You’re approved!

Doesn’t that have a nice ring to it? Qualifying for a credit card is one of life’s little victories. To help you achieve that triumphant feeling, we’ve identified some of the easiest cards to get approved for.

These cards offer you your best shot at approval, whether your credit is fair, bad, or non-existent. If you’d like to establish or build your credit, one of these cards may be the perfect answer to your credit needs.

Unsecured | Students | No/Limited Credit | Balance Transfers | Secured | Prepaid

Easiest Unsecured Card to Get Approved For

The Surge® Platinum Mastercard® is designed to help you rebuild credit by reporting your payments each major credit bureau. You can prequalify for this unsecured credit card in less than 60 seconds by filling out a short form that includes your Social Security number and total monthly income.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply!

- Monthly Credit Score – Sign up for electronic statements, and get your Vantage 3.0 Score Credit Score From Experian

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

- See if you’re Pre-Qualified without impacting your credit score

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

See website for Details

|

See website for Details

|

29.99% APR (Variable)

|

$75 - $125

|

See website for Details*

|

Easiest Student Card to Get Approved For

To qualify for the Discover it® Student Cash Back card, you must be a college student, at least 18 years old, and enrolled in a two- or four-year college or university.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

Easiest Card to Get Approved For With No Credit History

The Capital One Platinum Secured Credit Card is our top choice for an easy to get card when you have no credit history.

You can make a larger initial deposit of up to $1,000 if you want a higher credit limit. You must have a bank account from which you can fund your deposit.

- No annual or hidden fees. See if you're approved in seconds

- Building your credit? Using the Capital One Platinum Secured card responsibly could help

- Put down a refundable security deposit starting at $49 to get a $200 initial credit line

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Limited, Bad

|

To be approved, your credit card application must be verified by Capital One and you must reside in the United States or a U.S. military location (excluding correctional institutions). Your monthly income must exceed your mortgage or rent payment by at least $425. In addition, you must be age 18 or older and possess a valid Social Security number.

You won’t be approved if you have an unresolved bankruptcy, already have two or more Capital One credit cards, or have a Capital One card that is past due, over its limit, or has been charged off within the past year.

Easiest Balance Transfer Card to Get Approved For

The Discover it® Secured Credit Card requires you to deposit cash collateral with Discover® Bank in an amount equal to your credit line.

You must be a U.S. resident, 18 or older to qualify, and you must authorize Discover to perform a hard pull of your credit reports and to contact your employer, bank, and other information sources. You must also allow Discover to contact you via text or phone.

- No credit score required to apply.

- No Annual Fee, earn cash back, and build your credit history.

- Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount, starting at $200. Bank information must be provided when submitting your deposit.

- Automatic reviews starting at 7 months to see if we can transition you to an unsecured line of credit and return your deposit.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get an alert if we find your Social Security number on any of thousands of Dark Web sites. Activate for free.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

10.99% Intro APR for 6 months

|

28.24% Variable APR

|

$0

|

New/Rebuilding

|

The security deposit account is FDIC insured. You can’t withdraw funds from the account, and you cannot be involved in any bankruptcy proceedings or lawsuits that may impact your security deposit account.

Easiest Secured Card to Get Approved For

The OpenSky® Secured Visa® Credit Card bends over backward to make approval easy. For starters, it does not subject applicants to credit checks, which means that your credit score will not be negatively impacted. The card reports your payments to the three major credit bureaus to help you build credit.

- New feature! Earn up to 10% cash back* on everyday purchases

- No credit check to apply. Zero credit risk to apply!

- Looking to build or rebuild your credit? 2 out of 3 OpenSky cardholders increase their credit score by an average of 41 points in just 3 months

- Get free monthly access to your FICO score in our mobile application

- Build your credit history across 3 major credit reporting agencies: Experian, Equifax, and TransUnion

- Add to your mobile wallet and make purchases using Apple Pay, Samsung Pay and Google Pay

- Fund your card with a low $200 refundable security deposit to get a $200 credit line

- Apply in less than 5 minutes with our mobile first application

- Choose the due date that fits your schedule with flexible payment dates

- Fund your security deposit over 60 days with the option to make partial payments

- Over 1.4 Million Cardholders Have Used OpenSky Secured Credit Card To Improve Their Credit

- *See Rewards Terms and Conditions for more information

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

25.64% (variable)

|

$35

|

Poor

|

Qualified applicants must be US citizens or permanent residents, at least 18, with a Social Security number or Individual Taxpayer Identification Number. You must have sufficient monthly income to cover all expenses, including card payments.

