It’s a good idea to know the cash advance limits on your credit cards before asking an ATM to start spitting out money. As it turns out, each card and card issuer has set limits on the maximum cash advance you can get, further tempered by factors such as your current balance and daily ATM withdrawal limit.

Read on for a rundown on how several popular credit card companies control how much cash you can borrow from their cards.

Amex | BoA | Capital One | Chase | Citi

1. American Express Cash Advance Limit: $10,000

offers a sizable number of both credit cards and charge cards. The former lets you stretch payments over multiple months whereas the latter requires full payment by the next due date (unless you sign up for an Amex program that allows you to stretch your repayments).

We found a maximum cash advance limit of $10,000 on the American Express Centurion® Card (which can only be applied for by invitation), followed by $8,000 on the The Platinum Card®, $6,000 on the American Express® Gold Card, and $3,000 on the American Express® Green Card. There may also be a limit on the number of times and the cash amounts you can withdraw money from ATMs in a given time period.

- Earn 150,000 Membership Rewards® points after you use your new card to make $8,000 in purchases in your first 6 months of Card Membership

- Earn 5X Membership Rewards® points for flights booked directly through airlines or American Express Travel, on up to $500,000 on these purchases per calendar year. Also earn 5X Membership Rewards® points on prepaid hotels on AmexTravel.com. Earn 1X points on all other purchases.

- $200 annual hotel credit, $200 annual airline fee credit, $25 monthly Equinox credit, $15 monthly Uber cash credit, $50 bi-annual Saks Fifth Avenue credit, and more.

- Platinum Card Members have unlimited complimentary access to all locations of The Global Lounge Collection, including 1,400 airport lounges across 140 countries.

- Automatic Marriott Bonvoy Gold Elite Status and Hilton Honors Gold Status. Enrollment required.

- Choose among three card designs

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% - 29.24% Pay Over Time

|

$695

|

Excellent

|

- Earn 90,000 Membership Rewards® points after you spend $6,000 on purchases on your new card in your first 6 months of card membership

- Earn 4X Points at U.S. supermarkets on up to $25,000 per calendar year in purchases. Also earn 4X Points at restaurants, including takeout and delivery, and 3X points on flights when booked directly with airlines or on amextravel.com. All other eligible purchases earn 1X point.

- No foreign transaction fees

- Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. Enrollment required.

- Delight your senses when you book The Hotel Collection with American Express Travel. Get a $100 experience credit to use during your stay. Minimum 2-night stay is required.

- $250 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% - 29.24% Pay Over Time

|

$250

|

Excellent

|

- Earn 40,000 Membership Rewards® Points after you spend $3,000 on purchases on your new card in your first 6 months of card membership

- Earn 3X points on restaurants, including takeout and delivery, and 3X points on transit and travel — all other purchases earn 1X point per $1 spent

- Receive up to $189 per calendar year in statement credits when you pay for your CLEAR membership with the American Express® Green Card

- Find out if you Pre-Qualify for the American Express® Green Card or other offers in as little as 30 seconds.

- Use the American Express® Green Card to purchase lounge access through LoungeBuddy and receive up to $100 in statement credits per calendar year

- No foreign transaction fees

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% - 29.24% Pay Over Time

|

$150

|

Good/Excellent

|

American Express offers you two ways to withdraw cash from an ATM (or from a teller). The first method, which Amex calls Cash Advance, is a true cash advance feature that lets you borrow against the card’s credit line (minus your existing balance). Alternatively, you can use the card’s Express Cash feature to access cash from a linked financial institution account (such as a checking account), similar to how a debit card works.

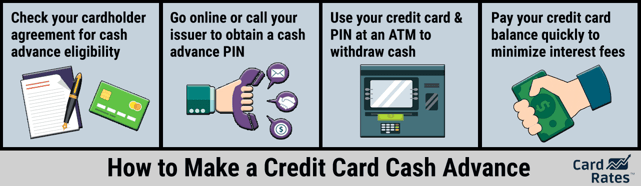

A 5% transaction fee applies for an ATM cash advance, plus any fee charged by the ATM operator, with a minimum charge of $10. You’ll need to obtain a four-digit PIN from Amex to use your credit card as an ATM card. Interest charges accrue starting on the transaction date — there is no grace period.

2. Bank of America Cash Advance Limit: 30% of Credit Limit

uses the term “Bank Cash Advances” to refer to advances via an ATM, over the counter, same-day online, and an overdraft protection cash advance feature. The total amount of cash available for cash advances is equal to the cash limit currently assigned to you on your credit card. The cash credit limit is 30% of your total credit limit.

