Secured credit cards with no annual fee can give you the best of both worlds. These cards can help you build or rebuild your credit without paying an annual fee for the privilege.

And while these cards will still require the upfront cost of a refundable security deposit, you get the flexibility that comes with choosing your credit limit and setting your personal credit card budget. That control is one reason many consumers turn to secured credit cards, and why we put together this list of the best secured credit cards with no annual fee.

Top Secured Credit Cards With No Annual Fee

Many banks and other financial institutions offer secured credit cards for customers who need to rebuild their credit. But many of these cards include annual or monthly fees as well as maintenance fees and other charges.

For this list, we stick to the cards that skip the annual fee and make it easier — and more affordable — to maintain your credit card account.

You will still need to provide a refundable security deposit for approval. The amount of your deposit will typically match your card’s spending limit. This deposit makes it possible for most secured credit card issuers to approve your credit application despite having a poor credit score.

- No annual or hidden fees. See if you're approved in seconds

- Building your credit? Using the Capital One Platinum Secured card responsibly could help

- Put down a refundable security deposit starting at $49 to get a $200 initial credit line

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Limited, Bad

|

The Capital One Platinum Secured Credit Card takes a different approach to security deposits. Instead of requiring a deposit that sets your spending limit, Capital One starts every new cardholder with the same credit limit and uses their credit history to determine how much of a deposit they need to pay.

Capital One also monitors all accounts and will check to see whether you are eligible for an automatic credit limit increase every six months. If you are, the bank will instantly boost your credit line at no extra charge and with no further deposit required.

2. Bank of America® Customized Cash Rewards Secured Credit Card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Bank of America® Customized Cash Rewards Secured Credit Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.

The Bank of America® Customized Cash Rewards Secured Credit Card is rare in that it offers cash rewards for all of your purchases. All cardholders also receive access to their FICO score with monthly updates on your credit-building progress.

The minimum required deposit for activation is $300. The amount of your deposit will equal your card’s credit line. This card does not charge an annual, monthly, or other maintenance fees, but there is a balance transfer fee if you want to move an existing balance from another credit card to your Bank of America card.

3. BankAmericard® Secured Credit Card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to BankAmericard® Secured Credit Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.

Not only will you pay no annual fee for the BankAmericard® Secured Credit Card, but you could also get your security deposit back before you close your account. Bank of America periodically checks accounts and, if you have a good payment history and a low balance, the bank will refund your deposit early as a statement credit.

All cardholders also receive free monthly access to their FICO score through BofA’s Mobile Banking app. This card has a very low variable APR and only charges fees for balance transfers.

4. Citi® Secured Mastercard®

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Citi® Secured Mastercard® has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.

Every Citi® Secured Mastercard® cardholder enjoys more than the typical access to credit. Cardholders also have $0 liability on unauthorized charges they didn’t initiate and have access to Citi® Identity Theft Solutions that helps lock down an account if there is a security breach.

You must undergo a credit check, which includes a review of your income and existing credit card debt, to receive a Citi® Secured Mastercard®. Citi has very forgiving standards for its secured credit cards and won’t disqualify you solely because of your credit score.

5. Wells Fargo Business Secured Credit Card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

The Wells Fargo Business Secured Credit Card is a great choice for entrepreneurs who are jump-starting their business and want to build business credit. This card lets you choose your rewards — cash back or points — and has one of the highest credit limits in this lineup.

This card also comes with valuable benefits to business owners, including free employee cards and online spending reports to help them manage their business expenses.

- All credit lines start at $250

- Earn Flexpoints Rewards - 1 point for every $1 spent

- Competitive low rate

- Use the card responsibly and you can be automatically graduated to a Platinum Rewards Credit Card

- Visa card benefits like Roadside Dispatch, a pay-per-use roadside assistance program

- 25-day grace period on purchases

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

16.49%

|

$0

|

N/A

|

While most credit union institutions set rules as to who can be a member, the Savings Secured Platinum Rewards Credit Card allows anyone to join and apply for a card in the same application. All cardholders can earn Flexpoint Rewards that can be redeemed for gift cards, merchandise, hotel stays, and airline tickets, among other options.

