Opinions expressed here are ours alone, and are not provided, endorsed, or approved by any issuer. Our articles follow strict editorial guidelines and are updated regularly.

A credit score is a number, most commonly ranging from 300 to 850, that represents how likely you are to repay borrowed money. The higher the number, the more trustworthy lenders find you, and they use it to decide whether to give you a loan and what interest rate to charge.

Credit card issuers design their products with costs and benefits specific to a range of scores. Credit scores are good for consumers because they make lending decisions more objective.

-

Navigate This Article:

How Credit Scores Are Calculated

The three major credit bureaus — Experian, Equifax, and TransUnion — calculate credit scores using details they receive from lenders, credit card companies, and others. These data providers often send updates every month. The updates include information about consumers and their credit accounts, new loan and credit card applications, debt collections, and other financial data.

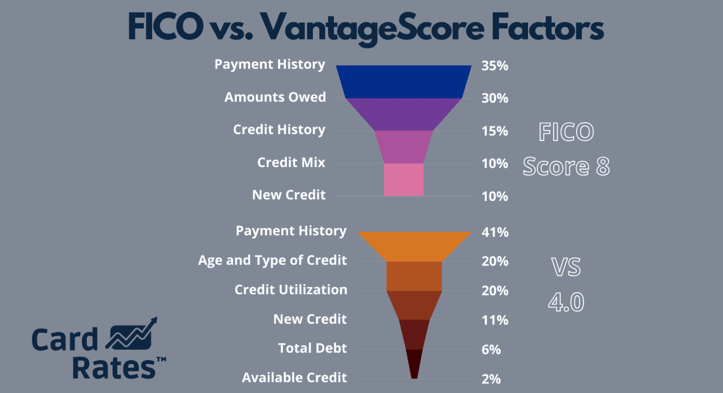

Each bureau uses credit score models to calculate consumer credit scores based on several factors, including payment history, amounts owed, and length of credit history. FICO and VantageScore are the two models that most credit bureaus use to compute credit scores.

FICO

Before credit scores existed, lenders used subjective opinions to make loan decisions, which often resulted in unfairness and inconsistency. After World War II, as more people wanted credit, lenders needed a reliable and unbiased way to judge if someone could repay a loan. This need led to the creation of the first consumer credit score by a company called Fair Isaac Corporation, or FICO, in 1956.

FICO is the top name in consumer credit scores, with 90 of the biggest 100 U.S. banks using FICO Scores to help determine if someone is likely to repay a debt. FICO offers many different types of scores, but the most popular are Score 8 and Score 9. They rate people on a scale from 300 (bad credit) to 850 (exceptional credit). The model uses five main factors from your credit history to establish your score:

- Payment history (35% of the total score): This reflects whether you pay your bills on time. Your track record of payments shows how likely you are to keep paying on time. You can occasionally be late, but many late payments will drop your score.

- Amount owed (30%): This measures your debt relative to your income and credit limits and assesses your capacity to manage more debt. It includes your credit utilization ratio (CUR), which represents the relationship between the amount you owe and your total credit limit. A high CUR (above 30%) indicates that you rely heavily on credit and may be living beyond your means.

- Credit history length (15%): FICO checks how long you’ve had your credit accounts and whether they’re still open. A long history of good account management boosts your score, tempered by how recently you’ve actively used credit.

- Credit types (10%): This category reflects the variety of your credit, such as home loans, car loans, and credit cards, among others. Having different credit types shows you can manage a mix of debts.

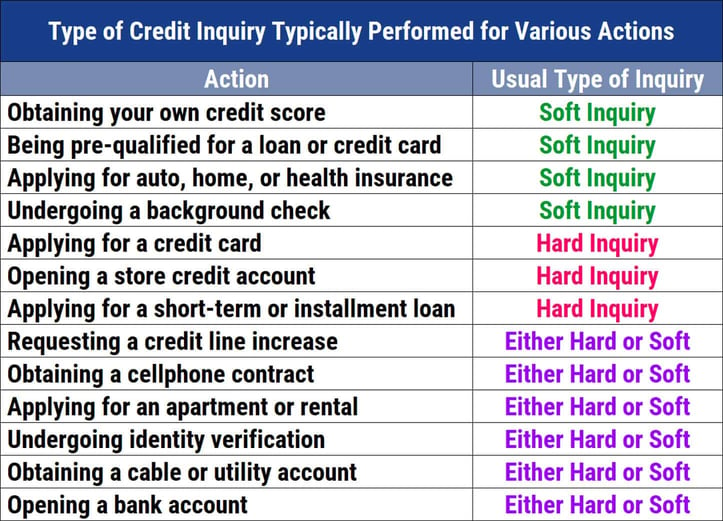

- New credit (10%): This factor reflects how many new credit applications you’ve submitted recently. The bureaus record every time you apply for most types of credit. Too many applications in a short time can lower your score. However, checking your own credit score, or checks by employers or landlords, has no scoring impact.

