Many consumers with low credit scores want to own credit cards for bad credit to help them manage their finances. Here are our top recommendations that represent the best balance between costs and benefits for consumers seeking the best credit card for their needs.

Use the links below to navigate to the card type you’re interested in:

Unsecured | Secured | Business | Store | Prepaid

How to Apply | FAQs

Unsecured Credit Cards For Bad Credit

An unsecured credit card is what most people think of as a regular credit card. Most credit cards are unsecured, meaning you don’t have to put up any collateral to get an unsecured credit card.

As you can see, many unsecured cards are available to you, even if you have bad credit.

The Surge® Platinum Mastercard® is an unsecured credit card that is a great option for anyone with less-than-perfect credit. You’ll have to provide some personal information to prequalify, including your Social Security number, whether you have an active checking account, whether you intend to use the card for cash advances, and the amount and primary source of your monthly income.

This unsecured credit card provides $0 fraud liability protection and the potential for earning a credit limit increase when you make your first six monthly payments on time.

The Reflex® Platinum Mastercard® offers a fair APR and generous credit limit to those rebuilding credit. You can see whether you prequalify for the card before applying.

The Reflex® Platinum Mastercard® is issued by Continental Finance. You must be at least 18 to get this card, 19 if you live in Alabama. Be sure to read its terms and conditions so you’re not surprised by any of its fees.

This card is currently not available.3. Indigo® Unsecured Mastercard® – Prior Bankruptcy is Okay

The Indigo® Unsecured Mastercard® – Prior Bankruptcy is Okay markets to consumers who have an imperfect credit rating. You can quickly enter information to prequalify for the card, and you’ll receive an approval decision within a minute.

Your credit rating determines your annual fee. You may select from a roster of five card designs for free. If Indigo can’t match you to one of its cards, it may recommend you apply to a selected credit card from another issuer.

The Milestone® Mastercard® makes the application process easy and is certainly open to those with less than favorable credit history. Unlike some of its competitors, this card does not charge one-time or monthly fees, although you will be billed an annual fee that is based on your creditworthiness.

The card also waives the cash advance fee for the first year. You get ID theft and liability protection at no extra charge.

The Total Visa® Card is the less-than-perfect credit card for consumers with less-than-perfect credit. To get and use this card, be prepared to pay a one-time program fee, an annual fee, and starting in year two, a monthly servicing fee, and a cash advance fee.

You may be offered a credit line boost after the first year, but, you guessed it, you’ll be charged a fee based on the increased amount. On the plus side, you can get this card even if you have really bad credit.

The Indigo® Mastercard® for Less than Perfect Credit is part of the Indigo® card trio available to consumers with bad credit.

The major difference distinguishing the three cards is how much you’ll pay in annual fees, which depends on your credit profile. The card charges no initial or monthly processing fees, and cash advances don’t trigger a fee during the first year.

You can apply for a First Access Visa® Card and receive a decision in a minute or less. But before you rush in, make sure you understand that you’ll pay an initial program fee and an annual fee, as well as cash advance, credit line increase, and monthly servicing fees after the first year.

You can choose your card color or pay a small fee to get a premium card design.

Secured Credit Cards For Bad Credit

Secured credit cards require you to deposit cash into a locked account as collateral. In return, you can expect fees and rates lower than those for similar unsecured cards.

The Capital One Quicksilver Secured Cash Rewards Credit Card is rated as our best secured credit card. It can help you improve your personal credit rating by paying your bill on time, and you’ll earn cash back rewards along the way.

Paying your bill on time will also earn you your security deposit back, and you may qualify for a credit limit increase without an additional deposit needed.

The Capital One Platinum Secured Credit Card may allow you to secure your credit line with a partial deposit, meaning you deposit less than your total credit limit. But whether you qualify for a smaller deposit depends on your credit rating.

This card is a great option for rebuilding credit and boats $0 fraud liability, $0 annual fee, and no hidden fees.

The OpenSky® Secured Visa® Credit Card lets you choose your credit line by requiring a matching security deposit. Unlike some other secured credit cards, you don’t need to have a bank account to get this card. But don’t worry, your deposit will be FDIC-insured.

