In this article, we review the best starter credit cards to build credit. Using a starter credit card is an efficient way to create and build your credit history.

Many consumers who’ve never used credit are candidates for these cards, including students. In addition, you can work to rebuild a low credit score by getting a starter credit card and using it responsibly.

These cards are easy to acquire and most offer cash back rewards. Whichever one you choose, resolve to pay your bill on time and limit the amount of available credit you use. By doing so, you can establish yourself as a creditworthy consumer with a good credit score and one who deserves access to loans and additional credit.

Best Overall

Students | Cash Back | Secured

Best Overall Starter Card to Build Credit

The Capital One Platinum Credit Card is our top choice for credit beginners. It is a no-frills card that is fairly easy to obtain.

It takes only a minute to find out whether you’re approved — just fill out a short application form with information about your employment status, annual income, and monthly mortgage/rent.

- No annual or hidden fees. See if you're approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One's mobile app

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

The card charges no annual fee and provides $0 fraud liability. The minimum credit line is $300, but you may be able to access a higher limit by making your first six monthly payments on time.

Benefits include instant purchase notifications, free access to your credit score, instant card lock/unlock, and suspicious activity alerts.

Best Student Starter Cards to Build Credit

College is a place to experience many new things, from wild to mild. In the latter category is getting your first credit card.

The following three student credit card options are designed to give students access to credit without requiring a credit history or score. They all offer cash back rewards and charge no annual fees.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

- Earn unlimited 1.5% cash back on every purchase, every day

- Early Spend Bonus: Earn $50 when you spend $100 in the first three months

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Enjoy no annual fee, foreign transaction fees, or hidden fees

- Lock your card in the Capital One Mobile app if it's misplaced, lost or stolen

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

The two Discover cards offer attractive cash back rewards. We also like the Discover cards for their free FICO scores and lower APRs.

Journey Student Rewards from Capital One encourages good financial habits by offering a higher cash back rate for the months you pay your bill on time. The card also rewards timely payments during the first six months of ownership by potentially raising your credit limit. (Information for this card not reviewed by or provided by Capital One.)

Best Cash Back Starter Cards to Build Credit

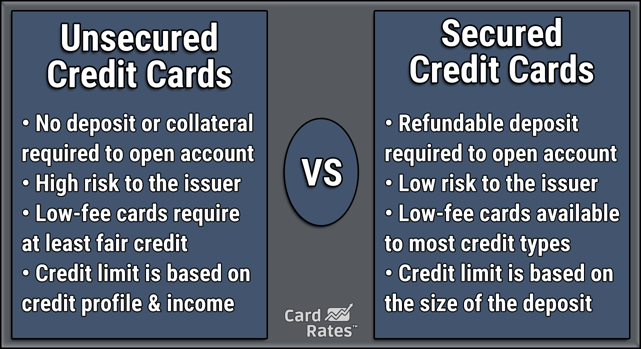

The combination of easy acceptance and cash back rewards sets these cards apart, as you often have to choose between one factor or the other. There is one unsecured credit card and two secured cards in the group.

- Earn unlimited 1.5% cash back on every purchase, every day

- No rotating categories or limits to how much you can earn, and cash back doesn't expire for the life of the account. It's that simple

- Be automatically considered for a higher credit line in as little as 6 months

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Help strengthen your credit for the future with responsible card use

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$39

|

Average, Fair, Limited

|

- No credit score required to apply.

- No Annual Fee, earn cash back, and build your credit history.

- Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount, starting at $200. Bank information must be provided when submitting your deposit.

- Automatic reviews starting at 7 months to see if we can transition you to an unsecured line of credit and return your deposit.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get an alert if we find your Social Security number on any of thousands of Dark Web sites. Activate for free.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

10.99% Intro APR for 6 months

|

28.24% Variable APR

|

$0

|

New/Rebuilding

|

- Earn 3% Cash Back Rewards* on Gas, Groceries and Utility Bill Payments

- Earn 1% Cash Back Rewards* on all other eligible purchases

- Good anywhere Mastercard® is accepted

- $0 fraud liability**

- Free access to your VantageScore 4.0 credit score from TransUnion®†

*See Program Terms for important information about the cash back rewards program.

