The best credit cards for building credit won’t just help you improve your credit score — they’ll also provide benefits that last long after you’ve achieved the excellent credit you strive for.

And whether you’re a student, consumer, small business owner, or all of the above, you can maximize your credit-building potential while developing a positive relationship with a bank and possibly earn some rewards along the way.

Every one of the cards below will report your payment and balance history to at least one major credit bureau. With responsible behavior, you could start building credit as soon as you receive your card in the mail.

Unsecured | Secured | Students | FAQs

Best Unsecured Credit Cards For Building Credit

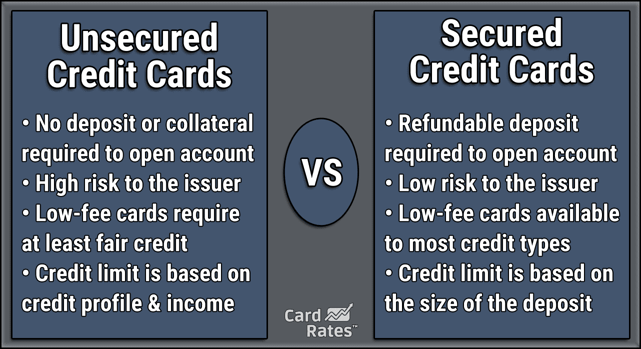

Most consumers think of an unsecured card when they imagine a credit card. You don’t have to place a cash deposit to activate an unsecured credit card, unlike secured credit cards.

These cards provide a modest initial spending limit but often allow you to earn a higher credit line while you prove your creditworthiness and establish your credit history. With responsible behavior, you could receive a higher limit in six months or less.

- Earn unlimited 1.5% cash back on every purchase, every day

- No rotating categories or limits to how much you can earn, and cash back doesn't expire for the life of the account. It's that simple

- Be automatically considered for a higher credit line in as little as 6 months

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Help strengthen your credit for the future with responsible card use

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$39

|

Average, Fair, Limited

|

The Capital One QuicksilverOne Cash Rewards Credit Card includes a small annual fee that gives you access to a flat and unlimited rate of cash back rewards on every purchase you make with the card. If you use your card enough — and pay your debts before they incur interest charges — you could make money from this card.

Capital One also reports your payment and balance history to each major credit bureau. In time, you may qualify for a card upgrade — including a promotion to the traditional Quicksilver card that offers the same rewards with no annual fee.

The Capital One Platinum Credit Card is the bank’s perfect entry-level card for those who are new to credit. This card offers a modest initial credit limit for all cardholders and will provide a competitive variable APR and no annual fee.

This is a great card to start with if you don’t plan on charging a lot of purchases. While you may be intrigued by the thought of cash back rewards, that perk only pays off if you charge several hundred dollars to your card each month — and pay off the credit card debt without interest charges.

The Milestone® Mastercard® is offered to applicants with bad credit and has very reasonable terms for a product of this type. The annual fee and APR are lower than that of some competitors, and there’s no monthly maintenance charge.

Payment history is reported to all three major credit bureaus, and there is a grace period after the close of each billing cycle, during which cardholders can avoid interest by paying their balance in full.

The Total Visa® Card checks in near the bottom of this list because it offers low initial credit limits that still require a hefty fee to access. The card’s program fee will be deducted from your initial credit line when you activate your account, which leaves you with less spending power than you may have expected.

But if you’re looking for a quick application, this card can get you qualified and set up with an account in less than 10 minutes.

Best Secured Credit Cards For Building Credit

A secured credit card requires you to make a refundable security deposit for approval. The amount of your deposit typically matches your new card’s credit limit. In other words, a $500 deposit will produce a card with a $500 credit line. And unlike a prepaid card, a secured card will help you build credit.

Since your deposit acts as security for your account, most banks will issue you a secured card without a credit check. Once you close your account, the bank will refund your deposit in full — as long as your account has no outstanding credit card debt.

