Like it or not, credit cards come with a variety of fees. As an account owner, you will be directly responsible for some, but others are embedded into the product, so you’ll never even notice them.

Here are 17 common credit card fees. As you’ll soon find out, a few are simply a part of doing business with a credit card issuer, but many are totally avoidable.

1. Interest

When you use your credit card to make purchases, you’re borrowing money from the issuing bank. You have the option to repay what you spent incrementally or all at once. If you choose the former option, the issuer will charge interest on any amount you don’t pay before the end of the credit card’s grace period.

How to avoid: Only charge what you can afford to repay in full before the interest-free grace period expires, which is typically around 30 days. To make it easier on yourself, consider paying weekly or as soon as you make the charge with funds from your checking account.

2. Compounding Interest

Credit card interest compounds, which means that interest will be calculated on a debt that already has grown larger with fees. This means you’ll be paying interest on interest.

Compound interest means you’ll pay interest on the interest fees your previously incurred by not paying your debt off.

How to avoid: The first months’ worth of credit card interest may not be so high, but the fees will escalate quickly if you continuously rollover balances. Commit to paying the debt entirely at least every two or three months.

3. Penalty Interest

Look deep into your credit card agreement and you’ll discover that the interest rate you will be charged on balances can change based on several factors, including the way you handle the account. If you’ve made a habit of paying late, the issuer may consider you to be a risky customer and hit you with a higher interest rate.

How to avoid: You can guarantee on-time payments by enrolling in your bank’s automatic bill pay system. The money will come out of your checking or savings account, so you’ll have to ensure you have sufficient funds to cover the payments.

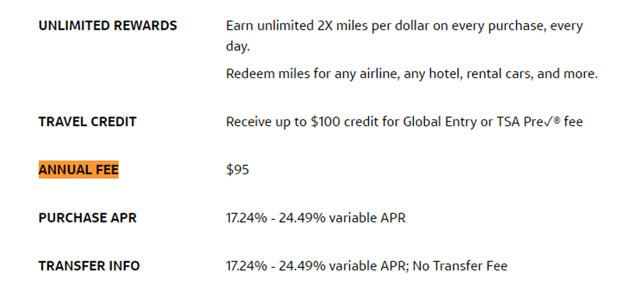

4. Annual Fees

Not all credit card issuers charge annual fees, but many do. Some annual fees kick into effect a year after you activate the card, while others are charged to the card from the get-go.

Card issuers charge annual fees for two main reasons. If you are new to credit or are rebuilding a damaged credit history, the accounts that are available to you may impose a small annual fee (often below $95). Other annual fees are meant to cover a portion of an expensive rewards program.

In fact, the more premium rewards cards charge a significant fee (typically between $95 and $250, but it can be over $500) to your account. As long as you keep the debt low or at zero and make full use of the rewards, you will profit from the card.

Some cards charge an annual fee to help cover the cost of expensive rewards programs.

How to avoid: If you don’t want to be charged an annual fee, now or ever, shop around for a credit card that doesn’t have them at all. You won’t have to look far since there are plenty. Here are just a few, and all with a rewards program: the Bank of America® Customized Cash Rewards credit card, Discover it® Cash Back, and Capital One Platinum Credit Card.

5. Late Payment Fees

Making your credit card payment on time is important, not just because it will protect your credit history and scores, but because credit card issuers will hit you with a late fee if a payment posts even one day after the due date.

Late fees are costly. Some issuers offer to waive the fee on the first instance of a late payment, but most do not. These late fees can add up quickly over time and are extremely avoidable.

How to avoid: In addition to signing up for automatic bill pay, be cognizant of all upcoming due dates. Write them on a wall calendar so you will have a visual reminder and sign up for text and email alerts through your credit card issuer.

6. Over Limit Fees

Every credit card has a credit limit, which is the amount of money the issuer will allow you to borrow. However, some will allow you to spend more than the limit but will charge you a fee to do so.

As per the Credit Card Accountability, Responsibility, and Disclosure (CARD) Act, an issuer can’t charge an over limit fee unless you opted in to accept them. Opting in to the fee may make sense when you want to avoid a declined credit card transaction when you are very close to hitting your limit. You can also go over your limit when you’ve maxed out your card, but interest and other fees have been added in.

You may be charged an over limit fee of up to $35 for spending more than your available credit limit.

According to the terms of the CARD Act, the most this fee can be is $35, but it can’t be more than the amount you went over. Therefore, if you’re only over by $5, that will be the maximum fee amount you’re charged.