Don’t be surprised if your credit scores from Experian, Equifax, and TransUnion are a bit different. Each bureau’s FICO Score depends on how they collect and interpret data. However, your scores from all three should be similar.

FICO Score 8 and FICO Score 9 are two versions with some distinct differences:

- Paid collections: FICO Score 9 doesn’t consider accounts that creditors have sent to collections and the borrower subsequently repays, but Score 8 does.

- Medical debt: FICO Score 9 doesn’t count unpaid medical bills as heavily as Score 8. So, medical debt affects your Score 9 less.

- Rental history: FICO Score 9 considers your rental payment history, unlike Score 8.

- Forgiveness: Score 9 is generally more lenient with single late payments or minor slip-ups.

Because of these differences, your Score 8 and Score 9 are usually not the same, but it depends on your individual credit activities and history.

While FICO dominates the consumer credit score market, it competes with another popular scoring model — VantageScore.

VantageScore

In 2006, the three major credit bureaus teamed up to create VantageScore (VS), a new type of credit score to compete with FICO. While creditors widely use VS, it’s still less popular than FICO. Both VS and FICO scores range from 300 to 850, but VS calculates scores a bit differently. Here’s how VantageScore 4.0 computes your score:

- Payment history (41% of your total score): This factor assesses whether you pay your bills when they’re due. Late payments can lower your score. The more often and the longer you are late, the bigger the hit to your score. When you last missed a payment also plays a role. These late payments remain on your credit report for seven years, though their negative impact lessens as time passes.

- Depth of credit (20%): This refers to the average age of your credit accounts, as well as the oldest and the newest. Having older accounts is good for your score since it shows lenders that you’ve managed money well for a long time. Depth of credit also checks your mix of credit, including the two main types, revolving and installment, each with several varieties.

- Credit utilization (20%): As explained earlier, your credit utilization ratio looks at how much credit you use and your credit limit. VS considers your balances on installment loans but focuses more on your revolving credit. This model wants you to keep your CUR below 30%.

- New credit (11%): This factor looks at the number of credit accounts you’ve recently applied for based on the number of hard inquiries showing on your credit report. VS considers all hard inquiries that take place within 14 days as a single inquiry.

- Total debt (6%): This category identifies how much you owe on all your credit accounts, including ones you’re late on. Owing a lot can lower your score, even if you’re up to date with payments. However, in the VS 4.0 model, this only makes up 6% of your score, so the impact is minimal.

- Available credit (2%): This category measures how much credit you have yet to use on your revolving accounts, including credit cards. It doesn’t significantly impact your score, but having more credit available can provide a slight bump.

The latest version of VantageScore (4.0) has some features that differ from FICO:

- VS looks at how you manage your debt over time, including whether you reduce it or just make the minimum payments.

- It doesn’t count unpaid medical debts.

- VS groups together hard credit checks made within a 14-day span, so they have less effect on your score. FICO 9 also groups credit inquiries, but only those for car, home, and student loans in a 30-day period.

While your FICO and VS scores are not the same, but they are often within a similar range. If they aren’t, check your credit report to see if you have many items that one of the scoring models weighs more heavily.

Why Your Credit Score Matters

Your credit score determines whether you can borrow money and how much interest it will cost. People with good credit scores typically receive better deals, lower interest rates, and more loan options. With bad credit, you may get higher rates on loans and credit cards — or not qualify at all.

Credit cards can have high costs, especially if your credit is poor. But a good score can get you cards with lower costs and extra benefits. Personal loans can be cheaper than credit cards. But bad credit may force you to choose expensive options such as payday, pawn, or title loans with very high costs.

Having good credit can also help you land a job or rent an apartment or house, while bad credit can make these situations more difficult.

