Credit cards with free credit monitoring are a big assistance to consumers interested in building, rebuilding, or maintaining their credit scores.

These cards let you stay on top of changes to your credit score and are often augmented with credit alerts for factors that can impact your score. When choosing one of these cards, make sure you understand exactly which free credit score is being monitored and what other information you will receive for free.

Cash Back | Travel | Students | Bad Credit

FAQs

Best Cash Back Cards With Free Credit Monitoring

For fans of cash back rewards, the following four cards offer free credit monitoring and several other benefits. Any one of these cards will do an excellent job keeping you informed about changes to your credit score and other important news about your credit account.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One Quicksilver Cash Rewards Credit Card works with CreditWise, a free tool that monitors your VantageScore® 3.0 credit scores from your TransUnion credit report. You can check the weekly updates to your scores online or via the Capital One mobile app as often as you like.

You’ll get personalized information on factors that may be affecting your score, as well as alerts when a meaningful change occurs to your credit file from any credit bureau. You’ll also receive dark web surveillance of your Social Security number and access to a credit simulator to test the impact of various financial decisions.

The Discover it® Cash Back card offers free viewing of your FICO credit score online on your monthly statements and via the Discover mobile app. You can look at a 12-month history of your credit score and the factors that impact your score. Your free credit score comes from TransUnion, and you can choose to opt out of receiving your score if you wish.

The Chase Freedom Unlimited® card gives you access to Chase Credit Journey, where you can check your VantageScore 3.0 credit score from your Experian credit report for free. Additionally, you can check the factors affecting your score and receive credit alerts for items like credit limit increases, new credit inquiry hard pulls, and new accounts. Credit Journey also reports your credit utilization ratio and helps with fraud alert and identity restoration.

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Customized Cash Rewards credit card provides free monthly updates to your TransUnion credit report and FICO Score via the bank’s mobile app or online. You can track recent monthly scores and compare them to national averages. You’ll also be able to see the key factors affecting your score and learn more about credit scores through Bank of America Better Money Habits® from this financial institution.

Best Travel Cards With Free Credit Monitoring

Travel cards reward you with points or miles for your eligible purchases. These four cards offer free credit monitoring, but they are also highly rated for their rewards and benefits.

The Capital One Venture Rewards Credit Card gives you free access to your TransUnion VantageScore® 3.0 credit scores via Capital One CreditWise. The score is updated weekly, but you can check it whenever you like. You also can view factors affecting your score, changes to free credit reports at a credit reporting agency, and the results of Dark Web surveillance of your email address and Social Security number.

The Discover it® Miles card gives you multiple ways to view your TransUnion FICO credit score for free — on its website, monthly statements, and mobile app. In fact, its Credit Scorecard lets you look up your last 12 scores. You can also check the factors affecting your score as well as other valuable information about your credit.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

The Chase Sapphire Preferred® Card card is your passport to Chase Credit Journey and a wealth of information about your credit. You get free access to your VantageScore 3.0 credit score from your Experian credit report, a score separate and distinct from FICO scores. Other useful information includes your current credit utilization ratio, recent account alerts, and warnings stemming from fraud monitoring.

The American Express® Green Card provides you with your TransUnion VantageScore 3.0 through MyCredit Guide. It also reports late payments, opened accounts, credit check inquiries, length of credit history, available credit, and current balances. Additionally, you can use Score Goals to help you boost your credit score and a simulator to show how various financial decisions can impact your score.

Best Student Cards With Free Credit Monitoring

Many students are new to the world of credit, making credit monitoring all the more valuable. Free credit monitoring from the following four cards can teach students about credit, including how to improve different credit scores and threats that can harm their finances.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

The Discover it® Student Cash Back card, through its Free Credit Scorecard, provides you with your FICO credit score from TransUnion. You can view up to one year of previous scores as well as key factors affecting your score. Your score is also reported on your monthly account statements, and you can access the Free Credit Scorecard online and through the Discover mobile app.

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Customized Cash Rewards credit card for Students gives you free online and mobile access to your TransUnion FICO Score. You can also receive information about the key factors impacting your score and how your score compares to national averages. The Bank of America Better Money Habits® website offers personalized financial solutions based on your priorities.

Best Cards For Bad Credit With Free Credit Monitoring

Free credit monitoring is especially useful when you are trying to rebuild good credit. These four cards are designed for consumers that don’t have good credit and who want to stay on top of their credit without extra fees.

- No annual or hidden fees. See if you're approved in seconds

- Building your credit? Using the Capital One Platinum Secured card responsibly could help

- Put down a refundable security deposit starting at $49 to get a $200 initial credit line

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Limited, Bad

|

The Capital One Platinum Secured Credit Card works with Capital One CreditWise to give you free access to your TransUnion VantageScore® 3.0 credit scores. CreditWise also alerts you to changes in any free credit report at a credit reporting agency and to factors that influence your credit score. You can check your score as often as you like without hurting your credit.

The Surge® Platinum Mastercard® from Continental Finance allows you to receive your credit score on a monthly basis for free. To participate, you must choose to receive your monthly statements electronically rather than on paper. You can also monitor online your recent transactions, card balance, payment history, and other important information.

