Have you ever applied for financing, like a credit card or loan, only to have your request for credit denied? If so, you know first-hand just how frustrating a credit denial can be.

And you probably didn’t find out that your credit application was denied until you received some sort of communication from the lender. This communication may have come in the form of what’s formally referred to as a Notice of Adverse Action.

These adverse action notices are often informally referred to as denial letters. They are valuable communications because they provide you with a great deal of information as to the lender’s decision.

While it’s optimal to never receive a denial letter, understanding what these notices indicate is a good idea.

An Adverse Action Notice is an Explanation of Credit or Loan Denial

Many companies rely on consumer credit information when they evaluate prospective customers. This is how they assess risk.

Credit card issuers and lenders don’t know you personally, so they need a way to determine whether you’re likely to repay the money you borrow as promised. The credit report and credit score fill this need.

When a lender reviews your credit reports or scores as part of your application, federal law requires that company to let you know when and if it uses your credit information as a basis for its decision. This is a law under the Fair Credit Reporting Act.

The Fair Credit Reporting Act requires companies to notify consumers when they use their credit reports or scores as part of an application decision.

In other words, if a credit card issuer checks your credit and decides that it doesn’t want to do business with you because of your credit report or score, it has to give you an explanation. This explanation is the declination letter or, more formally, an adverse action notice.

Insurance providers and employers may review your credit as well (though employers only check credit reports, never credit scores). These types of businesses may be required to deliver adverse action notices too. You may also receive an adverse action notice if an existing card issuer reviews your credit reports as part of its ongoing account management practices and decides to adversely alter the terms of your account.

Credit issues, including a negative credit history or low credit scores, may prompt a lender to deny your application for a credit card or loan. If a lender decides to deny your application because of your credit, it can deliver your adverse action notice in three ways:

- In writing

- Verbally

- Electronically

While there are no statistics that track the method of delivery for adverse action notices, it’s been my experience that these notices are almost always sent either via U.S mail or sent as an attachment to some form of electronic communication.

What Does an Adverse Action Notice Include?

The Fair Credit Reporting Act (FCRA) and the Equal Credit Opportunity Act (ECOA) are the two primary federal laws that lenders must follow where adverse action notices are concerned. These statutes specify the information lenders need to disclose when it denies credit.

An adverse action letter must include:

- The name of the credit reporting agency (or agencies) that provided the credit report(s) the lender reviewed during your application. This will almost always be Equifax, Experian, or TransUnion.

- Instructions on how to request your credit report(s) for free within 60 days after you’re denied or offered less attractive financing terms. While this consumer right is appreciated, there are ways to get credit reports much more often than waiting 60 days.

- Information about your right to dispute information on your credit report that you believe is inaccurate. You’ve enjoyed this right for many decades.

- A copy of your credit score if the lender reviewed it as part of your application. This is important. The credit score the lender must provide you has to be the score that was used as part of its decision. The point being, if the lender denied your application because your credit score from Equifax was 600, it must disclose this information.

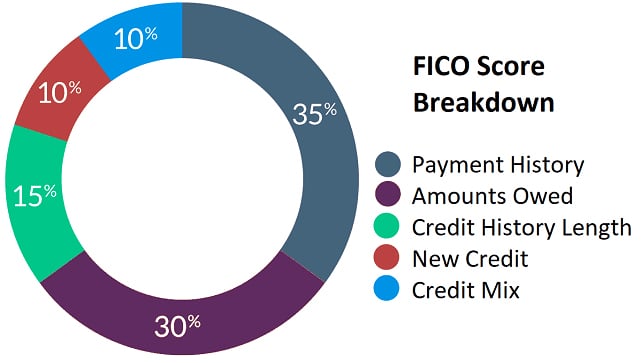

If a lender reviewed your credit score when you applied for financing, your adverse action will also include the credit score range and the top four or five reasons why the score isn’t higher. These are known as reason codes or score factors, and they can be very helpful when you want to understand why a lender considers you to be an unacceptable credit risk.

When you have less severe credit problems, a lender may not deny your application for financing outright. Instead, a lender could make a counteroffer with less favorable terms.

For example, if you apply for a credit card with a 17.99% APR, the card issuer — after reviewing your credit — could decide to offer you an APR of 24.99% instead. Or perhaps you may qualify for a lower credit limit than you anticipated or an account with fewer benefits.

When a lender offers you less attractive financing terms than advertised, it’s called an adverse approval. Both the Federal Trade Commission and the Consumer Financial Protection Bureau (CFPB) have identical rules that lenders must follow in these situations.

Namely, the credit card issuer or lender needs to send you a notice indicating you were approved but with terms that were not as good as others have received. This notice is called a Risk-Based Pricing notice. Risk-based pricing notices are similar to adverse action notices in several ways.

For example, both types of disclosures contain general details about which credit bureau the lender used to access your credit report. They should also tell you how to request a free copy of your credit report from the same credit bureau within 60 days. Additionally, a risk-based pricing notice should explain that the financing terms you’re being offered could be more favorable if your credit were better.

How an Adverse Action Notice Can Help You

When you receive an adverse action notice in the mail, you may be tempted to toss it in the trash. After all, who wants a reminder of being rejected?

But before you throw away a declination letter and pretend it never happened, you should know that the notice may contain some valuable details, including a customized road map toward better credit.

If your declination letter includes a credit score, pay special attention to the factors that are most influential to your score. An adverse action will usually include four credit score factors that explain why your credit score isn’t higher. And when too many hard inquiries are having a negative impact on your credit score, your declination letter may list five key credit score factors instead of four.

Now, it is worth noting that the factors you find in adverse action letters can be vague. They are often form letters with only a general overview of why you were denied credit. As such, you shouldn’t expect them to spell out the exact steps you need to take to fix your credit problems.

However, if you’re willing to do a little more digging, an adverse action letter has the potential to help you figure out exactly why a lender turned you down. Here are two strategies that may help you.

- If your lender used a VantageScore credit score to evaluate your application, visit ReasonCode.org to research why your score isn’t higher.

- FICO also provides a product sheet you can use if you want help deciphering the score factors associated with a FICO Score. Both options will include a legend that will help explain the numeric score factor that is printed on your denial letter.

Even if you plan to ask a credit card issuer to reconsider your application, your credit score factors can still be helpful. They’re a solid tool you can use to develop a customized credit improvement plan that will actually yield results.

For example, if one of your score factors indicates your credit card balances are too high relative to your credit limits, then it doesn’t make any sense for you to pay off your installment loans early.

Next Steps

No one likes rejection, especially when it comes to credit denials. But you have two choices when a lender denies your credit application. You can do nothing and hope it turns out better next time, or you can be proactive and start working to improve your credit.

Rebuilding your credit won’t happen overnight. But if you use an adverse action notice as your guide, you may eventually be able to improve your credit card approval odds so that you’re better prepared the next time you fill out an application for a new account.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![How to Apply for a Credit Card Online: 4 Easy Steps ([updated_month_year]) How to Apply for a Credit Card Online: 4 Easy Steps ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/07/How-to-Apply-for-a-Credit-Card-Online--1.jpg?width=158&height=120&fit=crop)

![How to Get a Credit Card in 6 Easy Steps ([updated_month_year]) How to Get a Credit Card in 6 Easy Steps ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/09/GETCARD.png?width=158&height=120&fit=crop)

![How Do I Get a Credit Card? 3 Easy Steps ([updated_month_year]) How Do I Get a Credit Card? 3 Easy Steps ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/01/getcard2.png?width=158&height=120&fit=crop)