Opinions expressed here are ours alone, and are not provided, endorsed, or approved by any issuer. Our articles follow strict editorial guidelines and are updated regularly.

Smart consumers know there are plenty of reasons to save money for future expenses, such as emergencies or major life events, like buying a home, financing your children’s education, or retiring at the end of your career.

There’s also another reason: inflation.

That may seem counterintuitive because as prices rise, spending sooner may appear more sensible. Why not buy now before prices rise even further?

The obvious flaw in that thinking is that not everything can be bought now and, as inflation erodes your purchasing power, your unavoidable future expenses may cost more tomorrow than they would today. More savings are needed to close the gap.

How much more depends in part on the inflation rate, which measures the pace at which prices are rising over time.

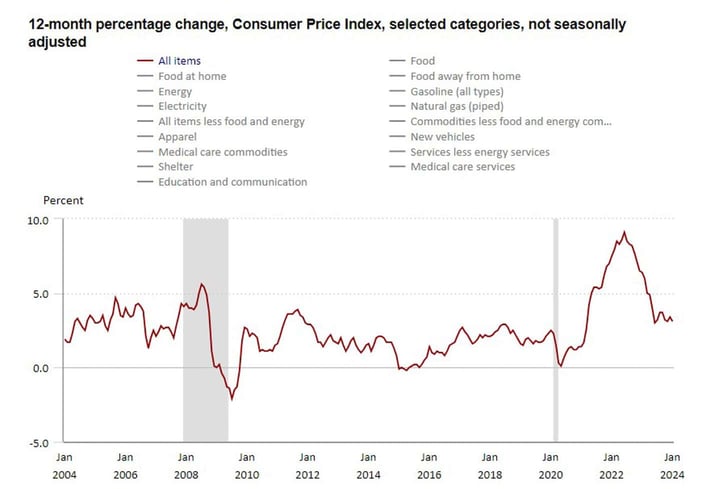

One measure of the inflation rate is the Consumer Price Index (CPI), which is tracked by the U.S. Bureau of Labor Statistics (BLS).

In the past 20 years, the BLS has reported monthly inflation rates that ranged from a high of 9.1% in June 2022 to a low of 0% in February 2015 and again in September 2015. Only once, during the Great Recession of 2009, did inflation flip to a negative rate, which is known as “deflation.”

This history suggests that today’s high prices may not return to what they were any time soon. Instead, prices are more likely to continue to rise, though the pace of price increases may, at times, be less painful.

Take the Pledge Every Day of the Week

The question then is how can you save more? Doing so may seem especially challenging when prices are rising and your income may not be keeping pace.

One way to find some good savings tips is to check out “America Saves Week.” The nonprofit Consumer Federation of America, which sponsors the annual event, describes it as “an annual celebration, as well as a call to action for everyday Americans to commit to saving successfully.”

This year, each weekday during America Saves Week (April 8-12) will have a special theme to help participants learn how to save and take specific action steps to increase their savings.

Here’s a preview of the themes and action steps for each day. Read ahead for more details on each day.

Monday: Saving Automatically

Putting your savings on auto-pilot may help you save more without having to think about every deposit you make to your savings accounts.

Tips:

1. Take the “America Saves pledge” to set savings goals and make specific plans to improve your financial habits.

2. Automate your savings with direct deposits to your savings accounts and monthly transfers from your checking accounts to your savings accounts.

3. Review how much you’re saving automatically and consider whether you can increase those amounts to save more.

4. Share your commitment to saving automatically with your family and friends.

5. Shop for high-yield savings accounts that could boost your interest income from your savings. A higher yield softens the impact of inflation.

Tuesday: Saving for the Unexpected

Unexpected expenses can derail your savings and undermine your budget. Saving for emergencies in advance may help you minimize the damage and get back on track sooner.

Tips:

6. If you don’t have a savings account for emergencies, open one today.

7. If you do have one, reassess how much you’ve set aside and consider whether you can save more to make sure you’re ready for anything unexpected.

8. Share your commitment to building your emergency savings with your family and friends.

Wednesday: Saving for Major Milestones

Saving isn’t just for emergencies. This important personal finance habit can also empower you to buy a home, take advantage of educational opportunities, or prepare for your retirement years.

Tips:

9. Create savings plans for your short-term, mid-term, and long-term financial goals, such as buying a car, paying for your children’s education, or feeling financially secure when you stop working.

10. Share your plans and savings goals with your family and friends.

Thursday: Paying Down Debt is Saving

Paying off debt may not seem like saving, but it can free up funds so you can save more for other needs and wants.

Tips:

11. Make a plan to pay off any loans, credit card balances or other debt that you may have.

12. Consider refinancing or restructuring your debt to lower your monthly payment or total interest expense or enable you to pay off debt faster.

13. Share your debt reduction plans with your family and friends.

Friday: Saving at Any Age

Saving isn’t just for younger people or just for older people. It’s important for everyone, regardless of age.

Tips:

14. Share your personal “money story” and savings plans with members of older and younger generations of your family.

15. Help your kids open savings accounts so they can set aside money for goals that matter to them.

More Tips to Boost Your Savings

Opening savings accounts and paying off debt aren’t the only ways to set yourself up to save more. You can also focus on cutting your expenses or raising your income to create more opportunities to save.

Tips:

16. Try to negotiate a raise from your employer.

17. Get a second, part-time job.

18. Turn your hobby into a side hustle.

19. Learn about investing to earn a higher return on your savings.

20. Look for ways to spend less on your home, car, utility bills, groceries, streaming services, and other monthly expenses.

21. Ask your tax preparer about tax deductions and credits that could lower your income tax.

How Cards Can Help You Save

Credit cards are a form of debt that can prove costly. But credit cards also can help you save — if you take advantage of the opportunities they offer.

Tips:

22. Apply for new cards with cash signup bonuses.

23. Pay off your card balance every month, so you won’t be charged any interest.

24. Apply for rewards cards that have a low or no annual fee and pay you back with cash, shopping points, airline miles, hotel stays, or other benefits.

25. Apply for premium travel cards if you’ll use the enhanced benefits often enough to offset the annual fees.

By now, you may be thinking that saving seems like a big project. Fortunately, it doesn’t have to feel burdensome. Just remember that while America Saves Week officially happens only once each year, these tips can help you boost your savings throughout the entire year and for many years to come.

![When Does Interest On a Credit Card Start? ([updated_month_year]) When Does Interest On a Credit Card Start? ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/10/When-Does-Interest-On-a-Credit-Card-Start.jpg?width=158&height=120&fit=crop)

![How to Start Building Your Credit at 18 ([updated_month_year]) How to Start Building Your Credit at 18 ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/04/How-to-Start-Building-Credit-at-18.jpg?width=158&height=120&fit=crop)

![First Savings Credit Card: Login, Application & 5 Similar Cards ([updated_month_year]) First Savings Credit Card: Login, Application & 5 Similar Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/02/first-savings-credit-card.jpg?width=158&height=120&fit=crop)

![6 Tips: Increase Your Capital One Credit Limit ([updated_month_year]) 6 Tips: Increase Your Capital One Credit Limit ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/08/Capital-One-Credit-Limit-2--1.jpg?width=158&height=120&fit=crop)

![6 Tips: How to Increase Discover Credit Limit ([updated_month_year]) 6 Tips: How to Increase Discover Credit Limit ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/09/DiscoverCreditLimit--1.jpg?width=158&height=120&fit=crop)