We’ve identified the Bank of America® Customized Cash Rewards credit card as having a credit limit as high as $95,000, although the average credit limit is certainly much lower. Presumably, the cash credit limit for this lucky cardholder would be 30% of $95,000, or $28,500.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- Receive 60,000 online bonus points - a $600 value - after you make at least $4,000 in purchases in the first 90 days of account opening.

- Earn unlimited 2 points for every $1 spent on travel and dining purchases and unlimited 1.5 points for every $1 spent on all other purchases. No limit to the points you can earn and your points don't expire as long as your account remains open.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means you could earn 2.5-3.5 points on travel and dining purchases and 1.87-2.62 points on all other purchases, for every $1 you spend.

- Redeem for cash back as a statement credit, deposit into eligible Bank of America® accounts, credit to eligible Merrill® accounts, or gift cards or purchases at the Bank of America Travel Center.

- Get up to $100 in Airline Incidental Statement Credits annually and TSA PreCheck®/Global Entry Statement Credits of up to $100, every four years.

- Travel Insurance protections to assist with trip delays, cancellations and interruptions, baggage delays and lost luggage.

- No foreign transaction fees.

- Low $95 annual fee.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.24% - 27.24% Variable APR on purchases and balance transfers

|

$95

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The cash advance transaction fee is $10 or 3% to 5% of the amount of each transaction, whichever is greater and depending on the type of advance. For overdraft protection cash advances, the fee is $12 per transaction.

Any outstanding or pending cash advances reduce the amount available for new advances. You need to create a PIN, using the bank’s website or mobile app, before your first cash advance.

3. Capital One Cash Advance Limit: 30% to 50% of Credit Limit

credit cards set cash advance limits at 30% to 50% of the total credit limit, depending on your creditworthiness. The cash advance fee is either $10 or 3% of the amount of each cash advance, whichever is greater. A daily ATM withdrawal limit of $600 on ATM cash withdrawal transactions applies to ATM cash advances.

In terms of the highest available credit line from a Capital One card, we came across one reviewer who reported an initial $50,000 credit limit from the Capital One Venture Rewards Credit Card, implying a cash advance limit up to $25,000. However, the average credit limit for this card is in the range of $5,000 to $10,000.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

You need a PIN to get an ATM withdrawal for a cash advance, but no PIN is needed for an in-branch advance as long as you have suitable identification.

4. Chase Cash Advance Limit: 5% of Credit Limit

The Chase Sapphire Preferred® Card has an average credit limit of $10,000, although remarks on Quora speak of a $500,000 credit limit. That’s the highest limit we’ve seen for any Chase credit card.

With a cash advance limit of 5% of the overall credit limit, that high-flying card would permit cash advances of up to $25,000.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

Chase charges either $10 or 5% of the amount of each cash advance transaction, whichever is greater. You will need a PIN for an ATM cash advance, but not for an in-branch one.

As is true for many credit cards, the cash advance APR on Chase cards is usually higher than the purchase APR.

5. Citi Cash Advance Limit: 50% of Credit Limit

Citi caps cash advances at no more than 50% of your overall credit limit. One reviewer reported a $50,000 credit limit on the Citi Double Cash® Card, which would translate into a $25,000 cash advance limit.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% - 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

- Earn 60,000 bonus ThankYou® Points after you spend $4,000 in purchases within the first 3 months of account opening.

Plus, for a limited time, earn a total of 10 ThankYou® Points per $1 spent on hotel, car rentals, and attractions (excluding air travel) booked on the Citi Travel℠ portal through June 30, 2024. - Earn 3 Points per $1 spent at Gas Stations, Air Travel and Other Hotels

- Earn 3 Points per $1 spent at Restaurants and Supermarkets

- Earn 1 Point per $1 spent on all other purchases

- Annual Hotel Savings Benefit

- 60,000 ThankYou® Points are redeemable for $600 in gift cards or travel rewards at thankyou.com

- No expiration and no limit to the amount of points you can earn with this card

- No Foreign Transaction Fees on purchases

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% - 29.24% (Variable)

|

$95

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- 0% Intro APR on balance transfers and purchases for 15 months. After that, the variable APR will be 19.24% - 29.24%, based on your creditworthiness.

- Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases.

Special Travel Offer: Earn an additional 4% cash back on hotels, car rentals, and attractions booked on Citi Travel℠ portal through 6/30/2025. - No rotating bonus categories to sign up for – as your spending changes each billing cycle, your earn adjusts automatically when you spend in any of the eligible categories.

