Although not quite 70 years old, the credit card has quickly become a fixture of American consumer finance, which means there are a handful of common credit card requirements consumers may come across.

The U.S. today is home to more than 350 million credit cards. To put that number in perspective, consider the fact that, with a population of approximately 326.6 million people, the U.S. officially has more credit cards than people.

More surprising than the sheer number of cards may be that, despite the fact that the U.S. has more than 4,600 commercial banks, the majority of those hundreds of millions of cards are issued by only 10 of them.

Because of — or, perhaps, despite — the narrow field of banks issuing credit cards, requirements are fairly uniform across the various issuers. While there may be some variance depending on the issuer or card (particularly in regards to specific income and credit qualifications), the majority of credit cards share the same basic seven requirements. In this article, we’ll take a closer look at these seven requirements, including age minimums, verifiable income, and having your address and social security number on hand. We’ll also look at some credit card offers for a range of credit scores.

Age Requirements | Verifiable Income | Address | Social Security Number |

Card Offers and Requirement Variations | Number of Accounts | Brand Relationships

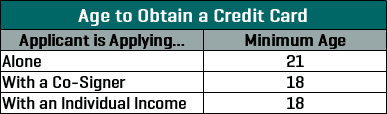

1. Solo Credit Card Applicants Must Be 21 or Older

Not so long ago (pre-2009, to be precise), young adults could look forward to an onslaught of credit card offers hitting their mailboxes practically the day they turned 18. I remember these offers filling my mailbox when I was barely out of high school. Thankfully, I did not sign up for any dubious offers during my younger and more naive days. These days, the chances are you won’t see much in the way of credit card offers until you turn 21 — and that’s thanks to the CARD Act of 2009.

In addition to specifying that card issuers cannot send unsolicited credit card offers to consumers under the age of 21, the CARD Act stipulates that solo credit card applicants must be at least 21 years old.

That said, the CARD Act does provide a few exceptions to the rule. Specifically, consumers aged 18 to 20 who can prove an independent source of income are eligible to apply for a personal credit card. In addition, those over 18 who have a qualified co-signer may also apply for their own card.

Those who are underage but still wish to start building a credit history should consider becoming an authorized user on the credit card account of a family member with good credit. This can help build your own credit history whether you actually use the card or not, and can teach good credit habits starting at 13 or younger, depending on the issuer.

2. You Must Have a Verifiable Income Source

A verifiable income source is a standard requirement for any potential cardholder, and is particularly important for applicants under 21 and those with poor credit. In most cases, your income doesn’t necessarily need to be a form of employment to qualify and could include investments or other income sources.

Although not every applicant who is approved will need to submit documentation to verify their income, it’s not a completely rare event, either, especially if they have a rocky credit report. Another reason not to stretch the income truth? It’s actually illegal to provide false information on a credit application and can get you into trouble if you are caught at it.

The specific income requirement will vary based on the specific card, but will typically be at least $800 a month. Of course, some of the most exclusive credit cards can require six-figure salaries (or more).

3. Card Applicants Need a Physical Address

Perhaps a surprise to those who don’t apply for credit frequently is that anyone looking for a new credit card will need a physical address to complete the application. This has been the case since the end of 2001, when the U.S. PATRIOT Act was put into effect, making it necessary for all financial institutions to enact a Consumer Identification Program (CIP).

Consumers can use either a home or business address, provided it is a physical address. According to the law, post office (PO) boxes do not count as physical addresses, and consumers will not be able to complete a credit card application with a PO box number. The only exceptions to the law are for Army Post Office (APO) boxes, typically granted to military personnel serving overseas, or for Fleet Post Office (FPO) boxes.

While financial institutions are required to collect a physical address, you do not have to receive mailed correspondence at that address. Your actual mailing address can be a PO box or other commercial mailbox.

4. U.S. Citizens Must Provide a Social Security Number

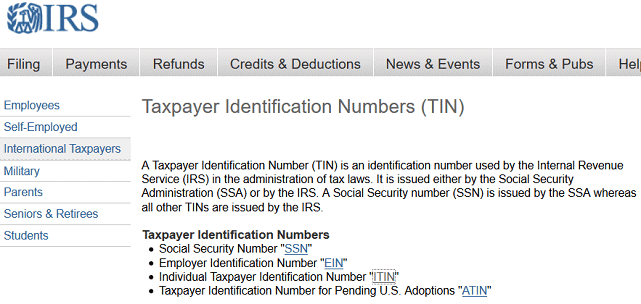

Your Social Security Number (SSN) is a necessity for just about anything to do with your finances — including getting a job — and that doesn’t stop with credit. A request for your SSN will likely be on every credit card application you encounter. Not only is it one of the ways the bank verifies your identity (which it is legally required to do), it also helps ensure the correct credit report is used.