- No annual or hidden fees. See if you're approved in seconds

- Building your credit? Using the Capital One Platinum Secured card responsibly could help

- Put down a refundable security deposit starting at $49 to get a $200 initial credit line

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Limited, Bad

|

The Capital One Platinum Secured Credit Card is one of the few secured card offerings that may not require a full security deposit for approval. Depending on your credit history, the bank may only require you to make a small deposit that equals a fraction of your credit line.

And since Capital One has one of the largest credit card portfolios in the business, you can work your way toward a good credit score and attempt to upgrade to a new card over time. That could mean a better variable APR and lucrative cash back or travel rewards.

The Discover it® Secured Credit Card allows you to earn cash back rewards on eligible purchases and also provides you with the opportunity to upgrade to an unsecured credit card over time with responsible use.

This card comes with no annual fee and provides all cardholders with free monthly FICO score updates. This can be an especially useful tool to track your progress while building credit.

The Applied Bank® Secured Visa® Gold Preferred® Credit Card has one of the lowest interest rates in the secured card market and also allows cardholders to increase their credit limit with an additional deposit after activating their account.

If you’re looking for a large initial credit limit, you may want to consider a different card. Applied Bank caps your initial deposit at $1,000 but allows you to increase your deposit — and your credit limit — after you activate your account.

Best Student Credit Cards For Building Credit

College isn’t just a time for hitting the books and making connections. It’s also the perfect time to start building your credit history before graduation.

With the cards below, you can establish a positive credit history before you hit “the real world.” This puts you at the head of the class when it’s time to apply for a mortgage, purchase a vehicle, or finance something with a large price tag.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

Student cardholders can earn a generous cash back reward rate with the Discover it® Student Cash Back. Discover will also match the full amount of cash back you earn during your first year with the card as part of its popular Cashback Match program.

Cardholders can also earn an statement credits for referring their friends if they apply and are approved. New members may also qualify for interest-free financing for their first several months with the card. Even with all of the perks, there’s no annual fee for membership.

The Discover it® Student Chrome will match all of the cash back you earn during your first year with the card as part of the issuing bank’s Cashback Match program. You’ll also benefit from reporting to all three credit bureaus to help improve your credit score faster.

Once you graduate, you can remain with your current card or use your improved credit score to graduate to an even more lucrative card in Discover’s credit card portfolio.

How Can a Credit Card Help Me Build Credit?

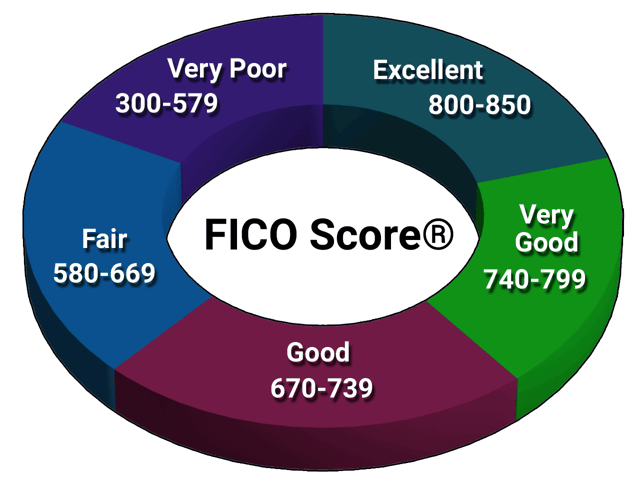

Your credit score is a way to visualize your track record of repaying debt. A high credit score shows a long history of responsibility. A bad credit or fair credit score shows that you’ve made mistakes.

You can use a credit card to establish a positive credit history or help repair any damage done to your credit profile.

Every month, your credit card issuer will report your current balance and payment history to at least one major credit bureau. There are three major credit bureaus — TransUnion, Experian, and Equifax.

The information the bureau receives will aid in the calculation of your credit score. Positive data, as you may expect, will improve your credit score. Negative data will cause your credit score to drop.