And since SDFCU maintains a large portfolio of credit cards, your responsible behavior could help you earn automatic graduation to an unsecured Platinum Rewards Card.

- Earn 1X point for every dollar spent

- H.O.G.® members earn 1 point for every mile ridden

- Whether you're a first-time cardmember needing to build credit or a card-carrying veteran looking to rebuild your credit, use the card that helps while also earning you points for Harley™ gear. Every 2,500 points earns you $25 at H‑D.

- Your account will be considered for an upgrade to an unsecured card after 12 months of responsible use.

- A minimum security deposit of $300 is required to open an account, up to $5,000.

- Zero fraud liability, free access to your credit score, and Auto Rental Collision Damage Waiver

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

27.49% (variable)

|

$0

|

None/Limited/Bad

|

The H-D™ Visa® Secured Card lets you earn H-D™ Genuine Rewards points you can use toward your favorite Harley gear, accessories, service, and more. Cardholders earn one point for every dollar of eligible net purchases. Every 2,500 points are worth $25.

Cardholders also can earn entries into periodic contests that include Harley Davidson motorcycle giveaways and more. This card charges no annual, monthly, or other maintenance fees.

What is a Secured Credit Card?

A secured credit card is a financial product designed to help consumers build — or rebuild — their credit. At the register, these cards work the exact same way as a traditional unsecured credit card. The difference between the two shows up before you activate your card.

As the name suggests, you need to provide a refundable security deposit to add this card to your wallet. The amount of your deposit will typically match your credit limit.

So, for example, a $500 deposit will net you a $500 credit line. Some secured credit cards allow for deposits of up to $5,000 or more. Most cards will set a minimum required deposit of between $200 and $300.

This deposit is similar to the one you make when you rent an apartment. Before you move in, the landlord will require a security deposit that protects him or her in case you stop paying rent or damage the apartment. If the home is in good shape when you move out, you will receive that money back.

You will receive a full refund of your deposit when you close your account, as long as you have no outstanding credit card debt on the card at that time. Some secured cards will monitor your account periodically. If you show a strong pattern of responsible behavior, you could receive an early deposit refund or be upgraded to an unsecured card account.

Once you activate your card, you can use it just as you would an unsecured card. Your new credit card will give you access to a revolving line of credit you can use to make purchases online or in person, pay bills, rent a car or hotel room, or pay for services.

Just remember your security deposit does not take the place of a payment. Your card’s issuing bank will hold your deposit in an account until it is time to refund it. You still have to make a monthly payment to cover each purchase you make.

You will also accrue interest rate charges for any balance you carry from month to month.

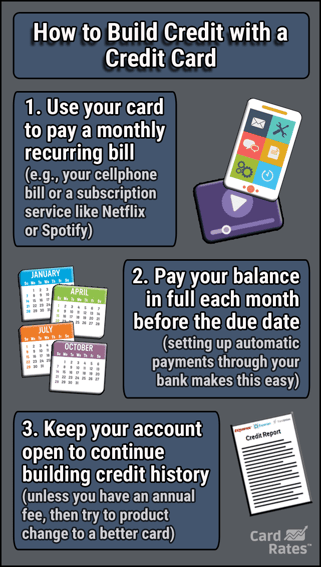

Do Secured Cards Build Credit?

Secured credit cards are a great way to build or rebuild credit. In fact, that is what these cards are designed to do.

Every credit card on the market will report your monthly payment history and overall balance to at least one major credit bureau. The three main credit reporting bureaus are Experian, Equifax, and TransUnion.

Each major credit bureau issues a credit score in your name. The bureau calculates these scores based on the information that lenders report. Positive information, such as on-time payments, improves your credit score. Negative information, such as late payments, hurts your credit score.

Most negative items will live on your credit report for between two and seven years. These items affect your score less as they get older — as long as you replace them with new and positive information.

This is where a secured credit card can help you build your credit score. If you keep your balance low and always pay your bill on time, the monthly reports from your credit card company will help to prove your financial responsibility and establish a positive credit history.

