When you open a credit card, you are required to agree to certain terms and conditions associated with the account. Somewhere among all that fine print, there’s a section that addresses credit reporting.

Essentially, your credit cardholder agreement discloses that the card issuer will report information about you and your account to the credit reporting agencies. This process is formally referred to in credit reporting nomenclature as furnishing.

If you want a credit card from almost any card issuer, you will have to agree to allow this information sharing. Most credit card issuers provide Experian, TransUnion, and Equifax with details about your credit card account each month. To that end, among the information furnished to the credit bureaus are the following 10 data attributes.

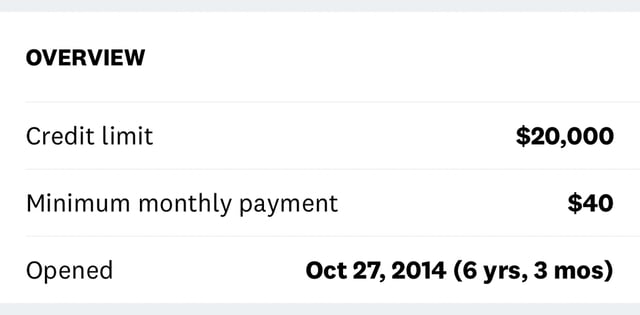

1. The Date You Opened the Account

Your card issuer will report the date you opened your account to the three major credit bureaus. On your report, this information will probably show up under a simple heading like “Date Opened.”

The date your account was opened affects the age of accounts, and older accounts are better for your credit scores.

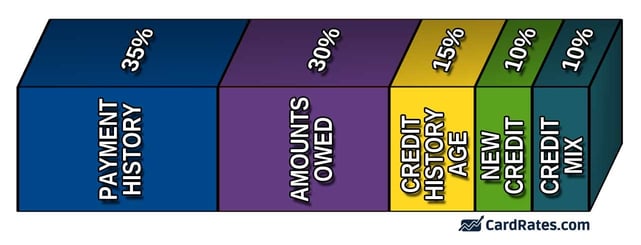

The date you opened your account matters because it can affect your credit scores. Both FICO and VantageScore’s scoring models factor the average age of your credit history into your credit score. Older accounts are better from a credit scoring perspective.

2. Your Legal Relationship With the Account

Another detail your card issuer will share with the credit bureaus is how you are tied to the account.

For example, are you the individual account holder, a joint account holder, an authorized user, or something else? Some of these designations indicate that you are liable for the debt, while others indicate that you are not.

Regardless of your relationship with the account, it has the potential to affect your credit score if it appears on your credit reports. You may, for example, only be an authorized user, and therefore not be legally liable for the debt. But, if there are late payments on the account and they show up on your credit reports, it could still have a negative impact on your various credit scores.

3. The Account Type

The account type, formally called the Portfolio Type in the Metro 2 credit reporting language, is another piece of information your credit card issuer shares with the credit reporting agencies.

This detail explains whether your account is a revolving account (like a credit card), an installment account (like a loan), or an open account (like a charge card).

Each type of account can affect your credit scores in different ways. Revolving accounts, for example, are extremely influential to your credit scores. The balances on your credit cards in relation to your account limits results in your revolving utilization rate. Aside from your payment history, how you manage your debt and this utilization ratio is an important factor in your credit scores.

NOTE: A common misinterpretation of the “open” account type is that it means the opposite of closed, which is incorrect. Open, in this context, indicates your payment is due in full each month, like with an American Express charge card. You cannot carry or revolve a balance on an open account type card.

4. Your Account Balances

Most credit card companies will share your account balance with the credit bureaus once a month. The balance is not a live snapshot of how much you owe, as you would see if you were to log into your credit card account online. Instead, the reported balance is the amount you owed when the card issuer generated your most recent monthly statement.

Because most card issuers only report your balance to the credit bureaus once a month, you may want to pay off your balance prior to your statement closing date. Doing this will result in a balance of $0 on your credit reports and, by extension, a utilization ratio of 0% as well. This is fantastic for your credit scores.

5. Past Due Balances

If you fall behind on your credit card account, your card issuer will generally inform the credit bureaus once you become a full 30 days past due. The card issuer will also share the amount of your delinquent balance.

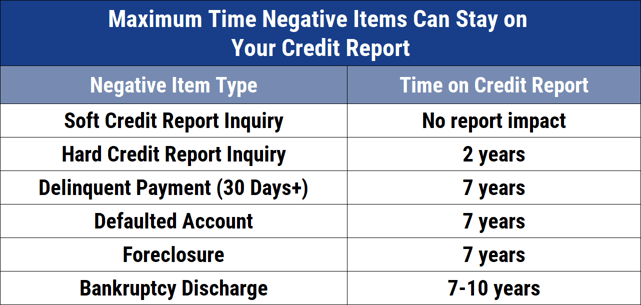

FICO and VantageScore’s scoring models consider past due accounts when calculating your credit score. As you have probably already figured out, this information could have a negative impact on your credit scores for up to seven years, as that is how long late payments can legally remain on credit reports.