To get a better idea of how a credit card helps you build credit, let’s look at three different scenarios:

- The newcomer: This person has no credit score — otherwise known as credit invisible. This means he doesn’t have enough information on his credit report to generate a reliable score. By using his credit card and paying his balance in full and on time each month, he starts to add some information to his credit file. After three to six months, there will be enough data for the credit bureaus to create a score. With responsible behavior, his first credit score will likely start in the mid-600s. If there are any negative behaviors reported during that time, such as a late payment, he’ll likely start in the mid-500s.

- The rebuilder: Let’s say this person has a few late payments or a collections account in his past. These mistakes have left him with a sub-500 credit score and unable to qualify for most credit cards or loans. But with a secured credit card, he can start to rebuild his credit history by adding regular, on-time monthly payments to his credit profile. While negative items have a big impact on your credit score, they lose their importance over time — especially when you replace them with newer, positive items. As the on-time payments and low balance reports slowly push the old late payments further down his credit report, he’ll start to see an increase in his credit score.

- The steady riser: This consumer has a long history of timely payments and low balances. She already has a good credit score. But that doesn’t mean that her credit card can’t help her improve her credit rating even more. Approximately 30% of your FICO score depends on your total debt load and credit utilization rate. This rate calculates how much of your available credit you’re utilizing. For example, a card with a $1,000 credit limit and a $500 balance has a 50% credit utilization rate. Lenders favor consumers who have a credit utilization rate below 30%. If this consumer keeps her credit card balances low, she’ll continue to grow her credit score. On the other hand, if she racks up a large balance and doesn’t pay her debts down, she could increase her utilization rate and decrease her credit score.

Your credit card account has other ways of helping to build your credit history. FICO bases 10% of your credit score on your length of credit history. By maintaining a long-standing relationship with a bank, you can improve your credit score.

Another 10% looks at your credit mix. Lenders like to see that you have a history of paying down different types of debts — including personal loans, auto loans, mortgages, student loans, and credit cards. Adding a credit card to your wallet will improve your credit mix.

How Do I Choose My First Credit Card?

Choosing your first credit card is a lot like choosing your prom date. While one card — or date — may seem really cool in the moment, you could end up regretting your decision down the road.

Many consumers fail to do much research when they apply for their first credit card. They think that, as newcomers, they need to take the first offer they receive. What they don’t realize is that the first offer is usually the worst offer.

Many small banks send out credit card offers with a high interest rate and other fees to young people who are just becoming eligible to apply for a card. Such predatory behaviors led to new laws in the Credit CARD Act of 2009.

These cards rarely provide room for growth. They typically charge fees, don’t increase your credit limit, and offer no path to move on to a better card once you establish a positive credit history.

That leaves you no other choice but to cancel your account and find a new bank with better rates and more appreciative culture. But this is something that you can do right from the start.

When choosing your first credit card, stick to a large bank that provides many different types of unsecured credit cards. You may not currently qualify for their top-shelf cash back card or that super-lucrative travel rewards card — but you may someday.

While you can always cancel your current card and apply for the card of your dreams later, it’s much easier to establish a relationship with a bank from the beginning and work your way to a great card through a series of upgrades. Plus, if you have a strong track record with a bank, you may qualify for that card earlier than if you sent in a cold application.

That’s why our best-of lists often include most of banking’s heavy hitters, including Capital One, Discover, Bank of America, Citi, and Chase.

These banks all have a diverse selection of cards available to consumers. Most have secured card offerings for rebuilding your credit or starter credit cards for establishing your credit history. As time goes on, you can also qualify for cards with top rewards, low interest rates, and other perks that are more than worth your patience and persistence.

Smaller banks with no upgrade potential simply can’t offer that. Plus, with a big bank, you can also sign up for a bank account and other loan products all from the same financial institution.

How Do I Apply For a Credit Card?

Every card issuer wants to make its application process as easy as possible. Whether you’re looking for a consumer credit card, store credit card, student credit card, prepaid card, or business credit card, you can typically get approval within a few minutes from anywhere in the world.

Online applications are the easiest way to apply for a credit card. You can usually find a card’s application on its website — accessible through the links in the cards above.

