Credit card use in America is growing. Americans currently have 511.4 million credit cards, and 61% of U.S. consumers have at least one credit card, with the average person carrying four cards in their wallet, according to The Ascent.

With so much love for these plastic payment methods, it’s no surprise credit card companies are constantly trying to win over new cardholders. And one way they do this is by sending out preapproved offers to potential customers.

When you get a preapproved credit card offer in the mail, there’s a bit of satisfaction knowing that a company is seeking you out as a potential customer. Not to mention, you may have been excited about the competitive interest rate offered by the given card or the extensive incentives touted in the letter.

Whether the offer letter piqued your interest or ended up in the trash, it’s important to know just how these preapprovals work. Ultimately, a preapproved credit card offer does not come with any guarantees.

A Prepapproval Offer Does Not Guarantee Approval When You Apply

The reality is, credit card companies use many different marketing strategies to attract new customers, and preapproved offers are no different. Such offers are sent directly to consumers to encourage new account sign-ups but do not assure final account approval. It’s more of an initial invitation to apply for the credit card than assurance you will be approved.

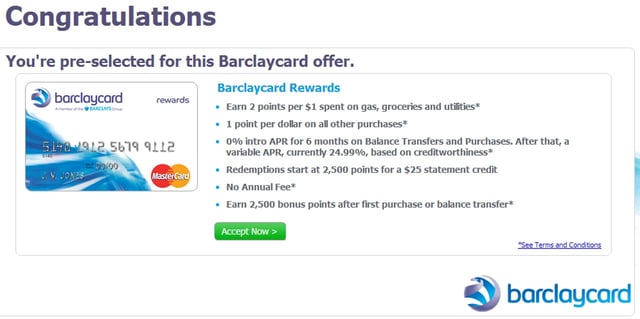

Although final account approval isn’t guaranteed, preapproved credit card offers aren’t sent at random. If you received an offer, it is likely you have been vetted through a prescreening process conducted by the card issuer. This means you have been identified as an ideal customer because you meet some basic criteria the credit card company requires to open a new account, such as a minimum credit score or positive on-time payment history.

Preapproval simply means you meet the issuer’s basic approval criteria — it does not guarantee approval if you decide to apply. Photo credits: myFICO® Forums.

Such information is gathered by credit card companies using a soft pull on your credit report and does not impact your credit score.

In fact, credit card companies work directly with consumer reporting agencies to pinpoint a list of people in their database who meet eligibility requirements to execute a more targeted marketing approach. This allows card issuers to send preapproved offers to consumers who are more likely to get approved rather than wasting time and resources sending offers to those who would not get approved.

Since a soft pull doesn’t offer the full picture in terms of your creditworthiness, this prescreening process does not guarantee final account approval. So, if you want to get your hands on that new card, you must fill out the entire application first, including additional details such as your gross annual income, monthly rent or mortgage payments, and full Social Security number. At this point, a hard credit inquiry will be made on your credit file before approval can be determined.

Keep in mind, a hard inquiry on your credit report can lower your credit score and multiple applications within a short period of time can have a significant impact on your overall credit.

Most Card Issuers Allow You to Prequalify On Their Site

Preapproved credit card offers can come through the mail, email, or even by phone. But written letters and verbal offers aren’t the only way to determine whether you may be eligible for that shiny new piece of plastic.

In fact, you don’t have to receive a preapproval to apply for a credit card. This is especially good to know for anyone who is actively searching for a new credit card. You can often check your preapproval status online directly through the credit card issuer’s website, which can give you that boost of confidence before going through the entire application process.

Proactively seeing whether you are preapproved for a credit card can save you the hassle of applying for credit cards you may not qualify for while preserving your credit since every hard inquiry can lower your score.

