Cards on the table: We love Discover credit cards. They are honest, straightforward cards that offer new cardmembers a coveted Cashback or Miles for Miles Match on rewards in the first year of card ownership. Although Discover is a strong candidate for the best credit card issuer, it isn’t particularly well known for its high credit limits.

Nonetheless, we’ve identified three of the highest Discover Card credit limits as reported on various web forums. That’s another good reason to add a Discover Card to your wallet.

Forum Contributors Disclose Credit Limits of $10,000+

Discover does not disclose maximum credit limits, but contributors to online forums often reveal intimate details about their credit cards. These websites are excellent places to learn the latest word about various financial products, including high-limit credit cards.

The following three examples should quiet any fears of low limits keeping you from applying for a Discover card.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% – 28.24% Variable APR

|

$0

|

Excellent/Good

|

The highest credit card limit we’ve come across for the Discover it® Cash Back is $56,500. That’s much higher than the minimum starting credit limit of $500. The card has a 0% intro APR on new purchases and balance transfers. Once the introductory period ends, the regular interest rates apply. Discover’s APRs compete well against those of similar cards with no annual fee.

The Discover it® Cash Back provides several security safeguards, including the Freeze it® on/off switch and online privacy protection. We consider this Discover’s best credit card for cash back rewards.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% – 28.24% Variable APR

|

$0

|

Excellent/Good

|

If you don’t care for quarterly rotating rewards, consider the Discover it® Chrome instead. We found a few forum references for credit limits exceeding $10,000, including one for $50,000.

This card offers high cash back rewards for purchases at restaurants and gas stations on up to $1,000 in combined purchases each quarter. Your rewards never expire, and you will receive a check for unused rewards if you close your account.

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers – only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more.

- 0% intro APR for 15 months on purchases. Then 17.24% – 28.24% Standard Variable Purchase APR will apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Discover is accepted nationwide by 99% of the places that take credit cards.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% – 28.24% Variable APR

|

$0

|

Excellent/Good

|

We’ve documented Discover it® Miles credit limits as high as $14,000, but we can’t rule out larger credit limits. We imagine most Discover cards can have equally high credit limits unless you have a student or secured card from the bank.

You can turn your miles into statement credits for eligible travel expenses or to pay your balance. In addition, you can redeem your miles at Amazon.com and PayPal. Your miles have no blackout dates and never expire.

What Is the Highest Credit Limit Available For Discover Cards?

We found references to Discover cards with credit limits between $50,000 and $60,000. Naturally, your credit card limit will depend on several factors, including your credit score, credit history, account age, income, and debts.

Discover seems to offer moderate initial credit limits but provides several ways to get a credit line increase:

- Make a phone call: Call 1-800-347-2683 and speak to a customer representative.

- Go online: You can request a credit limit increase when you log in to your Discover account online or in the app.

- Get a new card: Your credit history may allow you to obtain another Discover card with more credit if your old Discover card has a low limit. This is especially true if you have a secured or student Discover card but no longer have limited or bad credit.

- Be patient: Discover may reward you for creditworthy behavior by offering you a higher credit limit without you requesting it.

When you negotiate a larger limit with a Discover customer representative, discuss why you deserve it rather than why you need it. Point out your history of on-time payments, a higher salary, lower fixed costs, a second job, etc.

Keep the following negotiating tips in mind:

- Ask for a modest credit limit increase: You will have more success if you ask for an increase in the 10% to 25% range. Otherwise, you may appear greedy or desperate, traits that may turn off the issuer. You may qualify for a more significant boost if your credit score is solid, but it’s safer not to overreach.

- Highlight your accomplishments: Discuss your years of loyalty to Discover, your record of timely payments, your low credit utilization ratio, and, if applicable, your higher income. Only politeness will help your cause — don’t whine, beg, threaten, or lash out.

- Dangle a balance transfer: You may better your chances if you plan to use the increase to finance a balance transfer. Issuers earn a fee for each transfer, even if you take advantage of a 0% introductory APR. Moreover, any balance remaining after the intro offer expires will earn the issuer interest income.

Always treat the rep with respect. If they turn you down, thank them for your time and ask when you can reapply for a higher credit limit.

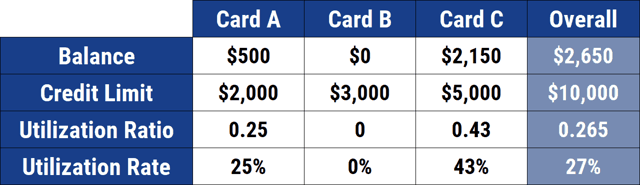

You don’t necessarily want to spend all your available credit limit increase. Remember, a higher credit limit left unused reduces your credit utilization ratio. This will help lift your credit score and may increase your chances for another credit limit boost.

How Do I Apply For a Discover Card?

