Whether you want to get your first credit card or your 50th, understanding the approval criteria before you apply can help you:

- Decide which cards to apply for.

- Fill out your credit card application correctly.

- Figure out what you need to do if your application isn’t approved right away.

For most cards, approval criteria can be divided into three categories:

- General criteria for most cards

- Specific criteria based on card type

- Specific criteria based on the card issuer

Let’s take a closer look.

General Criteria for Most Cards

While some exceptions exist, almost all cards require applicants to meet four basic criteria: age, income, address, and identity.

Age

The federal Credit Card Accountability, Responsibility and Disclosure (CARD) Act of 2009 sets minimum age requirements for credit card applicants.

The minimum age for most people to be approved for a card is 21 years old. That may sound harsh if you’re younger and feel you’re ready for your own card, but the requirement serves a purpose, which is to protect younger people from racking up more card debt than they can manage.

If you’re not yet 21, but you are 18, 19, or 20, you may be able to get a card if:

- You apply with a qualified cosigner or

- You have an independent source of income that doesn’t depend on another person, such as your parents or your spouse or life partner.

If you’re not yet 18, you’ll have to wait until you reach that milestone birthday before you can apply and get approved for your own card.

Income

To be approved for a card without a cosigner, you’ll need to show that you have a regular source of income you can use to make your card payment.

If you don’t have a full-time job, you may be able to qualify with the income you earn from a part-time job, seasonal work, gig work, or self-employment. You can also apply with income you receive regularly from other sources. Examples include:

- Investment income

- Government benefits

- Rental income from property you own

- Scholarships or grants

- Alimony or child support you receive

- Distributions from a retirement account or trust fund

You can include your spouse’s or life partner’s income if you’re 21 or older, and you can reasonably expect to have ongoing access to that income.

Funds that you receive from loans cannot be counted as income. That’s because loans are debt that you have to repay, not income that you get to keep.

How much income you’ll need to qualify for a card varies. Some cards have minimum income requirements as low as $800 per month. Other issuers require applicants to earn $100,000 per year or more.

If you’re not yet 21 or you’ve had some problems with credit in the past, you may need more income to qualify for the same card as someone who’s at least 21 or has a solid credit history.

If you don’t currently have a steady source of income, you may be able to get approved for a secured card. This type of card requires a deposit that can be applied to your account if you don’t make your payment.

Card companies can — and sometimes do — ask for documentation to verify your income. That’s one reason you shouldn’t inflate how much you earn when you apply. Another reason is that it’s illegal to lie on a credit application. Penalties can include fines and jail time.

If you’re asked to document your income, you may be able to provide pay stubs, W-2 or 1099 tax forms, or statements from bank, investment, annuity, or pension accounts, among other possibilities. If you’re applying for a business card, you may be asked to provide a profit-and-loss statement.

Address

To be approved for a card, you’ll have to provide a mailing address for a physical place that exists in the real world, and isn’t a post office (PO) box. This physical mailing address can be a home or place of business.

An Army Post Office (APO) box or Fleet Post Office (FPO) box is also allowed. APO boxes are used by U.S. Army and Air Force locations. FPO boxes are associated with U.S. Navy locations and ships.

After you’re approved, you can use any address you want for correspondence from your credit card company. That address could be a physical place, PO box, or email address.

Identity

When you apply for a card, the credit card issuer is legally required to verify that you are the person whose name is on the application. You’ll typically have to provide a government-issued identification number to get verified.

If you’re a U.S. citizen, you can use your Social Security number (SSN). If you’re a resident alien, foreign national, or immigrant who doesn’t qualify for a SSN, you may be able to use an Individual Taxpayer Identification Number (ITIN). ITINs are issued by the IRS.

If you’re applying for a business card, you may need an Employer Identification Number (EIN). Like the ITIN, the EIN is issued by the IRS.

When you apply for a card, you’ll also have to provide your full name, employment status, monthly housing cost, and a phone number where you can be reached.

Specific Criteria Based on Card Type

Two other criteria important for card approval are your credit score and DTI ratio. Here’s what you need to know:

Credit Score

Your credit scores are a key factor in determining whether you’ll be approved for a card, and which cards you’ll be approved for.