You’re not eligible if you’ve applied four or more times in the last 60 days for a Capital Bank credit card. Also, you can’t have more than one Capital Bank credit card.

Easiest Prepaid Card to Get Approved For

Let it be known that all prepaid cards are easy to get. There’s no credit check or income requirement to get a card, and they’re free to sign up for online.

The NetSpend® Visa® Prepaid Card is a cinch to obtain because you don’t need a bank account or to maintain a minimum balance. It costs $9.95 to buy the card at a retail location, but it’s free to apply for online:

- With Direct Deposit, you can get paid faster than a paper check.

- No late fees or interest charges because this is not a credit card.

- Use the Netspend Mobile App to manage your Card Account on the go and enroll to get text messages or email alerts (Message & data rates may apply).

- Card use is subject to activation and ID verification. Terms and Costs apply.

- Card issued by Pathward N.A., Member FDIC. Card may be used everywhere Visa debit card is accepted.

- See additional NetSpend® Prepaid Visa® details.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Up-to $9.95 monthly

|

Not applicable

|

As a prepaid account, you need not worry about overdraft fees, as you can only spend the amount on deposit. To qualify, you must be 18 or older, be able to prove your identity, and can lawfully enter into contracts in your state of residence.

Your deposited funds are maintained in an FDIC-insured account at Pathward.

What is the Easiest Credit Card to Get Approved For?

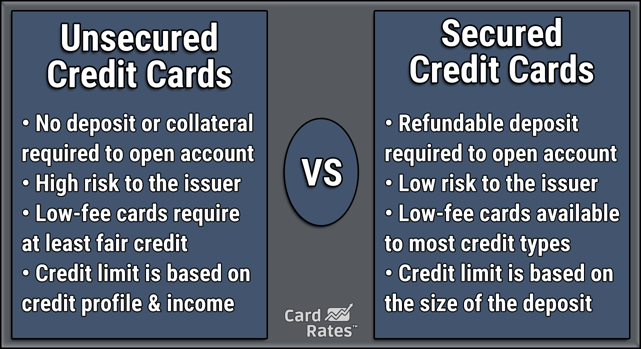

Without a doubt, secured credit cards are the easiest to obtain. By depositing cash collateral, you reduce the issuer’s credit risk.

This facilitates easy approval and relatively low APRs. We’ve recommended two secured cards in this article.

The OpenSky® Secured Visa® doesn’t require a credit check to obtain. Your credit limit will be equal to the amount you deposit.

The OpenSky® Secured Visa® doesn’t require a credit check to obtain. Your credit limit will be equal to the amount you deposit.

These cards are great for building credit because they report your payments to all three credit bureaus — Experian, TransUnion, and Equifax.

We also recommend the Capital One Platinum Secured Credit Card if you have no credit history. Your initial card limit will be $200, requiring a deposit of $49, $99, or $200. You can subsequently increase your deposit and credit line to $1,000.

To qualify for this card, you must be a US resident, age 18+, with sufficient monthly income and a valid Social Security number. You may be disqualified due to previous experiences with the issuer.

Finally, we recommend the Discover it® Secured Credit Card if you are looking to consolidate your credit card debt via balance transfers. You must be 18 or older, reside in the United States, and not be in active bankruptcy proceedings.

What is the Minimum Credit Score Needed to Get Approved For a Credit Card?

There is no set minimum score to obtain a credit card. Instead, cards are categorized by credit rating — excellent, good, fair, bad, and no/limited credit.

FICO credit scores range from 300 to 850, with scores below 580 considered to be bad. But you can get a type of credit card that ignores credit scores. Typically, these include secured, student, and prepaid cards.

Our top secured card for consumers with no credit is the Capital One Platinum Secured Credit Card. It’s easy to acquire because it’s secured by your cash deposit of $49 to $1,000. The minimum credit line is $200.

Requirements for this card are typical in terms of age and residency. Your monthly income must be at least $425 more than your monthly rent or mortgage payment. The biggest obstacle is that you cannot already have two or more Capital One cards.

Two other secured cards are similarly easy for bad- or no-credit consumers to obtain. The Discover it® Secured Credit Card is a good choice for folks with credit scores below 660 who are not currently in bankruptcy proceedings.

But the winner in terms of availability among secured cards is the OpenSky® Secured Visa® Credit Card that explicitly does not perform credit checks. The only real hurdle involves your previous experience with the issuing bank, Capital Bank (not to be confused with Capital One Bank).