**Fraud liability subject to Mastercard® rules.

† Your credit score will be available in your online account starting 60 days after your account is opened. (Registration required.) The free VantageScore 4.0 credit score provided by TransUnion® is for educational purposes only. This score may not be used by The Bank of Missouri (the issuer of this card) or other creditors to make credit decisions.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% or 36% Fixed

|

As low as $85

|

Fair

|

Cash back may be the most useful reward for a wide swath of consumers with no credit histories. Most folks who prefer travel cards that provide mile or point rewards, such as Chase Ultimate Rewards points, already have credit cards (and credit histories), considering how hard it is to travel without a credit card.

Certainly, cash back cards give you the most flexibility. It’s nice to earn cash back when you’re buying groceries and gas, as it acts as an automatic discount without the need to clip coupons.

Of course, you’ll only truly reap the benefits of cash back — or any credit card rewards — if you pay your total balance off each month. This prevents interest charges that will negate the value of any rewards earned from accruing.

Best Secured Starter Cards to Build Credit

Secured credit cards are among the easiest to obtain as long as you can afford to make the required cash deposit. You should prefer your deposit to be FDIC-insured and earning interest.

- No credit check to apply

- Adjustable credit limit based on what you transfer from your Chime Checking account to the secured deposit account

- No interest* or annual fees

- Chime Checking Account and qualifying direct deposit of $200 or more required to apply. See official application, terms, and details link below.

- The secured Chime Credit Builder Visa® Card is issued by The Bankcorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted.

- *Out-of-network ATM withdrawal and OTC advance fees may apply. View The Bancorp agreement or Stride agreement for details; see back of card for issuer.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

$0

|

None

|

- New feature! Earn up to 10% cash back* on everyday purchases

- No credit check to apply. Zero credit risk to apply!

- Looking to build or rebuild your credit? 2 out of 3 OpenSky cardholders increase their credit score by an average of 41 points in just 3 months

- Get free monthly access to your FICO score in our mobile application

- Build your credit history across 3 major credit reporting agencies: Experian, Equifax, and TransUnion

- Add to your mobile wallet and make purchases using Apple Pay, Samsung Pay and Google Pay

- Fund your card with a low $200 refundable security deposit to get a $200 credit line

- Apply in less than 5 minutes with our mobile first application

- Choose the due date that fits your schedule with flexible payment dates

- Fund your security deposit over 60 days with the option to make partial payments

- Over 1.4 Million Cardholders Have Used OpenSky Secured Credit Card To Improve Their Credit

- *See Rewards Terms and Conditions for more information

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

25.64% (variable)

|

$35

|

Poor

|

- No credit score required to apply.

- No Annual Fee, earn cash back, and build your credit history.

- Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount, starting at $200. Bank information must be provided when submitting your deposit.

- Automatic reviews starting at 7 months to see if we can transition you to an unsecured line of credit and return your deposit.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get an alert if we find your Social Security number on any of thousands of Dark Web sites. Activate for free.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

10.99% Intro APR for 6 months

|

28.24% Variable APR

|

$0

|

New/Rebuilding

|

We like the Capital One Platinum Secured Credit Card because you may need to only deposit as little as $49 to get the card.

The Discover it® Secured Credit Card is the only secured card we know of that offers handsome cash back rewards, and you can be automatically converted to an unsecured card with responsible use after a set period of time.

The OpenSky® Secured Visa® also requires a minimum deposit of $200, but unlike the other cards, it doesn’t require you to have a bank account and you won’t have to undergo a credit check for approval.

The OpenSky® Secured Visa® appeals to the millions of unbanked consumers who’d rather not deal with banks. However, it’s the only card in the trio that has an annual fee, albeit a small one.

What Is the Easiest Credit Card to Get With No Credit?

Secured cards are the easiest to acquire because your cash deposit acts as collateral. However, all the reviewed cards approve applicants with no or scant credit history, so you may not need a secured card unless your credit is already bad.

