Getting approved for a credit card is easy for some people. But for others, the approval process can be fraught with roadblocks. This article will explain what you need to know if:

- You’re applying for your first card, you need to rebuild your credit, or you have one or more cards and want to obtain another.

- You want to learn more about how to apply and improve your chances of being approved.

- You’ve faced challenges being approved, or you’ve applied and been denied.

Before you apply, you should educate yourself about your options so you can choose a card that fits your situation and for which you’re likely to be approved.

1. Complete an Application Online Based On Your Credit Score

Cards come with different rates, fees, and features. Some are designed for people with excellent credit; others target consumers with middle-of-the-pack credit scores, and still, others are intended for people who’ve had credit problems.

You can complete an application for a credit card online, in-person at a bank or credit union, or by calling the card issuer. You’ll need to provide your name, address, and other personal and financial information. If you don’t have a Social Security number, you may be able to use another form of identification.

Being approved for a card depends primarily on your credit score and your monthly income compared with your monthly minimum debt payments.

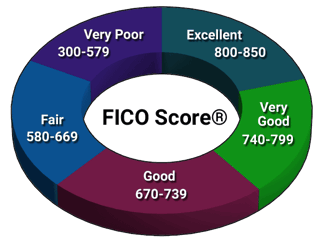

Your credit score is a three-digit number that represents the information in your credit reports. The most commonly used score is the FICO, developed by Fair Isaac, Corp.

There’s no one score that you have to have to get credit card approval. As a general guideline, a score of 800 or higher is considered exceptional; 740 to 799 is considered excellent credit; 670 to 739 is considered good, and 580 to 669 is considered fair credit. A score of 579 or lower is considered poor.

If you’ve never used credit or you’ve had problems with credit, your score could be low or even zero. In that case, you may want to apply for a starter, student, or secured card before you apply for a more sophisticated one.

See Cards For: No/Limited Credit (0 Score) | Bad Credit (300 – 579) | Fair Credit (580-669) | Good Credit (670-739) | Excellent Credit (740+)

Cards for No/Limited Credit

These types of cards tend to have lower limits, higher annual percentage rates (APRs), and fewer benefits. The advantage is that they can help you build your credit so you can be approved for other cards in the future. A low limit can help you learn to use credit responsibly and not incur more debt than you can manage.

- No credit check to apply

- Adjustable credit limit based on what you transfer from your Chime Checking account to the secured deposit account

- No interest* or annual fees

- Chime Checking Account and qualifying direct deposit of $200 or more required to apply. See official application, terms, and details link below.

- The secured Chime Credit Builder Visa® Card is issued by The Bankcorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted.

- *Out-of-network ATM withdrawal and OTC advance fees may apply. View The Bancorp agreement or Stride agreement for details; see back of card for issuer.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

$0

|

None

|

- No annual or hidden fees. See if you're approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One's mobile app

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

- Earn unlimited 1.5% cash back on every purchase, every day

- Early Spend Bonus: Earn $50 when you spend $100 in the first three months

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Enjoy no annual fee, foreign transaction fees, or hidden fees

- Lock your card in the Capital One Mobile app if it's misplaced, lost or stolen

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

Cards for Bad Credit

A card for bad credit may sound like a punishment, but some cards in this category are designed to help you rebuild your credit so you can qualify for more preferred cards. You won’t get a high credit limit, low APR, or awesome rewards and benefits, but you will get a chance to make your payment on time and beef up your credit score.

- No credit check to apply

- Adjustable credit limit based on what you transfer from your Chime Checking account to the secured deposit account

- No interest* or annual fees

- Chime Checking Account and qualifying direct deposit of $200 or more required to apply. See official application, terms, and details link below.

- The secured Chime Credit Builder Visa® Card is issued by The Bankcorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted.

