You must be invited to get your hands on the Centurion® Card from American Express, known widely as the “Black Card.” You also better be rich — the card requires a $10,000 initiation fee and a $5,000 annual fee.

Frankly, I get a nosebleed just reading this card’s terms and conditions. Happily, we’ve identified five American Express Black Card alternatives that mere mortals can own.

If life has been kind to you, treat yourself to one or more of these premium cards that provide a modicum of prestige at a much more affordable price.

Best Overall | Alternatives | FAQs

Best Overall Black Card Alternative

Our favorite Black Card alternative is the Chase Sapphire Reserve® card. With a $550 annual fee, this card provides you a boatload of bonus points when you spend the required amount on purchases during the first three months. You also get a credit of up to $300 each year to reimburse you for travel expenses.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

You’ll receive 3X points on restaurant dining and travel worldwide after you receive the $300 credit. All other purchases receive 1X points. Points are worth 50% more when redeemed for travel through Chase.

Other benefits include complimentary access to 1,000+ Priority Pass airport lounges, free travel insurance, and purchase protection.

Other Alternatives to the Amex Black Card

These four cards all offer generous benefits while charging annual fees that range from $95 to $995. Many have things in common, such as travel insurance and purchase protection.

These cards prove that you can get much of the value you’d receive from an Amex Black Card without the heart-stopping fees.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

The Capital One Venture Rewards Credit Card offers bonus miles after you spend the required amount in the first three months after opening the account. The card lets you earn unlimited 2X miles on all purchases.

You also receive a credit reimbursement of up to $100 for Global Entry or TSA Pre√ application fees. There are no foreign transaction fees and the annual fee is waived for the first year.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

The Chase Sapphire Preferred® Card offers elevated points on travel and restaurant dining and 1X on all other purchases. These points are worth 25% more for travel redemptions at Chase Travel.

You can transfer points one for one to leading airline and hotel loyalty programs. The card offers many peace-of-mind benefits for travel and purchases. The card charges an annual fee but no foreign transaction fees.

The Platinum Card® from American Express offers a tremendous signup bonus when you meet the spending terms after account opening. You’ll earn 5X points on flights and prepaid hotel stays, and 1X points on all other purchases.

You also get complimentary access to more than 1,200 airport lounges, a $200 statement credit for airline fees, select hotel credits and discounts, and $15/month in Uber Cash.

The Mastercard® Gold Card™ is made with 24K gold, weighs in at 22 grams, and charges a $995 annual fee. The card offers many premium benefits, including airport lounge access, travel credits and insurance, 24/7 concierge service, and invitations to select experiences.

Cardholders also receive special discounts with Postmates, Lyft, Boxed, ShopRunner, and more.

Who Qualifies for a Black Card?

Only well-heeled consumers will be invited to get a Centurion® Card from American Express. If you aren’t rich or famous, you may not make the cut. Nonetheless, there’s great curiosity about what it takes to obtain this anodized titanium card. American Express is pretty tight-lipped on the subject, but here’s what we know.

We understand that the card is available to only 0.1% of the consumer population. The average Centurion® cardholder earns more than $1.3 million per year, according to Investopedia.

The most likely recipients of a Black Card invitation will be existing American Express cardholders for at least one year. This gives you the opportunity to demonstrate your ability to manage high credit limits. We expect invitees will have an exceptional credit score, likely 800 at a minimum.

Rumor has it that Centurion® cardholders are expected to charge at least $250,000 to $450,000 per year. Whatever the actual spending minimum, you need to charge big money to stay in Amex’s good graces.

The bottom line: If you need to ask about the minimum requirements to get the Centurion® Card, it’s not for you.

Is the Amex Black Card Better than the Amex Platinum?

Better is a subjective modifier. While we aren’t shy about offering our own, the objective fact is that it’s much easier to get The Platinum Card® from American Express, since you don’t need an invitation.

The exclusivity of the Black Card is reinforced by its minimalist web page, which contains only a link to its cardmember agreement.

The Platinum Card® is certainly more affordable, with an annual fee of about 80% less than that of the Centurion® Card. And you don’t have to fork over $10,000 to apply for the Platinum Card® as you do for the Black Card.

The Platinum Card® offers at least 40 benefits and rewards to its members including free airport lounge access, hotel perks, car rental privileges, free WiFi from Boingo, and concierge services. On a dollar-for-dollar basis, the Platinum Card® beats the pants off the Centurion® Card for 99.9% of the population.

