Do you toss and turn at night worrying about your lousy credit score? You don’t need a better mattress; you need better credit. We hate to see you dragging your sleep-deprived self around in the morning, so we’ve assembled a list of the best unsecured credit cards for building credit.

You can obtain any of these cards without a security deposit (typically $200 or more). The card issuers designed these products for folks with less-than-good credit (i.e., FICO scores below 670). When used as directed, these cards can help you boost your credit score and perhaps allow you a good night’s sleep. No prescription required!

-

Navigate This Article:

Credit-Building Cards With No Deposit

These cards share a common selling point: They do not require a security deposit. But they differ widely in their costs (often high) and benefits (usually meager). Use our information to be an intelligent consumer and choose the card that gives you the biggest bang for the buck.

- No annual or hidden fees. See if you’re approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won’t be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It’s free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One’s mobile app

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

The Capital One Platinum Credit Card is ideal for consumers looking to build credit and is the best unsecured credit card in this group. The initial credit limit is relatively low, but you can increase your credit line with consistent on-time payments.

This card also features fraud protection, a competitive interest rate, no penalty APR for late payments, and unlimited credit monitoring through Capital One CreditWise. Capital One reports your payment history to each major credit bureau, allowing you to build credit by using your card responsibly.

- Earn unlimited 1.5% cash back on every purchase, every day

- No rotating categories or limits to how much you can earn, and cash back doesn’t expire for the life of the account. It’s that simple

- Be automatically considered for a higher credit line in as little as 6 months

- Enjoy peace of mind with $0 Fraud Liability so that you won’t be responsible for unauthorized charges

- Help strengthen your credit for the future with responsible card use

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$39

|

Average, Fair, Limited

|

The Capital One QuicksilverOne Cash Rewards Credit Card has a modest annual fee that it offsets with cash back rewards on all eligible purchases. You may come out ahead by charging at least $500 each month to this cash rewards credit card, the runner-up for best unsecured credit card in this review.

To use the card profitably, always pay your entire monthly balance. Otherwise, the interest charges will reduce your earnings potential.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply!

- Monthly Credit Score – Sign up for electronic statements, and get your Vantage 3.0 Score Credit Score From Experian

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

- See if you’re Pre-Qualified without impacting your credit score

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

See website for Details

|

See website for Details

|

29.99% APR (Variable)

|

$75 – $125

|

See website for Details*

|

The Surge® Platinum Mastercard® has one of the highest initial credit limits among the reviewed cards, and it can double in six months. But mind the card’s fees, which are also high.

The card has a hefty annual fee and a higher-than-average interest rate. Also, check out the monthly maintenance fee that begins in Year Two. But this card should prove satisfactory if you don’t mind paying for a sizable credit limit.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- See if you’re Pre-Qualified with no impact to your credit score

- All credit types welcome to apply

- Access to your Vantage 3.0 score from Experian (When you sign up for e-statements)

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% APR (Variable)

|

$75 – $125

|

Bad, Fair, or No Credit

|

You can prequalify for a Reflex® Platinum Mastercard® in less than a minute without impacting your credit score. The card is a virtual copy of the Surge® Platinum Mastercard®, including its generous credit limit. The card provides $0 fraud liability but assesses a rather high annual fee.

Depending on your credit score, you can avoid the monthly maintenance fee that kicks in after the first year. The card has a foreign transaction fee and charges for cash advances, additional cards, and late or returned payments. To help build credit, it reports to all three major credit bureaus.

5. Indigo® Unsecured Mastercard® – Prior Bankruptcy is Okay

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

The Indigo® Unsecured Mastercard® – Prior Bankruptcy is Okay is an excellent choice if you previously endured bankruptcy. You can prequalify without impacting your credit score and then use the card to rebuild credit, as each major credit bureau receives your monthly transaction details.

When you sign up, you get to choose one of the Indigo card’s uninspired designs. The card from Celtic Bank also provides Mastercard fraud protection.

- Earn 3% Cash Back Rewards* on Gas, Groceries and Utility Bill Payments

- Earn 1% Cash Back Rewards* on all other eligible purchases

- Good anywhere Mastercard® is accepted

- $0 fraud liability**

- Free access to your VantageScore 4.0 credit score from TransUnion®†

*See Program Terms for important information about the cash back rewards program.

