In this review of pre-approved credit cards by issuer, we describe how to get a credit card with a minimum of fuss. We look at the pre-approval processes of five major card issuers: Capital One, Chase, Discover, American Express, and Citi.

While pre-approval does not guarantee final approval, it’s a pretty good indication that your credit card application will ultimately sail through, barring unexpected problems.

Credit card preapproval is a nice feature for all consumers but especially important to folks with bad, thin, or no credit. For this reason, we’ve included credit cards for those with less-than-excellent credit. In all cases, credit card pre-approval will not harm your credit score nor obligate you to complete the application process.

Pre-Approved Capital One Credit Cards

About 10.5% of the cardmember population have a Capital One credit card in their wallets. That’s approximately 62 million cards held by consumers who choose Capital One for its wide range of acceptable credit scores, around-the-clock customer service, and free services like Credit One and Eno (where you can get a virtual card number upon request).

Here are our top-ranked Capital One credit cards — you can click the See Details links to learn more about each offer.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won’t expire for the life of the account and there’s no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% – 29.99% (Variable)

|

$0

|

Excellent, Good

|

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won’t expire for the life of the account and there’s no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% – 29.99% (Variable)

|

$0

|

Excellent, Good

|

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options

- Miles won’t expire for the life of the account and there’s no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% – 29.99% (Variable)

|

$95

|

Excellent, Good

|

- Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Earn 8% cash back on Capital One Entertainment purchases

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus cash back won’t expire for the life of the account and there’s no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% – 29.99% (Variable)

|

$0

|

Excellent, Good

|

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% – 29.99% (Variable)

|

$395

|

Excellent

|

Capital One has will allow you to prequalify for some of its most popular cards. You’ll receive a credit card pre-approval decision in seconds and can complete the application process without reentering any information.

Capital One allows you to own up to two of its credit cards at any one time, and it is the fourth-largest card issuer in terms of outstanding balances.

Pre-Approved Chase Credit Cards

JPMorgan Chase is the largest credit card issuer, with a market share of 16.6% and about 92 million cards in circulation. But Chase no longer offers a page on its site that allows users to see which cards they qualify for.

The only way to find Chase preapproval is to log in to your Chase account, go to “Open an account,” and select “Just for you” to see which Chase credit card offers you may be prequalified to apply for.

Chase caters to cardholders with good to excellent credit, choosing not to compete for consumers with bad credit. It does not offer a secured card. Our favorite Chase cards are as follows:

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) – worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% – 29.24%.

- No annual fee – You won’t have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% – 29.24% Variable

|

$0

|

Good/Excellent

|

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

- Get a free year of Instacart+ and a $100 Instacart credit automatically upon approval. Membership auto-renews. Terms apply.

- Earn 5% cash back on Instacart app and Instacart.com purchases

- Earn 5% cash back on travel purchased through the Chase Travel Center, including flights, hotels and more

- Earn 2% cash back at restaurants, gas stations and on select streaming services

- Earn 1% cash back on all other purchases

- No annual card fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.24% – 28.99% Variable

|

$0

|

Good/Excellent

|

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That’s $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won’t be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more – your points don’t expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24%-26.24% Variable

|

$95

|

Good/Excellent

|

This issuer stresses the synergies between its credit card and banking operations to attract and keep customers. In addition, the issuer has one of the most impressive loyalty programs, Chase Ultimate Rewards, where you can use reward points for travel and shopping.

Be careful not to get tripped up by the Chase 5/24 rule limiting you to no more than five credit or charge cards (from any issuer) opened within the last 24 months. This will shut down your preapproved offer in its tracks.

Pre-Approved Discover Credit Cards

Discover is both a credit card issuer and payments network, with an outstanding balance market share of 8.2%. Its cards are accepted at 99% of all locations that accept any credit card. You can obtain pre-approval for any of its cards by completing a short online questionnaire.

Our top-ranked Discover cards include offers for cash back, miles, and lengthy 0% APR promotions.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% – 28.24% Variable APR

|

$0

|

Excellent/Good

|

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% – 28.24% Variable APR

|

$0

|

Excellent/Good

|

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers – only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more.

- 0% intro APR for 15 months on purchases. Then 17.24% – 28.24% Standard Variable Purchase APR will apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Discover is accepted nationwide by 99% of the places that take credit cards.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% – 28.24% Variable APR

|

$0

|

Excellent/Good

|

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% – 28.24% Variable APR

|

$0

|

Excellent/Good

|

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% – 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% – 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

Discover cards are popular because they never charge an annual fee and offer a first-year Cashback Match or Mile-for-Mile Match to a new cardmember. They also attract thousands of students each year with two different credit card offerings just for them.

