American cooks ran to stores in the early 1950s to snatch up boxes of instant mashed potatoes, the latest kitchen craze in many households. But some felt deceived when they opened the box to find freeze-dried potato flakes and filler.

Similar confusion can occur in the credit card world, where many issuers throw around terms such as “instant” and “guaranteed” to a point where consumers often feel confused.

While most online credit card applications now offer consumers instant approval decisions after they submit their application, no bank can offer guaranteed approval — and only a few banks offer consumers instant use of their new card after being approved.

Below are our top choices of instant-approval credit cards if you’re looking for a quick decision — which often takes less time than whipping up a batch of instant mashed potatoes.

Bad Credit | Fair Credit | Good Credit | No Credit Score | Instant Use | FAQs

Instant Approval Cards For Bad Credit (300-579 FICO)

Every card in this category provides an online application and near-instant credit decision once you submit your application. That’s because each credit card company has a proprietary system for scanning applications and determining, in a matter of seconds, whether an applicant meets or falls below the bank’s acceptance standards.

These cards can provide much more than a quick decision. Each card also reports your payment history to the three major credit reporting bureaus so your on-time payments can improve your credit score. For low rates and fees, consider applying for a secured credit card that requires a cash deposit upon approval.

Instant Approval Cards For Fair Credit (580-669 FICO)

After a short online application, each of the cards below can return a credit decision in a matter of seconds. Occasionally, the bank will require more information from an applicant, which can slow down the decision-making process.

- No annual or hidden fees. See if you're approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One's mobile app

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

- Earn unlimited 1.5% cash back on every purchase, every day

- No rotating categories or limits to how much you can earn, and cash back doesn't expire for the life of the account. It's that simple

- Be automatically considered for a higher credit line in as little as 6 months

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Help strengthen your credit for the future with responsible card use

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$39

|

Average, Fair, Limited

|

+ See More Instant-Approval Cards for Fair Credit

A fair credit score typically falls between 580 and 669. If you’re in this range, you’ll likely have more options than those who have bad credit. However, you may have to pay more for your credit card in the form of higher interest rates than those with good credit.

Instant Approval Cards For Good Credit (670+ FICO)

Credit card companies love consumers who have good or excellent credit because there’s very little risk involved with issuing them a line of credit. Thanks to your attractive score, you’ll almost always receive a near-instant application response and access to a plethora of credit card options.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

+ See More Instant-Approval Cards for Good Credit

Just remember that even consumers who have good or excellent credit can receive denials. This can happen in the case of Chase’s 5/24 rule or Capital One’s two-card limit.

As stated earlier, no bank can guarantee your approval until you apply. Be certain you understand the issuer’s rules before you submit your application.

Instant Approval Cards For No Credit

Having no credit history is very different from having bad credit. If you have no credit history, it just means that you haven’t created enough financial data to generate a reliable score. This often happens with younger consumers, which is why student credit cards often target applicants with limited or no credit.

- No credit check to apply

- Adjustable credit limit based on what you transfer from your Chime Checking account to the secured deposit account

- No interest* or annual fees

- Chime Checking Account and qualifying direct deposit of $200 or more required to apply. See official application, terms, and details link below.

- The secured Chime Credit Builder Visa® Card is issued by The Bankcorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted.

- *Out-of-network ATM withdrawal and OTC advance fees may apply. View The Bancorp agreement or Stride agreement for details; see back of card for issuer.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

$0

|

None

|

- No annual or hidden fees. See if you're approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One's mobile app

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

- Earn unlimited 1.5% cash back on every purchase, every day

- Early Spend Bonus: Earn $50 when you spend $100 in the first three months

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Enjoy no annual fee, foreign transaction fees, or hidden fees

- Lock your card in the Capital One Mobile app if it's misplaced, lost or stolen

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

+ See More Instant-Approval Cards for No Credit

The beauty in these cards comes from their ability to help you build credit quickly. Most cards report your payment history to the credit reporting bureaus every month. With on-time payments and responsible spending, you can start to generate a positive credit score in less than six months.