- *Out-of-network ATM withdrawal and OTC advance fees may apply. View The Bancorp agreement or Stride agreement for details; see back of card for issuer.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

$0

|

None

|

- $400 credit limit doubles to $800! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply

- Monthly reporting to the three major credit bureaus

- Initial Credit Limit of $400.00 (Subject to available credit)

- Fast and easy application process; results in seconds

- Use your card at locations everywhere Mastercard® is accepted

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99%

|

$99

|

Fair/Poor/Bad

|

- Earn 1% cash back rewards^^ on payments made to your Revvi Credit Card

- Perfect credit not required

- $300 credit limit (subject to available credit)

- Checking account required

- Opportunity to request credit limit increase after twelve months, fee applies

- *See Rates, Fees, Costs & Limitations for complete offer details

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

See website for Details

|

N/A

|

35.99%

|

$75.00 1st year, $48.00 after

|

Fair

|

Cards for Fair Credit

Fair is neither good nor bad – it’s right in the middle – meaning the cards you’re likely to qualify for are also “right in the middle” in terms of APRs and rewards offered. Use the card responsibly to boost your credit score and eventually graduate to a card for good or excellent credit.

- No annual or hidden fees. See if you're approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One's mobile app

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

- Earn unlimited 1.5% cash back on every purchase, every day

- No rotating categories or limits to how much you can earn, and cash back doesn't expire for the life of the account. It's that simple

- Be automatically considered for a higher credit line in as little as 6 months

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Help strengthen your credit for the future with responsible card use

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$39

|

Average, Fair, Limited

|

Cards for Good Credit

A good credit score, generally 670 or higher, will get you approved for many great credit cards. Whether you want travel rewards, cash back, or a low APR, you’ll have your pick among some of the best offers.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

Cards for Excellent Credit

An excellent credit score will allow you to choose among the very best card offers available, including exclusive cards with expensive annual fees. These come with top-tier rewards, special cardholder privileges, and low APRs for those who qualify.

Additional Disclosure: Bank of America is a CardRates advertiser. Additional Disclosure: Bank of America is a CardRates advertiser.

+ See More Cards for Excellent Credit

If you don’t know your score, you can find out online. Some websites offer scores free. Others charge a fee. Before you use a specific website, you should read the fine print because some websites use your personal information to market financial products to you or share your personal information with other companies for their marketing purposes.

To understand your score, it may be helpful to look at your credit reports from the three main credit bureaus, Equifax, Experian, and TransUnion. Your reports are important because the information they contain is used to create your scores.

You can get your reports free from AnnualCreditReport.com. If you find any errors in your reports, notify the credit bureau and ask to have the error corrected. An accurate report may improve your scores.

The most important factor in your score is whether you make your payments on time. Setting up alerts and putting reminders on your calendar can help you remember when your payments are due.

Other factors that affect your score include the types of credit you use, your credit utilization rate, and how long you have used credit. Retail store cards, auto loans, and other types of debt can also help you build your credit history.

The best way to improve your score is to make all your payments on time.

2. Have a Steady Income

You’ll be asked to disclose your monthly income when you apply for a card. You don’t have to have a high income or full-time job, but you usually will need to have at least some steady income from somewhere or someone.

Card issuers have different rules to determine what type of income you can use to qualify, but there are some general guidelines:

- You must be at least 18 years old to apply for a card on your own. If you’re younger than that, you can become an authorized user on someone else’s card to establish your own credit history. That someone else may be your mom, dad, or another family member.

- If you’re 18, 19, or 20, you can apply for a card on your own. But to be approved, you’ll need to show that you have a reliable monthly income, or you’ll need a cosigner who has good credit and is willing to be responsible for your card debt along with you.

- You may be able to use financial aid, such as a scholarship, grant, stipend, or work-study, as income to qualify if you receive the income on a regular basis (i.e., not just once) and you can use the funds to pay for daily living expenses (i.e., not just tuition).

- If you’re 21 or older, you can use your own income or your spouse’s, partner’s, or parent’s income to apply if you have access to that income, such as if it’s deposited into a shared account, or a portion of it is transferred to you (e.g., as an allowance) every month. Student loans are debt and should not be used as income to qualify for a card.