You are allowed to own up to two Discover credit cards at the same time.

Pre-Approved American Express Credit Cards

American Express has the fifth-largest market share — 10.4% of outstanding balances — and is the third-largest credit card payments network, behind Visa and Mastercard. Originally an issuer of charge cards, it now also offers a full roster of credit cards — including the infamous Amex Platinum Card — for consumers and businesses.

Its best offerings include a mix of no-, modest-, and high-annual-fee cards, as well as its legendary, invitation-only Centurion Card.

- Earn 150,000 Membership Rewards® points after you use your new card to make $8,000 in purchases in your first 6 months of Card Membership

- Earn 5X Membership Rewards® points for flights booked directly through airlines or American Express Travel, on up to $500,000 on these purchases per calendar year. Also earn 5X Membership Rewards® points on prepaid hotels on AmexTravel.com. Earn 1X points on all other purchases.

- $200 annual hotel credit, $200 annual airline fee credit, $25 monthly Equinox credit, $15 monthly Uber cash credit, $50 bi-annual Saks Fifth Avenue credit, and more.

- Platinum Card Members have unlimited complimentary access to all locations of The Global Lounge Collection, including 1,400 airport lounges across 140 countries.

- Automatic Marriott Bonvoy Gold Elite Status and Hilton Honors Gold Status. Enrollment required.

- Choose among three card designs

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% – 29.24% Pay Over Time

|

$695

|

Excellent

|

- Earn 90,000 Membership Rewards® points after you spend $6,000 on purchases on your new card in your first 6 months of card membership

- Earn 4X Points at U.S. supermarkets on up to $25,000 per calendar year in purchases. Also earn 4X Points at restaurants, including takeout and delivery, and 3X points on flights when booked directly with airlines or on amextravel.com. All other eligible purchases earn 1X point.

- No foreign transaction fees

- Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. Enrollment required.

- Delight your senses when you book The Hotel Collection with American Express Travel. Get a $100 experience credit to use during your stay. Minimum 2-night stay is required.

- $250 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% – 29.24% Pay Over Time

|

$250

|

Excellent

|

- Earn 120,000 Membership Rewards® points after you spend $15,000 on eligible purchases with your Card within the first 3 months of card membership

- Earn 5X Membership Rewards® points on flights and prepaid hotels on amextravel.com, 1.5X points on business categories and purchases of $5,000 or more on up to $2 million per calendar year, and 1X point for each dollar you spend on other purchases.

- Get up to $400 back per year toward U.S. purchases with Dell Technologies, up to $360 back per year for purchases with Indeed, and $120 back per year for wireless telephone service purchases on the Business Platinum Card, plus additional credits. Enrollment is required for all.

- Access to more than 1,400 lounges across 140 countries and counting with the American Express Global Lounge Collection®

- Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees, such as checked bags and in-flight refreshments, are charged by the airline to your Business Platinum Card® Account.

- $695 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.49% – 28.49% Pay Over Time

|

$695

|

Excellent

|

- Earn $250 back in the form of a statement credit after you spend $2,000 in purchases on your new Card within the first 6 months of Card Membership

- 3% cash back on groceries from U.S. supermarkets (on up to $6,000 per year in purchases, then 1%)

- 3% cash back on U.S. online retail purchases (on up to $6,000 per year in purchases, then 1%)

- 3% cash back at U.S. gas stations, 1% back on other purchases

- Introductory 0% APR for 15 months on purchases and balance transfers, then a variable rate applies

- Find out if you Pre-Qualify for the Blue Cash Everyday® Card or other offers in as little as 30 seconds

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.24% – 29.99% Variable

|

$0

|

Good

|

- Earn $250 back in the form of a statement credit after you spend $3,000 in purchases on your new Card within the first 6 months of Card Membership.

- Earn 6% cash back at U.S. supermarkets on up to $6,000 per year on purchases (then 1%). Also earn 6% cash back on select U.S. streaming subscriptions.

- Earn 3% cash back on transit, including U.S. gas stations, taxis/rideshare, parking, tolls, trains, buses, and more. All other purchases earn 1% cash back.

- $120 Equinox Credit – Use your Blue Cash Preferred Card to pay for Equinox+ at equinoxplus.com and receive $10 in monthly statement credits. Enrollment required.

