When you apply for credit, a lender is almost always going to access one or more of your credit reports. Lenders do this as part of their risk assessment and underwriting procedures.

This process is formally referred to as a credit inquiry, which is actually both a noun and a verb.

Differences | Exceptions | Credit Score Impacts

What is a Credit Inquiry?

Before we dive into the specifics of the different types of credit inquiries, it helps to understand more about them. A credit inquiry, the noun, will be found on your credit reports. It’s a record indicating a credit bureau gave an individual or some company access to your credit report information.

The bureaus are required by law to provide you with information about who has accessed your credit reports.

Credit inquiries can occur for many reasons. The credit bureaus may grant access to your credit reports when you request a copy yourself, when you apply for new financing or services, when you apply for insurance, or when you apply for a new job.

The credit reporting agencies (Equifax, TransUnion, and Experian) give you information about who has accessed your credit report and on what date. Federal law requires them to do so.

Thanks to the Fair Credit Reporting Act (FCRA), employment-related inquiries must stay on your credit report for at least 24 months. Non-employment inquiries generally must remain for at least 12 months.

As a general rule of thumb, the credit bureaus leave a record of most inquiries on your credit reports for 12 to 24 months.

Differences Between Hard & Soft Credit Inquiries

Two types of credit inquiries may appear on your credit reports — hard inquiries and soft inquiries.

Hard inquiries are taken into consideration by credit scoring systems. Soft inquiries, on the other hand, are not considered by credit scoring systems, and, therefore, cannot have any impact on your credit scores.

Below are some examples of common types of credit pulls and the category each falls into:

Hard Credit Inquiries:

- Loan applications (auto, mortgage, personal)

- Credit card applications (both general use and retail store cards)

- Collection agency skip tracing

Soft Credit Inquiries:

- Checking your personal credit

- Employment credit checks

- Credit checks from your current creditors (a.k.a. account maintenance)

- Credit checks that lead to credit offers from Lenders

- Collection agency skip tracing

You may have noticed that collection agency skip tracing was listed in both the hard and soft inquiry sections. That’s because collection agency inquiries can show up as either, depending on how their particular accounts are set up with the credit bureaus.

You can find a list of both hard and soft inquiries when you check your personal credit reports. You can claim a free report from each credit bureau once every 12 months at AnnualCreditReport.com. By doing this, you will cause a soft inquiry to appear on your credit reports, which will not affect your credit scores.

When a lender or someone other than you checks your credit report, soft inquiries will not show up. They are only visible on credit reports that you pull yourself.

The Rate-Shopping Exception

As a general rule, you should limit how often you allow others to access your credit reports. As in, you should only apply for credit when you actually need it.

There is, however, a notable exception to this rule. It’s smart to shop around for the lowest interest rates and fees before you agree to certain types of loans to make sure you’re getting the best deal available.

Both FICO and VantageScore’s credit scoring systems include logic built into their systems that allow you to shop for rates without a credit score penalty. But, there are a few basic rules you need to follow.

When comparing loan rates for a large purchase, such as a car or home, each inquiry made by a lender will only count as one if it’s made within a certain period.

First, you should keep all of your rate shopping confined to a relatively short period of time. Certain types of inquiries will count as a single inquiry in your scores as long as they all take place within a 14-day or 45-day window.

In VantageScore’s credit scores, all hard inquiries — regardless of the type — that occur within the same 14-day period are considered to be one inquiry. VantageScore’s logic is very simple.

FICO’s logic is more complicated. With FICO scores, mortgage, auto loan, and student loan inquiries that are less than 30 days old are ignored. After they have become at least 31 days old, the same types of inquiries that occur within the same 45-day period are treated as one inquiry for scoring.

As soon as any hard inquiries become 12 months old, both FICO and VantageScore’s credit scores cease to consider them, regardless of the type.

How Many Points Does an Inquiry Affect a Credit Score?

Determining how much a specific inquiry may impact your credit score is no easy task. Credit scoring is complicated, and nothing on your credit report is considered in a vacuum or counts for any specific number of points — that’s not how credit scoring works.

Some factors which may influence the impact an inquiry has on your credit score include:

- Is the credit inquiry hard or soft?

- Which credit scoring model is a lender using to calculate your credit score?

- If it’s a hard credit inquiry, will it receive special treatment due to the rate-shopping logic in FICO’s scores?

- How many other hard inquiries (excluding special rate-shopping inquiries) are already on your credit report?

You won’t lose a specific number of points for each credit inquiry. Credit scoring models consider your total number of inquiries in the prior 12 months, as well as the rest of the information on your report.

Having said all of that, inquiries are the least influential of all credit report entries in determining your credit score. Their impact on your credit score is minimal, if it exists at all.

There Are More Important Factors to Your Score

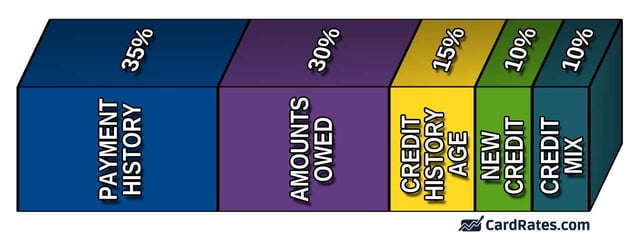

It’s smart and prudent to limit how often you allow others to access your credit reports, but if you want to earn and maintain solid credit scores, there are more important factors you should pay attention to as well.

For example, your payment history is worth 35% of the points in your credit scores. Which is why it’s always in your best interest to make sure you pay all of your credit obligations on time.

Your credit utilization is another major factor that influences your credit scores. Maintaining lower credit card balances will lower your credit card utilization ratio and, by extension, help you improve your credit scores.

Finally, it’s important to keep an eye on your credit reports from all three of the credit reporting bureaus. You should check them often and review them for errors. If you find mistakes, be sure to dispute them with the appropriate credit bureau so your credit score will not be penalized as a result of incorrect information.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![APR vs. Interest Rate: Is There a Difference? ([updated_month_year]) APR vs. Interest Rate: Is There a Difference? ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/APR-vs-Interest-Rate-Feat.jpg?width=158&height=120&fit=crop)

![12 Best Soft-Pull Credit Cards ([updated_month_year]) 12 Best Soft-Pull Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/01/softpull.png?width=158&height=120&fit=crop)

![How Does a Secured Credit Card Work? (+ 5 Best Cards) – [updated_month_year] How Does a Secured Credit Card Work? (+ 5 Best Cards) – [updated_month_year]](https://www.cardrates.com/images/uploads/2016/10/how-does-a-secured-credit-card-work.jpg?width=158&height=120&fit=crop)

![How to Calculate Credit Card Interest: 3 Steps to Find Your Rate ([updated_month_year]) How to Calculate Credit Card Interest: 3 Steps to Find Your Rate ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/how-to-calculate-credit-card-interest.jpg?width=158&height=120&fit=crop)

![Understanding Credit Cards: A Beginner’s Guide ([updated_month_year]) Understanding Credit Cards: A Beginner’s Guide ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Understanding-Credit-Cards-Feat.jpg?width=158&height=120&fit=crop)