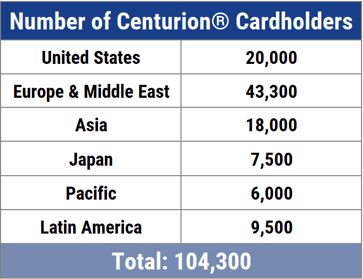

How Many Centurion® Cardholders are there?

The Identity Strategist reported on the circulation statistics of the Centurion® Card and The Platinum Card® in two international magazines exclusively sent to cardholders outside of the United States.

As of 2017, the magazine articles implied that there were 84,300 non-U.S. Centurion® Cards and 397,000 Platinum Cards. In addition, The Identity Strategist estimates that about 20,000 Americans own the Black Card.

That means there are rumored to be just over 104,000 Centurion® Cards issued all over the world as of 2017.

It’s little wonder why the card is so scarce. If the card were any easier to get, it would seem less exclusive and, therefore, less attractive to the rich. Millionaires and billionaires have a natural connection to luxury, and so does the Centurion® Card.

For example, a billionaire used his Black Card in 2015 to purchase an oil painting for $170 million. Needless to say, he racked up a lifetime supply of frequent flyer miles.

Whatever the actual number of Centurion® cardholders, you can expect it to remain relatively small, befitting its elite reputation.

Does a Black Card Have a Credit Limit?

If a billionaire can buy a $170 million painting on the Black card, it’s hard to make the case that American Express imposes any hard-and-fast credit limit.

Acquiring the card, fabricated from pure titanium, costs you $15,000 in the first year, and rumor has it that you are expected to charge at least a quarter-million dollars per year on the card. That’s bound to bring a smile to the person behind the counter at your favorite jewelry boutique on Fifth Avenue.

Given that the card places expectations on how much you’ll charge each year, any question about credit limits should rightfully refer to the minimum you’ll spend, not the maximum. The Black Card is a charge card, not a credit card, so you are expected to pay your full balance each month.

We have no statistics on how many cardholders use Amex’s Pay Over Time option to space out payments, but we’d guess that they are rare. After all, wouldn’t you risk losing your cache if someone found out you were financing your purchases?

Plenty of Great Cards Don’t Require an Invite

There is no shortage of premium cards available without an invitation. Our top choice is the Chase Sapphire Reserve® card. For a $550 annual fee, you receive generous benefits and rewards that make this card a favorite among travelers.

Two premium cards have annual fees under $100. The Chase Sapphire Preferred® Card offers more introductory bonus miles than does the Reserve® card. And the Capital One Venture Rewards Credit Card provides some nice miles rewards as well as a hefty signup bonus.

The Platinum Card® has a high annual fee, but you get many rewards and benefits for your money. The 5X points reward on selected purchases, high introductory bonus-point reward, and many premium benefits seem like a reasonable return on your annual fee payment.

We’re less enthusiastic about the Mastercard® Gold Card™. Several critics have noted that it has a relatively modest cashback-to-fee ratio, despite having an annual fee almost double that of the Chase Sapphire Reserve® card.

As you wait for the Black Card invitation to arrive in your mailbox, you can entertain yourself nicely with any of the five alternative cards in this review. Go on, you deserve it!

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![How to Get a Black Card – American Express® Requirements ([updated_month_year]) How to Get a Black Card – American Express® Requirements ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/03/How-to-Get-a-Black-Card-2--1.jpg?width=158&height=120&fit=crop)

![7 Best American Express Card Alternatives ([updated_month_year]) 7 Best American Express Card Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/11/amexalt.png?width=158&height=120&fit=crop)

![Mercury Credit Card: Review & 5 Alternatives ([updated_month_year]) Mercury Credit Card: Review & 5 Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/05/Mercury-Credit-Card-Review.jpg?width=158&height=120&fit=crop)

![Instacart Credit Card: Review & 5 Alternatives ([updated_month_year]) Instacart Credit Card: Review & 5 Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/Instacart-Credit-Card.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='22068' field_choice='title']: Review & Alternatives ([updated_month_year]) [card_field card_choice='22068' field_choice='title']: Review & Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/09/caponesavor2.png?width=158&height=120&fit=crop)

![9 Best Fixed-APR Credit Cards & Alternatives ([updated_month_year]) 9 Best Fixed-APR Credit Cards & Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/01/Best-Fixed-APR-Credit-Cards.jpg?width=158&height=120&fit=crop)