Americans love credit cards — why pay now if you can pay later and earn rewards for doing so? Unfortunately, poorly managed accounts can quickly deflate your bank account and end up costing you more than you charged to the card in the first place.

That’s because credit card companies charge interest on the balance you carry every month. But this isn’t the only way card companies make money. In addition to the fee you pay for borrowing their digital dollars, you may be on the hook for other charges when transferring a balance, taking out a cash advance, or missing a payment.

Not to mention, the companies you’re doing business with are also getting slapped with various fees when they accept your plastic form of payment. Here’s a look at the various ways credit card companies make money, along with a few tips on how you can avoid their unnecessary fees.

Interest

It will come as no surprise that credit card companies make a bulk of their revenue from the interest they charge cardholders who carry a balance on their accounts in any given month.

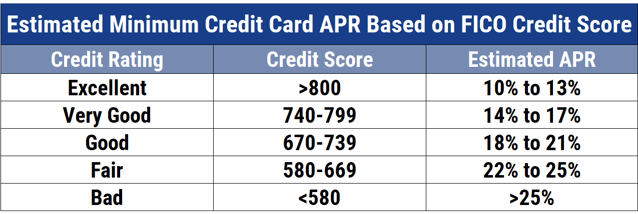

Since the interest rate you qualify for greatly depends on your credit score, credit card companies often make more on consumers who have low scores since they pose a bigger lending risk.

Considering Americans carry an average of over $6,200 in credit card debt with an average interest rate of over 20%, credit card companies are raking in a lot of money on interest fees every month.

You can avoid wasting money on interest by tracking daily spending before it becomes too much to manage and paying off your balance in full every month. If you can’t afford to do that, it’s a telltale sign that you’re living beyond your means and need to reassess your financial habits.

Otherwise, you will drown in interest charges and never break out of the debt cycle.

Annual Fees

Not every credit card charges an annual fee, but those that do may be raking in anywhere from $25 to $600 per account each year, sometimes more on the most exclusive credit cards. This is a fee the credit card company collects from a cardholder every year to access the benefits and rewards they offer.

Credit cards with annual fees offer more benefits and rewards than those that don’t require this fee. And, the higher the annual fee, the more perks you will receive.

For instance, The Business Platinum® Card from American Express charges an annual fee of $695 and offers perks that include a signup bonus potentially worth more than $1,000, 5 Amex Membership Rewards points per $1 spent on flight and hotel bookings, and several other valuable benefits, including airport lounge access.

Many credit cards will waive the annual fee for one year when you first sign up, but make sure you analyze the cost of this charge before applying. You want to ensure the rewards you earn and the benefits you receive outweigh the annual fee you pay.

Late Payments

Paying your credit card late is ill-advised. Not only will you rack up interest fees, but you will get slapped with a hefty late payment charge. Late payment fees were the most common credit card charge between 2015 and 2019, according to a CreditCards.com survey.

Thanks to consumer protection laws, the maximum late fee a credit card company can charge is $28 for the first delinquency. However, this fee can be as high as $41 (as of January 2023) for any late payments thereafter.

Keep in mind, credit card companies may assess a penalty interest rate of as much as 31.49%, often triggered by late payments, if you violate the terms and conditions of your card. Though this higher interest rate will only apply to new purchases, it’s important to keep a watchful eye on your payment due date.

Setting up automatic payments for at least the minimum due is an easy way to make sure you pay on time and avoid these penalty charges. If you have a nearly perfect payment history and miss a payment once, oftentimes you can call the credit card company to request this fee be removed from your account as a one-time courtesy.

Cash Advances

If you use your credit card to withdraw money from an ATM, it’ll cost you. Not only will you pay an upfront ATM fee, but your credit card issuer will also charge you a cash advance fee of around 5% for each transaction.

Cash advances also don’t qualify under the terms of your credit card’s grace period, so you’ll be charged an inflated cash advance APR starting the day you withdraw the money.

If this is a service you plan to use often, a few cards offer this perk for free or low cost. Otherwise, stick with your debit card to withdraw cash from an ATM or request cash back from a merchant to avoid any fees.

