When you apply to open a credit card, the card issuer will tell you how much you’re allowed to charge on the account at any given time upon being approved for the card. This maximum spending cap is known as your credit limit.

But when you apply for that card, have you ever wondered what exactly the issuing bank does to determine your credit limit?

First things first, having a higher credit limit may be helpful for several reasons. First, it gives you more buying power or capacity.

Whether you’re traveling or want to make a large purchase, a large credit limit can come in handy. A large credit limit is also desirable because it makes it easier to maintain solid credit scores, which we’ll get to in a moment.

4 Factors that Influence Your Credit Limit

When you’re approved for a new credit card, several factors influence how much your card issuer will allow you to spend on the account. Each card issuer has its own criteria, of course, but most will consider similar information.

1. Credit Risk

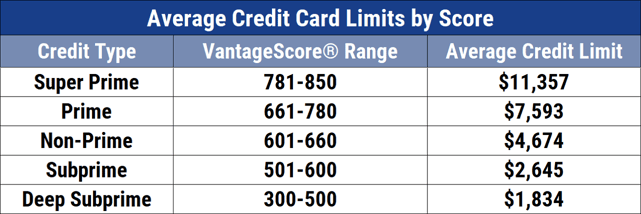

Your credit rating plays multiple roles when you apply for a credit card. The condition of your credit reports determines if you will qualify for the account and the interest rate you’ll receive.

Your credit reports and credit scores also help determine the credit limit a card issuer is comfortable extending to you. If your credit history and scores indicate that you have properly managed other accounts in the past, you’re likely to qualify for a higher limit on a new account.

2. Your Credit Card Track Record

In addition to reviewing your credit reports and credit scores, card issuers will dive deeper into your track record with current and previous credit card accounts. If your credit reports indicate a history of responsible credit card usage, you may be a better candidate for a higher limit.

And, here’s a little secret, most card issuers use scoring models that weigh your previous card usage more heavily. As such, proper management of your credit cards is even more important and influential to earning a large limit on a new card.

Point being, card issuers care about how you pay all your bills, but they care a lot more about how well you’ve paid your — you guessed it — credit cards.

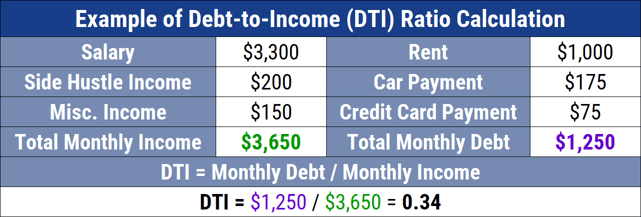

3. Capacity

Your ability to pay your bills, known as your capacity, is another key factor that card issuers use to determine your credit limit. When a card issuer considers your capacity, it looks at a combination of details — primarily your income and your existing debts.

This measurement is known as your debt-to-income ratio or DTI.

If you have a high DTI when you apply for a new credit card, your credit limit may be lower because you simply don’t have the ability to make large monthly payments.

4. The Card Issuer’s Memory

Credit card issuers have a very long memory. If you’ve ever defaulted on a debt or, worse, discharged a card issuer debt in bankruptcy, then the chances of ever getting credit from that issuer again are slim to none, regardless of what kind of credit limit you’re seeking.

This isn’t the end of the world, of course, because thousands of financial institutions in the U.S. issue credit cards.

How Your Credit Limit Impacts Your Credit Scores

Your credit limits have an indirect impact on your credit scores. FICO and VantageScore’s credit scoring models will likely reward you for having a higher credit limit. Higher credit limits can lead to a lower credit utilization rate, and your scores will benefit as a result.

Because higher credit limits may lead to lower credit utilization ratios, requesting a credit limit increase can sometimes be an effective credit improvement strategy.

Here’s an example of how a credit limit increase can improve your credit score:

Imagine that you have a credit card with a $2,000 limit and a $1,000 balance. Your credit utilization rate would be 50% in this scenario ($1,000 Balance ÷ $2,000 Limit = .50 X 100 = 50% Utilization). Not bad, but also not good.

Now, imagine you ask your card issuer for a credit limit increase and it agrees. Your new credit limit is $4,000 while your balance is still $1,000.