- 0% intro APR for 12 months from the date of account opening, then a variable APR applies

- $0 intro annual fee for the first year, then $95

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 12 months

|

N/A

|

19.24% – 29.99% Variable

|

$0 intro annual fee for the first year, then $95

|

Excellent Credit

|

You can fill in this pre-qualification form to see which American Express cards you may be eligible for. You may be offered personalized deals, such as a higher signup bonus or lower APR.

At one time, you could own five Amex credit cards and charge cards, but reports indicate Amex tightened up to just four lending products per customer in 2020.

Pre-Approved Citi Credit Cards

Citibank is the second-largest U.S. credit card issuer based on its $101 billion in outstanding balances and its 11.8% market share. Citi credit cards appeal to consumers who care more about low APRs and fees than fancy rewards.

Nonetheless, its roster of cards includes those offering 0% introductory APRs for eligible purchases, balance transfer transactions (including a 0% introductory APR balance transfer promotion), cash advances, and/or cash rewards on each qualifying purchase. Our top-ranked Citi cards are as follows:

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% – 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% – 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

- Earn 60,000 bonus ThankYou® Points after you spend $4,000 in purchases within the first 3 months of account opening.

Plus, for a limited time, earn a total of 10 ThankYou® Points per $1 spent on hotel, car rentals, and attractions (excluding air travel) booked on the Citi Travel℠ portal through June 30, 2024. - Earn 3 Points per $1 spent at Gas Stations, Air Travel and Other Hotels

- Earn 3 Points per $1 spent at Restaurants and Supermarkets

- Earn 1 Point per $1 spent on all other purchases

- Annual Hotel Savings Benefit

- 60,000 ThankYou® Points are redeemable for $600 in gift cards or travel rewards at thankyou.com

- No expiration and no limit to the amount of points you can earn with this card

- No Foreign Transaction Fees on purchases

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% – 29.24% (Variable)

|

$95

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- 0% Intro APR on balance transfers and purchases for 15 months. After that, the variable APR will be 19.24% – 29.24%, based on your creditworthiness.

- Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases.

Special Travel Offer: Earn an additional 4% cash back on hotels, car rentals, and attractions booked on Citi Travel℠ portal through 6/30/2025. - No rotating bonus categories to sign up for – as your spending changes each billing cycle, your earn adjusts automatically when you spend in any of the eligible categories.

- No Annual Fee

- Citi will only issue one Citi Custom Cash® Card account per person.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 15 months Purchases and Balance Transfers

|

0% 15 months Purchases and Balance Transfers

|

19.24% – 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

- Discover one of Citi’s best cash back rewards cards designed exclusively for Costco members

- 4% cash back on eligible gas and EV charging purchases for the first $7,000 per year and then 1% thereafter

- 3% cash back on restaurants and eligible travel purchases

- 2% cash back on all other purchases from Costco and Costco.com

- 1% cash back on all other purchases

- No annual fee with your paid Costco membership and enjoy no foreign transaction fees on purchases

- Receive an annual credit card reward certificate, which is redeemable for cash or merchandise at U.S. Costco warehouses, including Puerto Rico

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.49% (Variable)

|

$0

|

Excellent

|

Additional Disclosure: Citi is a CardRates advertiser.

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 18.24% – 28.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is a balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater

- Get free access to your FICO® Score online.

- With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

- No Annual Fee – our low intro rates and all the benefits don’t come with a yearly charge.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 12 months on Purchases

|

0% 21 months on Balance Transfers

|

18.24% – 28.99% (Variable)

|

$0

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

You can pre-apply for any Citi credit card without a hard credit inquiry that could hurt your credit profile directly through their website.

How Do I Get Pre-Approved For a Credit Card?

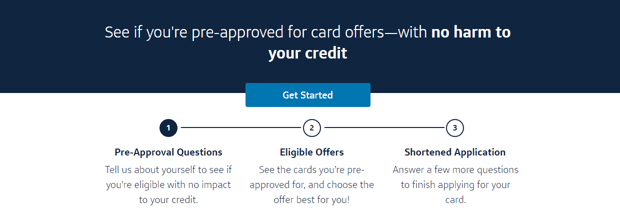

Pre-approval is an initial step you can take to see whether it’s feasible to own a particular credit card. Unlike a formal application, credit card preapproval does not require a hard pull of your credit and, therefore, won’t drive down your credit profile.

Most of the major credit card issuers have at least one pre-approved offer, and the procedure is pretty much standard across the industry. You can kick off the process by supplying some basic data — name, address, Social Security number, email address — on a card’s prequalification page.