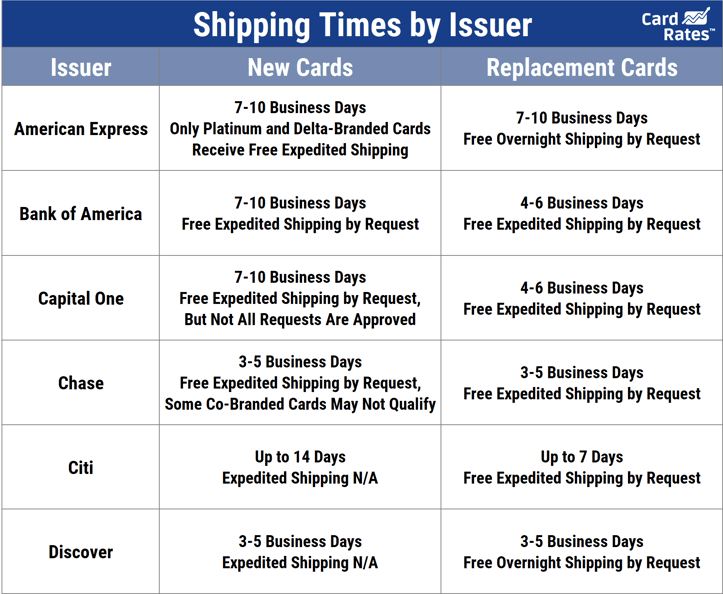

Card Issuers Offering Instant-Use Upon Approval

Some cards allow you to start using your new credit line right after being approved. The issuers below allow instant credit use, even before you receive your card.

This often happens thanks to a temporary virtual credit card number. You can use this card number online or make other card-not-present (CNP) transactions.

The number will be different from the card number on your physical card, so be sure to update any recurring payments you set up with the temporary number.

American Express: All American Express cards can be added to your digital wallet upon approval. You can use an Instant Card Number for online purchases, the amount of which will be withdrawn from your new credit line. You can generally only get an American Express card if you have good or excellent credit.

Bank of America: If you apply and are approved for select cards through the Bank of America mobile app, you can access a portion of your credit line immediately upon approval. The bank maintains the right to limit how much of your new credit line you can charge to your temporary card number before the permanent card arrives.

Barclays: Barclays is one of the world’s largest banks and issues several co-branded credit cards that allow instant access to card numbers. Some examples include the JetBlue Card and the FRONTIER Airlines World Mastercard®. One big caveat: These company-branded cards only allow you to immediately use your new credit line when purchasing from the company shown on the card.

Chase Bank: Chase offers Spend Instantly on select cards upon approval. This feature allows new cardholders to make secure payments by adding the card to their phone’s digital wallet, which can then be used in stores that accept digital wallets and online.

Citi: Citibank allows instant use on select co-branded cards, including its Costco and American Airlines cards.

HSBC: HSBC only provides approved applicants with their new credit card number upon approval — the bank will not provide the CVC security code or expiration date — which most merchants require to complete a transaction.

USAA: New USAA cardholders can instantly receive their new credit card number, along with the expiration date and CVC security code, upon approval. The only catch is that you’re limited to charging no more than $1,000 until your physical card arrives in the mail in seven to 10 business days.

Can You Get Approved For a Credit Card Immediately?

Thanks to the internet and the proliferation of financial technology, just about every credit card company can offer instant application decisions.

This takes place when your application enters the bank’s internal decision-making system that scans your criteria and pulls the necessary information to make a decision within a matter of seconds.

Sometimes a bank will require more information from an applicant. When this happens, you’re given a window — often between seven and 30 days — to submit the necessary data that will allow the bank to make a definitive decision.

But while banks can often give you an instant credit decision, there’s no way to tell if you’ll receive approval until you officially submit your application. At that point, they get a better look at your credit report, but the bank can’t see that information until you give them permission to view it via a submitted application.

Can You Use a Credit Card the Same Day You’re Approved?

In some cases, you can use your new credit card as soon as you’re approved — with some restrictions.

Some big banks, including American Express and Chase, let you add your new card account to your digital wallet through their mobile application after account opening. You can use your card to make purchases with any merchant or service provider that accepts compatible digital wallets, such as Apple or Google Pay.

Other co-branded cards, like the American Airlines credit cards from Barclays, will let you sign up for the card when checking out from the American Airlines website and let you use your new card account to cover the cost.