**Fraud liability subject to Mastercard® rules.

† Your credit score will be available in your online account starting 60 days after your account is opened. (Registration required.) The free VantageScore 4.0 credit score provided by TransUnion® is for educational purposes only. This score may not be used by The Bank of Missouri (the issuer of this card) or other creditors to make credit decisions.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% or 36% Fixed

|

As low as $85

|

Fair

|

The Fortiva® Mastercard® Credit Card is a cash rewards credit card that bases its APR and some of its fees on your initial credit limit. The higher your credit line, the higher the charges. At least a couple of the fees decrease after the first year of ownership.

You can prequalify for this card without affecting your credit. This unsecured credit card provides free credit scores, transaction alerts, and zero fraud liability.

7. Merrick Bank Double Your Line® Mastercard®

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

The Merrick Bank Double Your Line® Mastercard® will help you build credit when you pay your bills on time. It takes only seven months of timely payments to double your credit limit.

This Visa card has a competitive purchase APR and may waive the annual fee if your recent credit history is clean. You also get access to your FICO Score each month for free.

- Greater access to credit than before – $700 credit limit

- Get a Mastercard accepted online, in store and in app

- Account history is reported to the three major credit bureaus in the U.S.

- $0 liability* for unauthorized use

- Access your account online or from your mobile device 24/7

- *Fraud protection provided by Mastercard Zero Liability Protection. If approved, you’ll receive the Mastercard Guide to Benefits that details the complete terms with your card.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

See terms

|

See terms

|

Fair/Good

|

The Milestone® Mastercard® will welcome your application despite your poor credit. Account history is reported to the three major credit bureaus so responsible use is recommended as always.

This Mastercard charges an annual and foreign transaction fee but no monthly maintenance fee. The card automatically protects you from loss or theft and provides an app for mobile access.

- Earn 1% cash back rewards on payments made to your Total Credit Card

- Checking Account Required

- $300 credit limit (subject to available credit)

- No security deposit, simply pay a one-time $95 program fee to open your account.*

- User friendly Mobile App.

- *See Rates, Fees, Costs & Limitations for complete offer details

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

35.99%

|

$75.00 1st year, $48.00 after

|

Fair, Bad Credit

|

The Total Visa® Card offers a quick application process and an immediate approval decision. The card’s APR is high, but you can avoid it by paying your entire balance each month before its grace period ends. This Visa credit card waives its monthly maintenance and cash advance fees for the first year.

The low initial credit limit should make your monthly payment requirement manageable. The card offers free access to your credit score and monthly reporting to the major credit bureaus.

What Is an Unsecured Credit Card?

Most credit cards are unsecured, meaning you can get one without making a security deposit. You can use them to charge purchases in-store, online, by phone, and through an app, and stretch the payments over multiple months.

In contrast, your cash deposit collateralizes a secured credit card. The credit card issuer keeps your deposit in a special locked account, which it will use if you miss a monthly payment. Generally, your credit limit equals the deposit amount.

Unsecured credit cards operate as follows:

- Application: You can apply for an unsecured card online or over the phone by providing personal information about your income, debt, and expenses. If you receive approval, the issuer will immediately ship the credit card. It should arrive within a week to 10 days.

- The physical card: The card will display the issuing bank, payment processor, and your name, account number, expiration date, and a security code. There is a place to sign your name on the back of the card.

- Embedded chips: Credit cards embed microchips that store encrypted information, including transaction history and your current balance. Chips generate a unique ID for each transaction. They also feature a magnetic swipe strip for compatibility with older card-reading devices.

- Account characteristics: Your unsecured credit card account specifies your credit limit, interest rate (the annual percentage rate or APR), and fee schedule. CardRates.com’s credit card reviews provide the information you need to choose the products best suited to your lifestyle.

- Billing: Credit cards divide the year into monthly billing cycles. The card’s grace period is the interval, usually in the 21- to 25-day range, between the end of the billing cycle (the statement date) and the payment due date.