While you may not necessarily see an instant jump in your credit score as soon as you activate your card, your score can increase over time as you add positive data to your credit reports.

If you are new to credit and have no credit score at all — also known as being credit invisible — it could take as long as six months before you accrue enough data on your credit history to generate a reliable credit score.

What Credit Score is Needed for a Secured Credit Card?

There is no minimum credit score requirement for a secured credit card. Some card issuers don’t even require a credit check for card approval because your security deposit acts as a safety net in case you stop making payments or default on your credit card account.

Secured cards are intended to help people build or rebuild their credit. As a result, banks understand that most consumers will have no credit score or bad credit when they apply for a card.

If a secured credit card company requires a credit check for approval, the bank will likely look for information other than your credit score to gauge your qualifications.

For example, a card issuer may reject your application if you have an active bankruptcy case. This is solely a measure to protect their interests, as any credit the bank extends to you could be discharged during your court case.

A recently discharged bankruptcy case should not keep you from getting a credit card as long as your bills and debts are all current and you have no recent late payment history. A bank may also look to see whether you have any active collections accounts on your credit profile.

If you stop making payments on a loan, the lender may write off the debt and sell it to a collections agency. This is a very poor reflection on your ability to pay your debts and can cause substantial damage to your credit score. It can also keep you from getting a secured credit card or other debt, as a lender will see your recent default as a sign of things to come.

Banks also want to make sure you have no outstanding tax debts to the federal, state, or county government that could affect your ability to make your monthly payment. If this debt goes unpaid, the government may garnish your wages to get the money it is owed.

If you meet these criteria and don’t have a recent late payment on your credit history, you should have no trouble qualifying for a secured credit card.

Do All Secured Credit Cards Charge Annual Fees?

Not all secured credit cards charge annual fees, but the fees cards charge are solely up to the credit card company that issues the card. For instance, a card may choose to charge an annual fee or a monthly maintenance fee.

That said, every credit card — whether secured or unsecured — will charge some sort of fee. After all, that is how banks make money.

In addition to an annual or monthly service fee, you may have to pay a foreign transaction fee if you make a purchase in another currency. You will also likely incur a cash advance fee if you withdraw money from your card using an ATM or at a bank teller window. You may be charged a balance transfer fee when you move debt from an existing credit card to your new credit card.

These are common fees with all credit cards. Although some secured cards offer no foreign transaction fees and others offer no balance transfer fee for a limited time, you will rarely find a card that won’t charge you for a cash advance.

What is the Easiest Secured Credit Card To Get?

Secured credit cards, in general, are the easiest credit cards to qualify for. That’s because your security deposit replaces the prerequisite of having good credit to qualify.

In many cases, you may not even need to undergo a credit check for credit card approval. This is one reason these cards are among the best for building credit.

The Savings Secured Platinum Rewards Credit Card doesn’t require a credit check for approval.

The rest of the cards will want to review your credit history, but they don’t have a minimum credit score required for approval. That means you could qualify as long as your recent credit history is free of major defaults or a bankruptcy — even if you have very poor credit.

Building credit takes time and patience. Banks understand this and often have very forgiving approval standards when considering applications for secured credit cards.

When you officially apply, your final application will include a full credit check and access to your entire credit profile. If the bank finds something that wasn’t evident during the soft credit pull, it could rescind its offer.

What is the Best Secured Credit Card to Rebuild Credit?

The best secured credit card to rebuild your credit is one that reports to all three major credit bureaus. From the list above, that includes the Bank of America® Customized Cash Rewards Secured Credit Card, the Capital One Platinum Secured Credit Card, the BankAmericard® Secured Credit Card, and the Citi® Secured Mastercard®.

The three major credit bureaus — Equifax, Experian, and TransUnion — will have different credit scores for you. Unfortunately, there is no way to tell which credit score a specific lender will use when pulling your credit.