Discover accepts online preapproval requests and card applications. You can apply online, over the phone, or by responding to a prescreened mail offer.

The preapproval process will give you an answer in just a few minutes. Preapproval doesn’t conduct a hard credit inquiry and won’t impact your credit score, so there’s no harm in checking. If you’re not preapproved, you save yourself from a hard inquiry that may affect your score and remain on your credit report for two years.

To begin the preapproval process, complete the online form and select a customized preapproved credit card offer. If successful, you can move directly to the card application and add any other information required to receive final approval. Bear in mind that preapproval does not guarantee final approval.

You can skip preapproval and simply apply for a Discover card. The application process is quick and should provide you with an immediate decision. To be eligible for a Discover card, you must be at least 18 years of age and provide a US address, domestic bank account number, Social Security number, and all the other information required by the online application.

If Discover approves your application, it will expedite the shipment of your new rewards card to arrive within five days.

What Credit Score Do I Need For a Discover Card?

With a few exceptions, you must have a good credit score to qualify for a Discover credit card. That means you’ll need a score of 670 or higher in the FICO scoring system.

The issuer’s student card duo, Discover it® Student Cash Back and Discover it® Student Chrome, account for two of the exceptions. Students do not need a credit history to qualify for these cards. These cards have an initial credit line of at least $500, but one forum contributor claimed they had a $7,500 limit.

The third exception to the good credit requirement is the Discover it® Secured Credit Card. It is available to anyone with bad credit interested in building or rebuilding their credit history. No published minimum score requirement exists, but Discover evaluates applicants’ credit reports and other information.

Your security deposit determines your credit limit, which tops out at $2,500. The minimum security deposit for a secured account is $200.

This secured credit card reports your payment activity to each major credit bureau (i.e., Experian, Equifax, and TransUnion). You can increase your credit score and qualify for an unsecured Discover card by consistently paying your monthly bill on time.

What Benefits Can I Get From Discover Cards?

Rewards are the most significant benefit of the Discover card lineup. Other benefits are modest and deal mainly with credit card security.

Discover cards offer cash back rewards except for the Discover it® Miles card, which, as you might guess, rewards you with miles. The rewards you earn can be flat, tiered, or rotating:

- Flat: A fixed percentage of eligible purchases provides unlimited flat rewards — the more you spend, the more you earn.

- Tiered categories: A tiered Discover card offers two or more bonus categories depending on the merchant type. These cards limit the rewards available from the high reward tiers. All other eligible purchases earn the standard rate.

- Rotating bonus categories: You activate a different bonus category every three months to earn 5% back up to the quarterly maximum. All other eligible purchases earn 1% cash back.

You can redeem Discover cash back rewards in several ways, including the following:

- Applying the cash to your Discover bill as a statement credit

- Depositing any amount into your bank account

- Making charitable donations

- Paying with cash rewards at Amazon.com checkout

- Paying with PayPal

- Purchasing gift cards and instant eCertificates starting at $5

Except for gift card purchases, no minimum redemption amounts apply. But redemptions require your account to be in good standing (i.e., not restricted, suspended, delinquent, or otherwise in default). Discover lets you apply your cash back as a statement credit toward your balance, including the minimum payment.

Redemptions for gift cards and eCertificates are worth extra if they’re from Discover’s bonus partners. You will receive most rewards within three days, but mailed gift cards may take up to three weeks to arrive.

The Discover it® Miles card pays rewards in the form of general-purpose miles not tied to any particular frequent flyer program. You can cash in the miles (100 miles = $1.00 ) and use the money as described above.

In addition, you can take up to 180 days to apply your miles retroactively to pay for travel purchases, including:

- Car rentals

- Charter and tour bus lines

- Commercial airline tickets

- Cruises

- Hotel rooms

- Local and suburban commuter transportation, including ferries and passenger railways

- Taxicabs and limousines

- Tour operators

- Vacation packages purchased through airlines, travel agents, and online travel sites

You don’t have to pay fees for these transactions.

Discover rewards never expire. The issuer will credit your rewards even if you close your account or fail to use your card for 18 months. Discover may freeze redemptions for up to 48 hours if you report the loss or theft of your card.

Not all spending earns rewards. Exclusions include money orders, cash advances, and balance transfers. You’ll pay a fee for each cash advance or balance transfer transaction.

All Discover cards offer new cardmembers an unlimited year-end match (i.e., Cashback Match or Miles-for-Miles Match) of the rewards that post in the first 12 months after account opening The matched rewards are available in your account within two billing periods after the first anniversary of account opening.

Discover cards do not offer a signup bonus because the rewards-matching programs perform a similar function.

Many Discover cards offer new cardmembers an introductory 0% APR on purchases and balance transfers. These promotions allow you to purchase big-ticket items and stretch out the payments interest-free. The regular APRs kick in once the introductory period expires.