- Charging purchases: You can charge purchases on your credit card up to your credit limit. You’ll avoid paying any interest if you repay the entire balance by the next payment due date. Any unpaid balance from the previous billing cycle will incur daily interest until you pay off the balance.

- Cash advances: Your card may also offer cash advances, which are instant loans. There is no grace period for a cash advance — you accrue interest every day until you repay the advance.

- Rewards: While uncommon among unsecured credit cards for bad credit, some provide rewards in the form of cash back, miles, or points. You earn your rewards when you charge purchases, and you can redeem these rewards in various ways. Cards may offer simple or complex reward schemes — read the fine print for the details.

- Reporting: Most credit cards report your account activity to at least one of the three major credit bureaus. The bureaus collect your credit history and calculate a monthly credit score that expresses your creditworthiness in a single number. Your credit score helps determine which credit cards you can get and how much interest you’ll pay.

- Benefits: Credit cards may provide various benefits, such as discounts on purchases, free insurance, purchase and security protections, and free access to airport lounges, in addition to several other lesser-known perks.

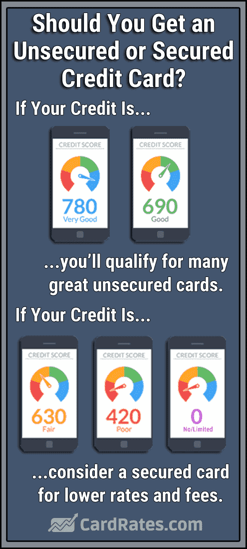

The reviewed cards are for consumers with poor to fair credit. Although secured cards for bad credit are easier to obtain, you can get an unsecured card despite having a subprime credit score.

Cards for poor credit share specific characteristics:

- Low credit limits: As low as $200

- Steep APRs: Usually between 24% and 36%

- High Fees: They can include signup, annual, and monthly maintenance fees, as well as charges for cash advances, foreign transactions, and late payments

- Few perks: These cards usually offer meager or no rewards and few benefits, although exceptions exist, such as the Capital One QuicksilverOne Cash Rewards Credit Card.

- Triple reporting: These cards usually report your account activity to all three credit bureaus (Equifax, Experian, and TransUnion). Triple reporting is the quickest route to credit repair as long as you pay your bills on time and maintain a credit utilization ratio below 30%.

The typical American consumer holds multiple credit cards. That’s a good idea in case of card loss or theft, which you should immediately report to the credit card issuer. The issuer will close the credit card account and send you a new credit card with a different account number.

Multiple cards also provide greater spending power, as you can utilize the entire credit limit on each card.

How Do I Build Credit With a Credit Card?

You can use your unsecured credit cards to build credit, but only if you use them responsibly. First, you must understand how credit scoring works.

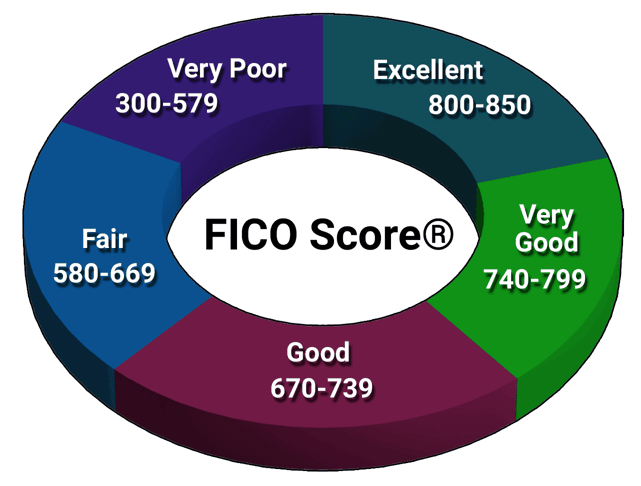

FICO Scoring System

Your credit score defines how creditors assess your likelihood of defaulting on your credit card debt. About 90% of US lenders and creditors use the FICO credit score system, which has a range from 300 (worst credit) to 850 (perfect credit).

FICO considers a score below 580 as an indication of very poor credit, whereas fair credit scores range from 580 to 669.