Students can get the Discover it® Student Cash Back card without any credit score or credit history. They just have to demonstrate that they are at least 18 years old, have a source of income, and are enrolled in a two- or four-year school.

Though not included in this review, the Discover it® Student Chrome is equally easy to obtain. It differs only in the cash back it offers, but both of Discover’s student cards offer friendly introductory terms for first-time card users.

The NetSpend® Visa® Prepaid Card doesn’t require a credit check because it’s not a credit card. You simply load cash into the prepaid account and forget about overdraft fees or bank accounts. You must be 18+ years old and have proof of identity.

What Type of Credit Card Is Issued to Someone With Bad Credit?

People with poor credit are likely to be approved for cards with low credit limits and high fees. But not all cards for bad credit are “bad.”

The secured cards reviewed in this article have lower interest rates and fees than their unsecured counterparts.

While you won’t yet qualify for an American Express card, you can inch your way closer to one by using any credit card you qualify for now responsibly. Always pay your bill on time and keep your balance low to build credit.

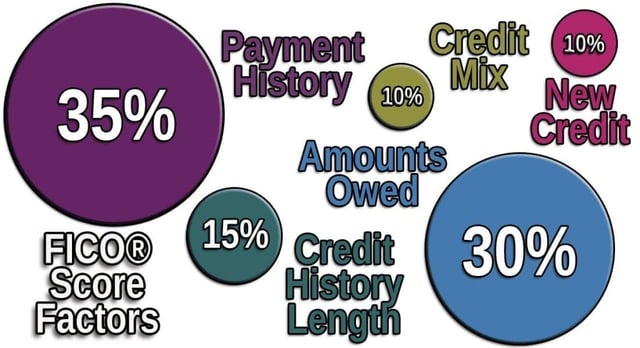

Payment history makes up 35% of your FICO Score, so paying on time will help you improve your credit scores.

You may also qualify for a store credit card, which is usually a closed-loop card issued by a bank that partners with a store, e.g., Target, Old Navy, Amazon, etc. Closed-loop means the store card can only be used for purchases made at that store, whether online or in person. Store cards usually issue reward points or cash back that can be redeemed for merchandise from the retailer or as a statement credit to cover your balance.

Ranking Methodology

Our rankings of the easiest credit cards to get approved for evaluated the approval criteria of more than 130 credit cards to determine the top 10. We looked at the ease of approval in each respective category and payment reporting to the credit bureaus to help applicants improve their credit scores with responsible card use.

CardRates’ reviews undergo a thorough editorial integrity process to ensure that content is not compromised by advertiser influence.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![11 Easiest Loans To Get Approved For ([updated_month_year]) 11 Easiest Loans To Get Approved For ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/07/Easiest-Loans-To-Get-Approved-For.jpg?width=158&height=120&fit=crop)

![15 Pre-Approved Credit Cards By Issuer ([updated_month_year]) 15 Pre-Approved Credit Cards By Issuer ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/07/Pre-Approved-Credit-Cards-By-Issuer.jpg?width=158&height=120&fit=crop)

![9 Easy Credit Cards to Get Approved For ([updated_month_year]) 9 Easy Credit Cards to Get Approved For ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/Easy-Credit-Cards-to-Get-Approved-For.jpg?width=158&height=120&fit=crop)

![15 Easiest Credit Cards to Get ([updated_month_year]) 15 Easiest Credit Cards to Get ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/12/easytoget.png?width=158&height=120&fit=crop)

![8 Easiest Approval Cards For Fair & Bad Credit ([updated_month_year]) 8 Easiest Approval Cards For Fair & Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/07/Easiest-Approval-Cards-For-Fair-Bad-Credit.jpg?width=158&height=120&fit=crop)

![6 Easiest Chase Cards to Get ([updated_month_year]) 6 Easiest Chase Cards to Get ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/easy2--1.png?width=158&height=120&fit=crop)

![#1 Easiest Capital One Card to Get ([updated_month_year]) #1 Easiest Capital One Card to Get ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/Easiest-Capital-One-Card-to-Get.jpg?width=158&height=120&fit=crop)

![7 Easiest Balance Transfer Cards to Get ([updated_month_year]) 7 Easiest Balance Transfer Cards to Get ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/07/Easiest-Balance-Transfer-Cards-to-Get.jpg?width=158&height=120&fit=crop)