If you have a credit card that only reports your balance and payment history to one bureau, you will only reap the credit building benefits of your secured card for that bureau and its credit score. The other two will remain unchanged. But if your card reports to all three bureaus, your credit score improvements will be reflected across the board.

Not every credit card publicizes which bureaus it reports to. Capital One, Citi, and Bank of America have indicated they report to all three bureaus.

If you stick with one of the cards named above, you can leverage your on-time payments to maximize your credit-building efforts.

If you are looking for a secured business credit card to help build business credit, you can also consider the Wells Fargo Business Secured Credit Card. This card claims that it reports to all three credit bureaus under your name and your business name — which can help build your business credit.

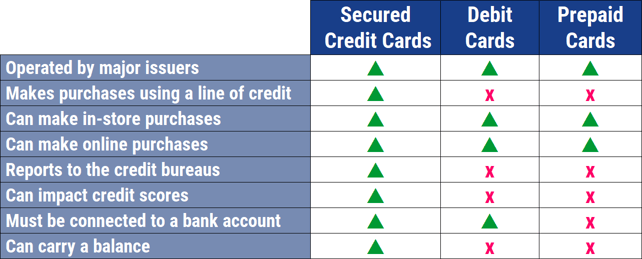

What is the Difference Between a Secured Card and a Prepaid Card?

The difference between a secured credit card and a prepaid card is that a secured card acts more like a credit card and a prepaid card functions more like a debit card.

With a secured card, you can purchase items using a line of credit that a bank extends to you through the card. This means the bank pays for your purchases and you pay the bank through your monthly payments.

A prepaid card attaches to a savings account held in your name. You load money onto your card and are only able to use the amount of money you have deposited into your account.

When you make a purchase, the money is automatically deducted from your account. You don’t have to make monthly payments because you are spending money you already have.

And since a prepaid card does not link to any sort of credit account, your transaction history is not reported to any credit reporting bureau. As a result, these cards don’t help build or rebuild your credit score.

At the same time, the lack of credit means you won’t have to undergo a credit check or have your credit score scrutinized when you apply for a prepaid card.

A secured card will report to at least one credit bureau. That means you can rebuild your credit history through responsible use.

Like a debit card, a prepaid card will feature the logo of a credit card network (typically Visa or Mastercard) on it. This does not mean the card functions as a credit card, but rather that the prepaid card’s transactions are processed by the same networks that process credit card transactions.

Can I Get a Credit Card with a 450 Credit Score?

You may be able to get a secured credit card with a 450 credit score, but you will have a very hard time finding a bank that will extend an unsecured card to you without a cosigner.

Your FICO credit score can range between 300 and 850. Any score at or below 580 is considered poor credit or bad credit, and 450 falls in poor territory.

A score that low typically means you have likely had significant financial issues in your past. While these issues may make it difficult to find unsecured credit options in your name, it doesn’t mean you’re completely out of luck.

Secured credit cards, like the options listed above, are designed to help consumers build credit. Many will consider your application for credit as long as you can provide the necessary refundable security deposit and you don’t have:

- A pending bankruptcy case

- Outstanding tax debts to any federal, state, or local government

- Recent collections accounts

- Accounts with a recent major late payment or delinquency

Every bank has different standards for approval when considering applications for a secured credit card, but most will look past a very poor credit score as long as you don’t fall into any of the categories above.

And if you are a glass-half-full kind of person, consider this: When you have a very low credit score, any positive data will impact your credit rating more than if you had good credit.

A few on-time payments, for example, may do nothing for someone who already has good credit. But if you are in the 450 range, some positive credit reporting can add several points to your credit score.

As your score increases over time, those payments will have less impact. But by then you will already be on the road to recovery.

This is why the secured credit cards listed above are such a great tool for rebuilding your credit while keeping your costs to a minimum.

How Much Will a Secured Credit Card Raise My Credit Score?

How many points your credit score will increase when you add a secured credit card to your wallet is hard to predict. To get a better idea, you have to factor in your personal credit score as it stands right now.

Credit score improvements are all relative to your score before the increase. For example, it is easier to add 50 points to a very poor credit score than it is to an excellent credit score.