The cards in this review can help you raise your credit score if you maintain good financial habits. Raising your credit score should result in having access to a higher credit limit, lower APR, and better rewards and benefits.

Credit Bureau Reporting

Virtually all credit cards report your payment activity to at least one of the major credit bureaus, and cards for bad-credit consumers invariably report to all three bureaus.

The bureaus keep track of your payment activity and credit history, including:

- Approved credit limits

- Bankruptcies

- Card balances

- Collections

- Credit inquiries

- Foreclosures

- Late payments

- Start and end dates for credit accounts

- Written-off accounts

- Your credit card payments, including dates and amounts

The credit bureaus maintain this information in your credit history file and issue an updated credit report monthly. The bureaus use the collected data to calculate your FICO credit score and their own proprietary scores.

Because credit bureaus don’t necessarily collect identical information about a consumer, they may calculate different credit scores for the same person.

Negative items such as late payments, delinquencies, collections, defaults, foreclosures, and bankruptcies remain in your credit history for up to 10 years. These items harm your credit score, although the impact diminishes after a few years.

Credit Monitoring

You should monitor changes to your monthly credit score to ensure it’s improving. Most credit cards offer free access to credit scores, but the quality of the information varies. Monitoring is most valuable when it reports the actual FICO scores from all three credit bureaus, but you usually receive a free FICO score from a single bureau.

If you pay your bills on time, keep your credit balances relatively low, and refrain from opening too many new accounts, you should see your credit score rise within six months to a year. If you fail to see a higher score within that period, contact your card issuer and ask why.

What Is the Easiest Unsecured Card to Get?

All the reviewed unsecured cards are about equally available to subprime consumers. The cards that charge steep signup and annual fees may be more accessible because they collect significant sums upfront.

The issuers of those cards use those fees, coupled with tight credit limits, to cushion against late payments and defaults.

I advocate secured cards for consumers with bad credit because these cards eventually return your deposit. You can’t make that claim about unsecured card fees — that money is gone forever.

Best of all, you can graduate from a secured card to an unsecured one in a few months, assuming you pay your bills on time. The new unsecured card may have been unobtainable when you first applied for the secured card.

Make sure the new, unsecured card offers the same or better terms and fees than the secured one, lest you end up saddled with a high-fee card.

What Should I Look For in a Credit-Building Card?

The most desirable credit-building cards have moderate costs, rewards, benefits, and credit limits. They should report your monthly activity to all three credit bureaus and give you free access to your FICO scores.

Avoiding credit cards with high fees and interest rates would be best. Favor credit-building cards that offer bonuses and some benefits, such as insurance or roadside assistance.

You’ll have access to better credit cards if you raise your FICO score into fair territory (580 to 669). If that should occur, consider stepping up to a better make and model of credit card. But don’t cancel your old card, as that may increase your credit utilization ratio and negatively impact your score.

What Are the Typical Costs For a Credit-Building Unsecured Card?

It would be best if the card didn’t have a signup fee (often as high as $99 or more) or monthly maintenance fee ($10/month starting in Year Two). You will usually pay an annual fee (typically between $39 and $99), but some cards may waive it, while others may charge triple digits.

The purchase APRs on these unsecured cards usually range from 25% to 36%. Some at the lower end of the range may have a penalty APR (usually 29.9%) that kicks in if you miss a payment. The cash advance APR is frequently higher than that for purchases.

A few of these cards may support balance transfers with their own APR. Both cash advances and balance transfer transactions trigger fees, typically 3% to 5%.

Late and returned payments typically cost around $40 per occurrence. A few cards charge a fee when they raise your credit limit. Other nuisance costs may include those for adding an authorized user, ordering a replacement card, and requesting copies of past monthly statements.

How Many Credit Cards Do I Need to Build Credit?

You need only one card to build credit. The most important aspect is to always pay your bill on time to build a positive payment history.