How to avoid: Before shopping, make a point of checking how much of your card’s account limit is left unused. You can do that by going online and visiting the credit card issuer’s website, using their app, or giving them a call. If your current balance is too high, either make a large payment so you can freely charge again or use another card that has plenty of room on it. Or pay with cash.

7. Foreign Transaction Fees

Traveling internationally is wonderful — except for the fees your credit card may add to your charges for transactions you make on foreign soil.

Many credit card issuers will add on a foreign transaction fee of between 1% and 3% of the amount you charge. If you charge $1,000 during your trip and the card imposes a 3% foreign transaction fee, you’ll be on the hook for $30 — money better spent on a souvenir.

How to avoid: Many credit cards, especially those with travel rewards programs, do not charge foreign transaction fees, so make sure you have one of those cards before heading out of the country. Here are just a few: Discover it® Miles, Capital One Venture Rewards Credit Card, and American Express® Green Card.

8. Expedited Payment Fees

Yikes! Somehow your credit card’s payment due date is today, and you need to get the money in before a late payment is assessed. You call the customer service number and speak to a representative so you can be sure it’s posted on time.

Although you won’t be charged a fee to pay the bill by phone, you may be charged one to expedite the payment. The fee to expedite payment is generally $10 to $20, but since it’s less than the late fee, it’s worth it.

If you need to process your payment the same day to avoid a late fee, you may be charged an expedited payment fee.

How to avoid: The methods to help prepare for due dates are great, but there may be a time when you don’t have the money to cover the payment until the very last minute. In that case, call the issuer, but ask the representative to forgive the fee this time. Very often they can, especially if it’s a one-off occurrence.

9. Returned Payment Fees

If you don’t have enough money to cover your credit card payment when your card issuer tries to collect, you may incur a returned payment fee.

A returned payment fee generally ranges from $25 to $40 per occurrence. Returned payment fees are usually incurred when you bounce checks, though scheduled online automatic payments can also be returned due to insufficient funds in the cardholder’s linked bank account.

How to avoid: Make sure you have enough money in your bank account before sending your card payments to the issuer to ensure you don’t get hit with a returned payment fee.

10. Interchange Fees

Credit card issuers aren’t charities — like any company, they are in business to turn a profit. And one guaranteed way to do so is through interchange fees.

An interchange fee is a credit card processing fee the merchant must pay when you, the customer, use the card. The average credit card interchange fee is around 1.8%, but each credit card network has its own pricing model.

An interchange fee is a small percentage of each transaction the merchant must pay its merchant account provider.

How to avoid: You can’t. The merchant is on the hook for the fee, not you the cardholder.

11. Cash Advance Fees

Credit cards are designed to be payment tools for the things you want to buy, from products to services. Even if you always maintain a zero balance so you can sidestep interest fees, the issuer will still make money with the interchange it gets from the businesses you’re shopping from.

There is no interchange for taking out cash, though, which is why the issuer will pass that cost — and then some — on to you. The cash advance fee is often between 3% to 5% of the amount you withdraw.

How to avoid: Use the card only as a payment tool. If you want to take out cash, defer to your debit card.

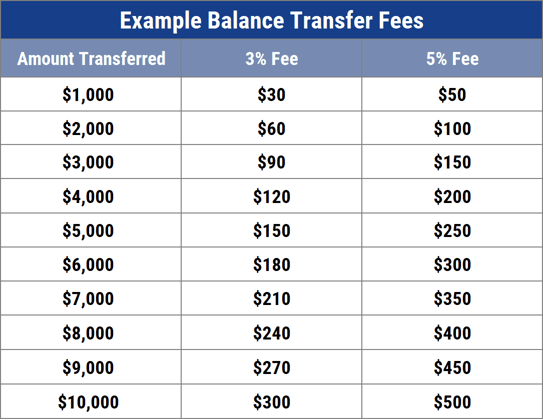

12. Balance Transfer Fees

Have high-interest debt that you can’t seem to pay off quickly? A balance transfer card can come to your rescue. With it, you can transfer your expensive debt to a credit card with a much lower APR (sometimes even 0% for a limited time). It’s not free, however.

The new issuer will charge you a transfer fee, which can be 3% to 5% of the amount transferred, and many issuers impose a minimum of $5 to $10.

How to avoid: You can’t, but in the end, it’s almost always worth the fee. Imagine you owe $5,000 on a card charging an APR of 22%. Assuming the balance transfer fee is 3%, the fee would be $150. Get a card that gives you a nice long break on accumulated interest, and you’ll come out ahead.