This secured Visa credit card doesn’t subject you to a credit check, making it a great choice if you’ve got a really low credit score, and charges a relatively low annual fee.

Would you pay a few extra dollars in an annual fee to get the lowest APR and cash advance fee in this merry trio of First Progress cards? If the answer is yes, go for the First Progress Platinum Prestige Mastercard® Secured Credit Card.

If you regularly stretch out your payments over several months, the money you save on interest could easily dwarf the small increment of an annual fee. All three cards are easy to obtain, just fork over your security deposit, and you’re good to go.

If every dollar you spend on annual fees pains you, choose First Progress Platinum Elite Mastercard® Secured Credit Card from this trio of cards because it has the lowest annual fee among the lot. However, be prepared to pay the highest APR and cash advance fee in the group.

If you regularly pay off your balance and seldom take cash advances, this is the First Progress card that may suit you best.

If the First Progress trio of credit cards were the three bowls of porridge in front of Goldilocks, the First Progress Platinum Select Mastercard® Secured Credit Card would be the one that’s “just right.” That’s because its APR, cash advance fee, and annual fee are intermediate among those offered by the other two cards.

As with the other two, this card doesn’t check your credit score or history when you apply.

Business Credit Cards For Bad Credit

There is no reason why you can’t own a business credit card just because you have bad credit. The three business cards reviewed here are all secured, so don’t fret about those old credit problems.

It takes only five minutes to navigate the four-step application process for the OpenSky® Secured Visa® Credit Card. If you are new to the world of credit, you’ll be heartened to know that the vast majority of the holders of this card were able to build their credit scores within six months.

As a Visa secured card, you get several benefits, including fraud protection and worldwide acceptance.

Store Credit Cards For Bad Credit

Store credit cards are among the easiest unsecured cards to obtain, even with poor credit. You can use them for purchases at the issuing store and its affiliates.

The Fingerhut Credit Account lets you charge purchases from the Fingerhut online marketplace. The account is a good way to build or rebuild your credit, as it reports your activity to the three major credit bureaus.

Even if you don’t qualify for the account, Fingerhut may approve you for its Fresh Start Installment Loan. The credit account charges no annual fee and frequently offers special promotions.

16. Amazon.com Store Card

The Amazon.com Store Card lets you charge items when you shop online at Amazon.com. You must have an Amazon account to get this card. If you happen to be an Amazon Prime Member, you’ll also get 5% cash back on your orders.

However, you can substitute promotional financing for cash back on eligible purchases, thereby letting you avoid interest if you pay off the balance during the promotional period. The card charges no annual fee.

17. Target RedCard™

If you shop at Target, you really should own a Target RedCard™, as it saves you 5% on your in-store and online purchases (10% on your anniversary). You get free shipping on most online items, an additional 30 days to return items, and access to exclusive special offers.

And if you need a little pick-me-up while shopping, you can use your card at the in-store Starbucks and save 5%.

Prepaid Cards For Bad Credit

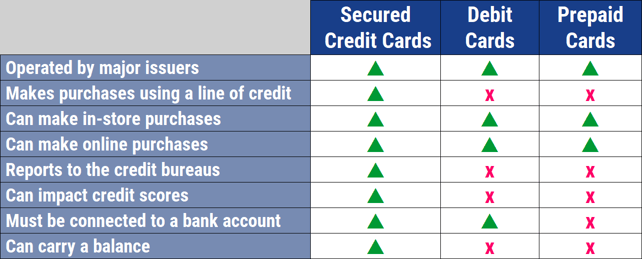

Prepaid credit cards are more like a reloadable debit card. You can spend as much money as you load onto the card at any place that accepts Visa (for Netspend) or Mastercard (for PayPal) debit cards.

The NetSpend® Visa® Prepaid Card likes to say no to its customers: No minimum balance, no credit check, no activation fee. And it says yes to nifty features like mobile check load, in which you take a few pictures on your cellphone to load checks onto your card.

You can customize your card with a family photo or other image, and you can receive Anytime Alerts™ for activity notifications.

This NetSpend® Visa® Prepaid Card offers the Pay-As-You-Go Plan, in which you pay a transaction fee for each purchase, or a flat-fee Monthly Plan. You can cut that monthly fee in half if the account receives at least $500 in direct deposits for at least one month.