Using a single card will be effective if you:

- Pay your monthly bill on time

- Keep your credit utilization ratio (i.e., credit used / credit available) below 30%

- Refrain from opening multiple credit card or loan accounts within a short period

- Keep old credit card accounts open, even if you seldom use the card

- Successfully juggle numerous types of credit cards and loans

Nonetheless, you may want to own multiple cards for a few reasons:

- To have a backup in case of the loss or theft of your primary card

- To increase your overall available credit

- To optimize your rewards by using different cards for various types of purchases — not a likely scenario for credit-building unsecured cards since few offer rewards

You may also end up with multiple cards as your credit score improves and you gain access to better credit cards. As mentioned, you don’t necessarily want to cancel your old cards, which may hurt your credit score.

Can I Get a Credit Card to Build Business Credit?

Business cards for rebuilding credit are rare, although you may be able to find a few for business owners with fair credit. One example of a fair-credit business credit card is the Capital One Spark Classic for Business, which pays unlimited cash back, charges no annual fee, and has a moderately high purchase.

If you apply for a business credit card, you may have to pledge your personal assets if your business can’t pay the monthly bill.

What If My Credit Card Application is Rejected?

Even the best credit card issuers reject a certain percentage of subprime applicants. If you are one, you should receive an Adverse Action Notice explaining why. You can use the information to address your credit deficiencies before reapplying.

Consider applying for a secured credit card if your bid for an unsecured card fails. A few secured cards don’t perform a credit check; all are easier to get than their unsecured siblings that do require a credit check. While you must post a security deposit, secured cards should have lower costs and better perks than unsecured cards.

What If I Can’t Pay My Credit Card Bill?

Immediately contact your card issuer if you’re having trouble making the minimum monthly payments. The issuer may offer you some form of accommodation rather than putting your account into collection or writing it off.

Consider contacting a credit counselor who can help you develop a workable budget and consolidate your credit card debt. If you have multiple unsecured debts, you may want to work with a debt relief company that may convince creditors to forgive some of your debt. But learn about the costs and risks of debt relief before proceeding, as it can backfire badly.

In the worst case, you can file for bankruptcy and have the court restructure or dismiss your unsecured debt. This will severely damage your credit score and remain on your credit report for up to 10 years.

Compare the Best Unsecured Credit Cards For Building Credit

Our review of the best unsecured credit cards for building credit should convince you that you have options despite a low credit score.

Building or rebuilding credit is a most worthwhile endeavor. It will give you greater access to affordable loans and better credit cards. In other words, rebuilding credit can be the key to fewer financial worries and a nicer lifestyle. One of the reviewed products may be the best credit card to help you accomplish your goals.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![9 Unsecured Credit Cards For Fair Credit ([updated_month_year]) 9 Unsecured Credit Cards For Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/08/shutterstock_617054912.jpg?width=158&height=120&fit=crop)

![8 Unsecured Credit Cards For Bad Credit ([updated_month_year]) 8 Unsecured Credit Cards For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/10/shutterstock_615013442-1--1.jpg?width=158&height=120&fit=crop)

![6 Last-Chance Unsecured Credit Cards ([updated_month_year]) 6 Last-Chance Unsecured Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/08/lastchance1.jpg?width=158&height=120&fit=crop)

![7 Unsecured Credit Cards After Bankruptcy ([updated_month_year]) 7 Unsecured Credit Cards After Bankruptcy ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/Unsecured-Credit-Cards-After-Bankruptcy.jpg?width=158&height=120&fit=crop)

![7 Unsecured Credit Cards With $1,000 Limits ([current_year]) 7 Unsecured Credit Cards With $1,000 Limits ([current_year])](https://www.cardrates.com/images/uploads/2021/09/Unsecured-Credit-Cards-With-1000-Limits.jpg?width=158&height=120&fit=crop)

![11 Best Credit-Building Credit Cards ([updated_month_year]) 11 Best Credit-Building Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/build.png?width=158&height=120&fit=crop)

![7 Best Credit Cards For Building Credit ([updated_month_year]) 7 Best Credit Cards For Building Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/02/Best-Credit-Cards-For-Building-Credit.jpg?width=158&height=120&fit=crop)

![5 Unsecured Loans for Bad Credit Borrowers ([updated_month_year]) 5 Unsecured Loans for Bad Credit Borrowers ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/02/Unsecured-Loans-for-Bad-Credit.jpg?width=158&height=120&fit=crop)