- No Annual Fee

- Citi will only issue one Citi Custom Cash® Card account per person.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 15 months Purchases and Balance Transfers

|

0% 15 months Purchases and Balance Transfers

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

A cash advance fee will apply, and Citi cards charge a higher APR for cash advances than it does for credit card purchases. You can get a cash advance at a Citibank or UnionPay ATM, but you must first obtain a 4-digit passcode, (unnecessary for in-branch cash advances).

What is a Credit Card Cash Advance?

A credit card cash advance is a loan from the issuer of your credit card. Like any loan, it has an interest rate (the card’s cash advance APR) and other terms such as daily interest accrual and monthly minimum payment due.

Usually, cash advance APRs exceed 20%, making this an expensive way to borrow money. Nonetheless, it’s also just about the fastest way to get an emergency loan since the maximum loan amount is already pre-authorized.

That maximum amount is usually a percentage of a credit card’s overall credit limit. Charge cards, which include many cards offered by American Express, have no stated credit limits, so these cards establish fixed maximum cash advance limits.

How Does a Cash Advance Work?

When you apply for a credit card, the credit card company assesses your creditworthiness. If your application is approved, you’ll receive the card along with a credit limit and, if cash advances are permitted, a limit on these as well.

You can get a cash advance by using your credit card account as an ATM card for an ATM withdrawal. However, you first must obtain a PIN to allow you to use the ATM.

Other ways to get a cash advance include interacting with a teller at a financial institution, requesting a direct deposit online or through a mobile app, or automatically covering an overdraft on a linked checking account or another financial account.

The amount you can borrow is capped by your cash advance limit (or your credit limit if there is no separate cash advance limit), your current cash advance balance, and any particular daily limits (such as those often imposed on ATM cash withdrawal transactions).

Fees, including an ATM fee, are tacked onto the advance amount and interest begins accruing on a daily basis starting on the day you received the cash advance.

You can repay your cash advance at any time but you must make at least the minimum payment monthly. Failure to do so will result in late fees and possibly a penalty APR. Because the APRs on cash advances are high, you normally only take an advance for emergencies and repay them as quickly as possible.

How Do I Know My Cash Advance Limit?

Your monthly credit card statement can tell you your cash advance limit. Find the standardized account summary section for the end-of-cycle figures, including:

- Cash advances made during the cycle

- Credit line

- Available credit

- Cash access line

- Available for cash

Your cash access line is the limit for cash advances. It usually represents a percentage of your overall credit limit, or simply a fixed amount if your card has no preset spending limits.

The amount available for cash advances is correct as of the last day of the billing cycle. Obviously, any repayments or additional advances since that date will change this figure.

Two more important figures in the account summary section are the fees and finance charges incurred during the billing cycle. These figures will include any of the cycle’s fees for new advances and the finance charge you incurred during the cycle on your cash advances. Interest on cash advances accrues daily, starting with the card transaction date.

What is the Maximum Cash Amount I Can Withdraw?

The maximum cash advance you can withdraw is called the cash access line in your credit card statement. That number remains unchanged unless you are granted a higher cash advance limit. The item “available for cash” on your statement refers to how much was available for cash advances as of the last day of the billing cycle.

“Available for cash” is equal to the cash access line minus cash advances. For example, if you have an $800 cash access line and have taken $300 in cash advances, you still have $500 available for cash.

Any activity involving cash advances occurring after the cycle end date will appear on the next statement, but you can get up-to-the-minute figures online and/or via a mobile app.

Which Credit Card Gives the Highest Cash Advance Amount?

To identify the credit card account with the highest cash advance amount, look at the percentage of the overall credit limit available for cash advances. In truth, the amount you will have available for cash advances depends on your credit rating and your overall credit limit.

Naturally, cards that market to consumers with excellent credit should have the highest cash advance limits. Many cards set the maximum cash advance amount at 30% to 50% of the overall credit limit. Our top-rated cards for excellent credit are as follows:

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

While Amex lists a $10,000 cash advance limit on its ultra-ritzy American Express Centurion® Card, we have the sneaking suspicion that cardholders can negotiate a higher limit — much higher.

Can I Withdraw More Than My Cash Advance Limit?

Card issuers set their own policies when it comes to advancing cash in excess of your approved limit. Some issuers may simply decline the transaction. However, other issuers may approve the transaction but charge you penalty fees and perhaps a penalty APR.