Each application will require your personal information. While some applications ask for more than others, you should at least be ready to provide your:

- Name

- Physical address

- Email address

- Phone number (home and/or cellphone)

- Social Security number

- Employment status

- Income information

- Current rent or mortgage monthly payment

An average credit card application takes five minutes to complete. Once you’re done, you hit the submit button and pass the baton to the credit card company.

Your computer or mobile device screen will show some sort of graphic to let you know it’s processing your application. This can take up to 60 seconds but is usually much faster. When your screen updates, it will display your credit decision.

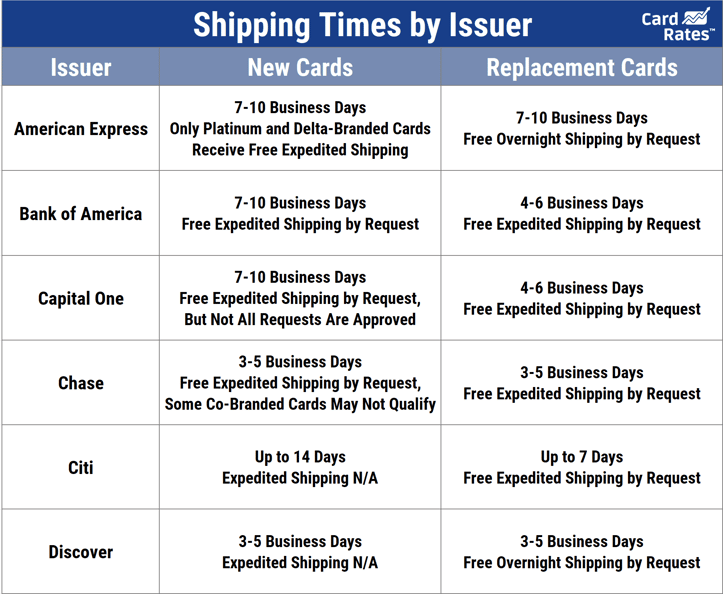

If you’re approved, the screen will show your new card’s credit line, as well as your account number. You’ll also be invited to create an online account in preparation for your new card — which will arrive in the mail within seven to 10 business days.

If the bank or credit union denies your application, you will receive an adverse action notice in the mail within seven to 10 business days. This letter will outline the reasons why the bank rejected your request and possibly give you some tips on how to improve your credit so you may have better luck on your next application.

Many store credit card options allow you to apply for a card while you’re at the register at your favorite store. This process is so fast that you can often apply, get approval, and use your new credit line during the same purchase.

In these cases, you’ll typically type your Social Security number in the debit card pin pad. You’ll also have to provide some of the basic information listed above to the cashier. Within a few seconds, thanks to automated underwriting software, you could have your account set up and ready to go.

A store credit card is typically much easier to qualify for — but you’ll also find that these cards have a higher interest rate and are usually limited to use only at the store that issues the card.

Which Credit Cards Build Credit Fast?

Just about every secured and unsecured credit card offering will help you build credit by reporting your payment and balance history to at least one major credit reporting bureau. These bureaus collect this information and use it to calculate your credit score.

Any on-time payments and low balances reported will help to improve your score. Late payments, defaults, or high balances will likely cause your score to decrease.

The best credit cards for building credit are those offered by a large bank or credit union. That’s because these issuers report your history to all three credit reporting bureaus — TransUnion, Experian, and Equifax.

Banks that report to all three bureaus include Capital One, Chase, Citi, Wells Fargo, Bank of America, and Discover.

You have a credit score through all three of these bureaus. It’s difficult to determine which score a lender will use when you apply for a loan or credit card. Capital One, for example, uses all three bureaus and chooses which score it uses based on your location.

That’s important to remember because some cards may only improve your score by reporting to one bureau. Let’s say, for example, your card only reports to TransUnion. If you attempt to apply for an auto loan, and the lender pulls your Equifax score, your responsible credit card usage won’t even show on your credit report. That means you could have a lower score with Equifax than you do with TransUnion.

Lenders have to pay to access credit scores through each bureau. Some only pay for access to one score, so there’s no way to request that a lender use a certain bureau to pull your credit history.

That’s why it’s best to stick to a credit card company that reports to all three bureaus and helps you to build your credit from every possible angle.

