Whether you’re looking to build your credit history, help a loved one build theirs, or add an employee to your credit account, the best credit cards for authorized users can help you achieve that goal.

Authorized users are issued their own credit card with access to your existing line of credit. The authorized user will see an improved credit score — assuming the account is managed responsibly — and the primary cardholder earns rewards for the authorized user’s purchases.

The cards below make it easy and rewarding to add an authorized user.

Best Overall | Other Cards | FAQs

Best Overall Card for Authorized Users

The Chase Sapphire Reserve® is our top choice for authorized users, mainly because authorized users get the same Priority Pass® lounge access primary cardholders do. Both cardholders’ spending can also help meet the minimum amount necessary to earn the generous signup bonus more easily.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

Plus, all purchases earn Chase Ultimate Rewards points that are worth 50% more when redeemed for travel through the Chase website. Alas, only the primary cardholder receives the $300 annual travel credit, but all cardholders will still earn the 3X rewards points on travel and restaurant purchases.

Each additional card on the account will cost $175/year. Of course, if you don’t want to pay the premium annual fee this card charges, we’ve provided less-expensive alternatives below.

Other Top Cards for Authorized Users

The cards below all allow authorized users who are younger than 18 if you want to help build a minor’s credit history. Each issuer reports the account’s history to the three major credit reporting bureaus, which helps your authorized user build his or her credit history.

Unfortunately, it can also hurt his or her credit history if a payment is made late or the card is near or exceeds its credit limit.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

The Discover it® Cash Back requires authorized users to be 15 or older. The bank doesn’t charge to add authorized users, and all spending on the account earns bonus cash back on the purchase maximum in quarterly rotating bonus rewards categories when activated.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

The Capital One Venture Rewards Credit Card allows authorized users of all ages. All cardholders’ spending earns an unlimited 2X miles on every purchase — and your authorized user’s spending can help you reach the spending threshold required to earn this card’s signup bonus that provides major travel credits.

Just note that only the primary cardholder can redeem rewards.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

The Chase Freedom Unlimited® places no age restrictions on authorized users and allows them to redeem accrued rewards within the shared account. The card’s 0% introductory APR applies to purchases made by both the primary and authorized cardholder.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

With the Chase Sapphire Preferred® Card, you can add an authorized user of any age and help him or her build (or rebuild) their credit history while earning up to 2X points on all purchases. This card’s annual fee only applies to the primary cardholder; authorized users are free.

Which Credit Cards Allow Authorized Users?

Just about every major bank, community bank, and credit union that issues credit cards will allow authorized users on approved accounts. You can add an authorized user when you first apply for a card or at any time after you’ve activated your account.

If you add an authorized user when you apply, you’ll receive two cards in the mail — one with your name printed on it and another with your authorized user’s name. If you add a user after you’ve received your card, you can typically receive the authorized user’s card in the mail within seven to 10 business days.

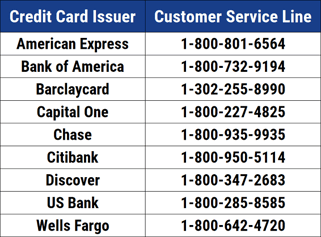

Most banks allow authorized users. Call your issuer’s customer service line for account details.

Synchrony is one of the few large issuers that limits authorized users. Synchrony issues many popular retail cards and only allows authorized users on select cards in its portfolio.

But, since the majority of these cards are closed-loop, meaning they can only be used to make purchases with the specific retailer associated with the card, you may find little benefit to adding an authorized user to a store credit card anyway.

If you’re applying for a credit card with the intention of adding an authorized user, check the issuer’s terms and conditions — or contact the issuer — before you apply. Most issuers don’t charge a fee to add an authorized user and make it easy to add someone to your account.

Does Making Someone an Authorized User Help Their Credit Score?

It can, as long as the credit card issuer reports the account to the three major credit reporting bureaus and the account is in good standing. All but two of the biggest credit card issuers report to all three credit reporting bureaus — Experian, Equifax, and TransUnion.

The exceptions are Barclays and Synchrony Bank, which only report to Equifax and TransUnion. These cardholders will receive credit reporting benefits with these two bureaus, but not with Experian.

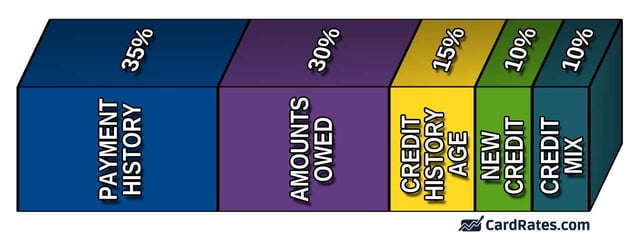

Keep in mind that credit reporting goes both ways. While responsible spending and on-time payments can improve your and your authorized user’s credit scores, late payments and/or high balances can have the opposite effect for everyone.