Other Discover card benefits include:

- Low fees: Discover cards never charge an annual fee. Nor are there any transaction or first-time late payment fees, and there is no penalty APR.

- Online privacy protection: Discover helps remove your personal information from 10 person-search websites that could sell your data.

- Freeze it® on/off switch: If you misplace your card, freeze the account to prevent new unscheduled transactions.

- Free FICO scores: You can view your FICO credit score on monthly statements, the mobile app, or online.

- Nationwide acceptance: 99% of US merchants that accept credit cards welcome the Discover brand.

- 100% US-based customer service: You can talk to a human being anytime.

In sum, Discover’s rewards and benefits provide great value at a low cost.

Can Discover Deny My Card Application?

Discover, and indeed any credit card issuer, may need to deny your application. You may be ineligible due to age, income, credit, or other reasons. Also, you can own only two Discover cards at one time and must wait 12 months to apply for the second.

The law requires card issuers to send you an Adverse Action Notice when they deny your application. These notices contain essential information, including:

- Why the creditor denied your application

- The information source (typically a major credit bureau) the creditor relied on to make its decision, including your credit scores and reports

- How to obtain free copies of your credit reports

- Instructions on how to dispute items on your credit report you feel to be incorrect, unverifiable, or obsolete

It’s helpful to consider an Adverse Action Notice as a tool that tells you what you must do to improve your approval chances next time.

Does a High Credit Limit Have Any Downsides?

The chief downside to a high credit limit is the potential to overspend. You’ll pay more for interest if you find yourself financing a larger outstanding balance each month. As you accumulate debt, you will have less cash for emergencies and unexpected bills.

Adding interest on top of debt can create an unsustainable (and sometimes unavoidable) situation for consumers who make only the minimum required payment.

You can avoid accumulating debt by paying off your monthly credit card balance. This may require you to regulate your spending according to your monthly budget (you do have a budget, don’t you?).

Overspending can threaten your credit score by increasing your credit utilization ratio above a critical threshold — 1% for FICO, 30% for VantageScore.

Not having enough money to pay the monthly minimum amount is a bigger problem. After 30 days, card issuers report delinquent payments to the credit bureaus, causing your score to drop. As matters deteriorate, you may be subject to write-offs, collections, repossessions, and even bankruptcy, all with escalating damage to your credit.

You don’t want to fall into the trap of paying only the required minimum amount, a sum too small to pay off your debt quickly or efficiently. Instead, minimum payments fatten the issuer’s profits by maximizing your interest costs.

If your credit card debt becomes unmanageable, consider consolidating your balances and refinancing through a personal installment loan. These loans can finance long-term debt, usually at lower interest rates than those offered by revolving credit. For consolidation to be effective, you should use your credit cards only minimally until you repay the loan.

Using high-limit credit cards responsibly helps you avoid burdensome debts, interest fees, and credit score damage while taking advantage of your cards’ valuable rewards and benefits.

Choose a Discover Card With a High Credit Limit

Our survey of the highest Discover card credit limits reveals that you may be able to achieve a five-figure credit line if you maintain a good credit history. There’s nothing wrong with seeking large credit lines as long as you don’t feel the compulsion to overspend. Remember, living within your means is an excellent recipe for long-term financial success.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![19 Highest Credit Card Limits by Category ([updated_month_year]) 19 Highest Credit Card Limits by Category ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/11/shutterstock_370788551.jpg?width=158&height=120&fit=crop)

![11 Highest Capital One Credit Limits ([updated_month_year]) 11 Highest Capital One Credit Limits ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/06/Highest-Capital-One-Credit-Limits.jpg?width=158&height=120&fit=crop)

![12 Bank of America Credit Card Limits ([updated_month_year]) 12 Bank of America Credit Card Limits ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/04/Bank-of-America-Credit-Card-Limits.jpg?width=158&height=120&fit=crop)

![11 Highest-Limit Cards for Bad Credit ([updated_month_year]) 11 Highest-Limit Cards for Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/11/highlimit.png?width=158&height=120&fit=crop)

![11 Highest-Limit Air Miles Credit Cards ([updated_month_year]) 11 Highest-Limit Air Miles Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/Highest-Limit-Air-Miles-Credit-Cards.jpg?width=158&height=120&fit=crop)

![6 Highest-Limit Chase Credit Cards ([updated_month_year]) 6 Highest-Limit Chase Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/Highest-Limit-Chase-Credit-Cards.jpg?width=158&height=120&fit=crop)

![5 Highest-Limit Citi Credit Cards ([updated_month_year]) 5 Highest-Limit Citi Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/Highest-Limit-Citi-Credit-Cards.jpg?width=158&height=120&fit=crop)

![11 Credit Cards With $2,000+ Credit Limits ([updated_month_year]) 11 Credit Cards With $2,000+ Credit Limits ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/02/Credit-Cards-With-2000-Credit-Limits.jpg?width=158&height=120&fit=crop)