If you’ve heard the buzz surrounding the American Express® “Black Card,” you already know that it’s the velvet rope of consumer credit options. This invite-only charge card, technically named the Centurion® Card from American Express, has been used to proclaim status, both in spending and in creditworthiness.

With all the hype, you may be wondering how to get a Black Card for yourself. But what is a Black Card? And what does it take to get an invite to this members-only club?

While we know that it’s an elite card used most often by celebrities and the ultra-rich, with the card itself being made of anodized titanium, less is known about exactly how to get your hands on one. That said, there are rumors of some rather strict requirements that must be met.

Invitation Only | For the Ultra-Rich | 10 “Easier to Get” Alternatives

Sorry, Black Cards Are By Invitation Only. But There’s Another “Black Card” You Can Apply For.

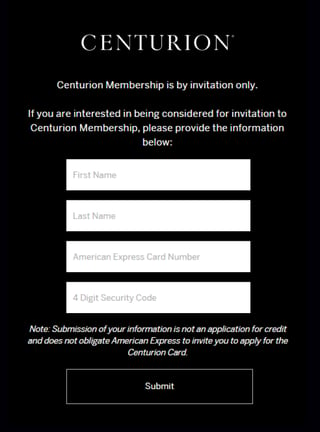

Like most elite experiences, the AMEX Black Card is invite-only at the moment, with no indication that this will change anytime soon. Loyal American Express cardholders are likely the most commonly invited, a list that includes both long-time business and personal charge card customers.

Since there is no way to officially apply without an invite, your best bet is to check the requirements for members to see if your spending habits and qualifications match up. Most people realize that it’s not about knowing how to get a Black Card, but rather managing the very strict thresholds for eligibility.

If you’re the type to spend hundreds of thousands a year on a credit card, you can request consideration for an invitation directly from Amex. This card offers unique perks for members, including access to airline lounges and VIP treatments at spas and hotels.

If you’ve decided you probably can’t get your hands on the elusive Centurion card anytime soon, check out the Mastercard® Black Card™. This card has a long list of perks and can be applied for by anyone who has excellent credit:

- Ideal for those seeking a premium travel card that doubles as an everyday workhorse, paired with elevated service beyond the ordinary. Leave behind the hassle of juggling various cards and monthly statements, while finding peace of mind with protection benefits that exceeds standard credit cards.

- Flat-rate redemption value of 1.5% for cash back or 2% value for airfare redemption with no airline or seat restrictions and no blackout dates. Earn one point for every dollar spent. Straightforward redemption without needing a high-maintenance reward strategy. No foreign transaction fees, no earning caps, no rotating categories, and no need to chase down transfer partners to escape very low point values.

- Annual Airline Credit—up to $100 in statement credits toward flight-related purchases including airline tickets, baggage fees, upgrades and more. Just pay for airline purchases with your Mastercard Black Card and we will automatically apply the credit to your account. That’s it. No need to activate or designate an airline. The credit amount is available in full at the start of the calendar year.

- Up to a $100 application fee credit for the cost of TSA Pre✓® or Global Entry. Also, enjoy automatic enrollment in Priority Pass™ Select with access to 1,300+ airport lounges worldwide with no guest or lounge limits. Includes credits at select airport restaurants for cardholder and one guest.

- 24/7 Luxury Card Concierge®—Make requests the way you want by phone, email, SMS and chat in the app. Connect directly with a real agent and receive 24/7 assistance for tasks big and small. Requests do not require a purchase, incure no charge for making them, and do not involve department transfers.

- Exclusive Luxury Card Travel® benefits—average value of $500 per stay (e.g., resort credits, room upgrades, free wifi, breakfast for two and more) at over 3,000 properties. Receive protection benefits like trip cancellation and interruption, auto rental car collision waiver, travel accident and baggage delay. Cell phone protection for eligible claims of up to $1,000 each year. Plus additional World Elite Mastercard® benefits.