By the way, you’ll never be too old to be approved for a card. That’s because lenders aren’t legally allowed to discriminate against you on the basis of your age once you’re at least 21.

3. Show a Healthy Debt-to-Income Ratio

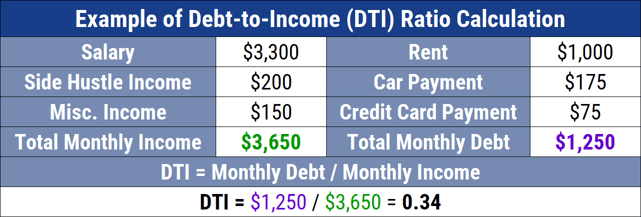

When you apply for a card, the income you earn isn’t as important as your ability to repay what you charge on your card and pay back any other debt you have.

To figure out whether you have enough income to handle your debt, card issuers look at your debt-to-income (DTI) ratio, which compares your monthly income to your monthly minimum debt payments. There’s no hard-and-fast DTI ratio to be approved, but all else being equal, a lower DTI ratio is better than a higher DTI ratio.

You will need more income, less debt, or both to lower your DTI ratio.

Card issuers have different standards for DTI so if you don’t qualify for one card, you may qualify for another, or you may qualify for the card you want, but with a lower limit.

You shouldn’t lie about your income when you apply for a card because it’s illegal, and you could get approved with a limit that’s too high for you. That could snowball into a number of financial problems, including too much debt, bad credit, or even bankruptcy.

Some card issuers will consider such factors as your employment, student status, and checking account balance when you apply for a card.

4. Begin with a “Starter” Card if You’re New to Credit

Some cards are designed for people who have a short — or no — credit history. These cards are sometimes called starter or no-credit cards.

Starter cards are great options to help you learn to manage credit responsibly and eventually graduate to cards with richer rewards and lower APRs.

Starter Cards: If you’ve had problems with credit, a true starter card — designed for people who have a limited credit history — may not be the best fit for you. But if you’re young, recently divorced, or new to credit for another reason, a starter could increase your chances of approval. The card below is a great option for anyone looking to build credit.

- No credit check to apply

- Adjustable credit limit based on what you transfer from your Chime Checking account to the secured deposit account

- No interest* or annual fees

- Chime Checking Account and qualifying direct deposit of $200 or more required to apply. See official application, terms, and details link below.

- The secured Chime Credit Builder Visa® Card is issued by The Bankcorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted.

- *Out-of-network ATM withdrawal and OTC advance fees may apply. View The Bancorp agreement or Stride agreement for details; see back of card for issuer.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

$0

|

None

|

Student Cards:

If you’re a student, you’re in luck because there are a lot of cards designed for people like you. Student cards may have a lower credit limit and most generally come with a few perks and benefits. Consider a student card training for the real world. Paying your credit card bill on time and in full every month will help build your credit history so you can qualify for cards with higher limits and more attractive benefits. See our top student selection below.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

Secured Cards:

If you don’t have much experience with credit or you’ve had some problems with credit, another option is a secured card. This type of card requires an upfront deposit, which may be refunded once you’ve established a good payment record or if you close your account without an outstanding balance. Our top secured card has no annual fee and the issuer will review your account for credit limit increases after you make five consecutive on-time payments.

- No credit check to apply

- Adjustable credit limit based on what you transfer from your Chime Checking account to the secured deposit account

- No interest* or annual fees

- Chime Checking Account and qualifying direct deposit of $200 or more required to apply. See official application, terms, and details link below.

- The secured Chime Credit Builder Visa® Card is issued by The Bankcorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted.

- *Out-of-network ATM withdrawal and OTC advance fees may apply. View The Bancorp agreement or Stride agreement for details; see back of card for issuer.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

$0

|

None

|

It’s easier to be approved for a secured card because if you don’t make your payment, your card company can use all or part of your deposit for that purpose. If that happens, that portion of your deposit will not be refunded even if you close your account.