Balance Transfers

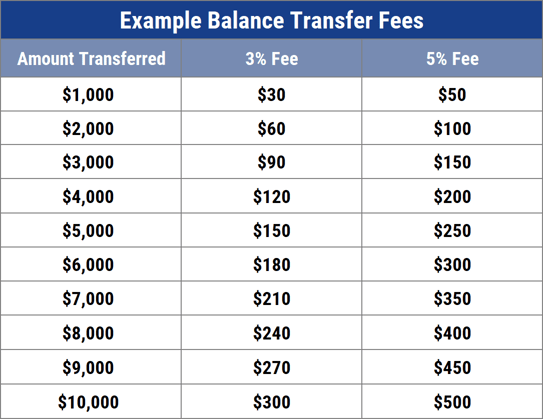

When you move your credit card debt from one card to another, you will be charged an average of 3% to 5% of the total balance, known as a balance transfer fee. The reason someone would want to transfer their balance to another card is usually to save money on interest.

Credit card companies often attract new cardmembers with special promotions that offer 0% interest on balance transfers for a certain period, usually between 12 to 18 months. This fee comes from the credit card company to which you transferred your balance.

Over-limit Charges

When your credit card charges surpass your approved credit limit, you could be assessed a fee. However, this can only happen if you agreed to permit the card issuer to allow you to charge past your credit limit in the first place.

Therefore, avoiding this fee is simple: Tell your credit card company that you do not want the option of being able to go over your credit limit when you first sign up. If you aren’t sure if you’ve opted in or out of this, you can call the customer support team at any time to confirm.

Foreign Transaction Fees

Your credit card may impose a surcharge of between 1% and 3% for each transaction that passes through a foreign bank, whether you’re traveling abroad or simply make an online purchase from a non-U.S. merchant. This is called a foreign transaction fee, or FX fee.

While that’s only about $3 for every $100 spent, FX fees can add up quickly on a two-week European vacation. You may not care about FX fees if you don’t regularly leave U.S. soil, but if you do, find a card that doesn’t charge foreign transaction fees.

Interchange and Assessment Fees

It’s not just cardholders who get slapped with fees — any merchant that accepts a credit card must pay a percentage of each credit card transaction to the bank and payment network associated with the specific card.

For instance, interchange fees, which range from 1.15% to 3.15%, along with a per-item fee of up to 65 cents for each authorization, are paid to the bank that issued the card, i.e. Chase, Bank of America, Citibank, etc.

Meanwhile, a smaller percentage, usually less than 0.15%, goes to the payment network tied to the card, i.e. Visa, American Express, Mastercard or Discover. These fees are based on the type of card, the type of merchant accepting the card, and how the credit card is entered.

For instance, a credit card that is not swiped or inserted to read the chip but keyed in manually has a higher interchange fee due to the higher risk of fraud. Although this charge eats into business profits, accepting credit cards is crucial for most merchants given the number of consumers who use this payment method.

In fact, credit cards accounted for 23% of payments made in October 2018, according to the 2019 Diary of Consumer Payment Choice from the Federal Reserve Bank of San Francisco. However, some businesses pass these fees on to the consumer, which is more common at a boutique store or mom-and-pop shop.

You Can Avoid Most of These Fees

As you can see, credit card companies make money in several ways, but thankfully, you can avoid being hit by most of their charges. You can pay your balance off every month to avoid interest charges, choose a card with no annual fee or foreign transaction fees, always pay on time to avoid late payment fees, and use your debit or ATM card to withdraw cash.

You can also find a card that doesn’t charge a balance transfer fee if you want to take advantage of a 0% interest rate to help pay your balance down, though these promotions are sometimes hard to find.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![Which Credit Card Companies Provide the Best Credit Cards? ([updated_month_year]) Which Credit Card Companies Provide the Best Credit Cards? ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/08/Which-Credit-Card-Companies-Provide-the-Best-Credit-Cards-2.png?width=158&height=120&fit=crop)

![5 Best Credit Repair Companies ([updated_month_year]) 5 Best Credit Repair Companies ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/09/shutterstock_1668079426.jpg?width=158&height=120&fit=crop)

![6 Facts: How to Transfer Money From One Credit Card to Another ([updated_month_year]) 6 Facts: How to Transfer Money From One Credit Card to Another ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/08/transfer--1.png?width=158&height=120&fit=crop)