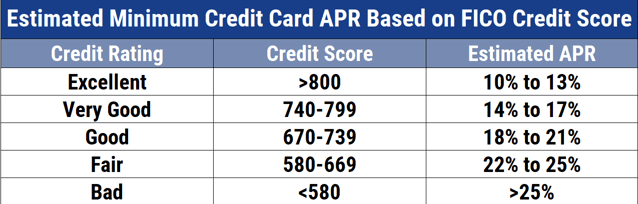

Your credit score determines the cards you’ll qualify for and the APR you’ll be charged.

If your scores are excellent and you’re otherwise well qualified, you’ll likely be approved for a wide selection of cards, including rewards cards and premium cards with high credit limits and highly desirable perks. Your card offers generally will have the lowest available rates and fees.

If your scores are good and you meet the other approval criteria, you can choose from many attractive cards, including those with travel and cash rewards. Some premium cards with very high annual fees may not be appropriate for you. Your card offers will typically have relatively low rates and fees.

If you’ve had a few glitches with your credit and your scores are only fair, your choices of cards may be a bit more limited, but you’ll still have many good cards to choose from. You may be offered cards with a lower credit limit, fewer high-value rewards or other perks, and somewhat higher rates and fees.

If your credit history includes serious problems like loan defaults or bankruptcy, it may be more challenging for you to find a card you like. Some of your options may be marketed as “bad credit cards.” This term isn’t a judgment against you. Rather, it’s a signal that these cards are designed for your credit score.

A secured card, which requires a deposit, may also be an option. These cards work essentially the same in most respects as other cards.

Credit cards for bad credit tend to have the highest rates and fees to compensate the card company for the perceived higher risk of customers who’ve had credit problems in the past. Be sure to read the disclosures that spell out the rates and fees before you apply.

If you’re a student, you’re in luck, because there are cards designed especially for your situation. These cards may have lower limits and fewer rewards, but they can be easier for students to qualify for. A student card can help you start building your credit history so you can apply to upgrade to a card with more bells and whistles after graduation.

DTI Ratio

When it comes to card approval, your DTI ratio may be more important than your total income. That may seem surprising, but there’s a reason DTI matters as much as it does.

Your income reveals how much money you have to make your minimum payments each month. It doesn’t reveal how much those payments are. If your income isn’t high enough to cover your debt payments, you may not be qualified for more cards even if your income seems high.

Your DTI is a ratio, or percentage, that compares your income and your monthly debt payments. Here’s a simple example of how DTI is calculated:

Monthly income: $6,000

Mortgage payment (principal and interest): $1,300

Car payment: $450

Student loan payment: $250

Card payments: $100

Total payments: $2,100

DTI: $2,100 / $6,000 = .35 = 35%

Debt payments include home, car, student, and personal loans as well as credit cards. Rent that you pay for your home doesn’t count as debt in your DTI calculation.

There’s no specific DTI that you’ll need for card approval, however, a DTI of 36% or less is often mentioned as a good general guide for most people. A high DTI suggests you may have more debt than you can manage with the income you receive.

Specific Approval Criteria Based on Card Issuer

Credit card companies also have their own requirements for credit card approval specific to their business needs. These requirements typically aren’t disclosed to consumers through official communication channels but may be widely known in an informal way.

One example is that a card company may impose a limit on the number of new cards you can get within a certain time frame. If you encounter this restriction when you apply for a card, you may not be approved even if you’re otherwise qualified for the additional card you want. A well-known example of this is Chase’s 5/24 rule.

Another example is that a card company may look at its history with you as a customer when it decides whether to approve your application for a card. If you had an account or were a cosigner on an account with the company that was delinquent or discharged in bankruptcy, the company may not approve you for a card.

Late payments, missed payments, delinquent accounts, and bankruptcies typically drop off your credit history after various time periods. The card company may still have its own internal records of that information, however. Companies aren’t required to purge this type of information from their customer records even if it has dropped off their credit history.

Preapproval Shouldn’t Affect Your Credit Scores

Applying for a new card can shave a few points off your credit scores for a relatively short period of time. That’s because card companies generally use a hard inquiry to check your credit report when you apply. A hard inquiry is associated with a formal application for credit.

If you’re shopping around for a card and filling out multiple applications, each with a separate hard inquiry, your credit score could drop and that could hurt your chances of getting the card you want.