How Long Does it Take to Build Credit?

The time needed to build your credit will depend on your current credit situation. For example, if you’re starting with no credit at all, you can typically earn your first credit score within three to six months.

If you have bad credit or fair credit already and want to rebuild it into a good score, this can take anywhere from a few months to a year or more. The exact time needed will depend on the factors keeping your score down.

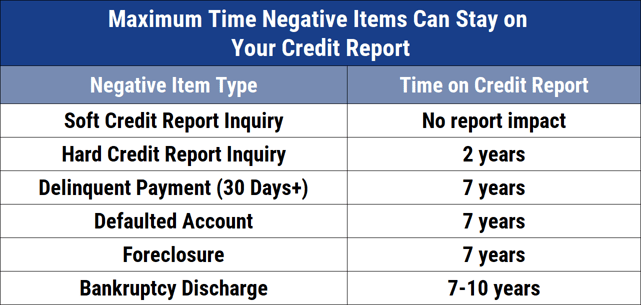

For example, a bankruptcy will live on your credit report for 10 years. As it gets older, it will lose its impact on your credit score. But you’ll still have to overcome that hurdle for several years before it’s off your record.

A late payment, on the other hand, will stick around for seven years. If you make only on-time payments for two years, though, you’ll see almost no effect from that late payment over the long term.

If you have no credit history and are just starting out, you can use a credit card to start to produce data on your credit report. Your credit card will report to at least one credit bureau each month to state your current balance and payment history.

To generate a reliable credit score, you must have credit or loan accounts open in your name, or be an authorized user on someone else’s account. Once you generate your first credit score, it will continue to update monthly as new information is reported to the credit bureaus.

If you cancel your credit card and have nothing reported for several months, your score will disappear and become outdated and unreliable.

You’ll then have to repeat the process to build a new credit score. In the meantime, any negative items will continue to stay on your report until they age off.

Why is Your Credit Score Important?

Your credit score is important because lenders use it as an indicator of your financial responsibility. The three-digit number assigned to your name can make or break you getting a loan, a credit card, or buying a car or home.

Your credit score doesn’t just show whether you make on-time payments — it’s an extensive record of your financial behavior over the last decade of your life (or as long as you’ve had credit if you’re younger than age 28).

Plus, many large employers will require you to submit to a credit check and may use your credit score while making hiring decisions. The thinking behind this is that someone who is financially responsible will also be responsible on the job. Your credit score can also influence your insurance rates and your ability to rent an apartment.

The major factors that determine your credit score include your:

- Payment history (35% of your score): This only takes into account whether you make on-time payments. It doesn’t matter if you make the minimum monthly payment or pay well more than you’re asked. As long as you’re on time, you’ll check this box off every month. Late payments are reported as 30-days late, 60-days late, or 90-or-more days late. If you’re less than 30 days late, it will likely trigger a late payment fee, but won’t be reported to the credit bureaus. The longer you go without making your payment, the worse it becomes for your credit score. A single 30-day late payment can shave as many as 100 points from your score.

- Amounts owed (30%): The more debt you hold, the lower your credit score drops. Lenders like consumers to have little debt responsibility when applying for new debt. If you have a lot of debt, you can expect your credit score to suffer. This is typically calculated through your credit utilization rate. This shows how much of your available credit is being used. You can calculate it by dividing your current balances by the overall combined credit limits on all of your cards. A card with a $1,000 credit limit and a $400 balance, for example, has a 40% credit utilization rate. Lenders like to see a rate below 30% for new applicants.

- Length of credit history (15%): There’s no way to rush this one. Lenders like to see that you have a long history of managing credit well. Seven to 10 years is considered a good length of credit history. That may not be possible if you’re just starting out, but over time, you’ll build this number up and it will positively impact your credit score.

- Credit mix (10%): A positive credit report will show that you can handle a variety of debt types. This may include credit cards, personal loans, auto loans, home loans, student loans, or other debt. You should never take on debt just to improve your credit mix. This typically has the opposite effect because it increases the amount you owe — which has a greater impact on your credit score. This is something you’ll develop over time.