Be mindful of the top two credit scoring factors to help you and your authorized user build good credit. Always pay on time and keep your credit card balance below 30% of its spending limit.

Many parents choose to help their children establish a credit history during their late teens by adding them as authorized users on a low-limit credit account. This not only has credit score impacts, but it also helps teach responsible credit behaviors at a time when adulthood is near and these skills become more important.

Note, though, that authorized users only get the credit score benefits if you provide their identifying information (including Social Security number) when adding them to the account and they receive a card in their name. If you have a business credit card that you loan out to employees as needed, the person will not see an impact on their credit score from using the card.

Do Authorized Users Get Benefits?

Benefits for authorized users vary by card. As mentioned above, the top-rated Chase Sapphire Reserve® provides luxury lounge access at select airports to both primary cardholders and each authorized user.

Most every credit card gives the same purchase rewards for every account cardholder, but read your card’s terms and conditions to confirm. The same goes for insurance and protection benefits, such as roadside assistance and extended warranty coverage.

Both Chase and Citi allow authorized users to redeem rewards earned through the joint account. Wells Fargo allows primary cardholders to choose whether authorized users can redeem rewards. All other major issuers limit redemptions only to primary cardholders.

Some high-end rewards — such as the $300 annual travel credit given to Chase Sapphire Reserve® members — only apply to the primary cardholder. Signup bonuses are generally restricted to one per account, though the authorized user can help you achieve the bonus quicker by spending on the card.

Special shopping discounts, such as Amex Offers and Chase Offers, are available to all cardholders.

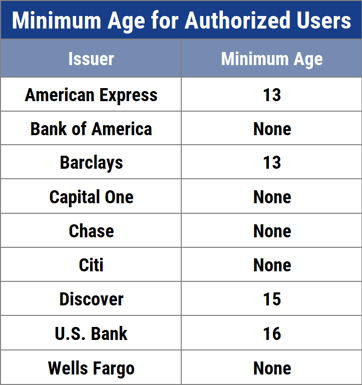

What is the Minimum Age Requirement for Authorized Users?

Even though credit is a necessary component of our financial lives, most public school systems don’t teach responsible spending, budgeting, and credit building. That means it’s up to parents to set the example.

A great way to do this is to add your minor child as an authorized user on a low-limit credit card. Not only will this teach your child how to manage his or her spending, but it will help them establish a credit history and an eventual credit score.

Most major credit card issuers allow you to add a minor to your account and have a card issued in his or her name.

Bank of America, Capital One, and Chase allow additional authorized users of any age. Just about every other issuer places an age limit of 13 to 16 years old for authorized users.

Citi, Bank of America, and Wells Fargo are the only issuers who do not require the Social Security number of the authorized user, which may limit the information submitted to the credit bureaus under the user’s name.

If you’re adding an authorized user with the intent of improving his or her credit score, check with the issuer before applying to make sure the bank reports the account information to all three credit bureaus.

You Earn, They Learn

Adding an authorized user to your credit account can not only boost the user’s credit score, but it can help you earn more rewards and reach spending thresholds for signup bonuses faster.

But it’s important that you discuss the responsibility of card ownership with anyone you are considering adding as an authorized user. Irresponsible spending and late or missed payments can sink your and your authorized users’ credit scores and quickly negate the rewards earned and the benefits of being a cardholder.

But if you spend wisely, the best credit cards for authorized users can give everyone an advantage on their credit-building journey and make it easier for you to earn while they learn.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![5 Best Credit Cards for New Credit Users ([updated_month_year]) 5 Best Credit Cards for New Credit Users ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-New-Credit-Users-Feat.jpg?width=158&height=120&fit=crop)

![5 Best Travel Credit Cards Reddit Users Love ([updated_month_year]) 5 Best Travel Credit Cards Reddit Users Love ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/07/Best-Travel-Credit-Cards-Reddit.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards Reddit Users Recommend ([updated_month_year]) 7 Best Credit Cards Reddit Users Recommend ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/07/Best-Credit-Cards-Reddit.jpg?width=158&height=120&fit=crop)

![7 Best First Credit Cards, No Credit Needed ([updated_month_year]) 7 Best First Credit Cards, No Credit Needed ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/07/firstcard.png?width=158&height=120&fit=crop)

![9 Credit Cards that Use Equifax Credit Reports ([updated_month_year]) 9 Credit Cards that Use Equifax Credit Reports ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/equifax2.png?width=158&height=120&fit=crop)

![7 Best Secured Credit Cards: No Credit Check ([updated_month_year]) 7 Best Secured Credit Cards: No Credit Check ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/11/Best-Secured-Credit-Cards-with-No-Credit-Check.jpg?width=158&height=120&fit=crop)