Continental Finance issues the Reflex® Platinum Mastercard®, which reports your credit score for free on your monthly e-statement. Free score reporting lets you see how your creditworthy behavior impacts your score over time. The mobile app and online website also let you check your account activity and status.

This card is currently not available. Additional Disclosure: The information related to Bank of America® Customized Cash Rewards Secured Credit Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.14. Bank of America® Customized Cash Rewards Secured Credit Card

The Bank of America® Customized Cash Rewards Secured Credit Card offers free access to monthly updates of your FICO score via the bank’s website or mobile app. You can use Bank of America Better Money Habits® to receive information about your finance, including how your score stacks up against national averages and the key factors impacting your score. You can also receive text alerts on your mobile phone or by visiting the online website.

What is Free Credit Monitoring?

Free credit monitoring is a service provided by many credit cards, allowing you to see your credit score without paying any extra fees. The different credit scores may be FICO, VantageScore, or some other product. Some cards provide monthly updates to your score, while others update weekly.

Normally, you can access your free scores on the card’s website. You may also be able to receive your scores on the card’s mobile app and on your monthly statements (electronic or paper). Credit monitoring usually includes information beyond just your score, such as the factors affecting your score, how your score compares to national averages, and fraud alert occurrences.

What Do I Need to Do as a Cardholder to Get Free Credit Monitoring?

The first thing to do is check to see whether the card offers free credit monitoring. If it does, it will usually tell you how to receive your scores. Sometimes, you have to activate free monitoring and specify how you want the scores delivered.

A card issuer may offer free credit monitoring even for those who don’t have any cards from the card issuer. For example, CreditWise from Capital One is open to anyone — all you have to do is sign up at the website.

Which Issuers Offer Free Credit Monitoring?

Several card issuers offer free credit monitoring to anyone who enrolls, not just customers of the card. These generous issuers include Chase, Capital One, Discover, and American Express.

Chase (pictured here), Capital One, Discover, and Amex all offer free credit scores to noncustomers.

Other credit card issuers require you to be a cardholder to receive free credit monitoring. These include Bank of America, Wells Fargo, and Celtic Bank (issuer for Surge and Reflex credit cards). Many credit unions and online banks also offer free credit monitoring — check your financial institution for availability.

Some issuers, such as Citi, offer free credit monitoring only on select cards. Citi happens to offer free FICO score monitoring on its better cards.

While TransUnion appears to be the most popular source of credit monitoring alerts, other credit cards may use an Experian or Equifax credit report as their sources. Note that, while they have different formats, Experian, TransUnion, and Equifax credit reports will all provide the same basic information.

What is the Best Free Credit Monitoring Service?

We think all credit monitoring services are valuable, especially because they are free. We especially like the services that provide monitoring even if you aren’t a credit card customer, offered by Chase, Capital One, Discover, and American Express.

- Chase Credit Journey

- Capital One CreditWise

- Discover Free Credit Scorecard

- American Express MyCredit Guide

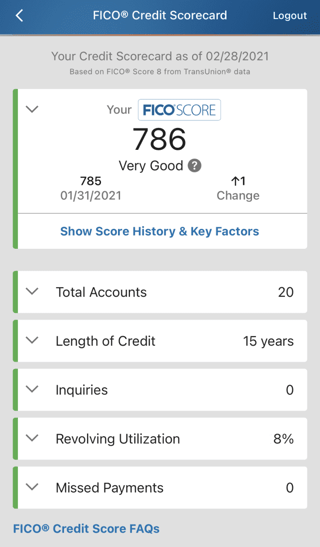

We think the Discover Credit Scorecard stands out from the other services because it reports the score from the FICO credit scoring model. The others monitor your VantageScore 3.0, which is not generally used by lenders to make credit decisions.

Discover Scorecard provides you with a free FICO Score 8 based on TransUnion data.

If you want the most meaningful score, you want the FICO credit scoring model.

However, we’ve found that FICO and VantageScore provide similar results. Each monitoring service offers features that can help you determine which is best for you.

Most of these services summarize and rate you on the factors that contribute to your score. However, we feel that the American Express MyCredit Guide offers the most powerful tools, including Score Goals for customized recommendations to improve your credit and the Credit Score Simulator, which lets you see how different actions will impact your score.

Capital One CreditWise also offers a Credit Simulator that lets you see how specific credit choices could impact your score. You can simulate the effects of opening a new credit card, increasing your credit limit, borrowing money from a lender, and transferring balances, among other options.

Chase Credit Journey walks you through an eight-question survey but doesn’t make any recommendations based on your answers. There is a summary of the factors comprising your credit score and ideas for improving these factors.

How Does a FICO Score Differ From Other Types of Credit Scores?

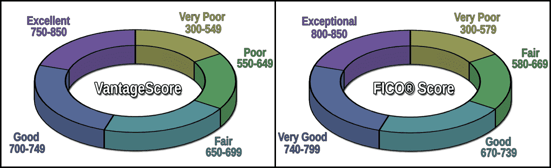

FICO scores are used in the real world by 90% of lender organizations to evaluate your credit risk. Your FICO score is based on a 300 to 850 scale.