For example, the Citi Double Cash® Card offers an APR of 0% Intro APR Period 18 months on Balance Transfers for balance transfers. Pay the debt off within that time frame, and all it will cost you is the initial fee.

13. Fraudulent Usage Fees

If someone has gotten a hold of your credit card or the account numbers and made charges, you are a victim of fraud. According to federal law under the Fair Credit Billing Act, you may be liable for up to $50 in unauthorized charges on your card.

How to avoid: Protect your credit card against identity theft and fraud by only shopping from safe sites and knowing where your card is at all times. Still, even if your card is compromised, most credit card issuers will waive the fee for you, as most cards provide $0 fraud liability protection.

14. Convenience Fees

A convenience fee is usually a flat fee charged by a merchant for the convenience of paying with credit. For example, if the merchant usually takes payments in person, it may charge a convenience fee to accept your card payment over the phone.

These fees are usually charged to cover the various payment processing fees the merchant is charged to accept credit payments.

A merchant can charge a convenience fee for accepting credit as a form of payment.

How to avoid: The best way to avoid this fee is to use one of the merchant’s payment methods that won’t impose a convenience fee. However, it may behoove you to incur the fee if the value of the credit card rewards you’ll earn is greater than the fee amount.

15. Adding an Authorized User

Almost all credit card issuers will let you, the primary cardholder, add people to your account as authorized users. Some of the travel and rewards cards charge a fee for cards for authorized users. For example, the Chase Sapphire Reserve® charges $75 per additional cardholder, and the Business Platinum Card® from American Express charges $300 for each additional user.

How to avoid: If you want to pass out cards to friends or family members for free, look for a credit card that doesn’t charge the fee, such as the Chase Sapphire Preferred® Card or the American Express® Gold Card.

16. Paper Statements

If you want a statement sent to you by mail, it may come with a small price. Not all issuers charge for the classic service, but those that do may add on a surcharge of a dollar or two for each paper statement it must mail you. Issuers generally encourage their account holders to sign up for free paperless billing statements.

You may be charged a small fee if you prefer to receive paper statements in the mail.

How to avoid: Check your account activity for free 24-7 online, or via the card issuer’s app. You can also go online and print out, if necessary, your monthly statement with a full description of all your charges, your balance, and minimum payment due.

17. IRS Payment

Although you can use your credit card to satisfy your income tax bill, the credit card processors the IRS approved to take those payments add on major fees. Pay1040 charges a 1.99% fee with a minimum fee of $2.58, PayUSAtax charges 1.96% with a minimum fee of $2.69, and ACI Payments charges 1.99%, with a $2.50 minimum fee.

How to avoid: It’s always best to plan ahead for a tax bill and then use cash that you’ve set aside to pay it off. Why add to the amount you owe?

Fees Abound, But Most Can Be Avoided

As you can see, many fees — both indirect and direct — are associated with credit card use. As a cardholder, most of them can be prevented with a little extra attention to detail and by getting the right credit card for your needs.

Always research the cards available for your credit rating and apply for the credit card that most suits your lifestyle. And don’t hesitate to contact your credit card company if you have questions concerning fees, as some can be waived with as little as a request.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![3 Ways to Avoid Interest Charges on Credit Cards ([updated_month_year]) 3 Ways to Avoid Interest Charges on Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/Ways-to-Avoid-Purchase-Interest-Charges-on-Credit-Cards-Feat.jpg?width=158&height=120&fit=crop)

![4 Credit Card Comparison Charts: Rewards, Fees, Rates & Scores ([updated_month_year]) 4 Credit Card Comparison Charts: Rewards, Fees, Rates & Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/charts.png?width=158&height=120&fit=crop)

![6 Ways to Save on Credit Card Interest Fees ([updated_month_year]) 6 Ways to Save on Credit Card Interest Fees ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Ways-to-Save-on-Credit-Card-Interest-Fees.jpg?width=158&height=120&fit=crop)

![15 Cheap Credit Cards: Low Interest & $0 Fees ([updated_month_year]) 15 Cheap Credit Cards: Low Interest & $0 Fees ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/cheap.png?width=158&height=120&fit=crop)

![14 Best Credit Cards With Waived Annual Fees ([updated_month_year]) 14 Best Credit Cards With Waived Annual Fees ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/03/Best-Credit-Cards-With-Waived-Annual-Fees.jpg?width=158&height=120&fit=crop)

![6 Best Prepaid Debit Cards with No Fees ([updated_month_year]) 6 Best Prepaid Debit Cards with No Fees ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/10/prepaid--1.png?width=158&height=120&fit=crop)