A score at or below 580 is considered bad credit. If your score is much lower than 580, you likely have many recent negative items weighing your score down.

Adding a few months of positive credit history — and keeping your balances low — from a secured credit card can give a very low score a quick boost and start to push those negative items further down your credit history.

A score of around 580 will likely have several negative items, but not as many as a score in the low 500s or high 400s. As a result, adding new positive information to your credit report will help — but maybe not as much as it would someone who has a credit score that is lower than yours.

On the opposite end of the spectrum, someone who has a credit score in the high 700s likely has no negative items on his or her credit report. Adding a secured card may have little impact on this person’s credit score.

Depending on your current credit score, it will likely take two or three months of on-time payments and a low balance to show a change in your score. That change may be small at first as you start to prove your responsibility.

Over time, you will see larger point gains. By the end of your first year, you could add 100 or more points to your credit score with responsible credit card use.

Just remember that rebuilding credit is not only about making on-time payments. While on-time payments are the most important factor that determines your credit score, it is still vital that you keep the balance on your credit card low.

Your credit utilization ratio accounts for 30% of your credit score (as a comparison, on-time payments make up 35% of your score).

You can calculate your credit utilization rate by dividing your current credit card balances by the total amount of credit available to you on all of your combined cards.

For example, a card with a $1,000 credit limit and a $500 balance has a 50% credit utilization ratio — meaning you are using 50% of your available credit.

The lower your utilization ratio, the better your credit score. If your balance always hovers around your spending limit, your credit score will suffer. If you keep your credit utilization low — preferably at 30% or lower — you will see faster credit-score gains.

How Much of a Deposit Should I Put On a Secured Credit Card?

You should set your secured credit card balance no higher than the amount of debt you are willing to take on and comfortably pay off each month.

Most secured credit cards have a minimum required deposit. This tends to sit around $200 or $300, depending on the card. Each card also sets a unique maximum deposit. This can vary widely — from $250 to $5,000 or more.

Your security deposit is not a payment. It is money that sits in an account and is only used if you stop making payments on your debt. You will still have to make your monthly payment to cover whatever charges you place on the card.

While having a $5,000 credit limit may sound appealing, it could also increase the temptation to spend. If you are not comfortable with repaying that much debt in a short amount of time, you may want to consider a lower deposit.

Use your secured credit card deposit as a way to set a budget. If you only give yourself access to as much credit as you can comfortably repay, you won’t have to worry about racking up huge debts while you attempt to repair your credit.

This is important to remember because a large balance on your credit card can have more of an impact on your credit score than making regular on-time payments. At best, they will negate each other, and you will see very little change in your credit score.

Will Having Two Secured Credit Cards Help Build Credit Faster?

While having multiple secured credit cards can increase your amount of total available credit — thus improving your credit utilization ratio — it won’t result in a quicker improvement to your credit score.

Instead of investing in a security deposit for a second secured credit card, you may want to consider putting that money toward a credit builder account. These loans essentially allow you to lend money to yourself.

Every payment you make toward the loan is placed into a savings account. Your on-time payments are reported to each credit bureau to help build your credit history. Once you make all of your payments, the bank returns your money to you.

To understand why this is more beneficial than a second secured credit card, we have to break down some numbers.

Approximately 35% of your credit score accounts for your payment history. This model does not care how large the payments are — only that they are on time. A $500 payment will give you no more of a boost in this category than the minimum payment required — as long as both payments are made before their due date.

Approximately 35% of your credit score accounts for your payment history. This model does not care how large the payments are — only that they are on time. A $500 payment will give you no more of a boost in this category than the minimum payment required — as long as both payments are made before their due date.

Making two on-time payments will add a second positive data point to your credit history each month, but it won’t cause a major jump.

The next largest factor in your credit score is your credit utilization. This calculates how much of your available credit is currently used. Again, keeping your balance low on one card has the same impact as keeping your balance low on two cards.

The only difference is that having more available credit will make your utilization look better. For example, having a $20 balance on a card with a $200 spending limit gives you a 10% credit utilization rate. That same $20 balance on a $500 credit limit is a 4% utilization rate.

