A cautionary tale about Joe, a new LLC owner. He was excited about his new business but also a little overwhelmed. One day, Joe was in an important meeting with a client, about to pay for dinner, and pulled out one of his daughter’s Pokémon trading cards instead of his personal credit card.

Joe had to laugh, but that got him thinking. He soon realized that mixing his personal and business spending was neither smooth nor professional. So, he decided to get a business credit card. That funny mishap helped Joe take a big step in organizing his business finances.

Here, we discuss why applying for a business credit card is such a smart move and show you some of the best options out there.

-

Navigate This Article:

Best Capital One Business Cards For LLCs

Capital One offers several business credit cards bearing the Spark brand. These two provide the best cost-to-benefit mix for LLC owners.

- Earn a one-time bonus of 50,000 miles – equal to $500 in travel – once you spend $4,500 on purchases within the first 3 months from account opening

- Earn unlimited 2X miles per dollar on every purchase, everywhere, no limits or category restrictions, and miles won’t expire for the life of the account

- Unlimited 5X miles on hotels and rental cars booked through Capital One Travel

- Transfer your miles to 15+ travel loyalty programs

- Redeem your miles instantly for any travel-related purchases, from flights and hotels to ride-sharing services

- Skip the lines with up to a $100 statement credit on TSA PreCheck® or Global Entry

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

26.24% (Variable)

|

$0 intro for first year; $95 after that

|

Excellent, Good

|

The Capital One Spark Miles for Business card is an excellent option for business owners who frequently travel. You receive generous air miles that you can redeem for travel expenses regardless of airline or hotel brand. The card waives its moderate annual fee for the first year and doesn’t charge a foreign transaction fee.

Benefits include an annual statement credit for TSA PreCheck or Global Entry, virtual card numbers, and mile transfers to more than a dozen travel partners. You can assign account managers to review transactions, make payments and purchases, and resolve problems.

- Earn a $750 bonus when you spend $6,000 in the first 3 months of account opening

- Earn unlimited 1.5% cash back for your business on every purchase, everywhere — with no limits or category restrictions

- No annual fee

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel

- Rewards won’t expire for the life of the account

- Redeem your cash back rewards for any amount

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

18.49% – 24.49% (Variable)

|

$0

|

Excellent

|

The Capital One Spark Cash Select for Excellent Credit is a tiered cash back card with unlimited rewards on eligible purchases. It provides a higher bonus rate when you book rental cars and hotels through Capital One Travel. You can qualify for a sizable signup bonus if you spend the required amount within three months of account opening.

The card lets you set spending limits on free employee cards and choose your monthly payment date. Use it to download your purchase records quickly and securely into multiple programs, including Quicken, QuickBooks, and Excel. Virtual card numbers let you make safer payments online without exposing your actual credit card information.

Best Chase Business Cards For LLCs

Chase has an Ink card to suit just about any LLC owner. All provide rewards and benefits scaled to their annual fees. It’s hard to say which is the best credit card in the group because all have unique perks and benefits.

- Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase made for your business

- No Annual Fee

- Redeem rewards for cash back, gift cards, travel and more through Chase Ultimate Rewards®.

- Earn rewards faster with employee cards at no additional cost. Set individual spending limits for greater control.

- Round-the-clock monitoring for unusual credit card purchases

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 12 months

|

N/A 12 months

|

18.49% – 24.49% Variable

|

$0

|

Good/Excellent

|

The Ink Business Unlimited® Credit Card pays flat-rate rewards on every purchase, so you don’t have to juggle card membership reward tiers. The rewards are unlimited on this no-annual-fee card.

The card’s signup bonus and introductory 0% APR help LLCs finance their purchases of business items, such as equipment, furniture, and supplies. You can redeem your points through Chase Ultimate Rewards in many ways, including cash, travel expenses, and gift card options.

- Earn $1,000 bonus cash back after you spend $10,000 on purchases in the first 3 months from account opening.

- Earn unlimited 2.5% total cash back on purchases of $5,000 or more and unlimited 2% cash back on all other business purchases.

- Travel Benefits: Unlimited 5% total cash back on travel purchased through Chase Travel℠, No Foreign Transaction Fees and Trip Cancellation/Trip Interruption Insurance.

- The only business credit card with 2.5% cash back on every purchase of $5,000 or more.

- Get the buying power you need to make large purchases, cover monthly expenses and help your business grow. While you must pay your Pay In Full balance each month, this card has built-in flexibility. The Flex for Business feature allows for qualifying purchases to be paid over time with interest.