Another available option is Purchase Cushion, which can give you up to $10 of overdraft protection.

If you use PayPal to send and receive money, you’ll enjoy the convenience of transferring money to load your PayPal Prepaid Mastercard®. And speaking of convenience, you can reload your card at more than 130,000 locations in the U.S.

In addition, cardholders can open a free, no-minimum-balance savings account at Bancorp Bank. The card is available in red, blue, plum, or white.

How to Apply For a Credit Card With Bad Credit

If your credit is bad, you can assume that credit card issuers will be cautious when they receive your application. In fact, issuers of unsecured cards may ask you to prequalify first, which is a good deal for you because it doesn’t require a hard pull (i.e., an inquiry that can reduce your credit score) of your credit report, which occurs when you apply after prequalifying.

You’ll have to cough up some personal information when you ask for prequalification, including items like your income sources, how much you bring home each month, and other responses to nosy questions. The full application may go on to inquire about your housing costs and other debts. Some cards require a minimum credit score, others don’t.

If you are intent on getting an unsecured card rather than a secured one, expect to pay high fees and a high interest rate, while being restricted to a low credit limit (frequently $300 less any upfront fees).

Sometimes, you can improve your credit score just enough to allow you to qualify for an unsecured card. Here are some tips to boost your score quickly:

- Check your credit reports for any errors. You can get a free credit report from each major credit bureau (Equifax, Experian, and TransUnion) at AnnualCreditReport.com. You can contact a credit bureau to request the removal of incorrect information that may be depressing your score. Or you can hire a credit repair company whose professionals scour your credit reports for errors.

- Pay down any existing debts. The less you owe, the more capacity you have to take on new credit.

- Pay your bills on time, unfailingly. A credit card company likes to see that you have a responsible attitude toward your debt.

- Find a cosigner. A card issuer will like a cosigner, especially one who has good credit, because cosigners are on the hook if you miss payments.

- Consider becoming an authorized user instead. As an authorized user of someone else’s card, you get to charge items without the primary obligation to repay. Of course, stiffing the card owner is a great way to ruin a relationship.

If it’s impossible to qualify for an unsecured card, consider a secured or prepaid one. The card issuer for these types of cards requires upfront cash but generally charges less in fees and interest. Best of all, the credit card company issuing this card doesn’t check your credit.

What is a Credit Card For Bad Credit?

A credit card for bad credit is one geared toward folks with a bad credit score looking to build credit. According to Experian, FICO scores (which run between 300 and 850) below 670 are “bad.”

This range consists of “fair” (580 – 669) and “poor” (300 -579) scores. If you have a low credit score that is in this range, you’ve experienced some financial problems in the past.

The unsecured cards reviewed here understand that your creditworthiness is in question. Nonetheless, they are willing to accept many consumers with bad credit, albeit at a steep price.

Look for these cards to impose several substantial fees, although they may waive some fees for the first year. Additionally, credit lines on these cards are tight, often $300 minus any upfront fees.

Alternatively, you may want to start with a store credit card. These unsecured cards are easy to get and seldom charge fees. They are a good way to build credit if you don’t have any, or to start repairing a bad credit score. Unfortunately, their range is limited to shopping at the issuing stores and their affiliates.

Naturally, the best way to reduce the cost of credit is to raise your credit score. But until you can do so, you may want to consider a secured or prepaid credit card, as these don’t care about your financial history.

However, bear in mind that a prepaid card isn’t building credit because it does not report to the credit bureaus.

What Credit Score Do I Need to Get a Credit Card?

There isn’t a universal minimum credit score required to obtain a credit card, but low scores reduce the number of cards available to you. Some secured cards don’t check credit at all, meaning they’re available to anyone who can put up the cash deposit and meets the basic eligibility criteria, such as being at least 18 and a US resident.

Secured cards are a great tool to establish or build credit. If you’re new to credit and don’t have a score yet, a secured card may be your best bet.

The gateway unsecured cards in this review, led by the top-rated Surge® Platinum Mastercard®, allow you to prequalify before you apply, meaning that they will not do a hard credit pull unless you are considered eligible to apply.