But with a secured card, you can often add to your security deposit to increase your credit limit — though this may come with a processing fee. Instead of creating a second card account, you can simply add to your existing account and get the same impact.

The difference between a second secured card and a credit builder loan comes in the next category. Approximately 10% of your credit score factors your credit mix. Lenders like to see you can handle multiple types of credit at once. A second secured credit card does not improve your mix. A small loan does.

By keeping your balances low, and making on-time payments, a small personal loan and a single secured credit card can supercharge your credit building efforts and get you on the right track faster.

Just make sure you can comfortably pay both bills each month. After all, missing a single payment can derail your entire mission.

Can You Be Denied a Secured Credit Card?

Yes, you can be denied a secured credit card. A secured card is a line of credit. Every bank has the right to choose to whom it extends credit.

But a secured card is designed for consumers who have bad credit or no credit. Banks expect these cards to attract applicants with past financial problems. That is why you make a refundable security deposit before activating your account.

But there are a few instances in which a bank won’t consider your application for a secured credit card. This is especially true if you have an active bankruptcy case that could see the card rolled into your dismissed debt.

A bank may also deny your application if you have active tax debts to local, state, or federal governments that could result in wage garnishment and an inability to pay your monthly payment.

You may also have trouble getting a card if you have recent collection accounts that show a current inability to pay your monthly bills.

In the end, the bank has the right to set its standards for approval. While most banks are very lenient with their approval criteria for secured credit cards, one bank could determine that you are too high of a risk to take on if you have a very troubled financial past.

Compare Secured Credit Cards With No Annual Fee Online

Will Rogers once said, “You never get a second chance to make a first impression.” He obviously didn’t know about using secured credit cards.

With a secured credit card, you can grab your second chance to build the financial future you deserve and overcome previous mistakes you may have made.

And, if you stick to secured credit cards with no annual fee like those listed above, it won’t cost you anything to take advantage of your second chance. Once you start your rebuilding journey, you’ll be one step closer to creating a fresh financial profile that gets you the loans and interest rates you want.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![5 Credit Cards For Bad Credit: No Annual Fee ([updated_month_year]) 5 Credit Cards For Bad Credit: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/12/Credit-Cards-For-Bad-Credit-With-No-Annual-Fee.jpg?width=158&height=120&fit=crop)

![7 Best No-Annual-Fee Cards For Excellent Credit ([updated_month_year]) 7 Best No-Annual-Fee Cards For Excellent Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Best-Credit-Cards-For-Excellent-Credit-With-No-Annual-Fee.jpg?width=158&height=120&fit=crop)

![8 Best Beginner Credit Cards: No Annual Fee ([updated_month_year]) 8 Best Beginner Credit Cards: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Best-Credit-Cards-For-Beginners-With-No-Annual-Fee-1.jpg?width=158&height=120&fit=crop)

![7 Credit Cards for Fair Credit: No Annual Fee ([updated_month_year]) 7 Credit Cards for Fair Credit: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/credit-cards-for-fair-credit-with-no-annual-fee-feat.jpg?width=158&height=120&fit=crop)

![7 No-Annual-Fee Credit Cards For Fair Credit ([updated_month_year]) 7 No-Annual-Fee Credit Cards For Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/01/shutterstock_1092414950-1.jpg?width=158&height=120&fit=crop)

![8 Best No Annual Fee Credit Cards ([updated_month_year]) 8 Best No Annual Fee Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/05/annualfee.png?width=158&height=120&fit=crop)

![13 Best No-Annual-Fee Credit Cards ([updated_month_year]) 13 Best No-Annual-Fee Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/03/best-no-annual-fee-credit-cards.jpg?width=158&height=120&fit=crop)

![7 Best No-Annual-Fee Credit Cards with Rewards ([updated_month_year]) 7 Best No-Annual-Fee Credit Cards with Rewards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/12/No-Annual-Fee-Credit-Cards-with-Rewards.jpg?width=158&height=120&fit=crop)