To work around this issue, some card companies will let you request a preapproval, which generally can be obtained without a formal application or hard credit inquiry. Instead, a preapproval involves what’s known as a soft inquiry. A soft inquiry is a type of credit check that generally won’t affect your scores.

To receive preapproval for a credit card offer, you’ll need to provide your personal information to verify your identity and some financial information to get any preapproval offers that you appear to be qualified for. Preapproval isn’t a guarantee that you’ll be approved, but may help you decide whether to go ahead and apply if you receive an offer for a card you like.

Most issuers allow you to see which of its cards you prequalify for without hurting your credit.

By the way, some credit scoring models treat multiple inquiries within a short time period as one inquiry regardless of whether the inquiries are hard or soft. If you’re planning to apply for multiple cards or other types of credit, grouping your applications may help to protect your credit scores.

Credit scores can be complicated. The important points to remember are:

- A hard inquiry may affect your scores.

- The effect of a hard inquiry is usually small.

- A soft inquiry won’t affect your scores.

- Preapproval often involves a soft inquiry.

- Grouping hard inquiries together in a short time frame may limit their impact.

- If you’re concerned that you may not qualify for a card you want, a preapproval can help you assess your chances before you apply and get hit with a hard inquiry.

How to Apply For a Card

There are multiple ways to apply for cards: in person, on the phone, by U.S. Mail, or online. Online applications are usually short and can be filled out quickly and easily.

You’ll need to provide some basic information, including your full name, physical mailing address, annual income, identification number, employment status, and monthly housing cost. You’ll also have to authorize the card company to check, or pull, your credit scores.

If you apply online, you may receive a response within minutes or even seconds. Typical responses include immediate approval, immediate denial, a request for more information, or a notice that your application is pending.

Taking steps to improve your credit before you apply could help you meet the card company’s criteria for you to be approved. Here are some specific steps to consider:

- Get copies of your credit reports from the three major credit bureaus: Equifax, Experian, and TransUnion. You can request free copies at AnnualCreditReport.com.

- Report any errors that you find and request that they be corrected.

- Pay your credit card account on time.

- Pay more than the minimum if your balance is higher.

- Pay off debt to keep your credit utilization low.

- Don’t apply for a lot of new credit all at once.

- Use a variety of different types of credit (e.g., credit cards and loans).

5 Ways to Use Cards to Build Credit

Cards can be a great way to build credit and improve your credit scores. Here are five tips to get you started:

1. Set Up Automatic Bill Payments

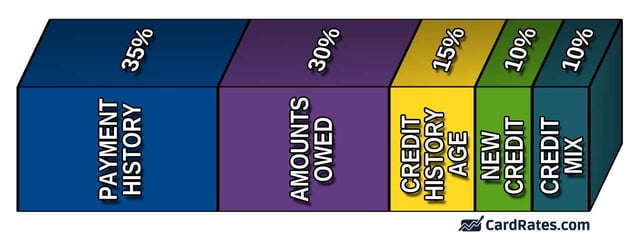

Paying your credit accounts on time every billing cycle is one of the most important and impactful things you can do to boost your credit scores. Your payment history accounts for 35% of your FICO score.

Setting up automatic payments with a card can help you ensure that you never miss a payment. Even if you’re traveling, not feeling well, or busy at work, your payments will still be made automatically.

Be sure to review your card statement when you receive it to make sure all the payments were authorized and correct.

2. Use a 0% Balance Transfer Card To Pay Off Debt

Having debt isn’t necessarily a problem. What can be challenging is having more debt than you probably should considering your income and total available credit.

If your income isn’t enough to manage your debt, you may miss payments, which can hurt your credit scores, or you may have a high DTI, which may make it difficult for you to get more credit.

A 0% balance transfer card gives you an opportunity to transfer debt and try to pay it off faster with 0% interest for a limited time. That could lower your DTI, improve your credit utilization ratio, and boost your credit scores.

“Experts suggest keeping your credit utilization ratio below 30% of your credit limit at all times; those with the highest credit scores have a rate in the low single digits,” according to credit bureau Experian.