In other words, you have nothing to lose by submitting the prequalification questionnaire, even if your score is 300. You’ll find with these cards that sometimes a verifiable income outweighs a low score.

We call these cards “gateway” because they can get you started on the road to a higher credit score through their reporting to the three major credit bureaus (Experian, TransUnion, and Equifax). By paying on time, you can slowly climb Score Mountain and trade up to a less expensive, more rewarding credit card.

Which Credit Cards Give You Instant Approval?

Virtually all the credit cards in this review will let you know your approval status online within minutes. However, only the prepaid cards provide guaranteed approval. That’s not surprising since you are depositing money with the issuer to cover your purchases.

The NetSpend® Visa® Prepaid Card rates highest among the prepaid cards, due to its flexible fee structure. You can pay as you go, which tacks on a small fee with each use of the card.

Alternatively, you can pay a fixed monthly charge for unlimited use of the card. Furthermore, arrange just one direct deposit of $500 or more to the card and your monthly fee will be sliced in half from that point forward.

- With Direct Deposit, you can get paid faster than a paper check.

- No late fees or interest charges because this is not a credit card.

- Use the Netspend Mobile App to manage your Card Account on the go and enroll to get text messages or email alerts (Message & data rates may apply).

- Card use is subject to activation and ID verification. Terms and Costs apply.

- Card issued by Pathward N.A., Member FDIC. Card may be used everywhere Visa debit card is accepted.

- See additional NetSpend® Prepaid Visa® details.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Up-to $9.95 monthly

|

Not applicable

|

The PayPal Prepaid Mastercard® is a good choice if you regularly use PayPal to transfer money. Many freelancers use PayPal to get paid for their work, and as the proportion of workers increasingly tips toward the self-employed, expect PayPal and its prepaid card to only gain in popularity.

- Move money from your PayPal account to fund your prepaid card account.

- Earn cash back and personalized offers, just for using your card.

- With Direct Deposit, you can get paid faster than a paper check.

- Card issued by The Bancorp Bank, Member FDIC. Card may be used everywhere Debit Mastercard is accepted.

- Click PayPal Prepaid Mastercard® for additional features & program details, and to request a Card.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Variable Monthly Fee

|

Not applicable

|

Prepaid cards offer some nice benefits. They look just like regular credit cards, don’t require you to have a bank account, and won’t ever hit you with an overdraft fee since you can only spend up to the card balance.

Secured credit cards are likely to provide instant approval, but you must wait until the issuer receives your security deposit before you are sent the card. And when you do receive approval, you’ll normally have to wait until the physical card shows up in your mailbox. That can keep you waiting a week or more.

If you’d like to start using the account sooner, you have a couple of options. For example, you can see whether the issuer will expedite shipping, either free or for a fee. That can cut your wait down to as little as overnight.

Another way to get shopping sooner is for the issuer to provide you with a virtual card number. This is a temporary number, unrelated to your actual card number, that you can use for online shopping as soon as you receive it.

Most cards will cancel the virtual number once you register the newly received credit card. However, you might find an issuer or third-party service, such as Privacy, that offers permanent virtual numbers.

With multiple virtual credit card numbers, you can limit each number to a particular merchant, time period, and/or spending limit. By doing so, you’ll limit the damage should a hacker steal the number.

Will I Need to Provide a Security Deposit?

Secured cards require a security deposit, while unsecured cards don’t. Typically, the size of the deposit is at least as much as the card’s credit limit, sometimes more, sometimes less.

Don’t confuse a secured card with a prepaid card. With a secured card, your deposit isn’t touched unless you miss a payment, in which case the card issuer will subtract the required amount from your deposit. If you close the account, the issuer returns the deposit, minus any unpaid balance, to you.

You must also put up-front money into a prepaid card, but that’s the money you spend when you make purchases with the card. You must replenish the prepaid card’s balance to continue using it.

Can I Get a $1,000 Credit Card With Bad Credit?

The unsecured cards in this review typically start you off with a $300 credit limit. But some offer initial credit limits of up to $1,000, including the Surge Mastercard® and Reflex Mastercard®.

But even if you start with a small credit limit, most card issuers evaluate your credit limit after the first year or so. But beware, some cards, such as the First Access Visa® Card, charge a fee for a higher limit.

