Opinions expressed here are ours alone, and are not provided, endorsed, or approved by any issuer. Our articles follow strict editorial guidelines and are updated regularly.

The credit card is the default preferred method of payment for almost 200 million consumers, according to Experian. Thanks to most card-using consumers having more than one credit card, the number of cards in circulation as of Q3 2023 was “close to 569 million,” again according to Experian.

Every single one of those cards is the result of an application, a credit report and credit score, underwriting, and then a decision by the card issuer. Given there are only two credit score brands in the United States financial services market, do credit card issuers use FICO or VantageScore credit scores, or both?

How Credit Card Issuers Use Credit Scores

Credit card issuers are no different from any other lender in that they will only do business with applicants who have credit scores high enough to make them feel comfortable extending credit.

Having said that, credit card issuers are also in a tough spot because almost all of their products are unsecured, meaning there’s no physical asset protecting their extension of credit, like a car or a house. This means card issuers have to charge higher interest rates simply as a product of the risk of issuing billions of dollars of unsecured credit.

Credit cards are not hard to get. You don’t need FICO or VantageScore 700 to get a credit card. Some card issuers will dive into the deep end of the credit risk pool to find customers. That means consumers with scores in the 600s, and below, have options, albeit more expensive options.

Some card issuers, like American Express, do not have what’s referred to as a subprime option. That means that, if you don’t have good enough credit scores, you won’t get a credit card from American Express, or other card issuers.

Conversely, other issuers like Capital One and Credit One Bank do have subprime options. That means if you don’t have good credit scores or if you have what’s generally believed to be poor credit scores, you still have options.

You Likely Won’t Know Which Score Your Card Issuer Uses

There are certain things to which you have the right, and there are things to which you are not entitled. Advance knowledge of which credit report and credit score brand your prospective card issuer will use when you apply for credit are two things to which you do not have a right.

In other words, there is no law that requires any credit card issuer to inform their applicants, “We’re going to pull your XYZ credit report and your ABC credit score when you apply.” If a credit card issuer does such a thing, it would be their choice to do so.

You can certainly find out which credit report — or reports — your card issuer pulled. Those of you who have credit monitoring services will get alerts indicating a lender pulled your credit report. And those of you who check your credit reports will see the new credit card inquiry on one or more of your credit reports, so that mystery is easy to solve.

But there is no data to indicate which credit score brand or brands, variant, or generation your card issuer used when you applied. You should assume FICO, and, more specifically, the FICO Bankcard Industry Option score … but you will likely never know for certain.

Both FICO and VantageScore Are Used in Credit Card Decisions

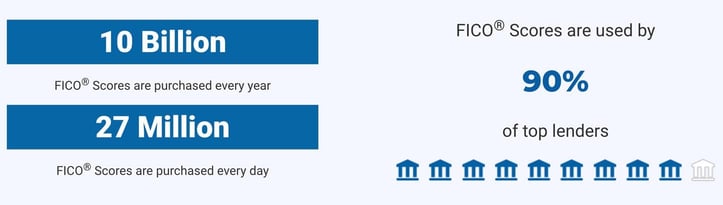

Both FICO and VantageScore credit scores are commonly used credit scoring models. Long gone are the days of “who cares about VantageScore because nobody uses it.” VantageScore Solutions has commissioned several market adoption studies from at least 2015 to as recent as 2022.

Those studies have revealed an increase in the use of VantageScore credit scores over that period of time with the annual volume of VantageScore credit scores used in one form or another going from 6 billion to over 14.5 billion. That’s billion with the letter B, which means VantageScore credit scores are used by almost twice the population of the globe.

According to its most recent 2022 market adoption study, VantageScore credit scores were used about 311 million times to approve or deny credit card applications from March 2021 to February 2022. To my knowledge, FICO doesn’t commission market adoption studies, which makes sense.

The market fully adopted FICO scores decades ago so there’s really no need. Until 2006, when VantageScore was introduced, FICO was essentially the only game in town.

FICO does not publish score volumes by industry but, according to the company, 90% of top lenders use FICO scores.

During my 32 years in the credit industry, I’ve rarely seen a credit report/credit score combination for any form of credit where the score was not a FICO score.

It’s safe to assume most credit card applications processed by large card issuers include at least a FICO score, if not a FICO score plus another score, such as a bankruptcy risk score or a custom-developed credit score.

This hybrid approach to using different scores is neither new nor unique. In fact, in the mortgage industry, the use of multiple scores has been standard operating procedure since the 1990s, as mortgages are commonly underwritten based on two or three FICO scores.

Starting in Q4 of 2025, assuming all goes as planned, mortgages will be underwritten using both FICO and VantageScore credit scores, the first time mortgages have been underwritten using two different credit score brands.