- Purchase with confidence with built-in protections like Fraud Protection, Zero Liability Protection, Purchase Protection, Cell Phone Protection, and Extended Warranty Protection.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

Flex for Business variable APR: 19.49% – 27.49%

|

$195

|

Good/Excellent

|

The Ink Business Premier® Credit Card features a generous credit limit. You earn cash back rewards at a high flat rate on all purchases of $5,000 or more. You can redeem your rewards for gift cards, cash back, and travel, among other options.

This is a hybrid charge/credit card. You can finance purchases up to a set limit and pay in full monthly for additional spending. A bonus rewards rate applies to the travel you book through Chase Travel℠. The card’s many protections can help your LLC save money.

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That’s $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won’t be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more – your points don’t expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24%-26.24% Variable

|

$95

|

Good/Excellent

|

A generous welcome bonus is just one of the reasons why business owners are partial to the Ink Business Preferred® Credit Card from Chase Bank. You must spend a hefty sum to earn the signup points, but an LLC may quickly satisfy the spending requirement through routine business purchases.

The card’s rewards points gain 25% in value when you redeem them for travel through Chase Travel℠. Business travel can be much more affordable when you save the card’s points for your tickets.

- Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening

- Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year

- Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. Earn 1% cash back on all other purchases

- 10% Business Relationship Bonus If you have the Ink Business Cash card plus a Chase Business Checking account on your first card anniversary

- With Zero Liability you won’t be held responsible for unauthorized charges made with your card or account information.

- No Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 12 months

|

N/A

|

18.49% – 24.49% Variable

|

$0

|

Good/Excellent

|

The Ink Business Cash® Credit Card has no annual fee and offers a solid signup bonus with a spending requirement many LLC owners can achieve. Combined with the 0% intro APR, the new card membership promotions provide persuasive reasons to acquire this Chase card.

Business owners receive the card’s top bonus rate on the types of purchases an LLC is likely to make, including utilities and supplies. A lower bonus rate applies to spending at restaurants and gas stations. The card does not charge a penalty fee on returned checks.

Best American Express Business Cards For LLCs

American Express is renowned for its business credit cards. This trio caters to small businesses and LLCs, offering a solid mix of rewards and benefits.

- Earn a $250 statement credit after you spend $3,000 in purchases on your Card in your first 3 months.

- Earn 2% cash back on all eligible purchases on up to $50,000 per calendar year, then 1%. Cash back earned is automatically credited to your statement.

- Buy above your credit limit with Expanded Buying Power. Make business purchases over your credit limit with no penalty or enrollments, and still earn cash back on those purchases. Terms apply.

- 0% introductory APR on purchases for 12 months from the date of account opening, then a variable APR applies

- Get an application decision in as little as 30 seconds

- $0 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 12 months

|

N/A

|

18.49% – 26.49% Variable

|

$0

|

Good/Excellent

|

The Blue Business Cash™ Card from American Express® suits business owners who want to avoid dealing with multiple bonus categories. You earn a high cash back rate on up to $50,000 in purchases yearly, after which you earn the standard rate on all eligible spending.

This no-annual-fee card offers an extended period to earn its signup bonus, and new cardholders can enjoy an introductory 0% APR on new purchases. Business-related benefits include employee cards, an automated interface to QuickBooks, year-end summaries, account alerts, and Vendor Pay by Bill.

- Earn 120,000 Membership Rewards® points after you spend $15,000 on eligible purchases with your Card within the first 3 months of card membership

- Earn 5X Membership Rewards® points on flights and prepaid hotels on amextravel.com, 1.5X points on business categories and purchases of $5,000 or more on up to $2 million per calendar year, and 1X point for each dollar you spend on other purchases.

- Get up to $400 back per year toward U.S. purchases with Dell Technologies, up to $360 back per year for purchases with Indeed, and $120 back per year for wireless telephone service purchases on the Business Platinum Card, plus additional credits. Enrollment is required for all.

- Access to more than 1,400 lounges across 140 countries and counting with the American Express Global Lounge Collection®

- Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees, such as checked bags and in-flight refreshments, are charged by the airline to your Business Platinum Card® Account.

- $695 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.49% – 28.49% Pay Over Time

|

$695

|

Excellent

|

The issuer’s best credit card for business is the The Business Platinum Card®. You should expect as much, considering its high annual fee. It has no preset spending limit if you pay your balance monthly.

You can choose the Pay Over Time option to finance purchases up to a set limit. The card pays top rewards for flights and prepaid hotels you book through AmexTravel.com. You can earn statement credits using the card for Dell, Indeed, and Adobe purchases.