Understanding Credit Score Ranges

Lenders use credit score tiers to determine how risky it is to lend money to someone. These tiers — bad/poor, fair, good, very good, and excellent/exceptional — help lenders understand how likely it is that a person will pay back a loan. Lenders also recognize a tier in which consumers have no credit profile.

No Credit

This tier means you have no credit history at the credit bureaus. It’s a blank slate, so lenders have little information to assess risk. To establish a credit history, you must borrow money or get a credit card, and the creditor must report your activity to at least one credit bureau.

Bad/Poor

For FICO, this is usually a score below 580, and for VantageScore, it’s 600 and under. Creditors consider people in this range to be high-risk borrowers, often facing astronomical interest rates or flat-out rejections.

Fair

FICO scores from 580 to 669 and VantageScore from 601 to 660 fall here. Borrowers in this range are somewhat risky, which may lead to less favorable loan terms compared to those with higher scores.

Good

A FICO score between 670 and 739 or a VantageScore between 661 and 780 is good. Lenders view these borrowers as dependable, leading to better loan terms and easier access.

Very Good

FICO places this tier of scores between 740 and 799, while VantageScore doesn’t specifically define this range. People with scores in this tier receive competitive loan terms and interest rates.

Excellent/Exceptional

In the FICO model, a score above 800 is exceptional, while VantageScore considers scores above 780 to be excellent. Borrowers with scores in this top tier get the best interest rates and loan terms due to their reliability and very low risk of default.

Understanding these tiers can help you see where you stand and how lenders may view your creditworthiness. This can also impact the terms of any loans you may apply for.

How to Check Your Credit Score

Monitoring your credit is crucial for spotting errors and preventing identity theft early on. You can obtain free credit reports from Equifax, Experian, and TransUnion or via AnnualCreditReport.com.

To track your credit score regularly, consider free services such as those offered by some credit card companies or financial websites, which provide updates and alerts.

A credit report is like a report card for your money. It shows how good you are with cash and debt. It has different parts:

- Personal information: This is where your name, address, Social Security number, and job details are listed. It helps creditors know it’s really you.

- Credit accounts: This shows accounts you have now or had before, such as credit cards, mortgages, and other loans. It identifies when you obtained each one, how much you owe, how much you can borrow, and if you pay your bills on time.

- Credit inquiries: This section lists anyone who has checked your credit report in the last two years. There are two types of inquiries. Hard credit checks occur when you apply for credit, and they can affect your scores. Soft credit checks don’t affect your score and occur when you check your own credit or a lender pre-approves you for an offer.

- Bankruptcies: These negatively impact your credit score. Details are available from public records.

- Collections: Any unpaid accounts that a lender has sent to a collection agency will be listed here. This can happen with credit card bills, hospital bills, and other debts. Some scoring models remove collections that you repay.

To obtain a more detailed view, you can use paid services that offer credit scores and reports more frequently, along with monitoring and identity theft protection. These services often provide insights into how much these different factors affect your scores and may include advice to improve them.

Ways to Improve Your Credit Score

A better credit score means you can get better deals on loans, including paying less interest and receiving better terms. It also makes it easier and cheaper to borrow money. To obtain (or maintain) a higher credit score, here are some things you should do:

Make Payments on Time

Timely payments are essential for improving your credit because they are the most significant factor affecting your scores. By always paying on time, you show lenders that you are likely to pay back what you owe.

When you keep doing this, your credit score will slowly go up over time. This can provide indisputable proof to lenders and credit card issuers that you’re responsible with money.

Lower Your Credit Utilization Ratio

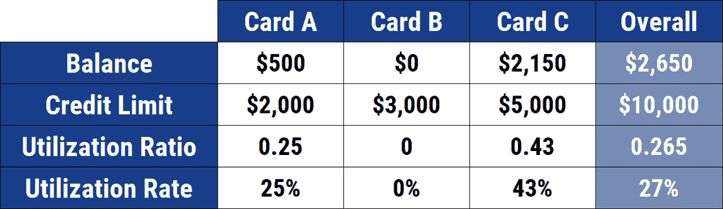

Your credit utilization ratio (CUR) is also a big deal for your credit score. It quantifies how much of your credit you actually use. Here’s how you can lower it:

- Pay off your credit cards faster by paying more than the minimum due each month.

- You can use a personal loan or balance transfer to consolidate what you owe into one payment with less interest, helping you pay down debt faster.