Your credit limit on secured cards is usually no more than the security deposit. One secured card, the Capital One Platinum Secured Credit Card may accept a smaller deposit amount than its credit limit for qualified applicants. But most secured cards allow you to place a $1,000 security deposit to receive a $1,000 credit limit.

There is no credit limit on a prepaid card because the card offers no credit. Your spending limit is set to the amount you deposit, up to the maximum amount allowed.

What is Credit Utilization?

refers to how much of your available credit you’re using. The credit utilization ratio (CUR) is equal to the outstanding balance on your credit accounts divided by the sum of the credit limits on those accounts.

For example, if your total credit limit is $5,000 and you currently owe $2,000 in credit card debt, then your CUR is ($2,000 / $5,000), or 40%.

CUR is important for a couple of reasons:

- A high CUR indicates to lenders that you may be in financial distress. That would make it harder for you to obtain additional credit.

- Amounts owed, as measured by CUR, is one of the five factors that determine your FICO credit score. It is responsible for 30% of your score. Your score goes down when your CUR rises above a certain threshold (typically 30%).

If you are looking to access new credit or to increase your credit limit, you should first calculate your CUR. If the result is higher than 30%, pay down your balances before applying for the additional credit.

Can I Do a Balance Transfer if I Have Poor Credit?

allows you to consolidate the balances of several credit cards onto one card. Many cards offer this feature.

In fact, when you get a new card, you may be entitled to a promotional period of 0% interest on balance transfers (but a fee applies for each transfer, usually 2% to 5%).

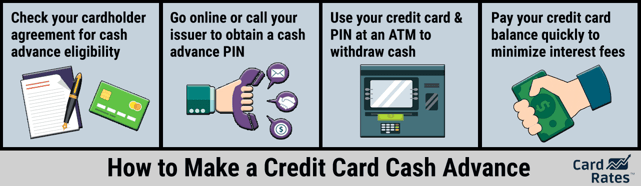

But credit cards targeted at consumers with poor credit generally do not offer balance transfers, much less 0% promotions. You may be able to simulate a partial balance transfer in the form of a cash advance. That is, you may be able to take a cash advance from Card A to pay off the balance on Card B, effectively transferring the balance from B to A.

But for the bad credit unsecured cards in this review, cash advances are subject to strict limits.

For example, the Total Visa® Card only allows cash advances if your account has been open for three completed billing cycles, is not past due, and you have available credit for cash advances. The card further restricts your total advanced cash to no more than one-half of your current credit limit.

Debt consolidation through balance transfers allows you to reduce the number of credit card payments you make each month. This allows you to concentrate on paying down the card that receives the transfers without having to satisfy multiple minimum payments during the month.

Naturally, this strategy only makes sense if you don’t reuse your other credit cards while paying down the consolidated balance. That sort of behavior will only land you in greater debt.

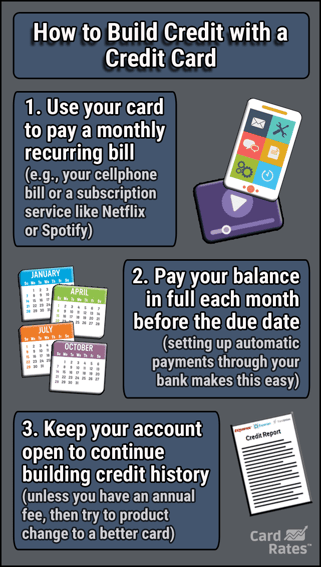

How Can I Build Credit Using a Credit Card?

All the reviewed credit cards, except for the prepaid ones, report your payment activity to one or more of the three major credit bureaus. These reports build your credit history and help the credit bureaus calculate your credit score.

To build your credit, you must demonstrate creditworthy behavior, and you can use your credit cards in this regard.

The most important component of your credit profile is your payment history, which comprises 35% of your FICO score. Here the advice is elementary: Pay your credit card bills on time.

The most important component of your credit profile is your payment history, which comprises 35% of your FICO score. Here the advice is elementary: Pay your credit card bills on time.