New credit card applicants will likely be required to supply an SSN, ITIN, or EIN.

In the case of resident aliens, foreign nationals, and other immigrants who don’t qualify for an SSN, some issuers will accept an Individual Taxpayer Identification Number (ITIN) in its place. Those eligible for an ITIN can obtain one through the IRS after verifying their identity.

Additionally, businesses looking to obtain a credit card will be required to provide either their personal SSN or an Employer Identification Number (EIN). Any business that pays employees or business taxes is required to have an EIN.

5. Credit Requirements Will Vary By Issuer & Card

After verifying your identity, the very next thing most issuers will do when you apply for a credit card is to make a hard credit inquiry, requesting your credit report from one (or all three) of the major consumer credit bureaus, Equifax, Experian, and TransUnion. Then, probably using the FICO Bankcard Score 8 — or an internal, proprietary model — the bank will determine your credit risk.

The specific credit score required for approval will vary largely with the card and issuer, but, in general, higher scores are always preferable. For the most part, high-limit cards and those with the biggest rewards will typically require the highest credit scores, while subprime issuers will tend to have lower credit score requirements than other issuers.

Excellent Credit | Good Credit | Fair Credit | Poor Credit

Credit Cards for Excellent Credit

The top of the credit score food chain, consumers with excellent credit — 800 and up on the FICO scale, 750 and up on the VantageScore 3.0 scale — will have their pick of the credit card offer litter. In fact, those with excellent credit may have a hard time choosing between all the great cards, so start with our top three below.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

+See More Cards for Excellent Credit

Credit Cards for Good Credit

Consisting of FICO scores above 670 and VantageScores of 700 and up, consumers in the good-credit category won’t see the same rates as their excellent-credit counterparts, but will still have a range of quality offers from which to choose. For instance, our top picks all include solid rewards and never charge an annual fee.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

+See More Cards for Good Credit

Credit Cards for Fair Credit

The “fair” credit range encompasses FICO scores between 580 and 669, and VantageScores of 650 to 699. While consumers in this credit score range are not limited to subprime issuers, they are unlikely to be approved for some of the more feature-rich cards. That said, our top picks include a number of options for earning rewards on everyday purchases.

- No annual or hidden fees. See if you're approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One's mobile app

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

- Earn unlimited 1.5% cash back on every purchase, every day

- No rotating categories or limits to how much you can earn, and cash back doesn't expire for the life of the account. It's that simple

- Be automatically considered for a higher credit line in as little as 6 months

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Help strengthen your credit for the future with responsible card use

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$39

|

Average, Fair, Limited

|

+See More Cards for Fair Credit

Credit Cards for Poor Credit

With the lowest FICO and VantageScore numbers, those who fall into the “poor” or “bad” credit ranges are the least likely to be approved for new credit. These consumers will likely need to focus on obtaining a secured credit card, which will require an initial deposit to open, or on applying to cards from subprime issuers who specialize in poor-credit consumers. Our top picks will report to the three major credit bureaus so you can build credit.

- No credit check to apply

- Adjustable credit limit based on what you transfer from your Chime Checking account to the secured deposit account

- No interest* or annual fees

- Chime Checking Account and qualifying direct deposit of $200 or more required to apply. See official application, terms, and details link below.

- The secured Chime Credit Builder Visa® Card is issued by The Bankcorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted.

- *Out-of-network ATM withdrawal and OTC advance fees may apply. View The Bancorp agreement or Stride agreement for details; see back of card for issuer.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

$0

|

None

|

- $400 credit limit doubles to $800! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply

- Monthly reporting to the three major credit bureaus

- Initial Credit Limit of $400.00 (Subject to available credit)

- Fast and easy application process; results in seconds

- Use your card at locations everywhere Mastercard® is accepted

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99%

|

$99

|

Fair/Poor/Bad

|

- Earn 1% cash back rewards^^ on payments made to your Revvi Credit Card

- Perfect credit not required

- $300 credit limit (subject to available credit)

- Checking account required

- Opportunity to request credit limit increase after twelve months, fee applies

- *See Rates, Fees, Costs & Limitations for complete offer details

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

See website for Details

|

N/A

|

35.99%

|

$75.00 1st year, $48.00 after

|

Fair

|

+See More Cards for Poor Credit

6. You Shouldn’t Have Too Many Recent New Accounts

Another requirement for which the specifics tend to vary by issuer is the limit on the number of new accounts you can have at the time of application. This requirement, a fairly recent one for some issuers, shows up as a limitation on new accounts, the total number of accounts, or even your total available credit.