The size of the security deposit generally determines your credit line. Some cards, like the Capital One Platinum Secured Credit Card, may allow you to make a deposit that is less than your issued credit line, depending on your credit. This is known as a partially or semi-secured credit card.

The issuer maintains your deposit in a locked account that covers missed or late payments. This reduces the riskiness of these cards, which enables lenders to offer reasonable APRs and approve applicants with unestablished or bad credit histories.

Most secured cards provide a path to upgrade to an unsecured card if you consistently pay your monthly bill on time. The OpenSky® Secured Visa® doesn’t perform credit checks for approval, nor does it require you to have a bank account. That’s great for unbanked consumers new to credit cards.

The student credit cards are also easy to get if you’re enrolled in a two- or four-year school. You don’t need to have a credit history or score, and these cards offer surprisingly generous rewards.

How Do You Get a Credit Card If You Have No Credit?

The 10 cards in this review all give you the opportunity to obtain a credit card even if you have no credit history. But you have additional options that will unlock access to a credit card:

- Ask to be an authorized user on another person’s credit card. As an authorized user, you can use the card as if it were your own, but you are not obligated to make payments — that honor falls to the primary cardholder. The credit bureaus will record payments on both your and the primary cardholder’s credit reports, giving you the opportunity to establish and build your credit through responsible use.

- Recruit a cosigner when applying for the card. Doing so means that you and the cosigner jointly own the card. As was the case for authorized users, payments are recorded on the credit reports of both parties. In this case, however, both you and the cosigner are responsible for ensuring the monthly payments are made. Naturally, you’d like to have a cosigner with a good credit score, as this will increase your chances of approval.

- Get a credit builder loan. These are offered by many credit unions and some other lenders. With a credit builder loan, you borrow a sum of money that is held in a bank account. You then make payments on the loan that are reported to the credit bureaus. Once you fully repay the loan, the money is released to you — you now have your money back (with interest) and a credit history.

Of course, if you are in a position to do so, you can apply for a mortgage or car loan. This will establish your credit profile and make it easier to get a credit card, assuming you make your payments on time.

What Is the Best First-Time Credit Card?

We give top marks to the Capital One Platinum Credit Card, as it charges no annual fee and most folks with no credit history will qualify.

However, it offers Spartan benefits (no rewards or introductory 0% APR offers) and a limited credit line. Nonetheless, if you want to establish your credit with a minimum of hassles, this card is our recommended choice.

If you happen to be a student, we suggest you get one of the three student credit cards we recommend. All three are easy for students to obtain, charge no annual fees, and offer cash back rewards.

Our favorite is the Discover it® Student Cash Back card. It is very similar to the Discover it® Student Chrome card, except for its more generous rewards scheme.

The Capital One QuicksilverOne Cash Rewards Credit Card is our recommendation among the cash back cards, due to its ease of approval, unlimited cash back reward rate, and access to higher credit limits through responsible use.

What Credit Score Do You Start With?

If you are new to the world of credit, be aware that the most popular credit scoring system is called FICO and has a range from 300 (worst possible score) to 850 (exceptionally good score). The average FICO score in the U.S. is just over 700.

It takes about six months of credit card use or loan repayments to establish a credit score. Actually, you get three credit scores, one from each major credit bureau — Experian, Equifax, and TransUnion.

Your credit card issuer reports your payment activity to one or more of the credit bureaus. Over time, the bureaus receive enough information to formulate a starting score.

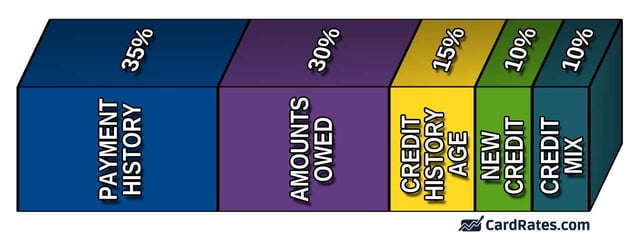

Many factors go into that score. If you use your card responsibly, you should expect an average beginning credit score.