As soon as the new credit limit updates on your credit reports, the credit utilization rate on your account drops from 50% to 25% ($1,000 Balance ÷ $4,000 Limit = .25 X 100 = 25% Utilization). That’s much better than 50%.

How to Score a Higher Credit Limit

Every card issuer follows different rules when it comes to setting credit limits. However, just as you can increase your credit card approval odds, you can also take steps that may help you qualify for a higher credit limit.

- Check your credit reports for errors. You can obtain your credit reports for free from annualcreditreport.com. If mistakes appear on your credit reports, they may hurt your credit scores unfairly. You have the right to dispute any inaccurate information you find on your credit reports.

- Pay down credit card balances at least 30 days before you apply. Reducing your existing credit card balances could help you in two ways when you apply for a new credit card. First, if you lower your credit utilization rate, your scores will likely increase. And, less credit card debt means a lower DTI. Best of all, paying down credit card debt can save you a ton of money in interest fees.

- Claim your household income. When you apply for a new credit card, you’re allowed to include your household’s income on the application, not just the income you earn yourself. Salary, alimony, child support, rent, and other common sources of income you and your spouse receive together may be acceptable if you reasonably expect to have access to the funds.

The Bottom Line

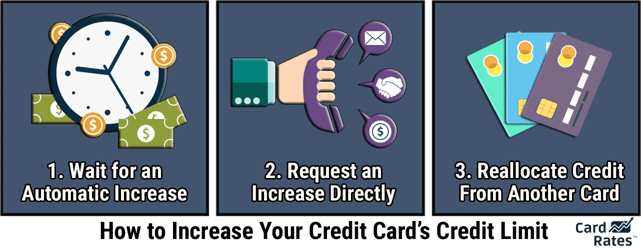

Don’t worry if you don’t get the credit limit you want right off the bat. Your initial account spending limit isn’t set in stone. You can work to improve your credit, pay down your debt, and properly manage your new account.

Then, after several months, you can call the card issuer and ask for a credit limit increase. The request is free, and the card issuer may not even pull your credit reports.

Whatever the size of your credit limit, it’s still crucial to pay off your balance every month. Follow this rule and you can enjoy the many benefits of credit cards without the negative side effects of credit card debt.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![19 Highest Credit Card Limits by Category ([updated_month_year]) 19 Highest Credit Card Limits by Category ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/11/shutterstock_370788551.jpg?width=158&height=120&fit=crop)

![3 Highest Discover Card Credit Limits ([updated_month_year]) 3 Highest Discover Card Credit Limits ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/03/Highest-Discover-Card-Credit-Limits.jpg?width=158&height=120&fit=crop)

![12 Bank of America Credit Card Limits ([updated_month_year]) 12 Bank of America Credit Card Limits ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/04/Bank-of-America-Credit-Card-Limits.jpg?width=158&height=120&fit=crop)

![11 Credit Cards With $2,000+ Credit Limits ([updated_month_year]) 11 Credit Cards With $2,000+ Credit Limits ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/02/Credit-Cards-With-2000-Credit-Limits.jpg?width=158&height=120&fit=crop)

![11 Highest Capital One Credit Limits ([updated_month_year]) 11 Highest Capital One Credit Limits ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/06/Highest-Capital-One-Credit-Limits.jpg?width=158&height=120&fit=crop)

![7 Unsecured Credit Cards With $1,000 Limits ([current_year]) 7 Unsecured Credit Cards With $1,000 Limits ([current_year])](https://www.cardrates.com/images/uploads/2021/09/Unsecured-Credit-Cards-With-1000-Limits.jpg?width=158&height=120&fit=crop)

![Which Credit Card Companies Provide the Best Credit Cards? ([updated_month_year]) Which Credit Card Companies Provide the Best Credit Cards? ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/08/Which-Credit-Card-Companies-Provide-the-Best-Credit-Cards-2.png?width=158&height=120&fit=crop)

![[card_field card_choice='22068' field_choice='title'] Review: Credit Scores, Limits & Rewards ([updated_month_year]) [card_field card_choice='22068' field_choice='title'] Review: Credit Scores, Limits & Rewards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/cover-2.jpg?width=158&height=120&fit=crop)