It’s better to make the minimum payment on time than to make a larger payment late. You will severely hurt your score if your credit card balance is delinquent by more than 90 days or if it goes into collection.

Thirty percent of your FICO score stems from amounts owed. Your credit card balances are an important part of your total debt.

Don’t let the amount you owe exceed 30% of the total credit available to you. If it’s higher, pay down your cards and other debts.

Another 15% of your score represents the length of your credit history — the longer the better. Therefore, do not close your credit card accounts simply because you no longer use the card.

Place your obsolete cards somewhere safe and let them molder quietly. Better yet, pull one out occasionally and use it — FICO looks at how long it’s been since you last used it.

Taking on too much new credit can hurt your score. In fact, new credit makes up 10% of your FICO score.

To protect your score, don’t apply for or open many new accounts too rapidly. Numerous hard inquiries in the previous 12 months can hurt your score (although not if you are rate shopping for a specific loan).

Finally, 10% of your FICO score rests on having a wide credit mix. So, if you have only student loan debt and/or a mortgage, getting a credit card may raise your score a bit.

Whatever your credit score, it’s important that you fix your credit reports to remove costly mistakes. We’ve mentioned how you can get your credit reports from AnnualCreditReport.com, When you receive your reports, carefully inspect them for mistakes and omitted information.

According to a study by the Federal Trade Commission, 26% of those surveyed reported at least one derogatory mistake on their credit reports, If you find any mistakes, you can dispute incorrect information or supply missing information by contacting the credit bureau.

Look for common errors. For example, credit reports often conflate your information with that of persons with a similar name.

Other frequent errors include missing accounts, transcription errors, wrong account numbers, double entries, and bad debts from more than seven years ago. If you’ve closed an account on your own initiative, ensure the report doesn’t say the account was “closed by grantor,” which makes it appear that the account was closed by the creditor.

To fix errors, you need to contact both the organization that supplied the inaccurate information and the credit bureau. The Fair Credit Reporting Act requires these parties to correct mistaken information. The Act gives you certain rights, including:

- The right to receive copies of your credit reports containing all the information on file as of the time of your request. You furthermore have the right to receive a free copy of your credit report within 60 days of being denied credit due to information provided by the credit bureau.

- The right to know who received your credit report in the last 12 to 24 months.

- For denied credit applications, you have the right to know the name and address of the credit bureau that the creditor contacted.

- The right to demand that the creditor and the credit bureau investigate the dispute.

- You have the right to add short explanations to your credit report explaining your side of the story regarding disputes that were not resolved in your favor.

While once, you had to correct errors through formal written communication, nowadays you can initiate credit disputes online with Equifax, Experian, and TransUnion.

To begin the dispute process, clearly identify the information you believe to be incorrect. The credit bureaus then have 45 days to investigate each item, although they can ignore disputes they deem to be “frivolous.”

Attach copies of relevant documents that back up your claim. Specifically request that the credit bureau correct or delete the disputed information.

If you prefer, you can mail the information to the credit bureau. Make sure you use certified mail and request a return receipt. Always keep copies of all correspondence and documents.

An internet search will quickly turn up websites that provide sample dispute letters you can use as templates for your own correspondence. Also, write to the creditor or information provider responsible for the inaccurate entries on your credit report. You should request that the creditor send you a copy of any correspondence between the creditor and the credit bureau regarding your dispute.

The goal of all this effort is to remove inaccuracies that hurt your credit score. However, even if the dispute is resolved in your favor, you may not see a boost to your score.

For example, suppose the credit bureau didn’t recognize that you closed an account. Your credit score may not increase if they agree to report the account closed because the account and payment history will continue to appear on your report.

In another example, the bureau may remove some derogatory information, but additional negative information on the report may prevent your score from rising.

If the dispute is not settled in your favor, make sure you ask the credit bureau to attach your dispute statement to your report. You can also ask (for a fee) that recent recipients of your credit report receive a copy of your dispute statement. As a last resort, you can contact a lawyer to help resolve the dispute in your favor.

Rebuilding your credit also requires you to pay your bills on time. Your credit score can suffer substantial damage from late payments and collections.

Try to keep your payments timely by enrolling in automatic payment programs. For example, you can have your mortgage provider pull the monthly payments from your bank account automatically.