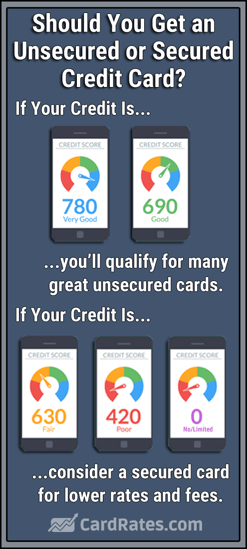

3. Get a Secured Credit Card

If your credit is impaired, you may not be able to get approved for most unsecured cards. In that case, a secured credit card may be a good option.

This type of card can help you demonstrate your ability to use credit responsibly, rebuild your credit history, and boost your credit scores.

This type of card can help you demonstrate your ability to use credit responsibly, rebuild your credit history, and boost your credit scores.

Secured cards require a deposit that can be used if you miss a payment. The minimum deposit may be as low as a few hundred dollars.

Your limit is usually equal to your deposit. You may be able to raise your credit limit by making a larger deposit if you’re able to do so.

Some secured cards have a refundable deposit or can be converted into unsecured cards with the deposit being returned after a set time period of on-time payments. If the deposit is nonrefundable and the card can’t be converted, you may need to close the account to free up your deposit.

By selecting a secured card from a major issuer, including Capital One, Citi, or Wells Fargo, you’ll have no problem upgrading to an unsecured card in the future if you manage your secured account well.

4. Become an Authorized User On Someone Else’s Card

An authorized user is a second person who’s allowed to use someone else’s card. This second user can make purchases with the card but isn’t responsible for the payments. When payments are made (or missed), they’re reported to the credit bureaus and may affect both the primary and secondary user’s credit scores.

If you choose to become an authorized user, be sure to select someone who will make the card payments on time. Decide upfront whether you’ll reimburse the cardholder for your purchases, and if so, when.

5. Improve Your Credit Mix

Your credit mix refers to the different types of credit you have in your credit history. Examples include installment loans, which have a fixed monthly payment, and revolving accounts, which allow you to charge up to a limit and carry a balance from month to month.

It’s usually not a great idea to add a lot of new credit that you don’t need or won’t use just to boost your credit scores.

That said, if you don’t have any cards or you don’t often use the cards you have very often, adding one or more new ones may make sense for you and improve your mix at the same time. Your mix makes up only a small part of your scores, but it is influential nonetheless, and improving it could boost your scores.

Building Good Credit Takes Years

Always keep in mind that building credit is not a quick process. Indeed, it’s more likely to take several years than mere months to build a good credit history.

“An excellent credit score is most often the result of years of conscientious financial behavior,” according to Experian. “While some strategies will let you see small improvements quickly, joining the ranks of those with the highest credit scores will take time….[C]ommit to doing your best — and try to avoid moves that could make improving your credit score more difficult.”

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 No-Credit Credit Cards with Instant Approval ([updated_month_year]) 7 No-Credit Credit Cards with Instant Approval ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/12/No-Credit-Credit-Cards-With-Instant-Approval.jpg?width=158&height=120&fit=crop)

![Which Credit Cards Use TransUnion for Approval? ([updated_month_year]) Which Credit Cards Use TransUnion for Approval? ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/transunion.png?width=158&height=120&fit=crop)

![9 Credit Cards That Use Experian for Approval ([updated_month_year]) 9 Credit Cards That Use Experian for Approval ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/12/experian-2.png?width=158&height=120&fit=crop)

![12 Credit Cards With Instant Approval by Type ([updated_month_year]) 12 Credit Cards With Instant Approval by Type ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/01/Credit-Cards-with-Instant-Approval-by-Category.jpg?width=158&height=120&fit=crop)

![12 Best Instant-Approval Credit Cards ([updated_month_year]) 12 Best Instant-Approval Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Instant-Approval-Credit-Cards--1.jpg?width=158&height=120&fit=crop)

![8 Easiest Approval Cards For Fair & Bad Credit ([updated_month_year]) 8 Easiest Approval Cards For Fair & Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/07/Easiest-Approval-Cards-For-Fair-Bad-Credit.jpg?width=158&height=120&fit=crop)

![7 Guaranteed-Approval Credit Cards With No Deposit ([updated_month_year]) 7 Guaranteed-Approval Credit Cards With No Deposit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/Guaranteed-Approval-Credit-Cards-With-No-Deposit.jpg?width=158&height=120&fit=crop)