Borrowing money often involves fees. One such fee is interest, which is calculated as a percentage of the amount you owe. The percentage is the interest rate.

For example, if you borrowed $1,000 for one year with an interest rate of 4%, you’d owe $40 of interest. An interest rate that’s calculated on a yearly basis is known as an annualized percentage rate (APR).

An APR always includes interest. It may also include other fees related to the loan. For example, if you applied for a home mortgage, your APR would include the lender’s fees as well as the interest rate.

With credit cards, the APR typically doesn’t include other fees, such as an annual fee, balance transfer fees, late payment fees, or foreign transaction fees, which may also be charged. When an APR includes interest, but no other fees, the APR and interest rate will be the same — this is true for most card rates.

The 4 Types of Card APRs

Most cards have more than one type of APR. Four common card APRs are:

- Purchase APR. This APR is applied to new purchases you make with your card and your card balance if you don’t pay it in full every month and you’re not paying an introductory or penalty APR.

- Introductory APR. This APR is applied to your card balance for a specific period. It may also be applied to new purchases during that time period. The introductory period is usually at least six months and may be up to 18 months or longer. An introductory APR may be as low as 0%. This type of APR is sometimes called a promotional rate or promotional APR.

- Cash Advance APR. This APR applies if you use your card to get cash, such as from an ATM or with cash advance checks. A cash advance is a form of debt. The APR for a cash advance is typically higher than the card’s purchase APR.

- Penalty APR. This APR may be applied if you make a late payment or miss a payment. Like the cash advance APR, this APR is typically higher than the card’s purchase APR.

The differences between APRs can be substantial. For example, if you carried a $5,000 balance for one year, you’d pay no interest with a 0% APR, $389 of interest with a 14.99% APR, and $631 of interest with a 24.99% APR. If your balance was higher or you carried the debt longer, you’d pay even more interest with the same APRs.

Most card APRs are variable, which means they can change over time. An APR may change because market rates changed, or your credit score went up or down. If your card’s APR increases, you’ll have to pay more interest to carry the same balance.

A card’s APRs must be disclosed in the cardholder agreement. APRs may also be shown on your monthly statement.

How to Use APR to Calculate Interest

Although APRs are annualized rates, card issuers don’t actually charge interest annually — they charge interest daily. That’s why you should be aware of your card’s Average Daily Periodic Rate (ADPR) as well as its APR.

If you carry a balance, it’s the ADPR that will be used to calculate how much interest you’ll be charged.

Your ADPR should be printed on your statement. This rate is typically rounded, so 16.987% would be shown as 16.99%, for example.

If your card’s ADPR isn’t equal to one 365th of its APR, it may be because your issuer uses a 360-day year rather than a 365-day year for its calculations. That may sound odd, but some issuers reportedly do it that way.

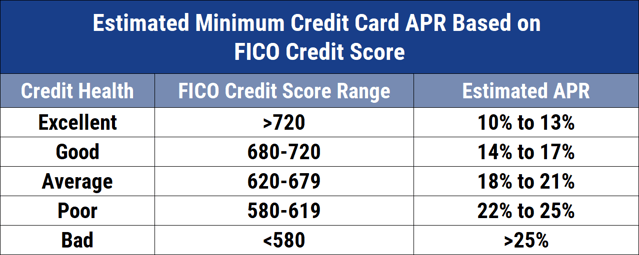

A “Good” APR Depends on Your Credit Score

Some cards charge a lower range of APRs while others charge a higher range. To qualify for the lowest ranges of card APRs, you’ll generally need good or excellent credit.

Your card’s APR may be higher than average if your credit rating is fair or poor. Whether a specific card has a “good” APR depends on the range of APRs for that card and your credit history.

For example, if you have excellent credit, a 30% card APR probably wouldn’t be considered a good APR for you. If you’ve had some issues with credit, that same 30% APR may be the best you’ll be offered.

How To Get a Lower Credit Card APR

A low APR may save you a lot of money if you carry a balance on your credit card. Here are four ways you may be able to get lower APR:

1) Apply for a new balance transfer card with a 0% introductory balance transfer offer.

You may have to pay a balance transfer fee to move your balance to the new card, and the introductory 0% APR may not apply to new purchases with that card, but your APR could drop significantly, making it easier for you to pay off your balance.

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 18.24% - 28.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is a balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater

- Get free access to your FICO® Score online.

- With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

- No Annual Fee - our low intro rates and all the benefits don’t come with a yearly charge.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 12 months on Purchases

|

0% 21 months on Balance Transfers

|

18.24% - 28.99% (Variable)

|

$0

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% - 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

2) Apply for a new card with a lower APR.

If you didn’t shop for a card with a low APR when you applied for the cards you have or if you’ve improved your credit since then, a new card could be your ticket to a lower APR.

If your credit isn’t good, you may need to raise your credit scores by making your payments on time before you’ll be approved for a card with a low APR.

