Bank of America offers a large variety of credit cards, including cards for people with excellent credit and even cards for bad credit. With such a large selection, it can be hard to figure out which card you want, which card you really need, and which ones you’re actually eligible for.

Below we explain the different cards that Bank of America offers, how they compare, and how to determine which is best for your credit profile.

-

Navigate This Article:

Bank of America Requires Good to Excellent Credit For Most of Its Cards (670+ FICO)

If you’re looking for a Bank of America credit card, you’ll probably need a credit score of 670 or higher. If you have that kind of credit score, here are the best Bank of America cards for you:

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you’re a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% – 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards – The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% – 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Customized Cash Rewards credit card gives users more control over how they earn cash back rewards. Bank of America lets you choose the purchase category you want to earn the most cash back from, and you’ll have several options.

There is no annual fee. You can also get a basic signup bonus after spending a certain amount within 90 days after account opening plus an introductory 0% APR on new purchases and balance transfers.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don’t expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening – that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want – you’re not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% – 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you’re a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards – The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% – 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

As the flagship travel card for Bank of America, this credit card includes more travel perks than other cards on the roster. You pay no foreign transaction fees, which can come in handy when traveling abroad.

The Bank of America® Travel Rewards credit card offers flat-rate points on all purchases with no limit on the amount you can earn. Points do not expire while the account is active.

The card provides users a signup bonus if they spend a predetermined amount within the first 90 days after account opening. It also has a 0% APR offer on new purchases and balance transfers. Balance transfers are subject to a balance transfer fee.

- Receive 60,000 online bonus points – a $600 value – after you make at least $4,000 in purchases in the first 90 days of account opening.

- Earn unlimited 2 points for every $1 spent on travel and dining purchases and unlimited 1.5 points for every $1 spent on all other purchases. No limit to the points you can earn and your points don’t expire as long as your account remains open.

- If you’re a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means you could earn 2.5-3.5 points on travel and dining purchases and 1.87-2.62 points on all other purchases, for every $1 you spend.

- Redeem for cash back as a statement credit, deposit into eligible Bank of America® accounts, credit to eligible Merrill® accounts, or gift cards or purchases at the Bank of America Travel Center.

- Get up to $100 in Airline Incidental Statement Credits annually and TSA PreCheck®/Global Entry Statement Credits of up to $100, every four years.

- Travel Insurance protections to assist with trip delays, cancellations and interruptions, baggage delays and lost luggage.

- No foreign transaction fees.

- Low $95 annual fee.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.24% – 27.24% Variable APR on purchases and balance transfers

|

$95

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Premium Rewards® credit card includes a signup bonus for new cardholders. The card also offers additional cash back rewards for travel and dining purchases and 1% back for all other eligible purchases.

While the card charges an annual fee, it’s comparable to fees for cards from competitors like Capital One and American Express. This is one of the best travel rewards credit card options from Bank of America. It charges no foreign transaction fees, and users will get a statement credit after spending a certain amount on travel-related purchases.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn unlimited 1.5% cash back on all purchases.

- If you’re a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 1.87%-2.62% cash back on every purchase with Preferred Rewards.

- No annual fee.

- No limit to the amount of cash back you can earn and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% – 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards – The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% – 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

Unlike other Bank of America credit cards, the Bank of America® Unlimited Cash Rewards credit card offers the same cash back percentage on all eligible purchases. And just as the name suggests, there’s no limit on the cash back rewards you can earn. Rewards remain active while the card is in good standing.

This card also includes a special 0% APR introductory deal for new purchases and balance transfers and charges no annual fee.

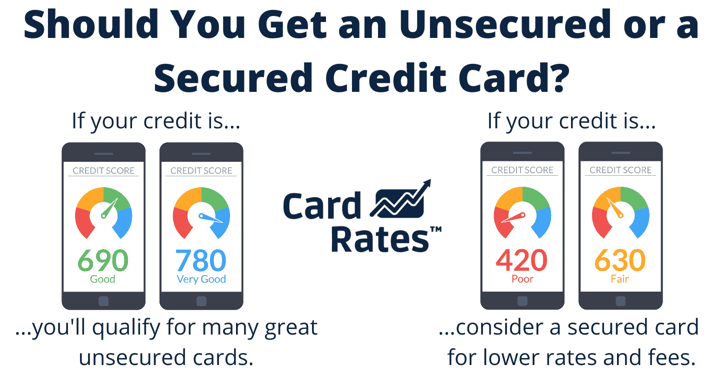

Bank of America Cards For Bad or No Credit (Sub 650 FICO or No Score)

If you have no credit or bad credit, the following Bank of America secured cards will likely be your best option. Secured credit cards work differently than unsecured credit cards.

You must make a deposit that will serve as collateral and act as the credit limit on a secured card. The deposit is a safety net for the card issuer in case you stop making payments on the card.

Bank of America has a large range for its minimum security deposit, so it’s easy for cardholders to put down an amount they’re comfortable with. When you sign up for a secured card, Bank of America will provide free credit education to help you learn how to improve your credit score.