- Welcome Offer: Receive a $125 Amazon.com gift card upon approval

- 5% Back or 90 Days Terms on U.S. purchases at Amazon Business, AWS, Amazon.com, and Whole Foods Market with an eligible Prime membership on the first $120,000 in purchases each calendar year, 1% Back thereafter

- 2% Back on U.S. purchases at restaurants, gas stations, and wireless phone services purchased directly from service providers

- 1% Back on all other eligible purchases

- Expense management tools to help you track and organize expenses

- $0 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.49% – 27.49% Variable

|

$0

|

Good/Excellent

|

The Amazon Business Prime Card makes your purchases at Amazon.com, AWS, Amazon Business, and Whole Foods Market more lucrative. You can still earn a generous cash back rate even if you don’t link a Prime membership to your card.

You earn bonus rewards on purchases from Amazon and select businesses. This card is the ideal choice for LLC owners who rely on Amazon to supply their business. Upon approval for the Amazon Business Prime Card, you receive an Amazon gift card, but check with your accountant, as the gift card may be taxable.

What Is an LLC?

An LLC, or limited liability company, is a blend of a partnership and a corporation. LLC members are not personally liable for any company debt.

LLCs have pass-through taxation. Any money the business makes goes straight to the members, who include it on their personal tax returns. This avoids the double taxation that corporations often face.

People use LLCs because they’re not as rigid as corporations. You can start one whether you are a sole proprietor or work with a team.

Small business owners find LLCs especially appealing. They receive limited liability protection without the headache of complex tax situations. It’s an innovative choice for those dipping their toes in the entrepreneurial waters.

What Makes a Credit Card Good For an LLC?

Credit cards for LLC owners must offer features that boost cost savings and operational efficiency. The following chart highlights the features an LLC business owner should seek when selecting a business credit card.

| FEATURE | DESCRIPTION |

|---|---|

| Limited Liability Protection | The LLC’s debts and liabilities don’t impact the personal assets of its members. |

| Separation of Finances | It’s best to use separate accounts and credit cards for business and personal transactions. |

| Expense Tracking | Look for tools and features that allow you to track and categorize business expenses. |

| Rewards and Perks | Benefits may include cash back, travel points, and discounts on business-related purchases. |

| Credit Building | Using the credit card contributes to building the company’s credit history. |

| Higher Credit Limits | Business credit cards often have higher credit limits than personal cards. |

| Employee Cards | Consider giving additional credit cards to employees for business-related expenses. |

| Customized Spending Controls | You can set limits on spending amounts, categories, and specific vendors. |

| Tax and Accounting Benefits | These cards simplify tax filing by consolidating business expenses into one account. |

Every feature is critical in enhancing your LLC’s financial and operational aspects. For instance, keeping business and personal finances separate ensures clear financial records and reinforces the LLC’s legal structure.

Rewards and perks on these cards are not just frills; they offer tangible savings for your business. Also, built-in expense tracking is a boon for tax preparation and budgeting. It’s a straightforward way to monitor spending patterns.

Furthermore, providing employee cards with customized controls brings an added layer of convenience and security. This enables effective management of business expenses, ensuring a smoother operational flow. Essentially, the right credit card for an LLC intertwines financial management with practical benefits, streamlining how your business operates.

How Can My LLC Get a Business Card?

If you are navigating the journey to a business credit card for your LLC, here’s a step-by-step guide to walk you through it:

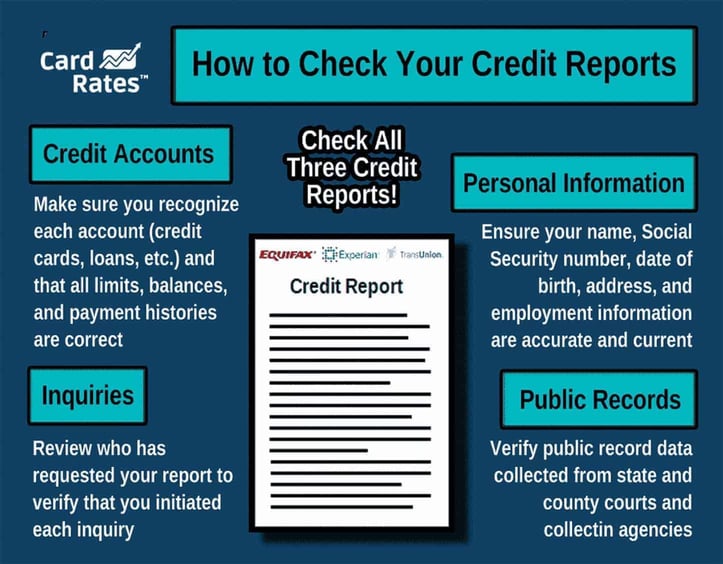

- Check your credit score: Before diving in, make sure your personal and, if applicable, business credit scores are in good shape. A solid personal credit score is crucial, especially for newer businesses.