- Pay your credit cards more often than once a month to keep the balances down.

- Ask for higher credit limits on your cards. If you get more credit but don’t spend more, it helps lower your ratio.

- Open new credit accounts carefully because it can give you more credit but might impact your scores briefly.

- Spread your spending across several cards to avoid maxing out any single one.

The key is to use less of your credit. This discipline shows lenders that you’re responsible, which can help raise your credit score.

Regularly Check Your Credit Report for Errors

When you obtain your credit reports, inspect them closely to spot any errors. Ensure your name, address, Social Security number, and job information are all correct. If anything is wrong, the report data might belong to someone else.

Then, check if the accounts listed are yours and if their details are correct, including whether the accounts are open or closed. Also, confirm that each account is only listed once.

Verify your payments appear correct. They shouldn’t be marked “late” if you paid on time, and fully paid debts shouldn’t reflect that you still have a balance. Also, check that the balances for your credit cards and loans are accurate.

Watch out for hard inquiries you didn’t ask for, as they might mean someone is trying to obtain credit under your name. If you find any, and if the creditor can’t prove you authorized the check, the credit bureau must remove them.

If you find errors, alert the credit bureau. You can do this online or by sending a letter explaining the mistakes and asking the bureau to fix them. Use certified mail to have proof your letter was received. A bureau must check your claim within 30 days, correct any errors, and inform the other bureaus.

Correcting mistakes on your credit reports can help improve your scores. If it seems too tough, you can hire a credit repair company to do it, but they’ll charge a fee. They can’t guarantee a better score, but reputable companies are good at fixing report errors.

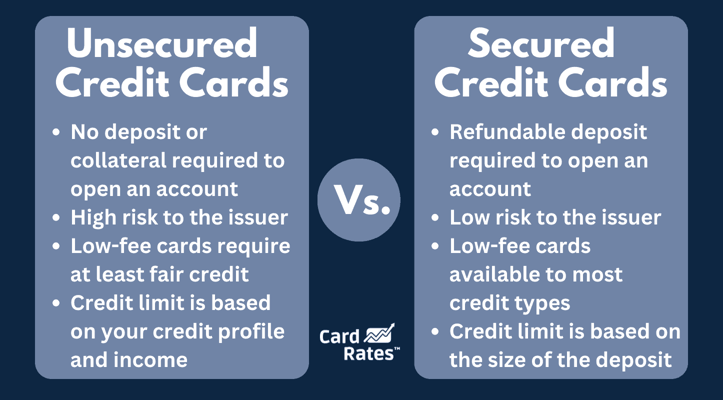

Consider a Secured Credit Card or Credit Builder Loan

Good credit scores benefit both the people lending money and those borrowing it. They make things safer and cheaper for lenders and allow borrowers to obtain credit more easily and affordably. That’s why products such as secured credit cards and credit-builder loans exist to help people build their credit profiles.

Secured credit cards require a cash deposit that typically becomes the credit limit. These cards are safer for lenders and more accessible for people with bad or no credit. Using these cards regularly and paying on time can help raise your credit score.

Credit-builder loans from credit unions and other financial institutions put the loan money in a special account. You pay into this account until you completely repay the loan, at which point you get the money back. Financial institutions report these payments to credit bureaus to help you build a good credit history.

Both of these methods are great for proving you can manage and pay back credit. They will help you slowly improve your credit score.

Avoid Closing Old Credit Accounts

Closing old credit accounts can hurt your credit scores because one factor is the age of your credit accounts. When you close an old account, it may seem as if you don’t have a long history of reliable credit management, which can decrease your score.

Keeping old accounts open shows you’ve managed credit longer, which is good for your score.

Report Additional Information

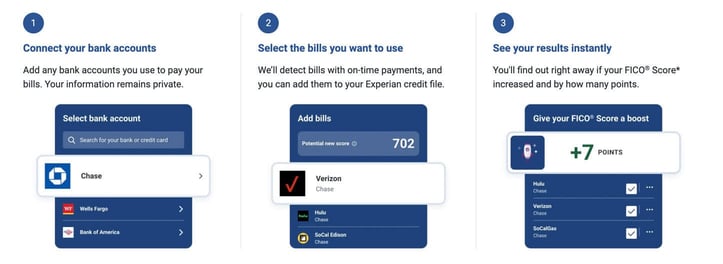

Products such as Experian Boost can help increase your credit score by highlighting your good bill-paying habits, including paying your phone, utility, and streaming service bills on time. Companies typically don’t report these payments to the credit bureaus, but Experian Boost can add them to your credit profile — and may give you a better credit score.