5. Bank of America® Customized Cash Rewards Secured

The Bank of America® Customized Cash Rewards Secured card gives cardholders the ability to choose which categories they want to earn extra cash back in. Cardholders can earn the most cash back on whatever they want out of a preselected group from Bank of America.

Consumers can also earn extra cash back on purchases made with the card at grocery stores and wholesale clubs, and they can earn a basic cash back percentage on all other eligible purchases. The card charges no annual fee, but it does charge a basic foreign transaction fee. The card doesn’t include a 0% APR offer, and there will be a balance transfer fee.

6. Bank of America® Unlimited Cash Rewards Secured

The Bank of America® Unlimited Cash Rewards Secured Credit Card is another secured credit card that offers cardholders cash back, a feature that has recently become more prevalent among secured cards.

This card follows the same cash back structure as its unsecured sibling and has no annual fee. The bank may invite you to upgrade to an unsecured card account after a period of responsible usage. You’ll get access to a free FICO score so you can track your credit-building progress.

7. BankAmericard® Secured Credit Card

The BankAmericard® Secured Credit Card is the only secured Bank of America card that does not offer any cash back benefits. But the card has a security deposit that ranges from $200 to $5,000 so customers have more flexibility when deciding how much to put down.

That’s a feature other secured Bank of America cards also offer. But this card has a slightly lower APR than the other secured Bank of America cards due to its lack of rewards, and it charges no annual fee.

(The information related to Bank of America® Customized Cash Rewards Secured, Bank of America® Unlimited Cash Rewards Secured, and BankAmericard® Secured Credit Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.)

How Do I Find My Credit Score?

If you’re currently a Bank of America credit card customer, you’re in luck. The bank offers its customers free FICO credit scores, a benefit other card issuers, including Capital One and American Express, also offer.

You can find your free FICO score in the Bank of America mobile banking app or on your desktop. Just log in to your account to see your score. The score is updated once a month.

If you’re not yet a Bank of America customer, you can use a free app such as Credit Karma or Credit Sesame to see your VantageScore credit scores.

Many other credit card issuers offer free credit scores. You can also get your free Experian FICO Score on the Experian website.

How Do I Know Which Bank of America Credit Card I’m Eligible For?

Your credit score is the most important factor when it comes to credit card eligibility; the second is your income and your ability to make payments.

Consumers with excellent credit will likely qualify for all available Bank of America credit cards, but those with low scores or no credit history may only qualify for the bank’s secured credit cards.

The bank also offers student credit cards for applicants with good to excellent credit. Other major banks don’t require any credit history for approval of a student cart. This makes a Bank of America student credit card one of the hardest student cards to qualify for.

What Is the Easiest Bank of America Credit Card to Get Approved For?

Secured cards are the easiest bank cards to qualify for. Secured cards are built for consumers who either have no credit history or are trying to rebuild a low credit score. Even if you have a bankruptcy, lien, or default on your credit history, you may still qualify for a secured credit card.

Bank of America’s three secured cards are equally simple to get. Your approval odds are good as long as you can make the minimum deposit and meet the bank’s other basic criteria.

What Is the Hardest Bank of America Credit Card to Get Approved For?

The cash rewards and travel cards will likely be the most difficult to get, especially if you don’t have good credit.

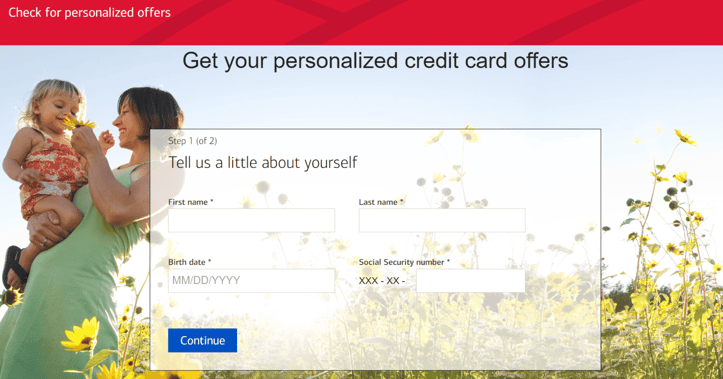

You don’t need to have an account to check for personalized offers on the Bank of America website. You must enter your first and last name, date of birth, and Social Security number to get started. You’ll then be required to enter your address and select the types of cards you’re interested in from a drop-down menu.

If you don’t see the card you were hoping for, you can open one of the three Bank of America secured cards instead. These are much more likely to accept anyone with bad credit or no credit history.

How Can I Improve My Credit Score to Qualify for a Bank of America Credit Card?

Anyone — even people with terrible credit — can improve their credit score and get approved for a Bank of America credit card.

The first step is to make all of your monthly payments, especially your loan and credit card payments, on or before the due date. Payment history makes up 35% of your FICO credit score, and even one late payment can hurt your credit score.