Catching up on your past due payments will result in the removal of any past due balances from your credit reports, but it will not remove the record of your prior delinquency. This is why it’s so important to always make at least your minimum payment every month.

6. Personal Identifying Information

Your credit card issuer will report your personal identifying information, or PII, to the credit bureaus. PII includes your name, address, Social Security number, and date of birth. These details help Experian, TransUnion, and Equifax make sure they match each account with the correct consumer.

If you have been the victim of credit card fraud, for example, a new account was opened fraudulently in your name, it’s possible that some of this PII will be incorrect. This underscores the importance of checking your credit reports periodically for errors.

You can check your reports at no cost at www.annualcreditreport.com.

7. Account Status

How you manage your payments determines whether you are paying as agreed or are otherwise delinquent. The credit reporting designation that identifies where you fall in this regard is known as your account status.

Your account will fall into one of the following account statuses, depending on whether your account is being paid on time or is delinquent:

- Current

- 30 days late

- 60 days late

- 90 days late

- 120 days late

- 150 days late

- 180+ days late

Your account status will be shared with the credit bureaus whenever your credit card issuer updates your accounts.

8. Date of First Delinquency

If you stop paying your credit card, it will eventually become terminally delinquent. On a terminally delinquent account, like a charged-off credit card, the date of first delinquency — or DoFD — represents the oldest late payment that proceeded to the default.

In other words, it would be the date of the 30-day delinquency that grew to a default without ever being paid.

The DoFD is extremely important for a variety of reasons. First, credit scoring systems use the date of first delinquency to determine the age of derogatory tradelines. Generally speaking, the more recent the DoFD, the more measurable of a scoring impact.

Second, the credit bureaus use the DoFD as the date from which the seven-year credit reporting clock will begin. This date, also informally referred to as the anchor date or trigger date, must be reported with all terminally delinquent credit card accounts.

Of course, if you’re paying your credit card account on time each month, then you’ll never have to worry about this date. Accounts that are paid on time will never have a date of first delinquency.

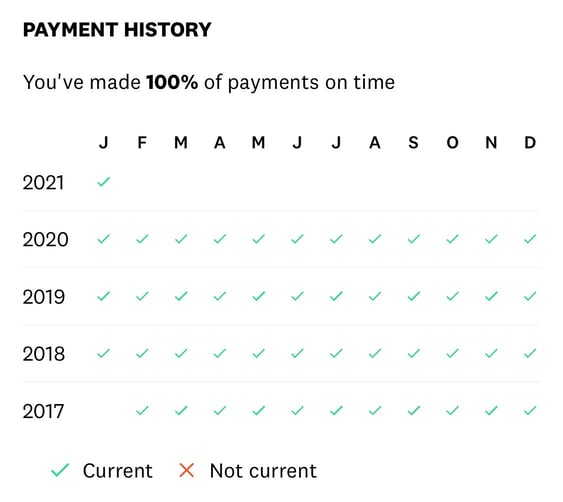

9. Payment History

In general, your credit card company will share your payment history with the credit bureaus every month. Your payment history on a credit report appears as an 84-month grid showing how you paid the account each month over the previous seven years (on time, 30 days late, 60 days late, etc).

Of course, you’d like your credit card account to indicate that it has always been paid as agreed. This will result in favorable credit scores.

10. Trended Data

Trended data, sometimes called time series data, is the historical information about your account. This information goes back as far as 24 months.

Trended data includes a variety of attributes associated with your account at the time of your monthly statements during the 24 previous months. This includes your:

- Account balance

- Scheduled payment amount

- The actual payment amount you made

- Credit limit

- Past due amount (if any)

The importance of trended data is increasing. Both VantageScore 4.0 and FICO 10T consider your trended data to the extent it is available. These are the most current versions of VantageScore and FICO’s commonly used credit scoring models.

Check Your Credit Reports to See More

While these 10 data attributes are commonly furnished by your card issuers, they are certainly not the only ones appearing on your credit reports. Again, if you want to see the full inventory of what your card issuers report to the credit bureaus monthly, you can check your reports at no cost at www.annualcreditreport.com.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![9 Credit Cards that Use Equifax Credit Reports ([updated_month_year]) 9 Credit Cards that Use Equifax Credit Reports ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/equifax2.png?width=158&height=120&fit=crop)

![How to Freeze Your Credit Reports in [current_year] How to Freeze Your Credit Reports in [current_year]](https://www.cardrates.com/images/uploads/2018/10/CR-Cool.png?width=158&height=120&fit=crop)