- Understand personal guarantees: This is where you, as the LLC owner, agree to cover the business card debt personally if your company can’t. It’s a big responsibility, indicating you’ll handle the debt if your LLC can’t keep up with payments.

- Gather necessary documentation: You’ll need to round up a few things: Your LLC’s legal name, contact details, federal tax ID number, and financial info such as your annual income and monthly spending.

- Research and compare cards: This may require some detective work. Hunt down cards that check off all your boxes. See eligibility, interest rates, credit limits, rewards programs, and other business-specific benefits. Sites like CardRates.com can be helpful for comparisons.

- Apply for the card: Complete the online application once you’ve chosen your card. You’ll provide all sorts of details about your LLC and your role in it. Post-application, there may be a review phase during which the issuer could ask for more info.

- Understand and use benefits: Got your card? Great! Now, get to know all its perks and features. Wise card use can help manage money flow, build credit, and earn excellent rewards.

- Set up management practices: This is about good card habits. Set spending limits, keep track of expenses, and pay bills promptly. This not only avoids interest but also polishes your credit history.

Remember, getting the best business card for your LLC isn’t as simple as checking off boxes. It’s an opportunity to integrate these features into managing your business’s finances.

What Is the Easiest Business Card to Get Approved For?

Secured credit cards are usually the easiest to attain. Here’s how they work: You put down a security deposit first. Think of it as a safety buffer for the lender. This deposit isn’t just sitting there; it actually limits your spending.

The cool part? That safety buffer makes lenders more relaxed about giving you the card.

Secured cards are excellent for businesses starting out or needing to build credit. Other options include:

- Cards with personal guarantees: Most small business cards need a personal guarantee, meaning you promise to cover the debt if your business can’t. This personal responsibility on your part makes the card issuer feel more at ease, thus making these cards easier to get.

- Cards for businesses with low or no credit: Some card issuers specifically cater to companies that haven’t built up much credit yet. However, these cards may have higher interest rates or fewer benefits. They’re stepping stones to better credit.

- Store cards from retailers: Think of cards from office supply stores or gas stations. They’re generally more accessible but only work at those stores. While they may limit where you can spend, these cards often come with neat, store-specific perks and can help build your business credit.

But remember, it’s not just about snagging any card. It’s essential to consider how the card aligns with your business needs. Will it play nice with your personal and business credit?

Always read the fine print — understand the fees, interest rates, and what the card expects from you, credit-wise, before you jump in.

How Do Business Credit Cards For LLCs Handle Credit Building and Reporting?

When your LLC gets a business credit card, it starts a new chapter in its financial story. How you use this card and how punctual you are with payments adds to the credit profile of your business. It’s similar to how your personal credit history works but for your company.

Unlike personal cards, the best business card offerings consult with commercial credit bureaus, such as Dun & Bradstreet, Experian Business, and Equifax Business. These entities report your business credit history. So, when you make wise decisions with your card (i.e., paying on time and not maxing it out), your company earns positive marks.

Having a solid business credit report is critical. Having a good reputation can help you get better deals in the future, including lower interest rates and higher credit limits. Keeping your personal and business credit reports separate is also essential. They’re similar to separate lanes on a highway; you don’t want them merging unexpectedly.

Some card companies may also report to consumer credit bureaus (i.e., TransUnion, Equifax, and Experian), especially if you personally back the card and forget to make payment. So, knowing how your card issuer reports credit activity is also essential. Understanding this helps you use your business credit card wisely and improve your company’s credit profile.

What are the Top Business Credit Cards for LLCs with Low Interest Rates?

Business credit cards from big names like American Express and Chase have relatively low interest rates. We say “relatively” because, as of now, even the best cards have APRs (annual percentage rates) higher than 18%.

These APRs move with the Prime Rate, so the numbers may change over time. But credit card issuers usually offer competitive rates, similar to what they do now, no matter how the interest winds blow.

Several factors play into a credit card’s APR. Let’s break them down:

- Creditworthiness of the business: This is all about how dependable your LLC is with money. Better credit history and scores mean lower risk, which can lead to lower interest rates.