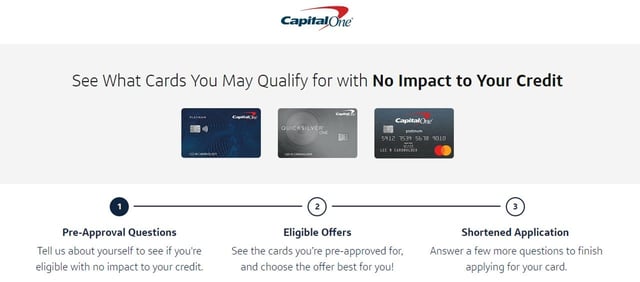

For instance, Capital One’s preapproval tool allows you to check whether you meet basic credit criteria for any of its cards with no impact on your credit score.

You can see whether you prequalify for a Capital One card on the bank’s website.

To find out if you’re preapproved, you may be required to enter personal data into an online form to determine your eligibility, including your name, address, and last four digits of your Social Security number. But this isn’t the only way to review your preapproval status for a credit card. You can visit a bank or credit union branch to check whether you’re preapproved for a credit card issued by that financial institution.

While you’re there, you may benefit from speaking with a representative who can guide you into applying for the card that best fits your needs.

Even shopping may present you with preapproved offers from store-branded credit cards. Many retailers have created systems to present people with preapproved store card offers right at check out, both in-person and online. Just make sure you understand the card’s full terms and benefits before applying, as reward redemption is often limited to that particular store or family of store brands, which may not work for you in the end.

Though preapproved credit card offers may be a bit misleading in the way they’re promoted, there’s nothing wrong with taking advantage of the offer and applying as long as the card makes sense for you. Oftentimes, preapproved credit card deals have better introductory bonuses and other incentives than what you would find online — and much better than those cards in your current wallet — making the offers worth exploring.

Before applying for any new card offer though, it’s important to review the credit card details in full, including the itty-bitty fine print at the bottom of every letter. Your goal should be to find a credit card that offers rewards that match your spending style to help you maximize benefits and score a competitive interest rate. And watch out for fees.

You Can Opt-Out of Prescreened Credit Offers

If you’re sick of the junk mail and want to cut down on excessive clutter or avoid tempting credit card offers, opting out is fairly simple. The Federal Trade Commission offers step-by-step instructions on how to temporarily pause or opt out completely from receiving prescreened offers. Or you can call 1-888-5-OPT-OUT.

Additionally, signing up with the National Do Not Call Registry is a free and easy way to reduce those unwanted telemarketing calls you get at home and on your mobile device. Just register your phone number at www.donotcall.gov or by calling 1-888-382-1222.

Lastly, you can opt out of receiving unsolicited commercial mail from many national companies for five years by registering through the Direct Marketing Association’s Mail Preference Service. Though this will drastically reduce the number of unsolicited mail you receive, it won’t fully put an end to mailings from those organizations that do not use this service.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Guaranteed-Approval Credit Cards With No Deposit ([updated_month_year]) 7 Guaranteed-Approval Credit Cards With No Deposit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/Guaranteed-Approval-Credit-Cards-With-No-Deposit.jpg?width=158&height=120&fit=crop)

![6 Guaranteed Installment Loans for Bad Credit ([updated_month_year]) 6 Guaranteed Installment Loans for Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/08/guaranteed--1.png?width=158&height=120&fit=crop)

![$5,000 Limit Credit Cards Guaranteed ([updated_month_year]) $5,000 Limit Credit Cards Guaranteed ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/01/5000-Limit-Credit-Card-Guaranteed.jpg?width=158&height=120&fit=crop)

![7 Guaranteed Approval Auto Loans ([updated_month_year]) 7 Guaranteed Approval Auto Loans ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/09/Guaranteed-Approval-Auto-Loans.jpg?width=158&height=120&fit=crop)

![13 Category Winners: Best Credit Card Offers ([updated_month_year]) 13 Category Winners: Best Credit Card Offers ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/cover-4.jpg?width=158&height=120&fit=crop)

![7 Best Credit Card Offers Right Now ([updated_month_year]) 7 Best Credit Card Offers Right Now ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/02/Best-Credit-Card-Offers-Right-Now.jpg?width=158&height=120&fit=crop)

![12 Best Credit Card Signup Bonus Offers ([updated_month_year]) 12 Best Credit Card Signup Bonus Offers ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/06/credit-card-signup-bonus-offers.jpg?width=158&height=120&fit=crop)