If you are allowed to withdraw more than your cash advance limit, you will be expected to repay the overage and fees by the next due date. The overage will be added to the minimum payment due.

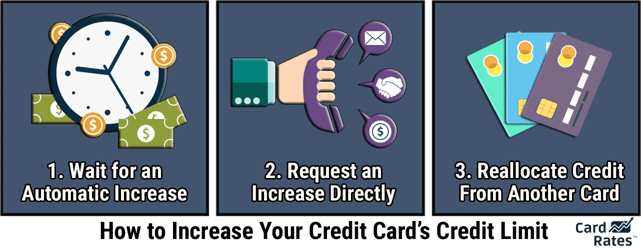

If you find yourself repeatedly needing over-limit cash advances, consider asking the card issuer for a higher cash advance limit or look for a new card that will be willing to grant you a higher cash access line. You can improve your chances of qualifying for a higher credit limit by taking steps to boost your credit score, decreasing your debt-to-income and/or credit utilization ratio, reducing overall credit card debt, and paying your bills on time.

Does a Cash Advance Affect My Credit Limit?

Typically, your credit limit does triple duty. It governs the amount available for your credit card purchases, cash advances, and each balance transfer. This is true even if all three types of transactions incur a different interest rate, as is often the case for a balance transfer or cash advance.

Taking a cash advance doesn’t affect your credit limit per se, but it does reduce your credit available. For example, if your overall credit limit is $5,000 and you take a $500 cash advance, your remaining credit available is $4,500. Typically, the amount available for a cash advance is some percentage of your overall credit limit.

If you find yourself constantly hitting your card’s cash withdrawal limit, consider asking the issuer for a credit line increase. You can help the process by taking steps to improve your credit score, such as making all your payments on time and not carrying a large cash advance balance on your cards.

Alternatively, you may want to get a credit card with a more generous credit limit, either as a replacement for your current one or simply as an additional source of credit.

Cash Advances Can Help When You’re in a Bind, But Should Only Be Used with Caution

Credit cards provide revolving credit, meaning you are given an approved credit line you can use as you wish. So, when you want a cash advance, you can get one up to the card’s cash withdrawal limit without having to fill out a new credit application.

The revolving nature of credit cards is very attractive because you can use your credit immediately and you only pay interest on the credit you use. Thus, if you need money in a hurry, a credit card cash advance up to the cash advance limits can really save your bacon. But beware, with APRs up to 30% or higher, the cost can mount up quickly and, in the worst case, throw you into a credit card debt spiral that can lead to bankruptcy.

Consider some other ways to handle a sudden need for cash. Start with an emergency savings fund where you stash up to six months of expenses. If you own a home, an excellent source of low-cost cash is a home equity line of credit. It’s also a revolving credit facility, but the interest rate is much lower than for credit card APRs.

Another preferable alternative is an online personal loan. If you qualify, you can get funding in a day or two, and the interest rate should be below that for credit card advances.

In all cases, do not get a payday loan. It’s hard to find a higher interest rate than the one you’ll be charged on a payday loan.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![6 Easy Approval Cash Advance Loans ([updated_month_year]) 6 Easy Approval Cash Advance Loans ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/10/shutterstock_1693980259--1.jpg?width=158&height=120&fit=crop)

![7 Cash Advance & Personal Loans For No Credit ([updated_month_year]) 7 Cash Advance & Personal Loans For No Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/05/Cash-Advance-Personal-Loans-For-No-Credit.jpg?width=158&height=120&fit=crop)

![Best Cash Advance Credit Cards of [updated_month_year] Best Cash Advance Credit Cards of [updated_month_year]](https://www.cardrates.com/images/uploads/2021/09/Best-Cash-Advance-Credit-Cards.jpg?width=158&height=120&fit=crop)

![7 Cash Advance Loans For Bad Credit ([updated_month_year]) 7 Cash Advance Loans For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Cash-Advance-Loans-For-Bad-Credit.jpg?width=158&height=120&fit=crop)

![15 Pre-Approved Credit Cards By Issuer ([updated_month_year]) 15 Pre-Approved Credit Cards By Issuer ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/07/Pre-Approved-Credit-Cards-By-Issuer.jpg?width=158&height=120&fit=crop)

![Hardship Accommodations By Credit Card Issuer in [current_year] Hardship Accommodations By Credit Card Issuer in [current_year]](https://www.cardrates.com/images/uploads/2021/08/Hardship-Accommodations-By-Credit-Card-Issuer.jpg?width=158&height=120&fit=crop)