hire a credit repair agency to do the work for you.

Credit repair companies try to identify and remove inaccurate, unfair, and unverifiable data from your credit reports. The best ones are effective and reasonably priced (the monthly fee is usually between $50 and $150, depending on the package you select), with a typical subscription period of about six months, although you can cancel at any time.

Other Things You Can Do

There are some other things you can do to preserve your credit score. For example, it can be a mistake to close old credit card accounts that you no longer use. Fifteen percent of your FICO score is based on the age of your credit accounts, so closing accounts can hurt your score by reducing your average account age.

FICO reasons that it takes financial acumen to manage credit accounts over a long period.

Accordingly, the FICO algorithm evaluates the age of each account and your average account age. Besides keeping old accounts open, use all your credit cards at least once a year to keep FICO from disregarding them.

Another 10% of your score arises from your credit mix. FICO considers having a wide credit mix (including credit cards and different types of loans) as creditworthy behavior, but only if you pay your bills on time.

Credit mix is relatively unimportant, so don’t feel the need to open credit cards to help your FICO score. Generally, you should only resort to debt when necessary.

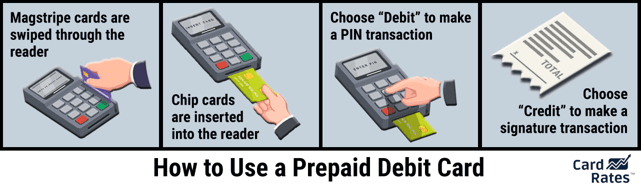

Do Prepaid Cards Offer Guaranteed Approval?

The only way that approval enters the prepaid card picture is whether the vendor will accept your payment. Cash isn’t a problem (unless you printed it yourself), but you could conceivably run into problems if you try to pay with a check, credit card, or debit card.

Prepaid cards are immediately usable wherever credit and debit cards of the same payment network (i.e., Visa, Mastercard, American Express, and Discover) are accepted.

That being said, keep in mind that prepaid cards are very different from credit cards. They don’t provide you with a line of credit, and they don’t require you to have a bank account. You can’t overdraw them or trigger late fees.

In most respects, prepaid cards are more like debit cards. Both are funded by cash in an account. For debit cards, the money is in a checking or savings account at your bank, credit union, or other financial institution. Prepaid cards have their own accounts that you fund with cash or other types of payment.

Keep in mind that some prepaid cards may charge reload fees, activation fees, or other fees that diminish their value. So be sure to read the fine print before you sign up.

Prepaid cards most closely resemble gift cards. The biggest difference is that you can deposit more money onto prepaid cards to continue using them, but gift cards aren’t typically reusable.

Guaranteed Approval Credit Cards With No Deposit Are Easy to Qualify For

To recap, credit card approval is never guaranteed, so we should really call them the easiest credit card offers to get approved for. Second, these cards are expensive and miserly: You’ll endure high fees and interest rates while receiving few benefits.

Nonetheless, the reviewed cards offer shopping convenience and fraud protection. They don’t require a security deposit to obtain a credit line. And if your credit is bad, they may be the only unsecured cards you’ll be able to access.

We think you should consider these cards as tools to build credit, particularly if you have a bad credit score. By making your payments on time and keeping your balances in check, you can use these cards to improve your credit history and hopefully qualify for better credit cards within a year.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Guaranteed Approval Auto Loans ([updated_month_year]) 7 Guaranteed Approval Auto Loans ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/09/Guaranteed-Approval-Auto-Loans.jpg?width=158&height=120&fit=crop)

![7 Easy Approval Credit Cards with No Deposit ([updated_month_year]) 7 Easy Approval Credit Cards with No Deposit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Easy-Credit-Cards-To-Get-Approved-For-With-No-Deposit.jpg?width=158&height=120&fit=crop)

![9 Best Instant Approval Credit Cards With No Deposit ([updated_month_year]) 9 Best Instant Approval Credit Cards With No Deposit ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/10/best-instant-approval-credit-cards-with-no-deposit.jpg?width=158&height=120&fit=crop)

![$5,000 Limit Credit Cards Guaranteed ([updated_month_year]) $5,000 Limit Credit Cards Guaranteed ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/01/5000-Limit-Credit-Card-Guaranteed.jpg?width=158&height=120&fit=crop)

![6 Guaranteed Installment Loans for Bad Credit ([updated_month_year]) 6 Guaranteed Installment Loans for Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/08/guaranteed--1.png?width=158&height=120&fit=crop)

![7 Cards For Bad Credit With No Deposit ([updated_month_year]) 7 Cards For Bad Credit With No Deposit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/01/Cards-For-Bad-Credit-With-No-Deposit.jpg?width=158&height=120&fit=crop)

![$50 Deposit Secured Credit Cards ([updated_month_year]) $50 Deposit Secured Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/50-Dollar-Deposit-Secured-Credit-Card.jpg?width=158&height=120&fit=crop)