- Get a 0% intro APR for 15 months on Balance Transfers and Convenience Checks that post to your account within 90 days of account opening. After this time, the Variable Regular APR will apply to your balance.

- Our lowest-rate card: Pay less in interest if you carry a balance from month to month

- Travel benefits include Auto Rental Coverage, Travel Accident Insurance, Baggage Delay and Reimbursement, and Trip Cancellation and Interruption Coverage

- No annual fee or foreign transaction fees

- This offer is only open to members of military-affiliated groups and their families

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% for 15 Months

|

9.15% - 26.15% (Variable)

|

$0

|

Good to Excellent

|

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- Earn 40,000 Bonus Points when you spend $3,500 within 90 days of account opening

- Free year of Amazon Prime®

- Receive 3X points on travel purchases and 2X points on everything else

- Receive statement credits (up to $100) for Global Entry or TSA Pre✓®

- No balance transfer fees, foreign transaction fees, or cash advance fees

- Worldwide Automatic Travel Accident Insurance, plus travel and emergency assistance

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

15.24% - 18.00% Variable

|

$49

|

Very Good/Excellent

|

3) Apply for a new secured card.

Secured cards don’t always have the lowest APRs, but you may find some with lower APRs than the cards you already have. To get a secured card, you’ll have to make a deposit, which serves as security, or collateral, for your card debt.

- No credit check to apply

- Adjustable credit limit based on what you transfer from your Chime Checking account to the secured deposit account

- No interest* or annual fees

- Chime Checking Account and qualifying direct deposit of $200 or more required to apply. See official application, terms, and details link below.

- The secured Chime Credit Builder Visa® Card is issued by The Bankcorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted.

- *Out-of-network ATM withdrawal and OTC advance fees may apply. View The Bancorp agreement or Stride agreement for details; see back of card for issuer.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

$0

|

None

|

- New feature! Earn up to 10% cash back* on everyday purchases

- No credit check to apply. Zero credit risk to apply!

- Looking to build or rebuild your credit? 2 out of 3 OpenSky cardholders increase their credit score by an average of 41 points in just 3 months

- Get free monthly access to your FICO score in our mobile application

- Build your credit history across 3 major credit reporting agencies: Experian, Equifax, and TransUnion

- Add to your mobile wallet and make purchases using Apple Pay, Samsung Pay and Google Pay

- Fund your card with a low $200 refundable security deposit to get a $200 credit line

- Apply in less than 5 minutes with our mobile first application

- Choose the due date that fits your schedule with flexible payment dates

- Fund your security deposit over 60 days with the option to make partial payments

- Over 1.4 Million Cardholders Have Used OpenSky Secured Credit Card To Improve Their Credit

- *See Rewards Terms and Conditions for more information

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

25.64% (variable)

|

$35

|

Poor

|

- No credit score required to apply.

- No Annual Fee, earn cash back, and build your credit history.

- Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount, starting at $200. Bank information must be provided when submitting your deposit.

- Automatic reviews starting at 7 months to see if we can transition you to an unsecured line of credit and return your deposit.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get an alert if we find your Social Security number on any of thousands of Dark Web sites. Activate for free.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

10.99% Intro APR for 6 months

|

28.24% Variable APR

|

$0

|

New/Rebuilding

|

4) Call your credit card company and ask.

If you’re a good customer, you may be able to get a lower APR just by reaching out and requesting it. If you usually carry a balance and you typically make your payment on time, this one phone call could save you a lot of money and help you pay off your balance sooner.

Pay Your Balance to Avoid Interest Charges

If you don’t carry a balance, APRs aren’t relevant to you. If you do carry a balance, you should pay attention to APRs when you shop for new cards.

A card with a lower APR or 0% balance transfer offer could be a better card for you than one with more perks or rewards. The choice is yours.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![How to Calculate Credit Card Interest: 3 Steps to Find Your Rate ([updated_month_year]) How to Calculate Credit Card Interest: 3 Steps to Find Your Rate ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/how-to-calculate-credit-card-interest.jpg?width=158&height=120&fit=crop)

![3 Ways: Get a Lower Interest Rate on Credit Cards ([updated_month_year]) 3 Ways: Get a Lower Interest Rate on Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/09/lowerinterest.png?width=158&height=120&fit=crop)

![What is Credit Card APR? 9 Best 0% APR Cards ([updated_month_year]) What is Credit Card APR? 9 Best 0% APR Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/05/what-is-apr.jpg?width=158&height=120&fit=crop)

![What is a Good Credit Card APR? 5 Best Low APR Cards ([updated_month_year]) What is a Good Credit Card APR? 5 Best Low APR Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/good-apr2.png?width=158&height=120&fit=crop)

![7 Best 0% APR & Low-Interest Credit Cards ([updated_month_year]) 7 Best 0% APR & Low-Interest Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/04/low.png?width=158&height=120&fit=crop)