The card issuer will give you an instant approval decision after you submit your data. If you are pre-approved, you’ll be asked to enter more extensive information and submit to a hard credit check. On the other hand, if you are turned down, you may be offered an alternative card, although this is not standard practice.

It is only after you apply for a card that you’ll know the final decision. At that time, you’ll be offered a customized APR and credit limit. If all seems good, you can e-sign the credit card agreement and receive your new card in seven to 10 days.

Is Credit Card Pre-Approval Guaranteed?

A pre-approval decision is guaranteed, but the decision can go either way. Normally, the decision is instantly rendered, so you won’t be left waiting for an answer.

A positive response to your pre-approval request is clearly a step toward getting you your credit card, but it is not a guarantee of final approval. The difference is the amount of checking a card issuer performs when you fill out a formal application, or more precisely, the additional information gathered by the credit card company.

If the application is successful, it means that you meet the issuer’s standards for a particular card. But if a hard credit check uncovers disturbing details, it can result in a decline notice.

The list of problems that can derail your card application include:

- A credit score below the card’s minimum.

- A large amount of existing debt relative to your income.

- Information that cannot be verified.

- Indications of irresponsible behavior, including missed payments, collections, repossessions, and bankruptcies.

- Previous debt settlements.

- Previous felonies or civil judgments.

- Previous negative experience with the issuer.

- Already owning the maximum number of credit cards permitted by the issuer.

- Failure to meet residency and/or age requirements.

- Current military status.

Pre-qualification will not necessarily turn up any of these derogatory items, but even so, neither you nor the issuer is obligated to reach a final agreement.

Which Credit Card Companies Offer Pre-Approval?

Almost all issuers offer at least one pre-qualified credit card. This is especially true for cards designed to meet the needs of consumers with bad credit.

Remember, a preapproved offer is an option that can be terminated at any time, as we saw during the COVID pandemic. Indeed, many issuers stopped accepting any new card applications during parts of the pandemic.

What Is the Easiest Credit Card to Get Approved

For?

There is no doubt that it’s easiest to get a secured credit card. The reason is simple: You must post a security deposit to guarantee that the credit card will be paid.

This removes the risk that the card issuer will have to take a loss on your credit account, making instant approval virtually automatic.

In almost all cases, the size of your security deposit will match your credit limit. After a period of on-time payments, the issuer may choose to increase your limit without requiring a further deposit, thereby converting your account to partially secured. Eventually, the issuer may refund your deposit and present you with an unsecured credit card.

If you have average credit or above, you should have no problem qualifying for most unsecured credit cards. But even if you have bad credit, certain unsecured cards are specifically designed for you. They usually include features like:

- High APRs: Expect an APR above 25% if your credit is bad. APRs as high as 36% are possible.

- Fees galore: Beyond the usual annual fee, these cards may charge a monthly maintenance fee, a signup fee, and fees for foreign transactions, extra cards, and even credit line increases.

- Tight credit lines: An unsecured credit card offer with credit lines as small as $200 is possible. Eventually, you can expect your credit line to increase, though probably not dramatically.

- Shorter grace periods: The grace period is an interval in which you do not have to pay interest on your card if your opening balance was zero. It extends from the last day of the billing cycle to the payment due date. Many credit cards routinely give you a 25-day grace period, but some cards for bad credit may cut the period to 21 days or eliminate it entirely.

- Few amenities: Expect the card to offer no cash back or other rewards and few benefits. About the only common perk is $0 fraud protection coverage.

Student credit cards are also easy to get if you qualify as at least a half-time student at an eligible institution. These cards do not require you to have good credit or even any credit at all. In addition, many offer rewards and benefits that you wouldn’t necessarily expect.

At the opposite end of the spectrum, it may be hardest to get a business credit card. You usually have to personally guarantee a business credit card or recruit a cosigner.

Do Pre-Approved Credit Cards Hurt Your Credit?

Fortunately, the pre-approval process does not affect your credit profile in any way. At most, the issuer may do a soft pull of your credit history, which does not count against you on your credit report.

However, even when a preapproved credit card skates through the process harmlessly, don’t expect the same treatment if you formally apply for a card. At that point, the issuer is likely to perform a hard credit check (except if you are applying for a secured or student card).