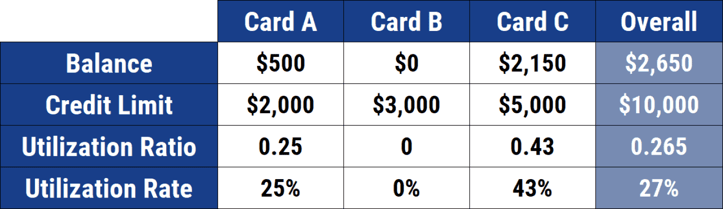

The next step is to work on your credit utilization percentage, which makes up 30% of your credit score. Your credit utilization is your current credit balance divided by your total credit limit.

A good rule of thumb is to have a maximum 30% credit utilization, but those with a credit utilization of 10% or less will see the best credit scores. For example, if you have a $5,000 credit card balance on a $10,000 credit limit, then you have 50% utilization. This will lower your credit score.

If you don’t have any existing loans or credit cards, you can open a secured credit card to improve your payment history and build a good credit score over time.

Don’t close old credit cards. Unless a card has a high annual fee and provides few other rewards or benefits, keep the account open. Otherwise, you risk increasing your credit utilization ratio and lowering your average account age, which is worth another 15% of your credit score.

How Quickly Can I Upgrade My Bank of America Secured Credit Card to an Unsecured Card?

There is no rubric to determine how quickly you can convert a secured card from Bank of America to an unsecured card. Every cardholder will be treated as a unique case.

According to its website, Bank of America will “periodically review your account” to see if it can return the deposit on your secured card. The bank may look at your recent account activity, including spending and payment history, as well as your activity with your other loans and credit cards.

While there is no specific plan to follow, you can increase the odds of approval by making all loan and credit card payments on time. If you accidentally miss a payment, try to fix it as soon as possible. Only payments made 30 or more days late will be reported to the credit bureaus and appear on your credit reports.

Does Bank of America Offer a Business Credit Card?

Even though Bank of America is known for its consumer and retail credit cards, it also offers business credit cards for entrepreneurs and small business owners. The bank currently has six different business credit cards to choose from, including a cobranded card with Alaska Airlines:

- Business Advantage Customized Cash Rewards credit card

- Business Advantage Unlimited Cash Rewards credit card

- Business Advantage Travel Rewards credit card

- Alaska Airlines Business credit card

- Platinum Plus® Mastercard® Business card

- Business Advantage Unlimited Cash Rewards Secured credit card

The last one is a secured card for business owners with less-than-perfect credit. It provides a great opportunity to build up your credit history with consistent on-time payments.

What is the Best Credit Card that Bank of America Offers?

The best credit card option from Bank of America depends on what you’re looking for in a card. If you want a card with exceptional travel benefits, then the Bank of America® Travel Rewards credit card may be best for you.

But if you just want to earn cash back, the Bank of America® Customized Cash Rewards credit card may be the better choice. If you have poor credit, one of the bank’s secured cards may be appropriate to help you build credit with responsible use.

Choosing a credit card is a personal choice dependent on your unique financial situation.

Bank of America Offers Something For Everyone

Whether you have no credit history or an excellent credit score, you can find a Bank of America card that fits your financial profile and your spending needs.

Remember, your credit score is the most significant factor affecting your credit card eligibility. If you have poor credit or no credit, then a Bank of America secured card is the best choice. But consumers with excellent credit can enjoy a cash back or travel rewards card.

Bank of America has so many cards on the market, that just about anyone can find a card that works for them.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![12 Best Credit Cards By Credit Score Needed ([updated_month_year]) 12 Best Credit Cards By Credit Score Needed ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/02/Best-Credit-Cards-By-Credit-Score-Needed.jpg?width=158&height=120&fit=crop)

![Discover Card: Credit Score Needed & 5 Best Cards ([updated_month_year]) Discover Card: Credit Score Needed & 5 Best Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/11/discovercard2.png?width=158&height=120&fit=crop)

![6 Top Cards: Credit Score Needed for Wells Fargo ([updated_month_year]) 6 Top Cards: Credit Score Needed for Wells Fargo ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/cover-2.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='5859' field_choice='title']: Review & Credit Score Needed ([updated_month_year]) [card_field card_choice='5859' field_choice='title']: Review & Credit Score Needed ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/01/shutterstock_1023516253-1.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='29774' field_choice='title']: Credit Score Needed for Approval ([updated_month_year]) [card_field card_choice='29774' field_choice='title']: Credit Score Needed for Approval ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/02/reserve--1.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='11298' field_choice='title']: Review & Credit Score Needed([updated_month_year]) [card_field card_choice='11298' field_choice='title']: Review & Credit Score Needed([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/unlimited-cover.jpg?width=158&height=120&fit=crop)

![Capital One Platinum Card: Credit Score Needed for Approval ([updated_month_year]) Capital One Platinum Card: Credit Score Needed for Approval ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/01/Capital-One-Platinum-Credit-Score-Needed.jpg?width=158&height=120&fit=crop)