The Difference Between FICO and VantageScore

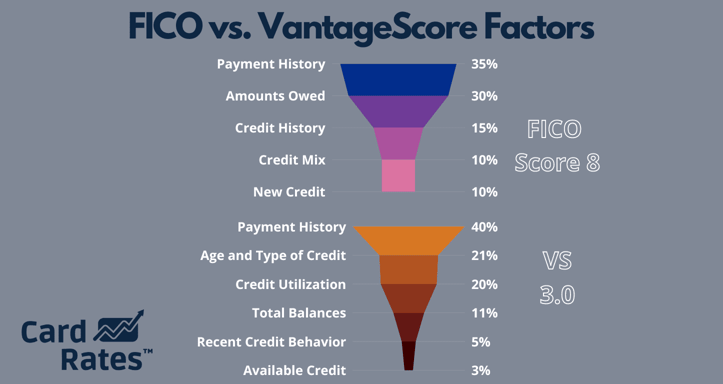

FICO scores and VantageScore credit scores are not the same thing. FICO, my former employer, is a software analytics company. It’s reasonable to expect most consumers in the U.S. who recognize the word “FICO” do so because of the company’s credit scoring models. In fact, FICO is recognized as being the inventor of credit bureau scoring and its FICO credit scores have been available from credit bureaus since 1989.

VantageScore Solutions is wholly owned by the Big Three credit bureaus, Experian, Equifax, and TransUnion. The VantageScore credit score has been commercially available from the Big Three since 2006. Collectively, FICO and VantageScore enjoy about 100% of the credit bureau scoring market in the U.S. There is no third credit bureau score option.

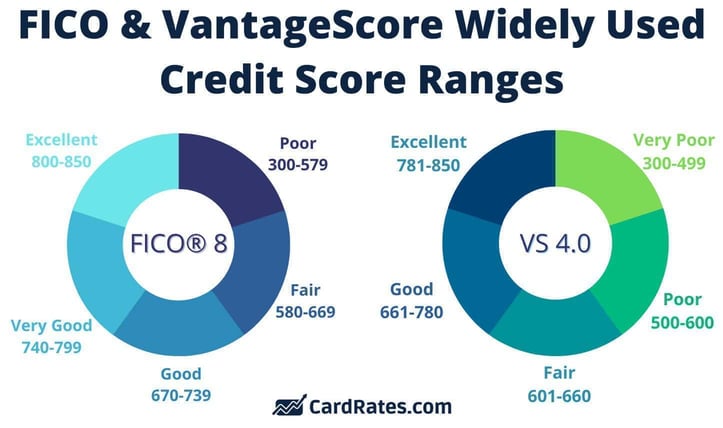

Both scoring models have a published score range or “scale” of 300 to 850, although many of FICO’s credit scoring models are scaled from 250 to 900. A higher score indicates less credit risk, and a lower score indicates elevated credit risk. Consumers who have average or better scores are generally approved for credit, but certainly not with the same terms.

Consumers who have below average or worse credit scores are either denied or approved but with onerous terms, like lower credit limits, lower loan amounts, and higher interest rates. Simply put, it pays to have good or better credit scores.

What is a Good Credit Score?

This is a simple question with a complicated answer. While anyone can categorize scores along the good/bad spectrum, the only entity that can truly say what is a “good” credit score is a company that uses credit scores to make decisions.

For example, banks, credit unions, credit card issuers, insurance companies, or property management companies all use credit scores of one variety or another to make decisions. They are the ones that determine, for their own use, what is good enough and what is not good enough as it pertains to credit scores. Some companies share their credit score requirements or “tiers,” but most do not.

Having said that, I’ve always been of the opinion that a good score is any score that gets you approved with the best terms. If your lender requires a 720, then anything above 720 is good enough. If the requirement is 760, then anything above 760 is good enough.

According to FICO, the average FICO score in October 2023 was 717 and about 48% of the population scored at or above 750.

Most consumers have really solid credit scores that would reasonably be categorized as good, or better.

Check Your FICO and VantageScore Credit Scores Before You Apply

I’ll end with some good news. You have several ways to access your FICO and VantageScore branded scores, and for free. Freemium websites, your bank, Experian, and some credit counseling organizations will give you either FICO or VantageScore credit scores at no cost.

The scores will be clearly branded so you won’t have to wonder which score you’re looking at. If you don’t want to depend on any of the previously referenced options, you can always get an estimate of your FICO score on FICO’s website here. And you can always check your credit reports here, at a centralized source of free annual credit reports.

![7 Best Credit Cards By FICO Score ([updated_month_year]) 7 Best Credit Cards By FICO Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/02/fico.png?width=158&height=120&fit=crop)

![9 Balance Transfer Cards For 600-700+ FICO Score ([updated_month_year]) 9 Balance Transfer Cards For 600-700+ FICO Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/Balance-Transfer-Cards-For-600-700-FICO-Score.jpg?width=158&height=120&fit=crop)