Tools similar to Experian Boost help in the same way. They showcase good payment habits that don’t typically appear on your credit report, showing your responsibility.

Common Credit Score Myths

Your credit score is pivotal throughout your adult life. When you want to borrow money, institutions rely on credit scores to decide whether to approve you. So, it’s essential to understand how your credit score works and what causes it to change.

But be careful. Many people have misconceptions about credit scores that can cause problems. Here, we debunk five persistent myths.

Myth 1: Closing a Credit Card Will Make Your Credit Score Better

Closing a credit card can actually lower your score. Here’s why: Credit scores identify how much credit you use compared to how much you have (that’s your credit utilization). If you close a card, you have less credit available, which can increase your utilization ratio.

High utilization can lower your score. So, keeping a card open, especially if you owe little or nothing on it, can help support your score.

Myth 2: You Have to Be in Debt to Have a Good Credit Score

You don’t need to owe much money to have a great credit score. Creditors like it when you don’t have too much debt. Keeping your debt low is ideal for your score, and you don’t get extra points for having more debt.

Repaying what you owe, especially on credit cards, can raise your score. If you use credit cards, try to pay off the balance every month to keep your debt low and avoid hefty interest charges. This way, you show you can manage credit well without staying in debt.

Myth 3: Moving Your Credit Card Debt Around to Different Accounts Will Help Your Credit Score

Just spreading your debt over several cards doesn’t help your score. If you have the same total debt, it doesn’t matter if it’s on one card or many; your overall debt level stays the same.

Also, having many accounts with money owed on them may lower your score. It’s better to focus on paying off your debt instead of just moving it around.

Reducing your debt, even a little, can help improve your credit score. If you have a lot of debt, consider consolidating it into one payment to lower the interest and clear the debt quickly.

Myth 4: You Have Only One Credit Score

You have many credit scores, not just one — or even three. In addition to your main scores from Experian, TransUnion, and Equifax, different types of scores exist for individual financial products, including auto loans, mortgages, and credit cards.

Even companies like FICO and VantageScore update their scoring systems to create even more versions. Different lenders might use any of those versions or even their own scoring systems. But all these scores look at the basics of your credit reports, so managing your money well should help you maintain good scores across the board.

Myth 5: Looking at Your Own Credit Report Will Lower Your Credit Score

Checking your credit report won’t hurt your score because it is considered a soft pull. Hard credit checks, on the other hand, affect your score and typically happen when you apply for loans or credit cards.

Soft checks don’t change your score, so you can look at your credit report as many times as you want with no impact.

Your Credit Score Is a Key Component of Financial Health

Knowing your credit scores is important because it determines how easily you can get loans or credit cards and how much you pay for them. A better score typically means borrowing money is easier and costs less. Tracking your scores can also help you find mistakes or identity theft early on, saving you trouble later.

It’s a good idea to continue checking, and working to improve, your credit score. It isn’t just about getting loans; it’s about being in control of your financial health. Making smart choices, such as paying bills on time, and not borrowing too much, helps your score grow. In addition, that discipline can make your financial future brighter and more secure.

![9 Best Loans & Credit Cards: 400-450 Credit Score ([updated_month_year]) 9 Best Loans & Credit Cards: 400-450 Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/bestloans.png?width=158&height=120&fit=crop)

![9 Loans & Credit Cards: 450 to 500 Credit Score ([updated_month_year]) 9 Loans & Credit Cards: 450 to 500 Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/450500.png?width=158&height=120&fit=crop)

![9 Loans & Credit Cards: 550 to 600 Credit Score ([updated_month_year]) 9 Loans & Credit Cards: 550 to 600 Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/550-to-600-Credit-Scores.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards by Credit Score ([updated_month_year]) 9 Best Credit Cards by Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/11/shutterstock_402532915.jpg?width=158&height=120&fit=crop)

![8 Low Credit Score Credit Cards ([updated_month_year]) 8 Low Credit Score Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/06/Low-Credit-Score-Credit-Cards.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards For a 700 Credit Score ([updated_month_year]) 5 Best Credit Cards For a 700 Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/12/Credit-Cards-For-700-Credit-Score.jpg?width=158&height=120&fit=crop)