You may eventually want to purge one, some, or even all of your credit card accounts. Whether it’s out of need or desire, you have every right to back out of the deal.

There are potential drawbacks to canceling a credit card, however, so it’s important to learn what they are before ending the relationship. The downsides may inspire you to keep an account active.

Of course, there are times when it makes sense to kiss your card goodbye, too. Here’s what you need to know to make the right decision.

Closing a Credit Card Can Hurt Your Credit in Various Ways

An open credit card account will stay on your consumer credit report for as long as it’s in use, and will remain there even after you close it. According to the credit reporting agency Experian, an account with no negative information attached to it can be listed for up to 10 years after you’ve closed it.

This means all your positive payment history and the paid-off balance on the card will remain on your file for a while. Still, shutting the account down does have an impact on your credit scores, and it’s often not positive. That doesn’t mean you can’t or won’t bounce back, but some points may be shaved off in the beginning.

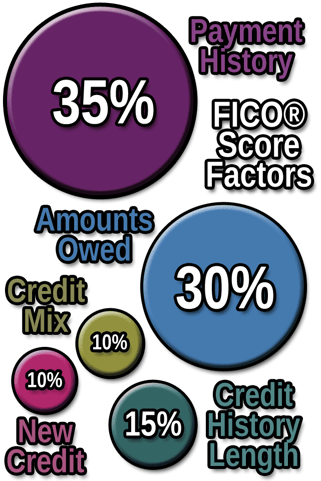

Payment History

Credit scores rank payment history as the most important factor, so a long pattern of paying your credit card accounts on time will drive your scores upwards. If you close your card, you won’t be making any transactions with it — and therefore eliminating any payments that would be working to your scoring advantage.

Credit Utilization

How much you owe compared to the amount you can borrow on your credit line is called your credit utilization ratio, and it’s the second weightiest factor in a credit score.

Your credit utilization — or amounts owed — considers both the debt you have on individual accounts and collectively.

If you cancel a credit card that has an available credit line and owe balances on other accounts, you are hurting your overall utilization ratio. This will result in an immediate credit score decline.

A general rule of thumb is to keep your credit utilization at or below 30% (the lower the better), so if closing an account will put you above this threshold, you may want to reconsider.

Length of Credit History

Credit scoring systems give points for keeping older accounts active. The longer you’ve had a well-managed credit card, the better your credit scores will be. Since canceling a card that you’ve had for many years shortens a credit history, your scores can decline.

Credit Mix

Another scoring consideration is the variety of credit products you have and use. A diverse mix of credit cards and loans works in your favor, but if you only have a couple of accounts and close one, you’re reducing the mixture. This can result in a lower credit score.

Smaller Safety Net

In addition to the potential damage to your credit score, canceling a credit card can also mean reducing your ability to pay for something necessary and expensive. According to the 2018 Federal Reserve Report on the Economic Well-Being of U.S. Households, 27% of American adults can’t cover an unexpected expense of $400 with cash on hand.

Unfortunately, financial emergencies do occasionally happen. It could be anything from paying a costly hospital bill to fixing a car you need for work or school. A credit card equipped with an available limit can give you peace of mind in the event of a crisis.

Having a credit card tucked away for such a purpose is usually prudent, though you would have to keep the account active by using it occasionally. Issuers usually close accounts automatically if you’ve left them dormant for between 12 months and two years.

Sound Reasons to Cancel a Credit Card

Even with all the possible hazards of canceling a credit card, there are upsides too.

Debt is Too Easy

It may be easier to cancel a card if the temptation to spend is too great.

Plenty of people have a tough time managing their credit cards and ensuring their debt is low or nonexistent. It can be tempting to overspend on a credit card when the ability to charge more than you can realistically payoff is in your wallet, logged into shopping sites, and saved in your smartphone.

If self-control is an issue for you, it may be preferable to cancel the card and remain in the black than constantly battle the seductive nature of an available credit line.

You Have Enough Credit

Having excess plastic can be a drain on your time and energy. Every account you have must be monitored, even if you don’t use it often. You’ll need to check to make sure that fraud hasn’t occurred, that balances are manageable, and payments are being posted on time.

If you have more than enough credit products (especially if they’re all appearing on your credit report in favorable ways) and want to rid some accounts to streamline your bookkeeping efforts, go for it.

Your Retail Card is No Longer Useful

Maybe you opened a retail card at a store where you used to shop but haven’t been to it in ages. If you have no plans to go again, feel free to close the account. The issuer will do it for you anyway if you wait too long.

You’re Starting a Debt Management Plan

If you are on a credit counseling plan to pay off your debt, you’ll need to cancel your credit cards. It’s for the greater good because you’ll be concentrating on getting out of debt. Once you’re done with the plan, you can always apply for credit cards again and get back on track in a healthy way.

You’re Just Done with Credit Cards

Maybe you’ve already bought a home and financed a car, have more than enough money to handle a financial emergency and don’t care about lucrative rewards programs that come with many accounts. Canceling a credit card account is a perfectly fine decision.

In no way are you required to have a credit card, so if you’d prefer to use a debit card that’s attached to your checking account, that is your choice.

If You’re Ready to Cancel, Call Your Issuer

Clearly there are pros and cons to canceling a credit card. You may want to hold on to them in the end, but if you’re ready to safely give one or more up, call your credit card issuer and explain what you want to do. The account will be deactivated in minutes.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![If I Cancel My Credit Card, Will The Interest Stop? ([updated_month_year]) If I Cancel My Credit Card, Will The Interest Stop? ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/11/Cancel-Credit-Card.jpg?width=158&height=120&fit=crop)

![Walmart Credit Card: Bad Credit OK? ([updated_month_year]) Walmart Credit Card: Bad Credit OK? ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/01/Walmart-Credit-Card.jpg?width=158&height=120&fit=crop)

![3 Best Credit Card Loans for Bad Credit ([updated_month_year]) 3 Best Credit Card Loans for Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/loans.png?width=158&height=120&fit=crop)

![7 Credit Card Bonuses For Bad Credit ([updated_month_year]) 7 Credit Card Bonuses For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/12/Credit-Card-Bonuses-for-Bad-Credit-Feat.jpg?width=158&height=120&fit=crop)

![How to Apply For a Credit Card With Bad Credit ([updated_month_year]) How to Apply For a Credit Card With Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/01/How-to-Apply-For-a-Credit-Card-With-Bad-Credit.jpg?width=158&height=120&fit=crop)

![The 1 Discover Credit Card For Bad Credit ([updated_month_year]) The 1 Discover Credit Card For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/01/Discover-Credit-Card-For-Bad-Credit.jpg?width=158&height=120&fit=crop)

![7 Best Secured Credit Cards for Bad Credit ([updated_month_year]) 7 Best Secured Credit Cards for Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/securedcards.png?width=158&height=120&fit=crop)

![7 Easy-to-Get Store Credit Cards for Bad Credit ([updated_month_year]) 7 Easy-to-Get Store Credit Cards for Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/storecards-2--1.png?width=158&height=120&fit=crop)