- New credit (10%): We all understand how too much debt can impact your credit score, but many don’t realize how too many credit applications can impact you. Every time you apply for a new credit card or loan, the lender places a hard inquiry on your credit report to access your credit score. This inquiry will live on your credit report for two years. When you add lots of inquiries to your credit report — typically more than three or four — you could see a slight drop in your credit score. As lenders see it, when you constantly apply for credit, you’re either desperate for money or you’re getting rejected. You’ll regain these points as your existing inquiries get old and drop off your credit report — as long as you don’t replace them with new inquiries along the way.

Your credit says a lot about your financial responsibility. Thankfully, most scoring calculations place an emphasis on recent data over previous information. Even if you have mistakes in your past, you can overcome them and get a second chance to make a good first impression.

What is the Easiest Credit Card to Get Approved For?

The easiest credit card to get approval for is a secured credit card. These cards require a refundable security deposit for approval and may not even ask for a credit check during the application process.

For most secured cards, your deposit amount will equal your credit limit. For example, a $300 deposit will net you a card with a $300 credit line. You can use a secured card as you would an unsecured card — to make purchases in person or online, to rent a car or hotel room, pay bills, or make any other purchase.

Your deposit will not serve as a payment on your account. You’ll have to repay at least the minimum balance due on your card each month — with interest. Meanwhile, the card’s issuing bank will hold your deposit as security until you close your account.

Your deposit acts like the security deposit you make when you rent an apartment. If the home is in good shape when you move out, the landlord will refund your money. If you trash the place, the landlord will keep the money to cover any repairs.

The same goes for your secured card. If you have no outstanding credit card debt when you close your account, the bank will refund your deposit in full.

These cards are easier to obtain because your deposit acts as security and reduces the bank’s exposure to risk.

How Can I Raise My Credit Score by 100 Points in 30 Days?

The best way to create a rapid jump in your credit score is to pay off existing debt.

The amount of debt you have represents 30% of your credit score. The more you owe, the lower your score. When you eliminate a large percentage of that debt, your score will increase quickly.

Just remember that banks only report to credit bureaus once per month — and not always on the same day. Depending on when you pay the debt, it could take up to one month before the balance change hits your credit report and impacts your credit score.

You can also use Experian Boost, a free service that can add tens of points to your credit score by adding your utility accounts and other recurring bills to your Experian credit report. This will only help if you have a track record of consistent on-time payments, though.

What Credit Score Do You Start With?

When you’re just starting out, you have no credit score at all. This is also known as being credit invisible.

Your FICO score can range between 300 and 850 — with 850 considered to be perfect credit. If you don’t have enough information on your credit score to generate a credit score, you’ll simply have no score at all.

This will change as you start to add information to your credit profile. Each month, your credit card issuer will report your balance and payment history to at least one credit bureau. Within three to six months, you’ll have enough data to build your first credit score.

If you have all positive reporting — meaning a low balance and on-time payments — your first score will fall somewhere in the mid-600s. If you have any late payments or high balance reports, you could start out in the mid-500s.

Which Credit Cards Give You Instant Approval?

With the growth in online applications, just about every credit card issuer can give you an application decision within 30 seconds or less.

Thanks to automated underwriting, you can submit your application at any time of the day or night and get a near-instant decision. If you’re approved, some banks will allow you to access a portion of your new credit line right away.

Others will make you wait until your new card arrives in the mail in between seven and 10 business days.

Does a Business Credit Card Help Build Personal Credit?

Most small business credit cards will help you build both personal credit and business credit with on-time payments and low balances.

A traditional business credit card will rely on your business records to determine eligibility. The card will then be issued to the business and won’t be reported to your personal credit history. Many people attempt to qualify for this type of card to avoid adding inquiries to their personal credit reports.

But many small businesses or startups don’t have enough credit history or a track record of profits to qualify for a business card on their own. That means that the issuing banks will want some way to limit their risk in issuing new credit to an unproven business.