5. Understand How Credit Works Before Applying

A credit card is a form of debt. Each time you use your card to make a purchase, you’re borrowing that amount of money from the card issuer. The maximum you’re allowed to owe at any one time is known as your credit limit.

Each month, you receive a statement that shows how much you owe and a due date by which you must make a minimum payment. If you pay off your card balance every month, you’ll never have to pay any interest. If you carry over a balance, you’ll be charged interest for that amount and any new purchases you make.

Cards are a type of revolving debt. Revolving means that, if you hit your limit and then pay off all or part of the amount you owe, you can borrow that amount again.

You don’t have to have a credit card, but there are good reasons to get one — or a few — if you qualify:

- Cards are more convenient than cash or checks.

- If your card is lost or stolen, your losses will be limited. If cash is lost or stolen, it’s gone.

- Cards can help you track your expenses.

- Cards are free to obtain and use if you avoid fees and pay your full balance every month.

- Cards allow you to make rental car and hotel reservations and shop online.

- Many cards give you rewards, such as cash back, travel benefits, or points toward merchandise purchases.

- Cards can help you build your credit history so you can qualify for other types of loans with lower rates and better terms later.

Read on for the advantages of having multiple credit cards.

Additional Cards In Your Wallet Can Lead to More Perks

Once you’ve been approved for one or more cards, you may want to get additional cards.

More cards could let you earn signup bonuses and give you access to other perks like cash back, air miles, and gifts. You may also be able to transfer a balance and get a 0% introductory APR offer or upgrade from a secured card to an unsecured card. Additionally, having more credit cards in good standing can lead to higher credit limits.

You may also want more cards in case your favorites are lost, stolen or temporarily unusable due to fraud on your account. Or you may want multiple cards for different purposes, such as online shopping, travel or dining. Some cards offer company-specific rewards that may appeal to you. If you own a business or you have a side gig, you might want to have business cards as well as personal cards.

To get approved for additional credit cards, you’ll need to use your credit responsibly, make your payments on time to secure a high credit score, and keep your card utilization relatively low. Now that you know how to get approved, you can shop and apply for the cards you want with confidence.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![6 Easiest Credit Cards to Get Approved For ([updated_month_year]) 6 Easiest Credit Cards to Get Approved For ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/02/Easiest-Credit-Cards-to-Get-Approved-For.jpg?width=158&height=120&fit=crop)

![15 Pre-Approved Credit Cards By Issuer ([updated_month_year]) 15 Pre-Approved Credit Cards By Issuer ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/07/Pre-Approved-Credit-Cards-By-Issuer.jpg?width=158&height=120&fit=crop)

![9 Easy Credit Cards to Get Approved For ([updated_month_year]) 9 Easy Credit Cards to Get Approved For ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/Easy-Credit-Cards-to-Get-Approved-For.jpg?width=158&height=120&fit=crop)

![11 Easiest Loans To Get Approved For ([updated_month_year]) 11 Easiest Loans To Get Approved For ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/07/Easiest-Loans-To-Get-Approved-For.jpg?width=158&height=120&fit=crop)

![How to Get Approved For a Loan in [current_year] How to Get Approved For a Loan in [current_year]](https://www.cardrates.com/images/uploads/2021/09/How-to-Get-Approved-For-a-Loan.jpg?width=158&height=120&fit=crop)

![Credit Card Reconsideration: Phone Numbers, Tips & Options ([updated_month_year]) Credit Card Reconsideration: Phone Numbers, Tips & Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/recon.jpg?width=158&height=120&fit=crop)

![How Quickly Can I Get a Credit Card? 2 Tips for Fast Turnaround ([updated_month_year]) How Quickly Can I Get a Credit Card? 2 Tips for Fast Turnaround ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/02/quick.png?width=158&height=120&fit=crop)