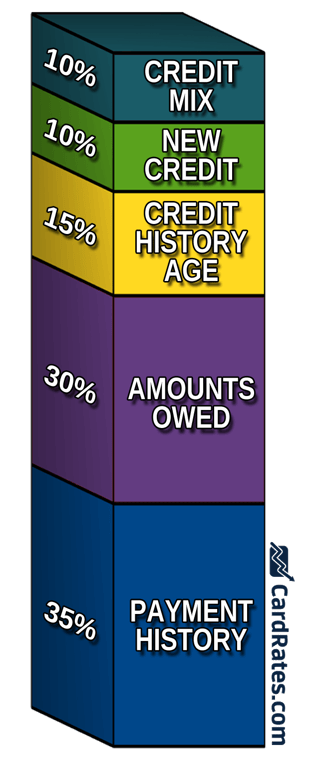

Here’s the rub: Your FICO score is composed of several factors, of which one, new credit, accounts for 10% of your overall score.

A credit bureau using FICO considers new credit, measured by hard pulls of your credit, to be a potential negative, especially when the credit bureau sees you making multiple attempts to get new credit within a relatively short period (i.e., six to 12 months).

The reason FICO dislikes new credit is that it may indicate financial distress. Your credit score may drop five to 10 points when a hard credit check occurs, and the damage can be worse if many hard checks occur within the same month or two.

Another negative occurs if your new credit card application is accepted. Fifteen percent of your FICO score stems from your credit history age — FICO rewards you for managing your credit accounts successfully over an extended period (i.e., seven years or more).

By adding new credit accounts, you reduce your average credit history age, putting downward pressure on your credit score.

On the other hand, a new credit account can also help your score by decreasing your credit utilization ratio (your credit used divided by total available credit). FICO counts your amounts owed as 30% of your score, and it wants to see your CUR below 30%.

A new credit card increases your available credit and lowers your CUR, but only if you don’t use the new credit line. If you deplete your new credit and increase your debt, your CUR will increase and do further damage.

Here’s an example: Suppose you have available credit of $10,000 and have used $5,000 of it, giving you a CUR of 50%. You then get a new card with a $2,000 credit limit that you immediately exhaust. Your new CUR is now ($7,000 divided by $12,000), or 58.33%.

Had you kept the preapproved credit card on the shelf, your new CUR would have been ($5,000 divided by $12,000), or 41.67%. In support of your credit score, this would be the wiser choice.

The most important factor to your credit score is your payment history — always make your credit card bill payment on time to maintain healthy credit scores. Most card issuers offer you a free credit score, usually updated monthly, to help you track your credit history.

Compare Pre-Approved Credit Cards By Issuer

Our review of pre-approved credit cards by issuer strongly indicates the card issuers’ desire to recruit new cardholders. By offering a pre-approval option with no negative consequences, issuers can start you on a journey that they hope will end in you getting a new card, making many eligible purchases, and financing those eligible purchases over multiple billing periods.

A pre-approved credit card is good for you too. It won’t hurt your credit score and keeps you from wasting time applying for a card that is beyond your reach.

You can use this review to identify the cards with pre-approval that interest you the most. Then, simply click on the APPLY NOW link to begin the pre-approval process that will, hopefully, get you the credit card you want.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![6 Easiest Credit Cards to Get Approved For ([updated_month_year]) 6 Easiest Credit Cards to Get Approved For ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/02/Easiest-Credit-Cards-to-Get-Approved-For.jpg?width=158&height=120&fit=crop)

![9 Easy Credit Cards to Get Approved For ([updated_month_year]) 9 Easy Credit Cards to Get Approved For ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/Easy-Credit-Cards-to-Get-Approved-For.jpg?width=158&height=120&fit=crop)

![11 Easiest Loans To Get Approved For ([updated_month_year]) 11 Easiest Loans To Get Approved For ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/07/Easiest-Loans-To-Get-Approved-For.jpg?width=158&height=120&fit=crop)

![[current_year] Cash Advance Limits by Issuer ([updated_month_year]) [current_year] Cash Advance Limits by Issuer ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/12/shutterstock_2980733.jpg?width=158&height=120&fit=crop)

![5 Pre-Qualified Credit Cards For Bad Credit ([updated_month_year]) 5 Pre-Qualified Credit Cards For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Pre-Qualified-Credit-Cards-for-Bad-Credit.jpg?width=158&height=120&fit=crop)

![18 Best Pre-Approval Credit Cards: 100% Online ([updated_month_year]) 18 Best Pre-Approval Credit Cards: 100% Online ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/09/preapprove-23.png?width=158&height=120&fit=crop)