Wouldn’t it be nice if people were just born with excellent credit? Unfortunately, credit is something you must establish, build, and maintain over time. And, if you believe you don’t need credit, think again.

A healthy credit score is your ticket to reaching many life goals — whether that’s buying your dream home or starting a business. Even if you just want to rent an apartment, own and insure a car, or open a credit card that offers a cool travel rewards program, you need credit to qualify.

And, the better your credit score, the easier it will be to do all these things. If you’re looking to establish credit because you don’t have any credit history or you want to improve and rebuild your current credit score, time is the biggest hurdle.

However, you can take several steps to begin building and repairing your credit score. One of the easiest ways to do this is to become an authorized user.

What is an Authorized User?

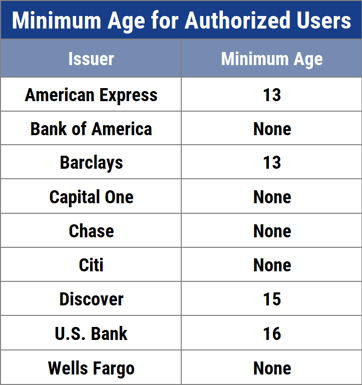

Becoming an authorized user means that someone you know adds you to their credit card account as a secondary account holder. You will receive a credit card tied to this account in your name.

Although you can use the credit card to make purchases, you’re technically not responsible for paying it off. Nor do you have the same privileges as the primary cardholder — you won’t have the ability to request account changes such as credit limit increases or add additional authorized users.

Although you can use the credit card to make purchases, you’re technically not responsible for paying it off. Nor do you have the same privileges as the primary cardholder — you won’t have the ability to request account changes such as credit limit increases or add additional authorized users.

The main account user still has complete control over the account, can view all charges and purchases, and is the only person who can add an authorized user. This also means that he or she is on the hook for any charges made by the authorized user.

Therefore, it is important to act responsibly and come to an agreement about how or when the card will be used, if at all, to avoid any unpleasant surprises. You will also want to discuss how to manage reimbursements for potential charges if you make an agreement to use the card.

But, before we get into how you can improve your credit score or establish it in the first place, it’s important to understand what your credit score is used for and how it’s analyzed.

How Does this Help My Credit Score?

When you become an authorized user on a preexisting credit card account, the financial behavior associated with that account will be reported by the credit card company to the credit reporting agencies and will appear on your credit report.

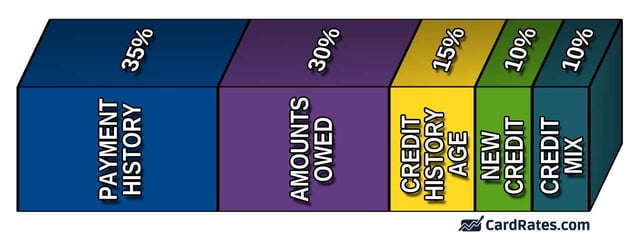

Such activity may include how long the credit card account has been active, how much credit is available at any given time, and payment history. Since these factors are important in determining your score, you will benefit the most from joining an account that has been open for a long time and one that has a stellar payment record, along with a low credit utilization rate.

On the flip side, your credit can be negatively impacted if the primary cardholder misses a payment or racks up a lot of debt on the card.

How Scores are Calculated

Your credit score is a number used by lenders to understand how responsible you are with money. This score is based on several items in your credit file, including your payment history, how long you’ve had credit, the types of credit you have, your credit limits, how much of your available credit you’re using at any given time, and how often you’re requesting new lines of credit.

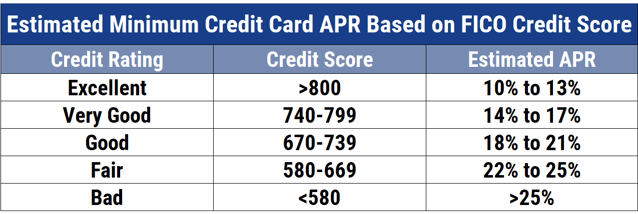

The most commonly used credit score system is FICO, which measures credit scores that range from 300 to 850. Credit scores are often rated from poor to fair to good to very good to excellent, and a credit score of 670 or above is generally considered good, with scores over 800 marked as excellent.

A credit score between 580 and 669 is usually defined as fair, while those below 579 are considered poor.

Why Good Credit is Important

Borrowers with fair to poor scores may be denied a mortgage or loan, be subject to higher insurance premiums, face problems during employment background checks, and have trouble opening contracts for a new cellphone, for example.

Those with good to excellent credit scores are more likely to be approved for loans and credit cards that offer better repayment terms and lower interest rates. This means you will spend less money paying off the loan by saving on interest, and you may even qualify for lower monthly payments.

When you pay less for your loans, you have more flexibility in your budget to save money and afford more of the things you enjoy.

When you’re constantly making late payments or missing them altogether, maxing out your credit cards, or opening new credit cards, chances are your score is hurting, and it can take a long time to build it back up.

Even if you are generally responsible with your accounts and payments, certain situations can cause your credit score to drop, such as making several large charges on your credit card due to unexpected life events, fraud and identity theft, or financial hardship, such as a job loss.

Regardless of why your credit is hurting, building it back to a good to excellent score can take time. However, it’s a crucial step to take toward improving your financial health.

Who Should I Approach to Become an Authorized User?

Your credit is nothing to mess with and if you are thinking about asking someone to add you as an authorized user on their credit card, make sure you are confident in this person’s financial responsibility and credit habits. Otherwise, this strategy can backfire, as a mismanaged credit card could have a detrimental impact on your score.

Therefore, it’s crucial to find a loved one who manages their money wisely before going down this path. Keep in mind, an authorized user’s limited or low score will not impact the primary cardholder’s credit.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![5 Best Credit Cards for Authorized Users ([updated_month_year]) 5 Best Credit Cards for Authorized Users ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Best-Credit-Cards-for-Authorized-Users.jpg?width=158&height=120&fit=crop)

![How to Build Business Credit: 7 Expert Tips to Build Credit Fast ([updated_month_year]) How to Build Business Credit: 7 Expert Tips to Build Credit Fast ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/how-to-build-business-credit1.png?width=158&height=120&fit=crop)

![3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year]) 3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Credit-Cards-For-Kids.jpg?width=158&height=120&fit=crop)

![5 Best Secured Credit Cards to Build Credit ([updated_month_year]) 5 Best Secured Credit Cards to Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/07/Best-Secured-Credit-Cards-to-Build-Credit.png?width=158&height=120&fit=crop)