Based on the above credit score factors, responsible credit card use entails:

- Paying your bill on time, every time, without exception.

- Maintaining a credit utilization ratio (i.e., amounts owed / total available credit) below 30%.

- Having a mix of credit and loan accounts.

- Having a long credit history (i.e., not closing old accounts just because you no longer use them).

- Not applying for too many accounts at the same time.

Through continued responsible use, your credit score may climb into the good or excellent range. This usually requires you to maintain several credit accounts of various types.

On the other hand, if your credit habits are sloppy, you can expect your credit score to sink into fair or poor territory. This can raise your interest rate and limit your access to additional credit.

Is No Credit Worse than Bad Credit?

Having no credit is actually better than having bad credit. With no credit, you have a clean slate. By using your first credit card responsibly, you can establish an average credit score and work your way toward a higher score.

If you already have bad credit, you’re in a hole from which you must emerge. That’s harder to do, especially if your bad credit is due to one or more derogatory marks on your credit reports.

When you get your first card, you should make sure it reports your payments to one or more credit bureaus — not all cards do. For example, a prepaid card is easy to obtain, but this kind of card doesn’t report payment activity.

That’s also true of debit cards — except if you are overdrawn and fail to correct the problem quickly, at which point you may be dinged on your credit report. In other words, debit cards can only hurt your credit score.

Other types of accounts may not appear on your credit reports. These include accounts such as rent, cable services, utilities, and water.

However, a free product called Experian Boost automatically incorporates your phone and utility account payments into your Experian credit report, giving your score a modest boost.

How Many Credit Cards Should You Have?

There is no fixed number of credit cards a person should or shouldn’t have, but having at least one is good for building credit. The average American has four credit cards.

You can get a rewards card and earn cash back or points on eligible net purchases or a card with low ongoing APR if you tend to carry a balance.

After you’ve had your card for a while and are comfortable using credit, you can consider applying for another card to help maximize your rewards-earning potential or take advantage of 0% APR deals when your credit score is in the good to excellent range.

Use Your First Card Responsibly to Establish Good Credit

Most folks eventually take the plunge and obtain a credit card. The 10 cards in this review all make it easier to get your first card and thereby establish your credit profile.

Use your first card to establish responsible habits that will help you build a good credit score. A good score can improve your lifestyle by allowing you to make purchases without waiting to save up the cash.

Once you have a good credit score, you can qualify for premium credit cards that offer copious rewards and benefits.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![How to Build Business Credit: 7 Expert Tips to Build Credit Fast ([updated_month_year]) How to Build Business Credit: 7 Expert Tips to Build Credit Fast ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/how-to-build-business-credit1.png?width=158&height=120&fit=crop)

![7 Best Starter Credit Cards ([updated_month_year]) 7 Best Starter Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/01/startercard.png?width=158&height=120&fit=crop)

![11 Starter Credit Cards With No Deposit ([updated_month_year]) 11 Starter Credit Cards With No Deposit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/12/shutterstock_1825058507.jpg?width=158&height=120&fit=crop)

![5 Best Starter Credit Cards by Experts ([updated_month_year]) 5 Best Starter Credit Cards by Experts ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/10/What-Is-the-Best-Starter-Credit-Card.jpg?width=158&height=120&fit=crop)

![3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year]) 3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Credit-Cards-For-Kids.jpg?width=158&height=120&fit=crop)

![5 Best Secured Credit Cards to Build Credit ([updated_month_year]) 5 Best Secured Credit Cards to Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/07/Best-Secured-Credit-Cards-to-Build-Credit.png?width=158&height=120&fit=crop)

![How to Leverage Credit Cards to Build Wealth ([updated_month_year]) How to Leverage Credit Cards to Build Wealth ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/06/How-to-Leverage-Credit-Cards-to-Build-Wealth.jpg?width=158&height=120&fit=crop)

![5 Prepaid Cards That Build Credit ([current_year]) 5 Prepaid Cards That Build Credit ([current_year])](https://www.cardrates.com/images/uploads/2021/03/Prepaid-Cards-That-Build-Credit.jpg?width=158&height=120&fit=crop)