- Personal credit score of the owner: Your credit score also weighs in for small businesses and LLCs. Higher scores mean better APRs.

- Relationship with the financial institution: If your business has a good history with a bank or card issuer — think of it as a strong friendship — you may see lower interest rates, mainly if you use other services they offer.

- Economic conditions: Bigger rate trends, such as those for the Prime Rate or Federal Funds Rate, also influence what interest rates the credit card companies set. When overall market rates are low, finding cards with lower APRs is more likely.

- Competitive market offerings: Credit card issuers keep an eye on each other. If one offers low interest rates, others may follow suit to stay in the game.

- Introductory offers: Some cards come with 0% APR promotions. This can help businesses looking to make big purchases or shuffle debt around.

- Credit card type: Certain types, including secured or store business cards, may have lower rates. Remember, secured cards need a deposit, which usually means less risk and, thus, a lower APR for you.

All of these factors can help you determine which card fits your company’s financial needs best, especially when hunting for a low APR.

How Can LLCs Benefit From Employee Cards?

Most top-notch business credit cards let you give free employee cards to your team, and you’re handing them a key to the company’s financial door. Each employee with a card becomes an authorized user of the company card, deputizing them to make purchases on behalf of the company.

As the boss, you set spending limits on each card and decide what employees can buy. This is handy for keeping a tight rein on expenses. Big companies often have massive corporate credit card programs, managing spending for thousands of employees.

The following table summarizes how employee cards can benefit an LLC:

| FEATURE OF EMPLOYEE CARDS | BENEFIT TO THE LLC |

|---|---|

| Streamlined Expense Management | Centralizes business expenses, making tracking and reconciliation easier. |

| Custom Spending Limits | Allows control over employee spending, reducing the risk of overspending. |

| Simplified Accounting Processes | Consolidates expenses into one account, simplifying accounting and bookkeeping. |

| Enhanced Oversight of Expenditures | Provides real-time visibility into employee spending, aiding in budget management. |

| Rewards and Perks Accumulation | Increases the total rewards for the business owner from combined employee spending |

| Building Business Credit | Helps establish and improve the LLC’s credit history through consistent use and payment. |

| Employee Empowerment and Trust | Empower employees with direct spending ability, fostering responsibility and trust. |

| Tax and Expense Reporting | It helps to categorize expenses for tax purposes and potential deductions accurately. |

But here’s a heads-up: Handing out employee cards is more than being generous. You need to plan carefully. It’s similar to setting up a security system; you need the proper controls and checks. This ensures everything runs smoothly, and you know where your company’s money goes.

Grow Your LLC With a Great Business Credit Card

When you start an LLC, consider getting a top-notch business credit card. There’s a wide choice of cards for small businesses and startups.

Choosing the right small business credit card helps you finance your LLC, especially in the startup phase when you probably need to purchase furniture and equipment. A business credit card is a tool to help manage your business as you tackle the many challenges awaiting you.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![4 Tips: Getting Business Credit Cards with No Personal Credit Check ([updated_month_year]) 4 Tips: Getting Business Credit Cards with No Personal Credit Check ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/biznocredit.png?width=158&height=120&fit=crop)

![Financing a Business Using Credit Cards ([updated_month_year]) Financing a Business Using Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/01/Financing-Business-Using-Credit-Cards.jpg?width=158&height=120&fit=crop)

![6 Best 2% Cash Back Business Credit Cards ([updated_month_year]) 6 Best 2% Cash Back Business Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/2bus.png?width=158&height=120&fit=crop)

![7 Best Business Credit Cards for New Businesses ([updated_month_year]) 7 Best Business Credit Cards for New Businesses ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/01/newbus2--1.png?width=158&height=120&fit=crop)

![17 Best Credit Cards for Business Expenses ([updated_month_year]) 17 Best Credit Cards for Business Expenses ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/expense.png?width=158&height=120&fit=crop)

![12 Best Business Credit Cards for Travel ([updated_month_year]) 12 Best Business Credit Cards for Travel ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/03/business-credit-cards-for-travel-feature.jpg?width=158&height=120&fit=crop)

![8 Best Business Credit Cards for Startups ([updated_month_year]) 8 Best Business Credit Cards for Startups ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/Best-Business-Credit-Cards-for-Startups-Feat.jpg?width=158&height=120&fit=crop)

![7 Business Credit Cards With & Without Personal Guarantee ([updated_month_year]) 7 Business Credit Cards With & Without Personal Guarantee ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/cover-5--1.jpg?width=158&height=120&fit=crop)