They do this by requiring a personal guarantee for the card. That means the bank will use your personal credit score to qualify your business for a revolving line of credit. In this scenario, you’re acting as a cosigner for the credit card and will be responsible for any debt that the business accrues and cannot repay.

While this increases the consumer’s risk in taking on new debt, it can also provide an opportunity for credit improvement since the monthly reports from each credit bureau will be in your name and the business’s name.

Just make sure you keep your balances low and make timely payments. One slip-up can greatly damage both your personal credit score and your business credit score.

Can I Get a Credit Card Without a Credit Check?

A credit check is an important part of any lending decision, but you can still qualify for several secured credit cards without a credit check. This is because a secured card will require a refundable security deposit that mitigates some of the risk in issuing credit without first seeing the applicant’s credit history.

Lenders rely on three main factors to make a credit decision: your credit history, your employment status, and your current income. If you take away a lender’s access to any of those three details, you may still qualify — but at a cost.

In most cases, you’ll see an increase in fees or interest rates to make up for the added risk in these loans. That’s why bad credit loans are often more expensive than loans for someone who has good credit.

If you don’t give a lender access to your credit history, it will assume you have poor credit. And this isn’t just for credit cards. You can often find personal loans with no credit check, and some auto lenders even consider applications without a credit check.

Just be prepared to pay more for these loans.

Can You Be Denied For a Credit Card?

A bank can turn anyone down for a credit card — even someone with excellent credit.

When you apply for a credit card, you’re asking a bank for a loan. No bank is obligated to lend money to anyone.

Think of this as someone asking you to borrow money. Whether it’s a complete stranger or a family member, you don’t have to say yes to anyone.

With that said, banks make money by approving loans and credit cards. Without the profits made from interest payments, most would go out of business. They’re motivated to work with you — as long as you qualify.

If you have a credit score that works with their standards, you will have a good shot at approval. But some banks have added rules that may disqualify you — even if you have great credit.

Capital One, for example, only allows consumers to have two of its cards at any given time. If you apply for a third, you’ll receive an automatic rejection.

Chase’s 5/24 rule states that if you have five or more new bank card accounts (credit or charge cards) opened within the last 24 months, you’ll most likely be rejected for a new Chase credit card even if you otherwise qualify.

Keep that in mind when you’re applying for a card. After all, your credit score isn’t the only thing banks look at when reviewing your application.

Research the Best Credit Cards for Building Credit Online

Don’t look at building credit as a job. Instead, consider it a mission that you’re on to improve your financial health today and provide a better tomorrow for you and your loved ones.

While it can get tedious and seem like you’re making no progress with small two- and three-point increases, you should celebrate every jump in your credit score as a victory during your important mission.

Those two points may not seem like much, but as they continue to build, you’ll see big improvements to your credit score. That may help you qualify for great mortgage and auto loan interest rates as well as the best credit card offers around.

But for now, stick to the best credit cards for building credit to start. This is your mission — if you choose to accept it.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![11 Best Credit-Building Credit Cards ([updated_month_year]) 11 Best Credit-Building Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/build.png?width=158&height=120&fit=crop)

![12 Best Credit Cards for Building Credit ([updated_month_year]) 12 Best Credit Cards for Building Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/08/BUILD.jpg?width=158&height=120&fit=crop)

![How to Start Building Your Credit at 18 ([updated_month_year]) How to Start Building Your Credit at 18 ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/04/How-to-Start-Building-Credit-at-18.jpg?width=158&height=120&fit=crop)

![How Many Credit Cards Should I Have for Good Credit? ([updated_month_year]) How Many Credit Cards Should I Have for Good Credit? ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/howmany.png?width=158&height=120&fit=crop)

![7 Best Starter Credit Cards to Build Credit ([updated_month_year]) 7 Best Starter Credit Cards to Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Best-Starter-Credit-Cards-to-Build-Credit.jpg?width=158&height=120&fit=crop)

![7 Credit Cards With Free Credit Monitoring ([updated_month_year]) 7 Credit Cards With Free Credit Monitoring ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Credit-Cards-With-Free-Credit-Monitoring.jpg?width=158&height=120&fit=crop)