Your credit score plays a key role in lending decisions, but creditors often interpret a person’s score within the historical context that credit file reports provide.

VantageScore (VS) 3.0 is FICO’s closest competitor. It uses the same scale as FICO (300 to 850), although it weighs the factors comprising the VS score differently. You can use your VS score to get a general feeling of your credit profile, but don’t expect it to match FICO.

Here is a comparison of the score ranges for FICO and VantageScore:

FICO scoring depends on five weighted factors:

- Payment history (35%): Your record of payments, including late payments, collections, and defaults. Only on-time payments are positive.

- Amounts owed (30%): Your debts, including your credit utilization ratio for credit card debt. The less you owe, the better.

- Credit history age (15%): The age of each account, including oldest, newest, and average. The older, the better.

- New credit (10%): Recent hard credit inquiry pulls of your credit report. The less credit check activity, the better.

- Credit mix (10%): The different types of debt you use currently and in the past. The more varied, the better.

Other scoring systems may calculate credit scores differently. When you sign up for free credit monitoring, make sure you understand which credit score you’re getting. If it’s not FICO, it may not be used by lenders to make credit decisions.

Will Credit Monitoring Protect Me From Identity Theft?

Thousands of consumers become victims of identity theft each year, much of it stemming from stolen credit card accounts. It is virtually impossible to stop all identity theft, but there are steps you can take to reduce your exposure. Credit monitoring alert services can warn you about accounts you didn’t open and charges you didn’t authorize, both of which are red flags for fraudulent activity.

You benefit when credit monitoring services watch out for a wide range of suspicious activity, such as appearances of your Social Security number or email address on the Dark Web. But no amount of credit monitoring will protect you against fraudulent activity if you don’t pay attention to it. It’s important that any alerts you receive about your credit accounts be accepted by your email inbox rather than shunted aside as spam.

Programs like Chase Credit Journey can help protect you from identity theft by sending you real-time alerts when there are changes to your credit report.

Most of the free monitoring services provided by credit cards allow you to control the types of alerts you receive. For example, Chase Credit Journey has 14 separate credit monitoring alert settings: five for balance and spending, four for payments, and five for protection and security.

The most important alerts deal with your credit accounts and personal information. You want to know immediately if a new account is established, or the balance of an account significantly changes. You may want to know when your available credit suddenly drops, or your balance suddenly rises.

Because many consumers are concerned about identity theft, several independent services offer identity theft insurance, which provides more comprehensive support if your identity is breached. Look for identity theft insurance that promises to spend a set amount to respond to identity theft on your behalf.

For example, the Petal credit card comes with free Norton LifeLock ID Navigator that includes identity theft protection, credit monitoring, data breach notifications, credit freeze (and reversing a credit freeze) dark web monitoring, restoration assistance, and more.

Free Credit Monitoring Is a Valuable Cardholder Benefit

It isn’t hard to find credit cards with free credit monitoring. We’ve identified several in this article, and you’ll find many on the largest credit card company list that provides this service. When considering a new credit card, free credit monitoring should definitely be on your list of required perks if you are at all concerned about suspicious activity alerts, identity theft protection, personal information security, and credit card fraud.

Having gone to the trouble of obtaining a credit card with free credit monitoring, make sure you sign up for alerts and pay attention to them when they appear in your email. It’s also a good idea to periodically change the passwords to your credit card websites and to add security to your mobile phone to protect credit card apps.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Best Credit Cards for Free Hotel Stays ([updated_month_year]) 7 Best Credit Cards for Free Hotel Stays ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-Free-Hotel-Stays-Feat.jpg?width=158&height=120&fit=crop)

![12 Credit Cards that Offer Free Checked Bags ([updated_month_year]) 12 Credit Cards that Offer Free Checked Bags ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/02/Credit-Cards-that-Offer-Free-Checked-Bags.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards for Free Flights ([updated_month_year]) 9 Best Credit Cards for Free Flights ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Best-Credit-Cards-for-Free-Flights.jpg?width=158&height=120&fit=crop)

![8 Free Prepaid Credit Cards ([updated_month_year]) 8 Free Prepaid Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/03/Free-Prepaid-Credit-Cards.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards For Free Car Rentals ([updated_month_year]) 8 Best Credit Cards For Free Car Rentals ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Best-Credit-Cards-For-Free-Car-Rentals--1.jpg?width=158&height=120&fit=crop)

![How to Get Free Flights With Credit Cards ([updated_month_year]) How to Get Free Flights With Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/03/How-to-Get-Free-Flights-With-Credit-Cards.jpg?width=158&height=120&fit=crop)

![12 Free Prepaid Debit Cards ([updated_month_year]) 12 Free Prepaid Debit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/09/Free-Prepaid-Debit-Cards.jpg?width=158&height=120&fit=crop)

![8 Prepaid Debit Cards with Free Reload Options ([updated_month_year]) 8 Prepaid Debit Cards with Free Reload Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/01/Prepaid-Debit-Cards-With-Free-Reload.jpg?width=158&height=120&fit=crop)