A few banks, namely HSBC, will provide you with your new credit card number but nothing else. You can’t see your expiration date or CVC security code. To get that information, you’ll have to wait for your card to arrive in the mail, which typically takes between seven and 10 business days.

USAA also provides instant access to your full range of credit card data but limits new cardholders from charging any more than $1,000 to their new credit line before the physical card arrives in the mail.

Can I Get a Physical Credit Card Same Day?

Some bank branches have the technology to print new cards on demand. If you’re approved at one of these banks, you can potentially receive your credit card as soon as you’re approved. But this may only be available for debit cards, so be sure to check with the bank before applying.

If you submit a credit application online, you can often receive an instant credit decision, but it’s nearly impossible for the bank to approve your application, print your card, and send it to you on the same day.

Some issuers will provide expedited shipping to get your card to you faster — but no one has found a way to make it all happen in one day… yet.

If your bank doesn’t provide on-demand printing and you desperately need access to a credit card that same day, you can consider opening a prepaid debit card account at your local grocery or convenience store.

These cards require you to fund the account with a cash or debit deposit at the register, but you instantly receive your new card and can make credit charges against the funds you deposited.

While this isn’t a traditional credit card, you can use the card at any merchant that accepts credit cards — and you can start as soon as you purchase the card from the store.

What Is the Easiest Instant Credit Card to Get?

The easiest instant credit card to get approved for is a secured card, particularly one that doesn’t do a credit check and pull your credit report from a credit bureau.

One secured credit card that doesn’t do credit checks is the OpenSky® Secured Visa Credit Card. This card is great for rebuilding credit through on-time payments.

This card is accepted everywhere Visa is. A secured card is easier to get than an unsecured credit card because a cash deposit serves as collateral for the account. If you miss a payment, the card issuer can withdraw funds from your deposit to cover the missed payment.

Get an Approval Decision in a Matter of Seconds

While instant potatoes earned instant approval among most American households, it took many years for the credit card industry to catch up with the same speedy processing.

Today’s rapid-fire internet banking makes it easier than ever for a bank to scan your application and return with a credit decision in a matter of seconds. But just because the bank can review your application quickly doesn’t mean you’re guaranteed a card.

Be sure you fully understand the state of your credit report before submitting an application for credit to a bank.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![8 Instant-Approval Credit Cards with Instant Use ([current_year]) 8 Instant-Approval Credit Cards with Instant Use ([current_year])](https://www.cardrates.com/images/uploads/2021/07/Instant-Approval-Credit-Cards-With-Instant-Use.jpg?width=158&height=120&fit=crop)

![9 No-Credit Credit Cards with Instant Approval ([updated_month_year]) 9 No-Credit Credit Cards with Instant Approval ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/12/No-Credit-Credit-Cards-With-Instant-Approval.jpg?width=158&height=120&fit=crop)

![12 Credit Cards With Instant Approval by Type ([updated_month_year]) 12 Credit Cards With Instant Approval by Type ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/01/Credit-Cards-with-Instant-Approval-by-Category.jpg?width=158&height=120&fit=crop)

![7 Credit Cards for Fair Credit: Instant Approval ([updated_month_year]) 7 Credit Cards for Fair Credit: Instant Approval ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/Credit-Cards-For-Fair-Credit-With-Instant-Approval.jpg?width=158&height=120&fit=crop)

![9 Best Instant Approval Credit Cards With No Deposit ([updated_month_year]) 9 Best Instant Approval Credit Cards With No Deposit ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/10/best-instant-approval-credit-cards-with-no-deposit.jpg?width=158&height=120&fit=crop)

![5+ Instant Approval Auto Loans For Bad Credit ([updated_month_year]) 5+ Instant Approval Auto Loans For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/05/Instant-Approval-Auto-Loans-For-Bad-Credit--1.jpg?width=158&height=120&fit=crop)

![8 Instant-Approval Bad Credit Personal Loans ([updated_month_year]) 8 Instant-Approval Bad Credit Personal Loans ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/06/Instant-Approval-Bad-Credit-Personal-Loans.jpg?width=158&height=120&fit=crop)

![7 Best Instant-Approval Personal Loans ([updated_month_year]) 7 Best Instant-Approval Personal Loans ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/05/Best-Instant-Approval-Personal-Loans.jpg?width=158&height=120&fit=crop)