If you have delinquent payments, your best bet is to get current on those accounts. Otherwise, you may be saddled with a low credit score.

Be aware that paying off a collection will not remove it from your report. However, you may be able to negotiate with the collection agency to have the entry expunged in return for you paying the debt back.

Establishing a long record of on-time payments should help to increase your score. Also, the impact of derogatory information evaporates over time, so even if you have black marks on your report, they will cease hurting your score.

Usually, negative information remains on your report for no more than seven years, although some bankruptcy filings may remain for up to a decade.

If you’re having trouble paying your debts, you can work with a credit counselor and/or a debt settlement agency to negotiate easier repayment terms. You may be able to arrange some debt forgiveness as well.

Do I Need a Bank Account to Open a Credit Card?

Some credit cards do not require you to have a bank account, but you’ll usually find it easier to manage your credit cards if you do have a bank account.

Bank accounts allow you to pay your credit card bills online. That becomes a big hassle if you don’t have a bank account. You’ll have to pay your card with cash or money order, either in person at a bank branch or via the mail.

You could also use a money service, but that tacks on extra expenses. Bank online payments are instantaneous, while other methods introduce delays. Moreover, delivered payments could get lost in the mail.

In addition, you can use your bank account to set up automatic monthly payments to your credit card. You can set the payments to equal the full balance, the minimum amount due, or some other amount. If you get your credit card from the same bank that provides your checking and/or savings account, you can manage the whole lot on the bank’s mobile app.

Nonetheless, many consumers don’t want to use a bank or credit union and prefer not to use any type of financial institution. If you fall into this category, you may want to consider the OpenSky® Secured Visa® Credit Card — it doesn’t require a bank account, even though your security deposit is FDIC-insured.

If you are unbanked, you may naturally prefer to use a prepaid credit card. These are a good alternative for anyone who would rather not hassle with banks and all their fees and rules.

Consider the PayPal Prepaid Mastercard®. Many PayPal customers are unbanked and prefer it that way — for them, this Mastercard is perfect.

Compare the Best Credit Cards For Bad Credit

Our review of credit cards for bad credit has revealed a few appealing alternatives aimed at consumers with less-than-perfect credit. Be sure to study the rates and fees charged for every card offer you consider so you avoid a predatory product that profits off consumers who need help.

These card reviews and handy tips for improving your credit can help you avoid costly mistakes.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Best Secured Credit Cards for Bad Credit ([updated_month_year]) 7 Best Secured Credit Cards for Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/securedcards.png?width=158&height=120&fit=crop)

![7 Easy-to-Get Store Credit Cards for Bad Credit ([updated_month_year]) 7 Easy-to-Get Store Credit Cards for Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/storecards-2--1.png?width=158&height=120&fit=crop)

![7 Credit Card Bonuses For Bad Credit ([updated_month_year]) 7 Credit Card Bonuses For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/12/Credit-Card-Bonuses-for-Bad-Credit-Feat.jpg?width=158&height=120&fit=crop)

![7 Low APR Credit Cards For Bad Credit ([updated_month_year]) 7 Low APR Credit Cards For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/01/shutterstock_615601223-4.jpg?width=158&height=120&fit=crop)

![$1,000+ Limit Credit Cards For Bad Credit ([updated_month_year]) $1,000+ Limit Credit Cards For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/05/1000-Limit-Credit-Cards-For-Bad-Credit.jpg?width=158&height=120&fit=crop)

![5 Credit Cards For Bad Credit: No Annual Fee ([updated_month_year]) 5 Credit Cards For Bad Credit: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/12/Credit-Cards-For-Bad-Credit-With-No-Annual-Fee.jpg?width=158&height=120&fit=crop)

![11 Credit Cards For Bad Credit: Deposits Needed ([updated_month_year]) 11 Credit Cards For Bad Credit: Deposits Needed ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/01/Credit-Cards-For-Bad-Credit-With-Deposit.jpg?width=158&height=120&fit=crop)

![9 Credit Cards For Very Bad Credit ([updated_month_year]) 9 Credit Cards For Very Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/06/Credit-Cards-For-Very-Bad-Credit.jpg?width=158&height=120&fit=crop)