- Black PVD-Coated Metal Card: Weighing in at an industry-leading 22g. Designed for frequent shoppers, big ticket purchases and everything in between.

- Annual Fee: $495 ($195 for each Authorized User). Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% introductory APR for the first fifteen billing cycles following each balance transfer that posts to your account within 45 days of account opening.

|

21.24%, 25.43% or 28.24%

|

$495 ($195 for each Authorized User added to the account)

|

Excellent

|

While the Mastercard version of the Black Card isn’t made of titanium, it is a black PVD-coated metal card that looks the part. It also comes with concierge 24/7 benefits to help you tackle day-to-day tasks.

According to the Luxury Card website, a couple from Denver used the Luxury Card Concierge service to help them determine the best school districts and narrow down their search for a new home.

Centurion Card Requirements: For One, Be a Multi-Millionaire

Credit scores are one of the most important factors in getting a great credit card offer, and the Black Card is no different. The card, available to just 0.1% of the population, according to The Motley Fool, would most likely only be offered to those who can handle its spending power.

While the jury is out on what the exact cut-off is for a qualifying credit score, common sense would dictate that you must have an excellent credit score and established history of spending and payments with an existing American Express®= card to even be considered for this premium offer.

In the end, though, it’s mostly about how much you spend. The typical card user won’t be using their card in a way that meets Black Card requirements because most people don’t spend that much.

While it’s rumored that only cardholders of The Platinum Card® would have the credit lines available to push spending to the limits of qualifying for a Black Card, the purported $250,000 a year in purchases and payoffs required can likely come from any qualifying card.

No matter what card you use, however, it’s obvious that you need the income to both buy and repay a massive amount of goods and services to be Black Card material.

In addition to the high spending thresholds needed to be invited and maintain your status, there is a cost to join, as well. The initiation fee is $10,000 on top of a $5,000 annual fee. That means the perks you use must likely be high valued enough to make it worth the cost.

10 Black Card Alternatives

If you haven’t received a Black Card invitation and don’t happen to be a millionaire with a near-perfect credit score, that’s quite alright. There are many other cards that offer robust credit lines, awesome rewards, and other great features for the rest of us, including the Mastercard® Black Card™ mentioned above.

Here are some more of our favorite alternatives to the AMEX Black Card, along with links to each card’s online application:

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

Additional Disclosure: Bank of America is a CardRates advertiser.

+ See More Cards For Excellent Credit

Final Thoughts

For those wondering just how to get a Black Card, the answer is pretty obvious (and pricey!): spend often, and on big purchases, with the intent to pay back promptly. If you find that you don’t meet the posh requirements of the American Express® Centurion card, you may want to consider your alternatives.

VISA and Mastercard have their own cards with elite characteristics, and they may be more open to new recruits. Many of these alternatives offer appealing benefits and rewards that the average user will find very valuable.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Best American Express Card Alternatives ([updated_month_year]) 7 Best American Express Card Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/11/amexalt.png?width=158&height=120&fit=crop)

![7 Credit Card Requirements & Minimums to Apply ([updated_month_year]) 7 Credit Card Requirements & Minimums to Apply ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/08/req.png?width=158&height=120&fit=crop)

![Capital One Credit Score Requirements By Card ([updated_month_year]) Capital One Credit Score Requirements By Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/caponecredit.png?width=158&height=120&fit=crop)

![[card_field card_choice='5853' field_choice='title'] Credit Score Requirements ([updated_month_year]) [card_field card_choice='5853' field_choice='title'] Credit Score Requirements ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/shutterstock_465713531.jpg?width=158&height=120&fit=crop)

![8 Credit Cards without SSN Requirements ([updated_month_year]) 8 Credit Cards without SSN Requirements ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/01/Credit-Cards-without-SSN-Requirements--1.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='5861' field_choice='title'] Review & Deposit Requirements ([updated_month_year]) [card_field card_choice='5861' field_choice='title'] Review & Deposit Requirements ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/08/shutterstock_680176312.jpg?width=158&height=120&fit=crop)