For instance, American Express requires that new credit applicants not have more than three current American Express credit cards in their name, including both business and personal cards, with a maximum of four Amex cards at any time. Of course, the poster child for the requirement is Chase Bank, whose infamous “5/24 Rule” was applied to the bulk of its cards in mid-2016.

In essence, Chase’s rule means that consumers who have opened five or more new credit accounts within the last 24 months will be automatically rejected if they try to apply for a new Chase credit card (including most co-branded cards). The limit of five new accounts includes both Chase credit accounts and those opened with other banks.

7. Bad Brand Relationships May Impact Your Approval

The last requirement you’ll be likely to encounter when applying for a new credit card is that you have a good — or, at least, neutral — relationship with the issuing bank. This refers to both your actual relationship (a history of cursing at the customer services agents will be remembered) as well as any financial relationships.

In general, if you’ve had an account of any sort with the bank before, including being a co-signer on someone else’s account, and it became delinquent or was discharged in a bankruptcy, the bank will be less likely to offer you credit in the future. Even if the incident has been taken off your credit reports, the bank may have internal records that retain the information.

I recently applied for the Chase Freedom and received a letter of denial. According to the letter, I was denied because of, ‘Delinquency or other derogatory relationship with our bank.’ — myFICO Forum Member

Fortunately for those caught in the crossfire, some reports indicate you may have luck calling the bank and explaining your situation. If the issue was far in the past and/or due to the mistakes of someone else, you may be reconsidered for credit.

Make Sure You Meet the Requirements Before You Apply

With more cards than people, the U.S. is home to literally hundreds of millions of credit cards — and there’s likely one out there with your name on it. Yes, credit cards truly have become a major part of American consumer culture, and even the lowly vending machine now accepts plastic as payment.

Of course, no matter how many of the cool kids have them, credit cards are not to be taken lightly. Credit cards have real financial implications and responsibilities attached to them, and therefore must be used responsibly.

And, of course, whether you’re looking for your first credit card or your 71st, it’s important to know what to expect. Your chances of approval are always highest when you know you meet the requirements before you even apply.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![How to Apply For a Credit Card With Bad Credit ([updated_month_year]) How to Apply For a Credit Card With Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/01/How-to-Apply-For-a-Credit-Card-With-Bad-Credit.jpg?width=158&height=120&fit=crop)

![How to Apply for a Credit Card Online: 4 Easy Steps ([updated_month_year]) How to Apply for a Credit Card Online: 4 Easy Steps ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/07/How-to-Apply-for-a-Credit-Card-Online--1.jpg?width=158&height=120&fit=crop)

![Apply For a Prepaid Card: 5 Best Card Options ([updated_month_year]) Apply For a Prepaid Card: 5 Best Card Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/Apply-For-a-Prepaid-Card.jpg?width=158&height=120&fit=crop)

![Capital One Credit Score Requirements By Card ([updated_month_year]) Capital One Credit Score Requirements By Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/caponecredit.png?width=158&height=120&fit=crop)

![How to Get a Black Card – American Express® Requirements ([updated_month_year]) How to Get a Black Card – American Express® Requirements ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/03/How-to-Get-a-Black-Card-2--1.jpg?width=158&height=120&fit=crop)

![Is It Bad to Apply For Multiple Credit Cards At The Same Time? ([updated_month_year]) Is It Bad to Apply For Multiple Credit Cards At The Same Time? ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Is-It-Bad-to-Apply-For-Multiple-Credit-Cards-At-The-Same-Time.jpg?width=158&height=120&fit=crop)

![5 Steps to Apply for a Business Credit Card ([updated_month_year]) 5 Steps to Apply for a Business Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/12/How-to-Apply-for-a-Business-Credit-Card.jpg?width=158&height=120&fit=crop)

![8 Credit Cards without SSN Requirements ([updated_month_year]) 8 Credit Cards without SSN Requirements ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/01/Credit-Cards-without-SSN-Requirements--1.jpg?width=158&height=120&fit=crop)